Navigating the insurance accident claim process can often feel overwhelming, but it doesn't have to be! Whether you're dealing with vehicle damage or medical bills, understanding the right steps to take can help simplify the experience. In this article, we'll break down the essential components of filing a claim, ensuring you have all the information you need to tackle the situation with confidence. So, grab a cup of coffee and settle in, because you're invited to read more about the insurance claim process ahead!

Policyholder Information

Policyholder information plays a crucial role in the insurance accident claim process. Essential details include the policyholder's full name, policy number, and contact information such as phone number and email address. Accurate identification of the insured vehicle, including the make, model, and year, helps streamline the claims process. Location details, particularly where the accident occurred, such as street names or notable landmarks, assist investigators in understanding the incident context. Also, the date and time of the accident are vital for recording circumstances and validating the claim. Gathering this information expeditiously increases the likelihood of a swift resolution.

Incident Details

An insurance accident claim requires comprehensive incident details to ensure a smooth processing experience. Essential elements include the date of the incident, which occurred on May 15, 2023, at approximately 3:45 PM, and the location, specifically at the intersection of Maple Avenue and Oak Street in Springfield. A precise description of the event should outline the sequence of actions leading to the accident, which involved a red Toyota Corolla colliding with a blue Ford F-150. Weather conditions were clear, contributing to visibility at the time of the incident. Additionally, capturing information on witnesses, such as John Smith and Mary Johnson, who were present during the accident, adds credibility to the claim. Documenting police report details or correspondence with local law enforcement, including report number 123456, is crucial for validation. Providing photographic evidence of vehicle damage and injuries sustained establishes the severity of the incident, aiding the claims process.

Claim Description

In a detailed description of an insurance accident claim procedure, it is crucial to emphasize the key actions taken post-incident. The accident occurred on Main Street in Springfield at approximately 3:30 PM on October 5, 2023. A red 2015 Honda Civic was involved, colliding with a blue 2020 Ford F-150 during adverse weather conditions characterized by heavy rain and reduced visibility. The driver, John Smith, immediately documented the scene, noting vehicle damages estimated at $5,000 and injuries sustained by passengers, including a fractured wrist requiring medical attention at Springfield General Hospital. The police report, filed under incident number 2023-4512, corroborated the version of events, highlighting the negligence of the F-150 driver for speeding during inclement weather. Supporting documents, including photographs of the damaged vehicles, medical bills totaling $2,300, and witness statements, have been compiled to substantiate the claim and facilitate the claims adjustment process expeditiously.

Supporting Documentation

Supporting documentation is crucial for the effective processing of an insurance accident claim. For instance, detailed photographs of the accident scene can provide visual evidence of damages, which is vital for claims assessment. Witness statements, ideally collected from individuals present at the incident location, add credibility to the claim. Medical records, including hospital bills and treatment reports, are necessary to substantiate personal injury claims resulting from the accident. Additionally, police reports filed post-incident serve as official accounts that outline the circumstances surrounding the accident, aiding in liability determination. Proof of loss or damage, such as repair estimates for vehicles or property involved, further enhances the claim by outlining financial impacts. Collectively, these elements significantly contribute to a thorough and efficient claims review process at insurance agencies.

Contact Information and Signature

Accident insurance claims often involve critical information such as policyholder details, incident location, and pertinent dates. Providing clear contact information, including the full name, phone number, and address, ensures proper communication during the claims process. The signature of the policyholder serves as an affirmation of the truthfulness of the presented information and authorizes the insurance company to process the claim. Accuracy in these sections is essential for expediting the claim's resolution and reducing potential delays in compensation for the policyholder's financial losses resulting from the accident.

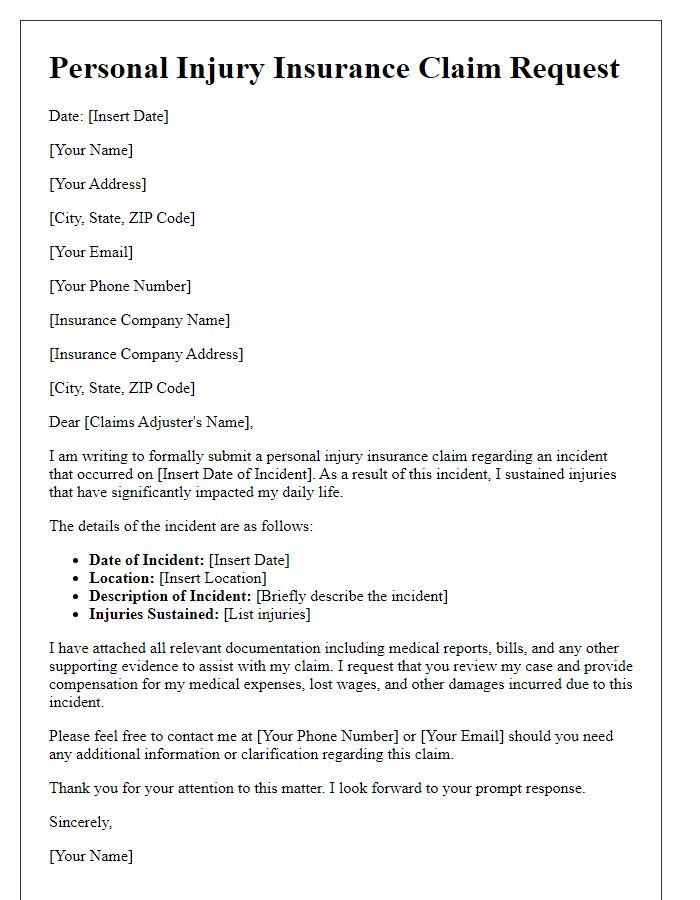

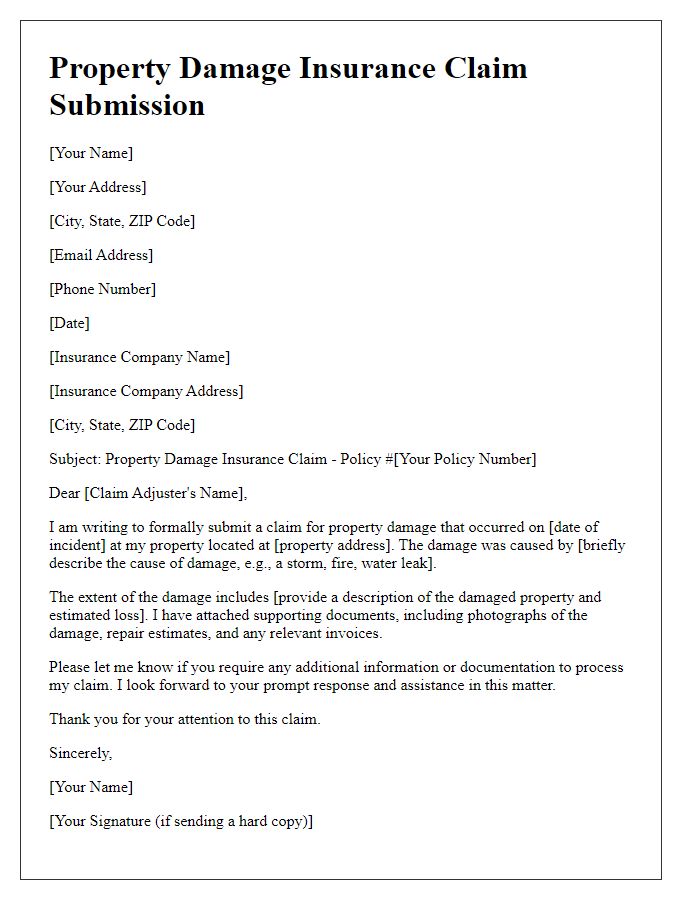

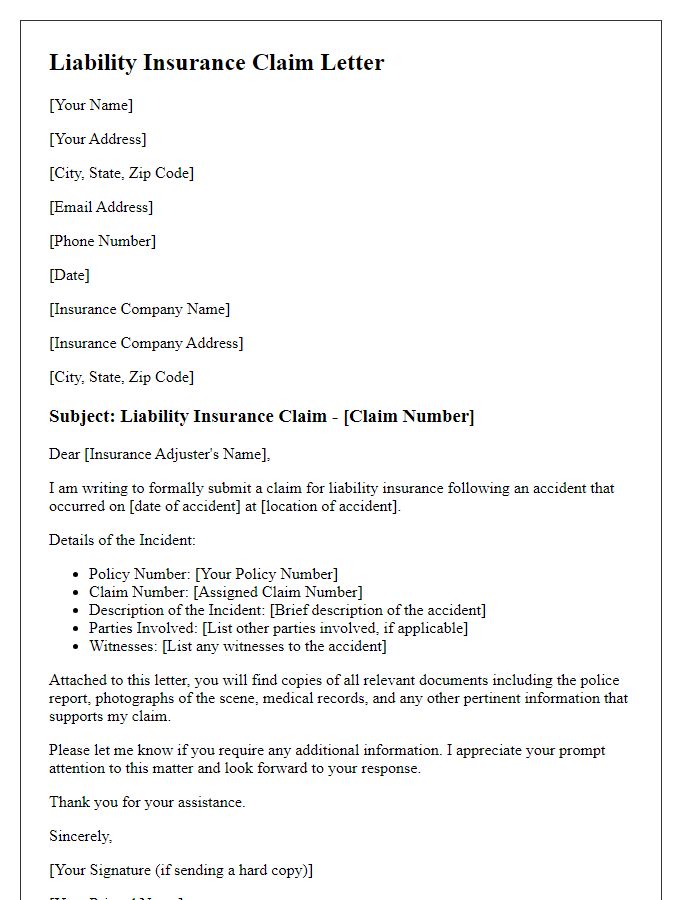

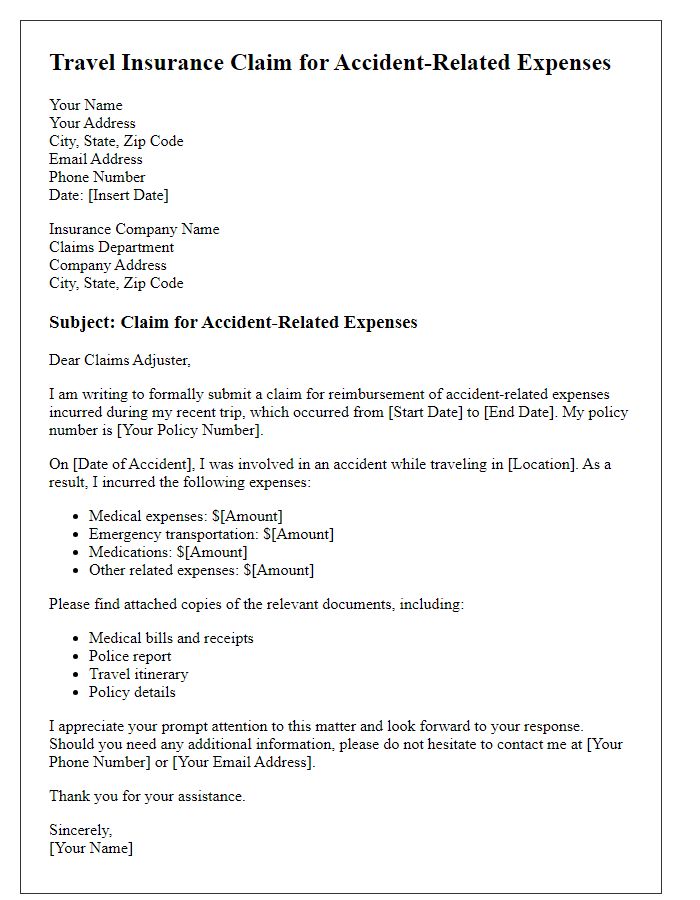

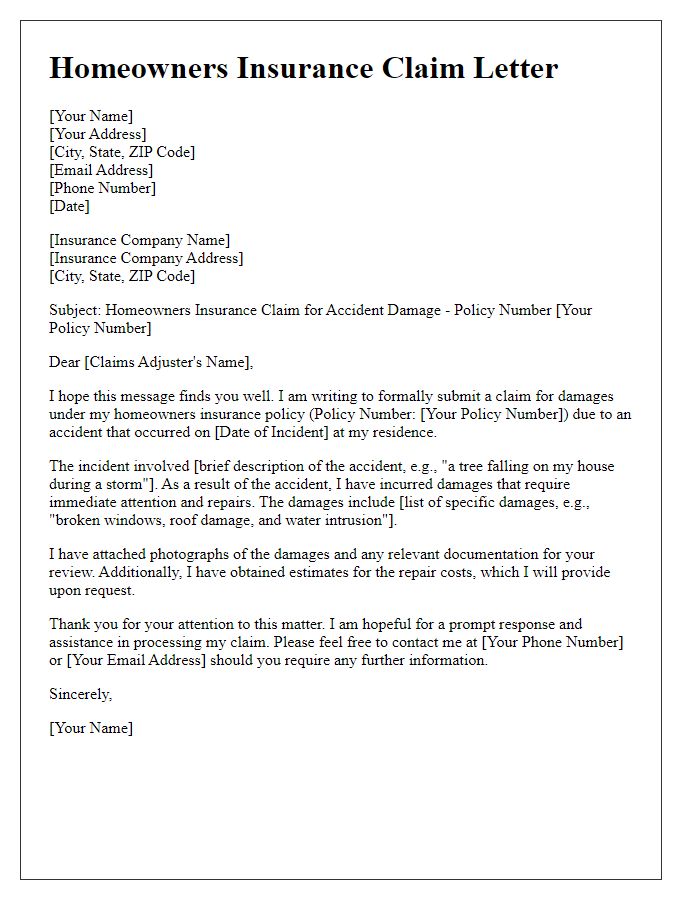

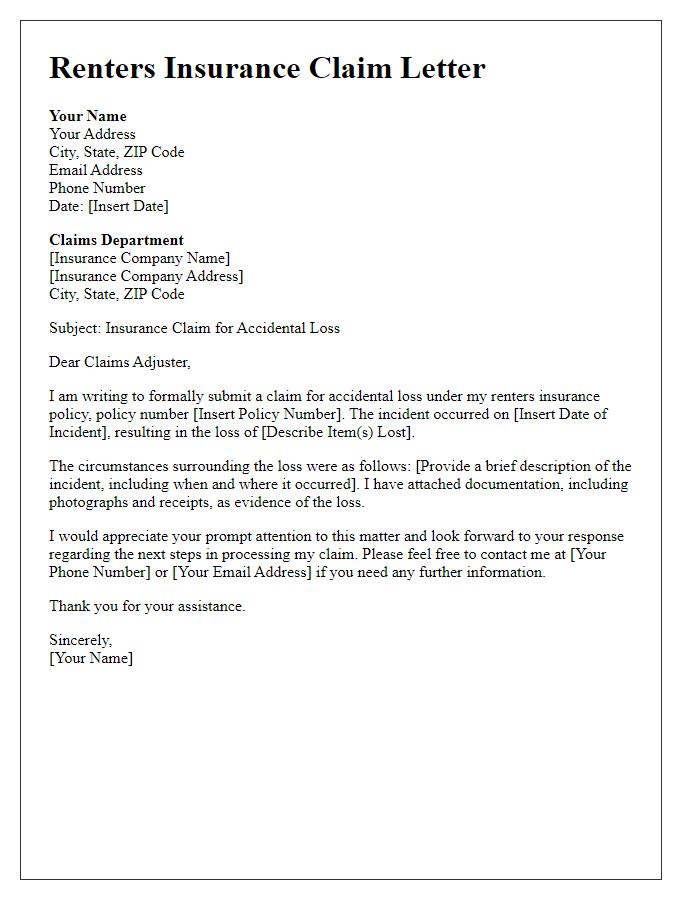

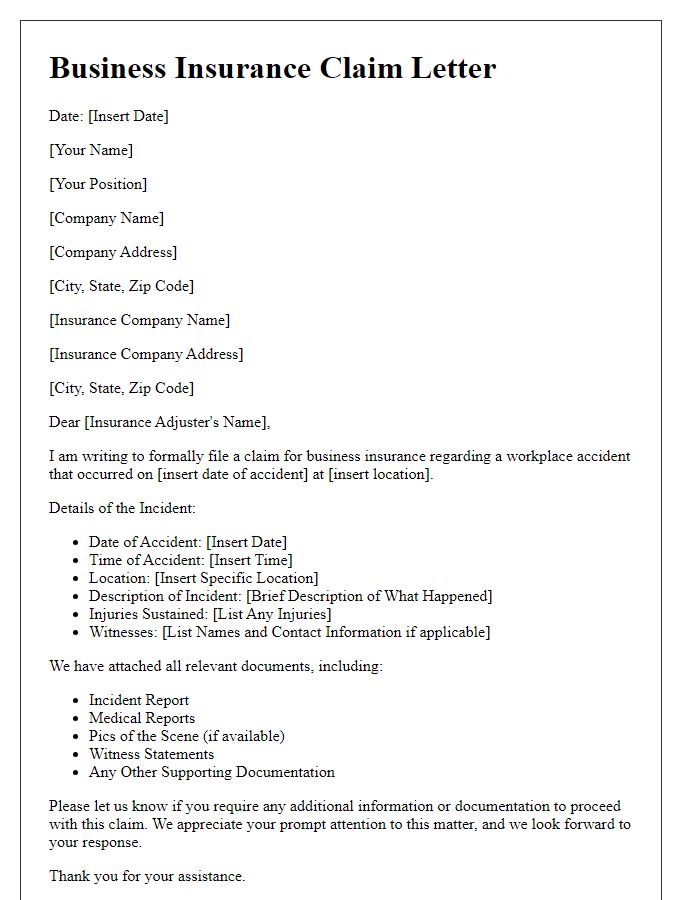

Letter Template For Insurance Accident Claim Procedure Samples

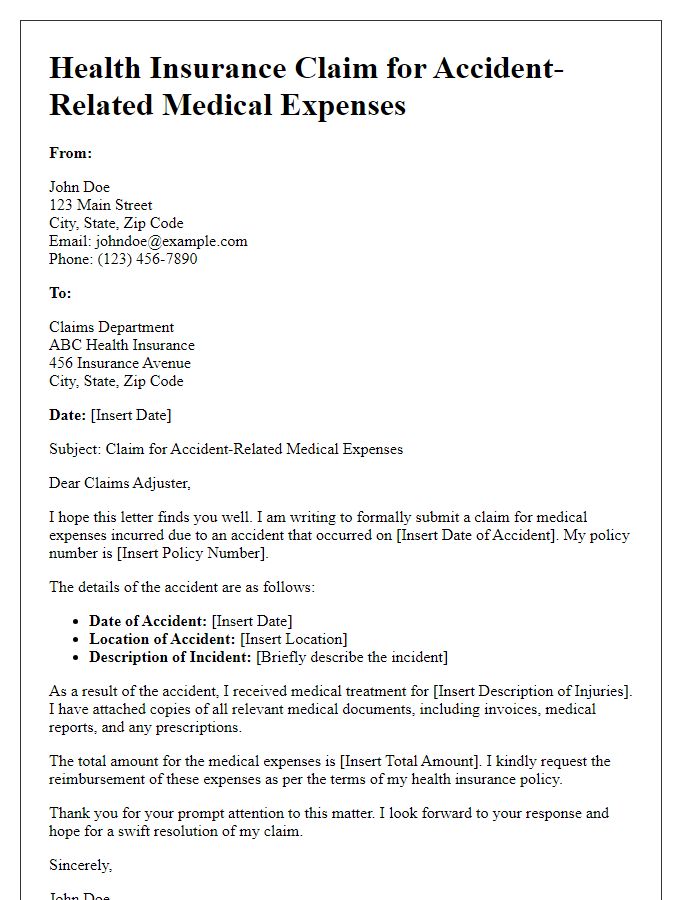

Letter template of health insurance claim for accident-related medical expenses

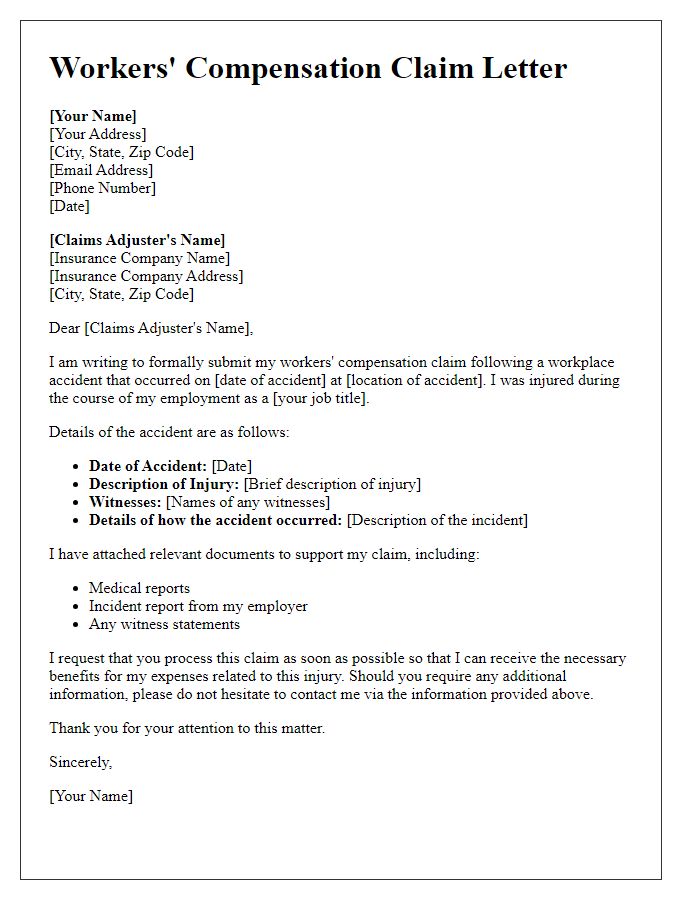

Letter template of workers' compensation claim following workplace accident

Comments