Are you feeling overwhelmed by the insurance claim process? You're not alone! Many people find it challenging to navigate the often complex requirements for approval. This article will provide you with a helpful template and tips to simplify your claim submission, ensuring you get the coverage you deserve. Let's dive in and make this journey smoother together!

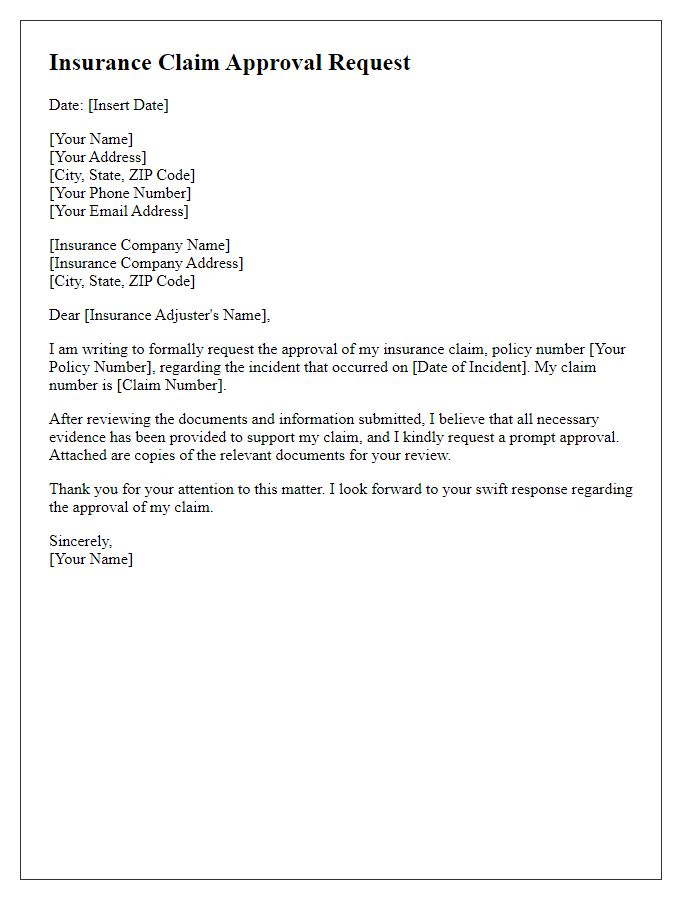

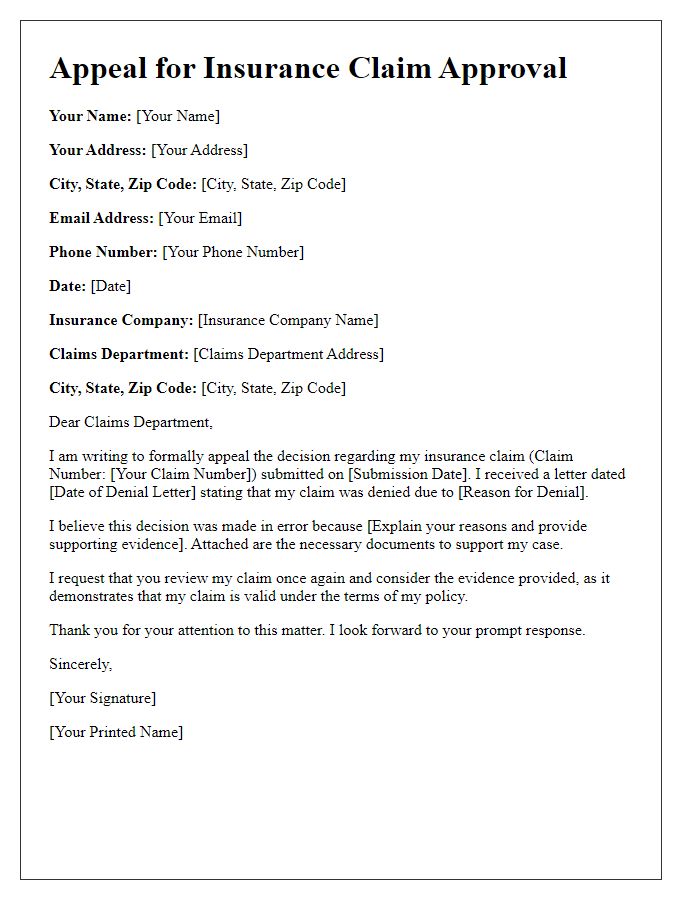

Policyholder Information

Policyholder Information, including full name, policy number, contact address, and phone number, is critical for processing insurance claims efficiently. This data allows insurance companies to verify the identity of the claimant and associate the claim with the correct policy, ensuring timely communication. Accurate contact information is essential for follow-ups regarding claim status and further documentation requests. Additionally, some policies may require specific details related to the insured event, such as dates, locations, and descriptions of damages or losses. Providing clear and complete policyholder information lays the foundation for a smooth claims process.

Claim Details

Insurance claims require accurate documentation to ensure approval. Essential elements include claim number, policyholder information (such as name and address), incident date, and detailed event description (like an automobile accident). Supporting documents should include photographs of damage, repair estimates, medical bills, and police reports if applicable. For instance, a car accident on Main Street on July 15, 2023, should be thoroughly documented with photos showing damages to both vehicles (make and model details), witness statements, and location specifics. This information improves the clarity of the claim process, increases approval chances, and expedites reimbursement.

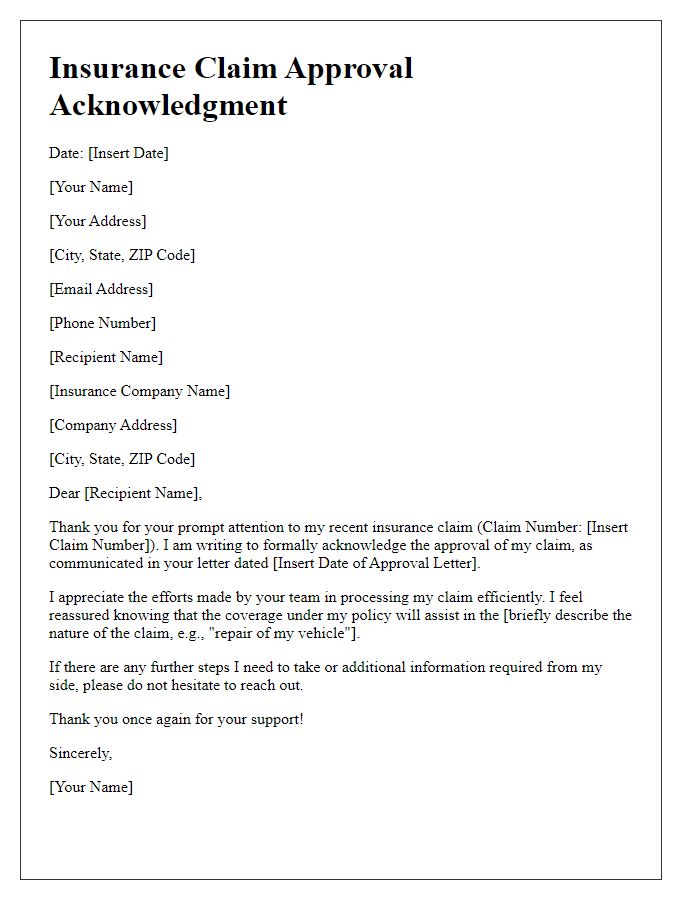

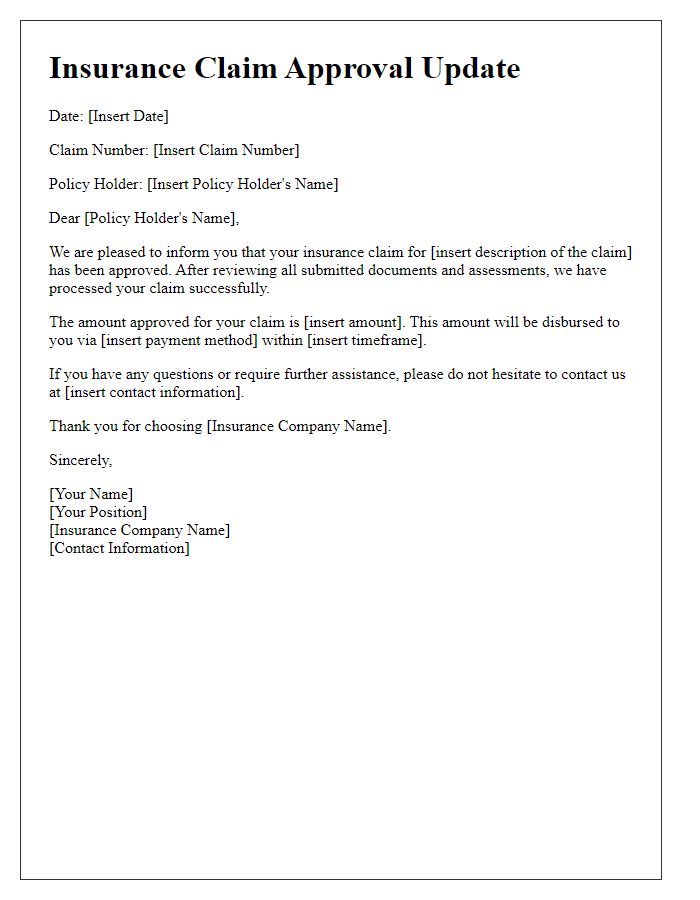

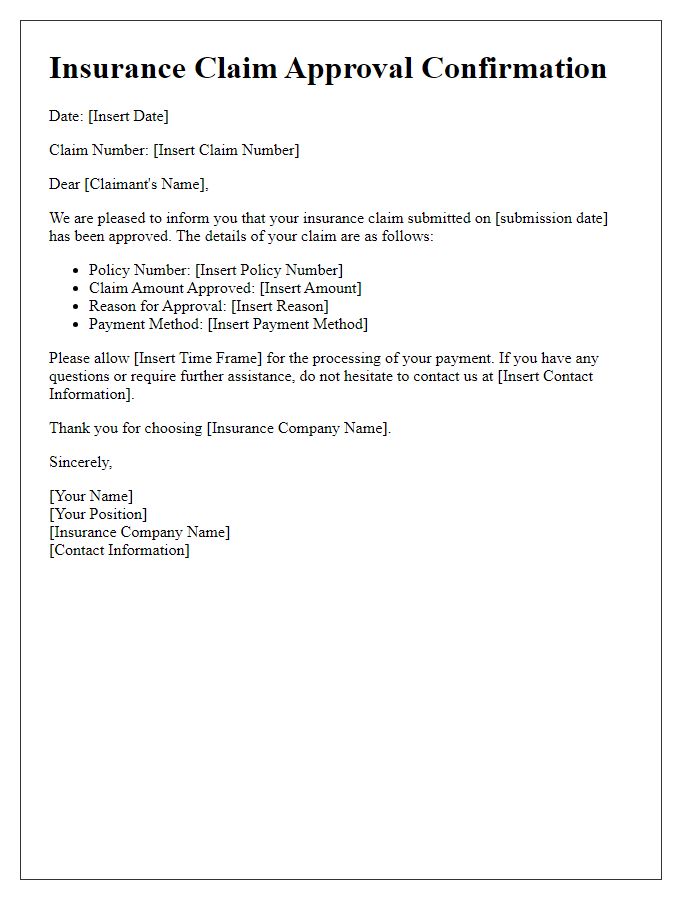

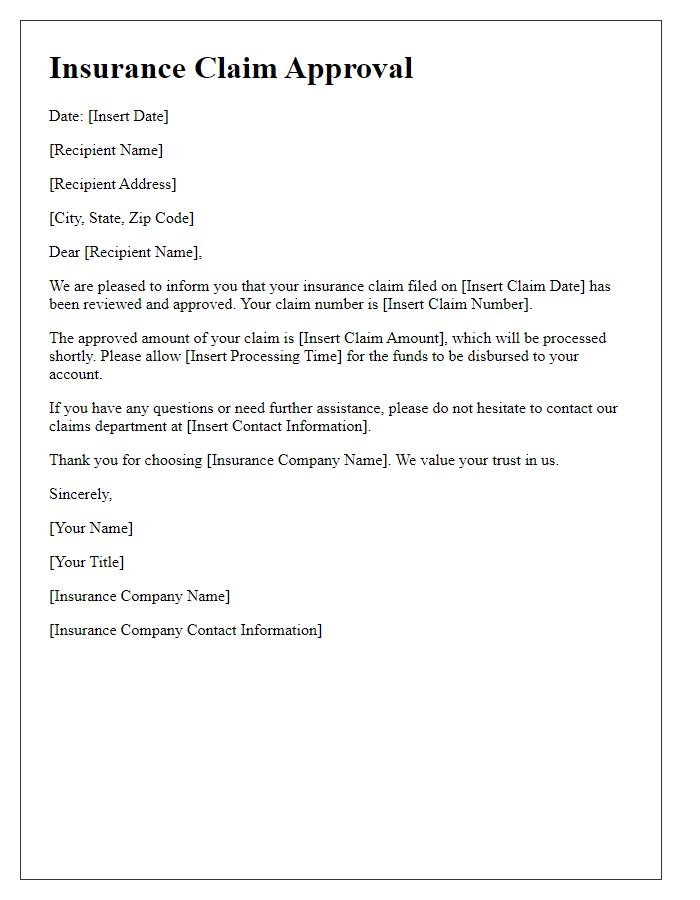

Approval Confirmation

Insurance claim approvals provide essential confirmation for policyholders, ensuring financial compensation for covered incidents. The approval process typically involves a review of submitted documentation, such as police reports, medical records, and repair estimates, often taking seven to ten business days. The final confirmation comes through a formal communication, usually from an insurance adjuster, detailing the specific amount approved based on policy coverage limits. Events leading to the claim approval, such as natural disasters or accidents, influence the amount awarded. Additionally, policyholders receive directions on next steps, including payment procedures and timelines for receiving funds.

Coverage Summary

Insurance coverage summary outlines the specifics of the policy, detailing inclusions such as property damage, liability protection, and medical expenses. For example, a homeowners insurance policy (like those provided by Allstate or State Farm) typically covers dwelling costs up to a certain limit (often $250,000) for damage due to fire, theft, or vandalism. Liability coverage may provide up to $300,000 for incidents involving injury to others on the property. Additional living expenses can also be included, covering hotel costs during repairs, usually capped at a specific percentage of the dwelling coverage. Understanding these details is crucial when filing a claim, ensuring that all covered aspects are accurately represented for approval.

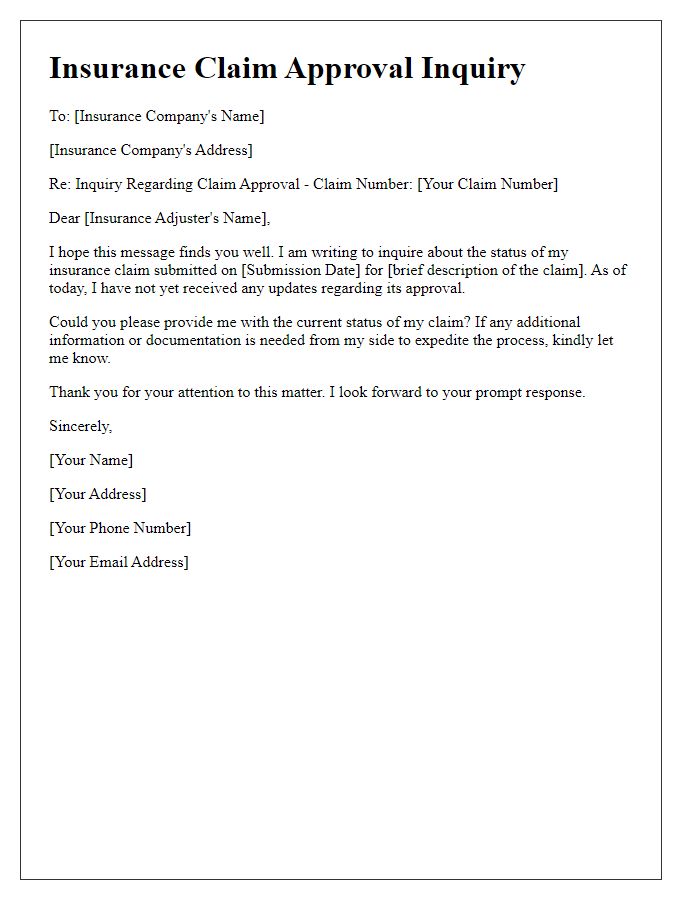

Contact Information for Queries

In insurance claim processes, clear communication is essential for a smooth resolution. Policyholders should have access to specific contact information for queries related to their claims. Typically, this includes the insurance company's customer service hotline, which may be available 24/7, and dedicated email addresses for claim inquiries. The physical address of the claims department should also be provided for those who prefer traditional mail communication. Additionally, the claims adjuster's direct contact information, if assigned, can expedite the process by allowing immediate access for urgent questions or updates. Keeping this contact information easily accessible fosters efficient communication between policyholders and insurance providers, ultimately facilitating quicker claim resolutions.

Comments