Are you feeling overwhelmed by the complexities of navigating an insurance payment plan? You're not aloneâmany find it challenging to understand their options and obligations. Whether you're looking to manage your premiums better or need assistance with a specific payment schedule, we've got you covered. Stick around to discover a comprehensive letter template that can simplify your request for an insurance payment plan!

Policy details and account information

Insurance payment plans can provide financial relief to policyholders facing unexpected expenses. Specific policy details, such as policy number (e.g., 123456789) and type of coverage (e.g., comprehensive auto insurance), are critical for accurate processing. Account information, including the name of the insured (e.g., John Doe) and associated contact details (e.g., phone number or email), ensures that requests are correctly linked to the respective account. Payment plans, often structured around monthly installments (e.g., $200 per month over 12 months), allow policyholders to manage premium payments effectively while maintaining coverage.

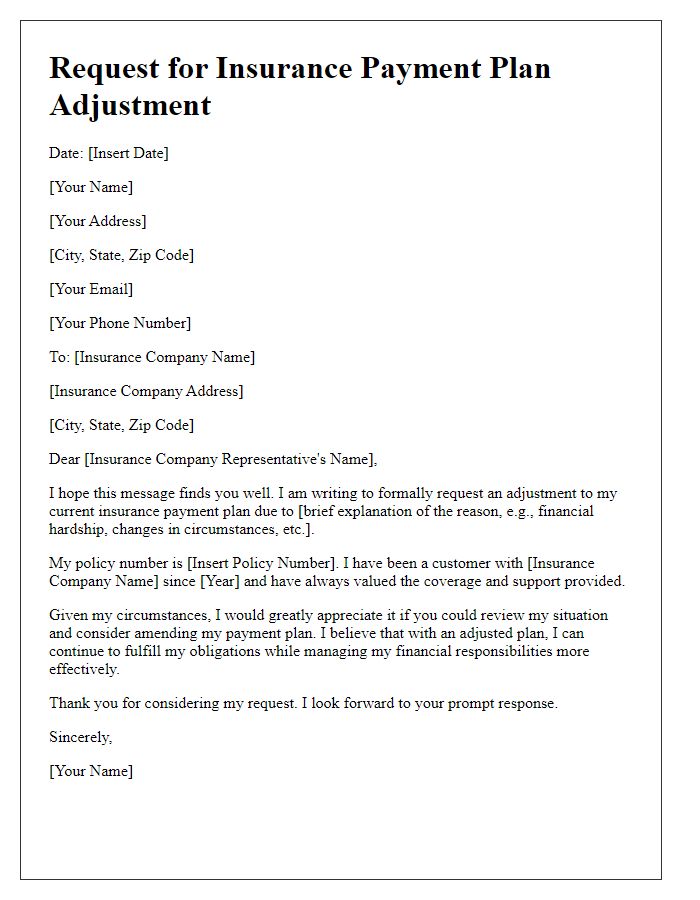

Financial hardship explanation

Financial hardships often arise from unexpected circumstances, such as job loss, medical emergencies, or natural disasters affecting personal stability. In 2022, a significant percentage of Americans faced similar challenges, with many reporting difficulty in meeting everyday expenses. Insurance policies are designed to provide security during these times, but premiums can become burdensome. A formal request for a payment plan can offer relief, allowing individuals to manage their financial obligations more effectively. Documenting specific reasons for hardship, including recent income changes or increased expenditures, can strengthen the case for a revised payment schedule. Providing supporting documents, such as unemployment benefits statements or medical bills, adds credibility to the request and facilitates understanding from the insurance provider.

Proposed payment plan outline

Creating a structured insurance payment plan can help policyholders manage their financial responsibilities efficiently. A proposed payment plan typically involves dividing the total premium into manageable installments. For instance, an annual premium of $1,200 can be broken down into 12 monthly payments of $100 each. Specific details should include due dates, acceptable payment methods such as electronic funds transfer or credit card, and any applicable late fees for missed payments. Additionally, clear communication about the consequences of defaulting, such as policy cancellation or increased future premiums, is essential to set proper expectations. Regular statements outlining remaining balance and payment history can enhance transparency and allow for better financial planning.

Contact information for follow-up

A structured insurance payment plan request can significantly streamline the process of securing necessary financial arrangements. Addressing key entities such as the insurance company (e.g., State Farm, Allstate) ensures clarity. Policy number assigned to the insurance policy provides a unique identifier, facilitating efficient communication. Contact details, including phone numbers (e.g., 1-800-123-4567 for inquiries) and email addresses (e.g., support@insurancecompany.com), play an essential role in follow-up actions. Including a specific timeframe (e.g., response expected within 10 business days) emphasizes urgency. Clearly stated payment terms, such as monthly installments or due dates, further clarify expectations and responsibilities.

Request for confirmation and written agreement

Submitting an insurance payment plan request can enhance financial management by spreading costs over manageable periods. Insurance policies, such as health or auto insurance, often require monthly premiums, typically ranging from $50 to $500 depending on coverage and risk factors. Written agreements confirm the terms and conditions under which payments will be made, including due dates and any potential fees for late payments. Seeking confirmation from the insurance provider ensures that both parties understand obligations, thus preventing miscommunications. Obtaining this written confirmation can also serve as a reference in case disputes arise regarding payments or coverage specifics. Such proactive communication fosters transparency and reinforces trust between policyholders and insurers.

Letter Template For Insurance Payment Plan Request Samples

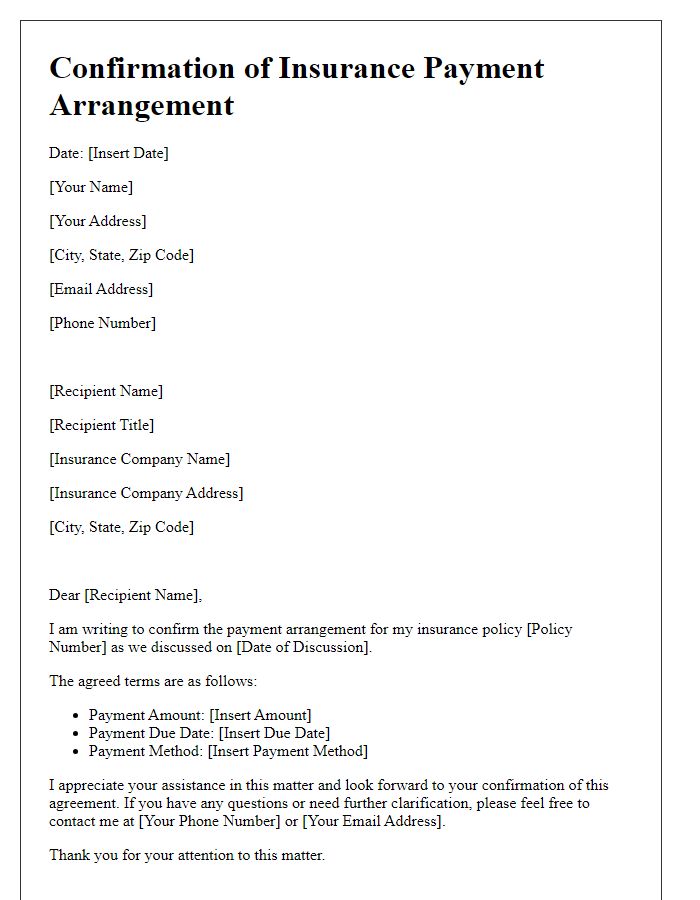

Letter template of confirmation for agreed insurance payment arrangement

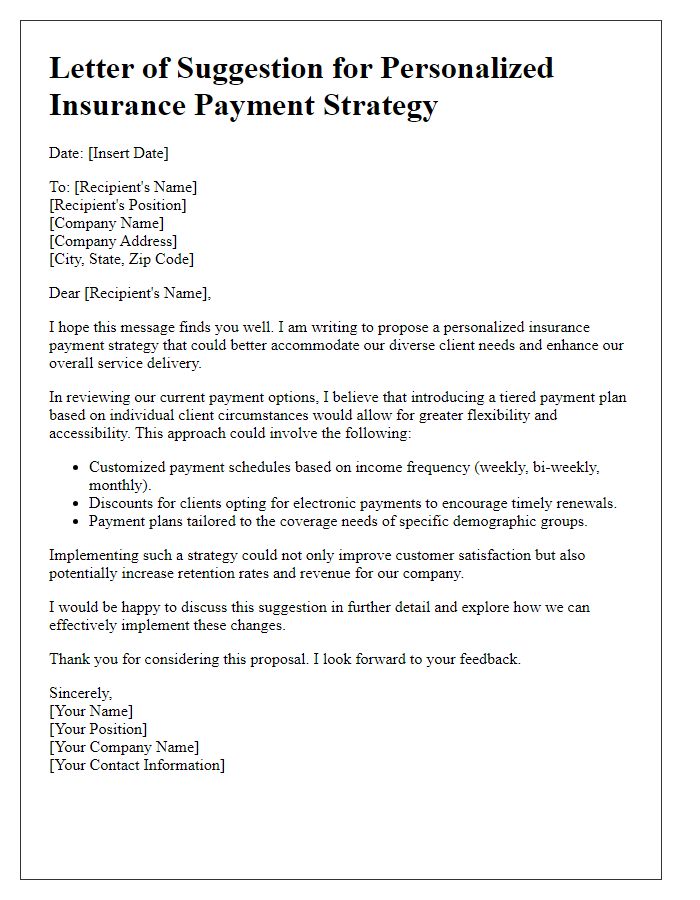

Letter template of suggestion for personalized insurance payment strategy

Comments