Hey there! If you've ever found yourself wondering about the best way to draft an insurance request acknowledgment notice, you're in the right place. This type of letter is essential for confirming that your request has been received and is being processed, ensuring a smooth communication flow with your insurance provider. By understanding the key components of this letter, you can express professionalism and clarity, making it easier for both you and the recipient. So, let's dive in and explore some effective templates and tips to craft the perfect letter!

Policyholder Information

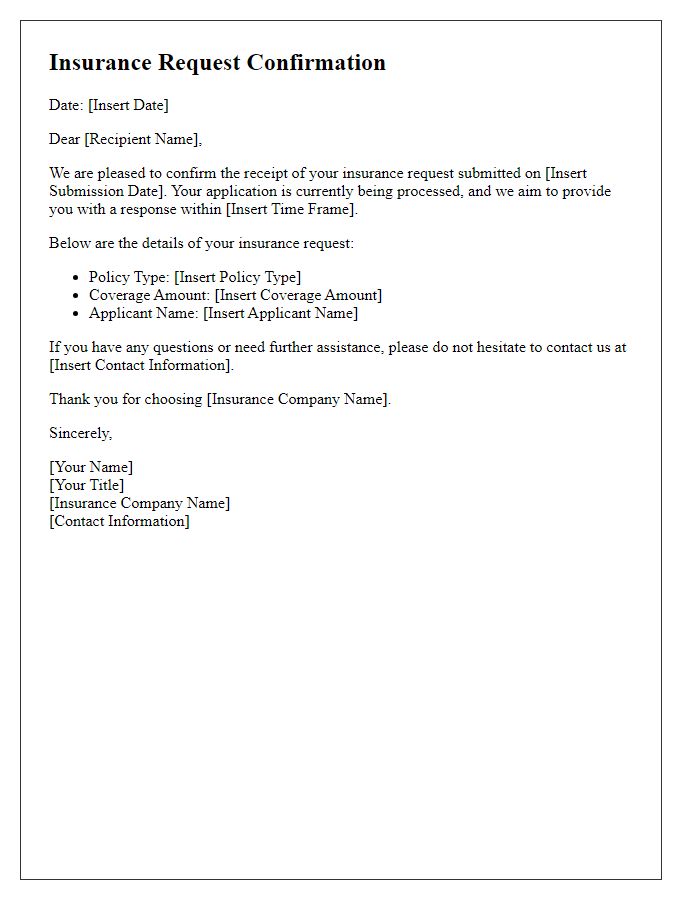

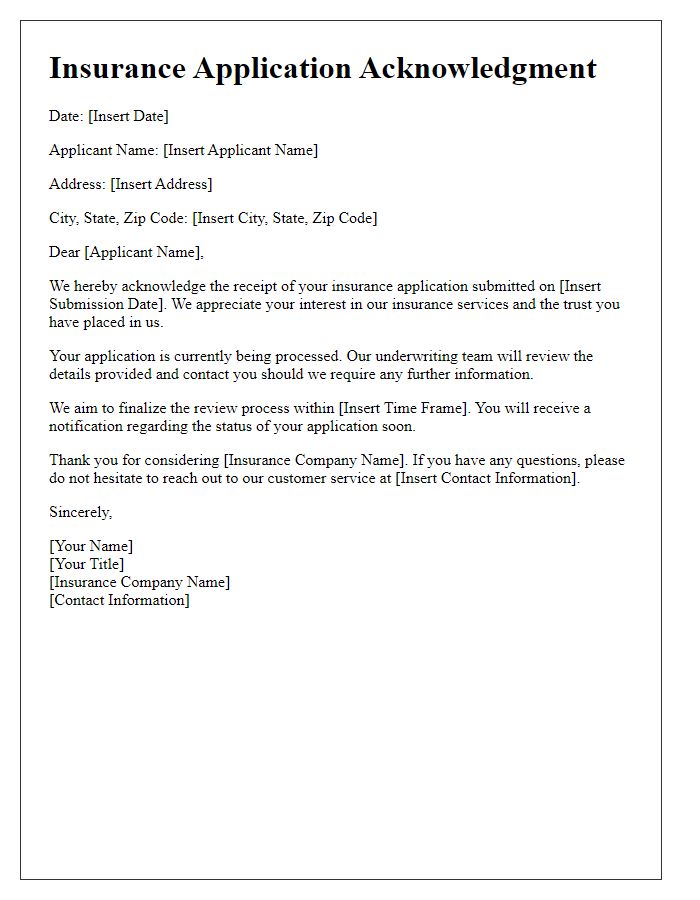

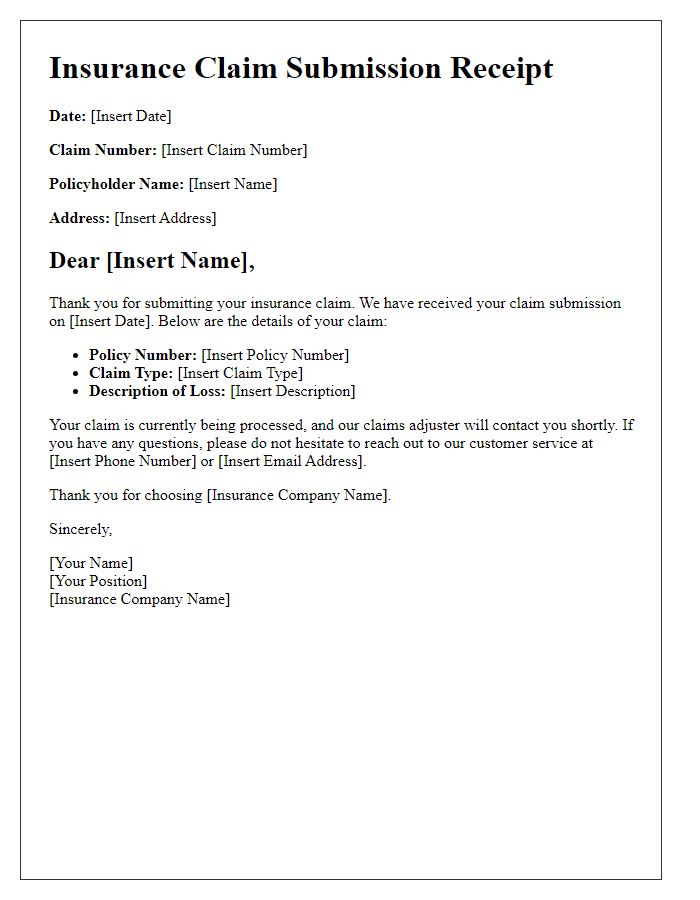

The insurance request acknowledgment notice is a crucial document for policyholders seeking confirmation of their submission. This notice typically includes the policyholder's full name, policy number, and contact information, ensuring clear identification of the insurance account. The date of submission is also recorded, providing a timeline for processing. Additional details about the specific request, such as the type of claim, coverage type, or policy modification requested, are noted for reference. The acknowledgment serves as an assurance that the insurance company, such as Allstate or State Farm, has received the request and is reviewing it according to industry standards and regulatory timelines, often stated as 10 to 30 business days for most claims.

Request Details

A formal acknowledgment notice for an insurance request typically includes essential details about the request status. The notice confirms receipt of the request, outlines the specific type of insurance involved (for instance, homeowner's insurance, health insurance, or auto insurance), and provides a reference number for tracking purposes. The communication may also indicate the expected timeline for processing the request, potential follow-up communication, and relevant contact information for inquiries. Additionally, it reassures the claimant that their request is being reviewed in compliance with defined regulatory timelines, ensuring transparency and trust in the claims process.

Confirmation of Receipt

The acknowledgment notice confirms the receipt of an insurance request submitted to the claims department of [Insurance Company Name], located in [City, State]. The acknowledgment guarantees that the request, received on [Date], is being processed according to the industry standards of timely review and evaluation. Policy number [Policy Number] corresponds to the individual's account, which includes coverage for [specific coverage types, e.g., health, automotive]. The processing team will reach out for any additional information, ensuring adherence to the timeline established by [State/Region] insurance regulations, typically spanning [number of days, e.g., 30 days] for initial response. Clients can track the status of their request through the online portal available at [website URL].

Contact Information

Insurance request acknowledgment notices serve as essential communication between policyholders and insurance companies. This type of notice typically includes contact information such as the policyholder's name, address, phone number, and email address, ensuring that both parties can easily reach one another. Additionally, the insurance company's contact details, including the name of the representative handling the request, their direct phone line at the company headquarters, and an email address for swift follow-up, are crucial. This organized presentation of contact information helps facilitate efficient communication regarding the status and progress of the insurance claim, enhancing customer service and support.

Next Steps to Follow

Insurance claim acknowledgment notices are crucial documents in the claims process, confirming receipt of the claim submission. After submission, policyholders can expect several next steps. Initial assessment will occur within 10 business days, after which an assigned claims adjuster will connect for further information. Policyholders should prepare necessary documentation, such as medical records or police reports, and store them securely. If additional information or clarification is needed, the claims adjuster may reach out via phone or email. Upon completion of the investigation, a decision will be communicated, typically within 30 days. Claims can occasionally involve appeals if coverage questions arise, ensuring policyholders understand their rights throughout this process.

Comments