Are you considering a new insurance policy but feeling overwhelmed by the choices available? Don't worry; you're not alone! Many people find themselves confused by the fine print and various options presented by insurance companies. In this article, we'll guide you through crafting the perfect inquiry letter to ensure you get all the information you needâso let's dive in and explore!

Policyholder Information

Policyholder information, including the policyholder's name, address, and contact number, is critical for insurance inquiries. The name represents the individual or entity holding the insurance policy, vital for identification purposes. Address details ensure accurate communication, especially during claims or policy updates. The contact number facilitates quick communication with the insurance provider, allowing for prompt resolutions of questions or issues regarding coverage, claims, or policy renewals. Accurate information helps streamline the process, ensuring that inquiries are handled efficiently and effectively by the insurance representative.

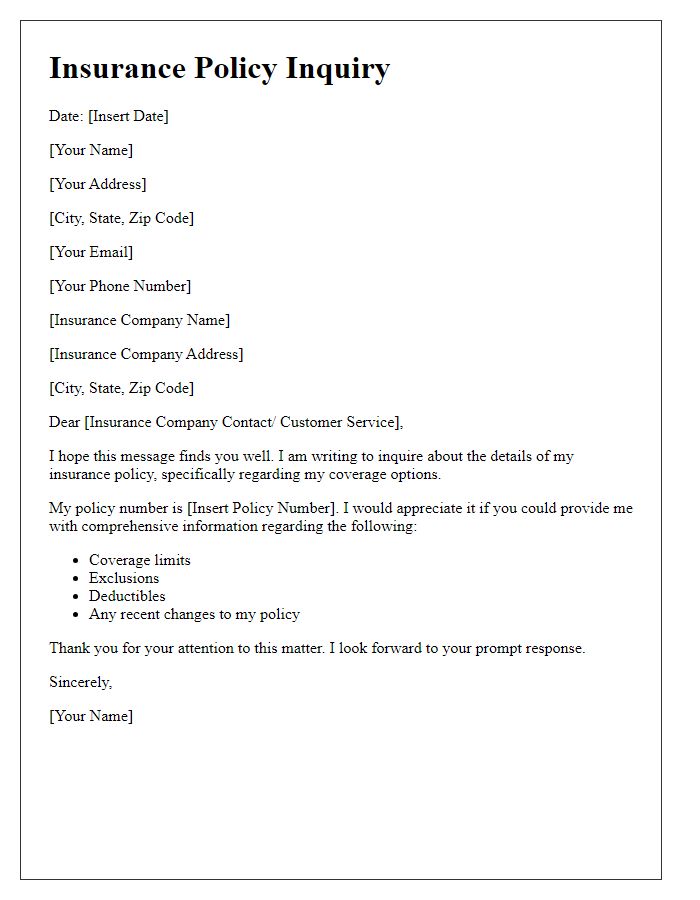

Policy Details and Type

An insurance policy inquiry typically involves requesting clarification about specific terms and coverage options. For instance, a health insurance policy, such as Blue Cross Blue Shield, may include key details like annual premiums, deductibles, and co-pays. Understanding the policy type, whether comprehensive or catastrophic, is crucial for effective coverage management. Elements such as waiting periods for pre-existing conditions, provider networks, and prescription drug coverage are essential for ensuring the policy meets individual healthcare needs. Additionally, state regulations might influence policy provisions, emphasizing the importance of being informed about the local insurance landscape.

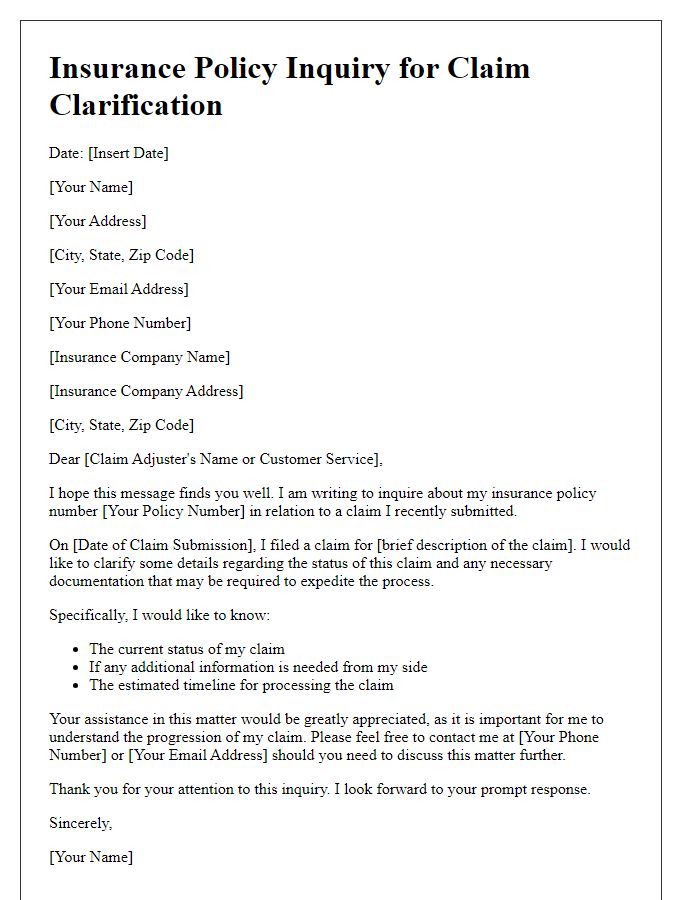

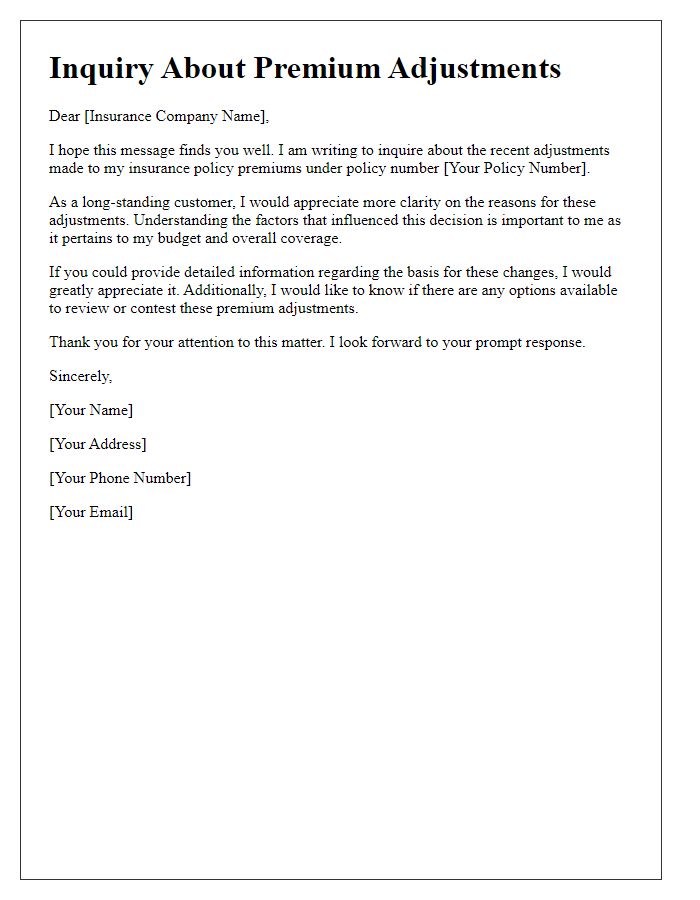

Specific Inquiry or Concern

Insurance policies often contain numerous stipulations that may require clarification, such as coverage details, claim processes, and premium amounts. A specific inquiry regarding a homeowner's insurance policy might involve concerns about the replacement cost of dwelling coverage, which safeguards against damages due to natural disasters like hurricanes or fires. Such policies in states like Florida, known for their vulnerability to hurricanes, must be thoroughly understood, especially concerning the specific limits and deductibles. Consumers should inquire about the timeline for claims processing, which can vary widely between insurers, ranging from days to several weeks, depending on the complexity of the claim. Furthermore, knowing how personal property like electronics (typically covered for theft or damage) is valued in these policies is crucial for effective asset protection.

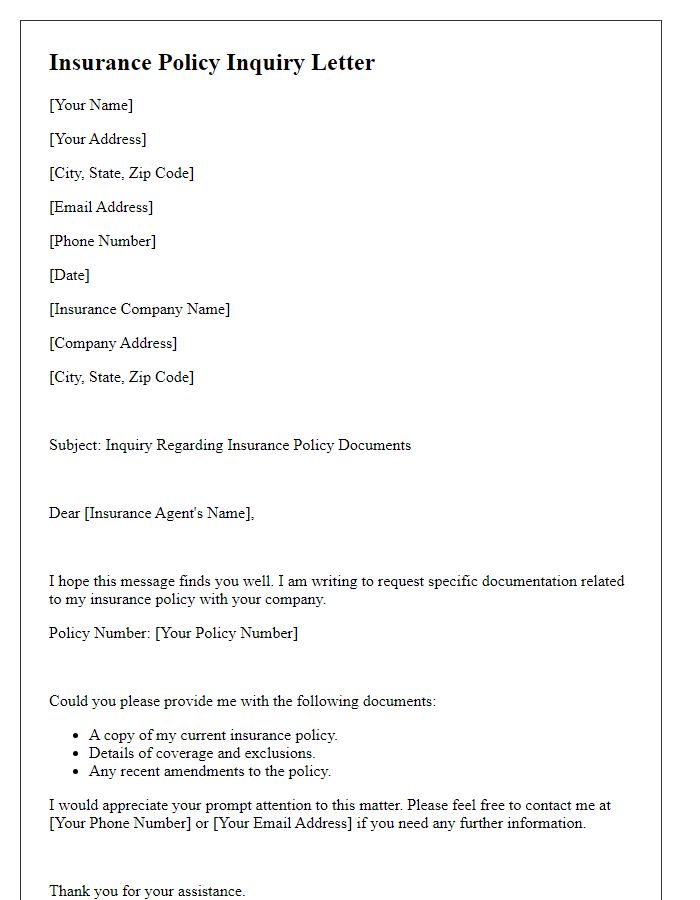

Contact Information for Response

Contacting your insurance provider is crucial for clarifying policy details and ensuring comprehensive understanding. Utilize phone numbers provided in official documents, typically located on the policy declarations page. Email addresses on the provider's website or customer service section can facilitate inquiries, often providing a faster response time. Many insurance companies also feature dedicated online portals for policyholders, enhancing communication efficiency. Additionally, in-person visits to local branches can be beneficial for discussing complex issues. Always ensure that your policy number (a unique identifier for your insurance coverage) is readily available for reference during communications.

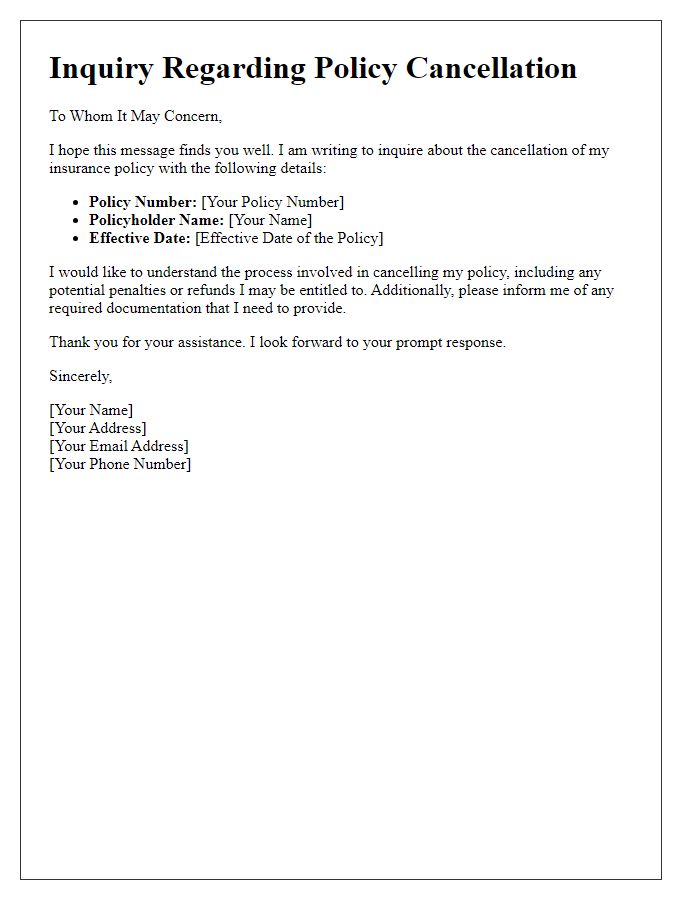

Request for Prompt Response

Insurance policy inquiries often require prompt attention. Clear communication with your insurance provider is essential. Details of the policy number and claimant name should be included for identification. Timelines may vary, but response times should be less than a week to ensure timely resolution. Any specific questions regarding coverage limits, premiums, or claims processes should also be outlined to streamline the response. For optimal engagement, contacting customer service via their designated hotline or official email is recommended. Always maintain copies of correspondence for personal records.

Letter Template For Insurance Policy Inquiry Samples

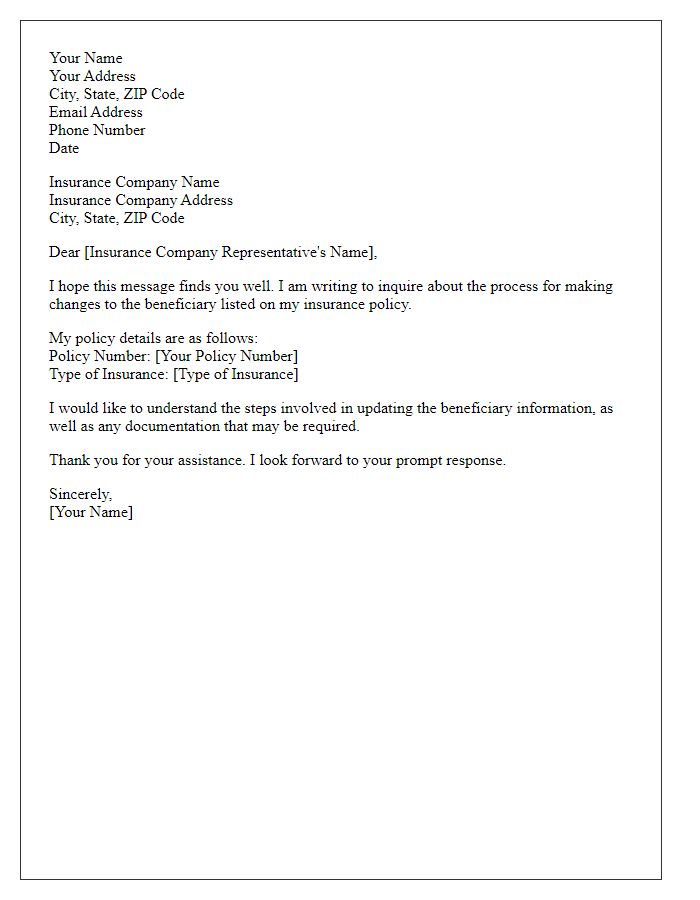

Letter template of insurance policy inquiry relating to beneficiary changes

Comments