When it comes to understanding insurance, special condition notices can feel a bit overwhelming, right? These notices serve as important reminders or updates about specific terms that may influence your coverage. It's crucial to grasp what's in these documents to ensure you remain protected and informed. Curious to learn more about how to navigate these notices effectively?

Clear Policyholder Identification

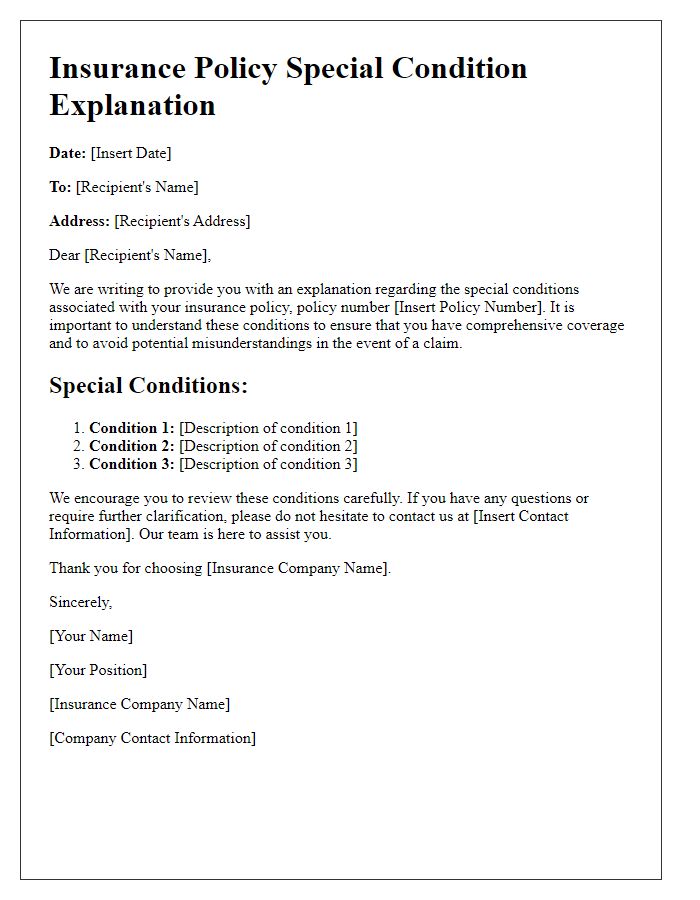

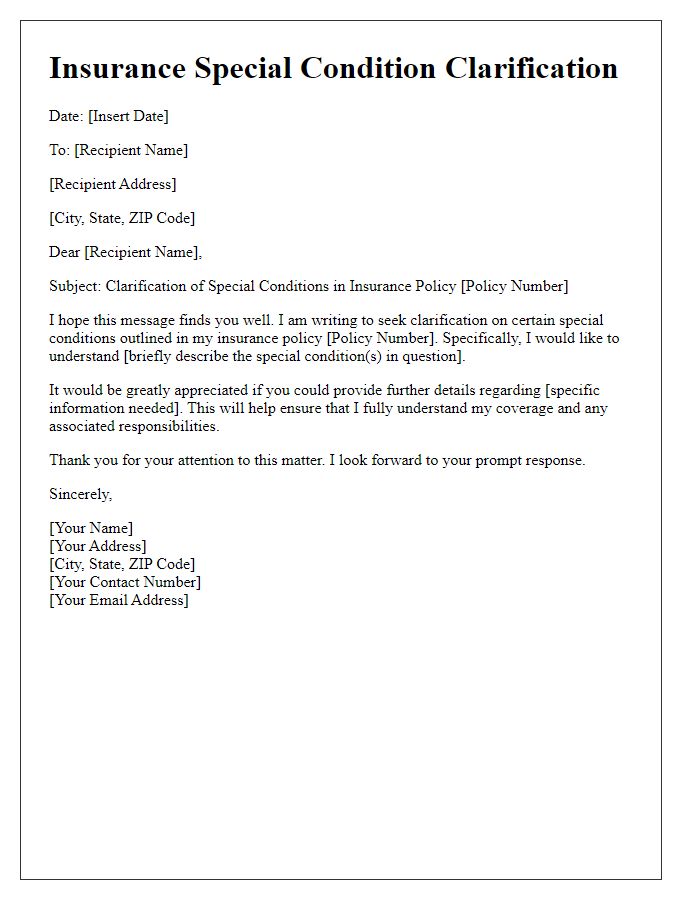

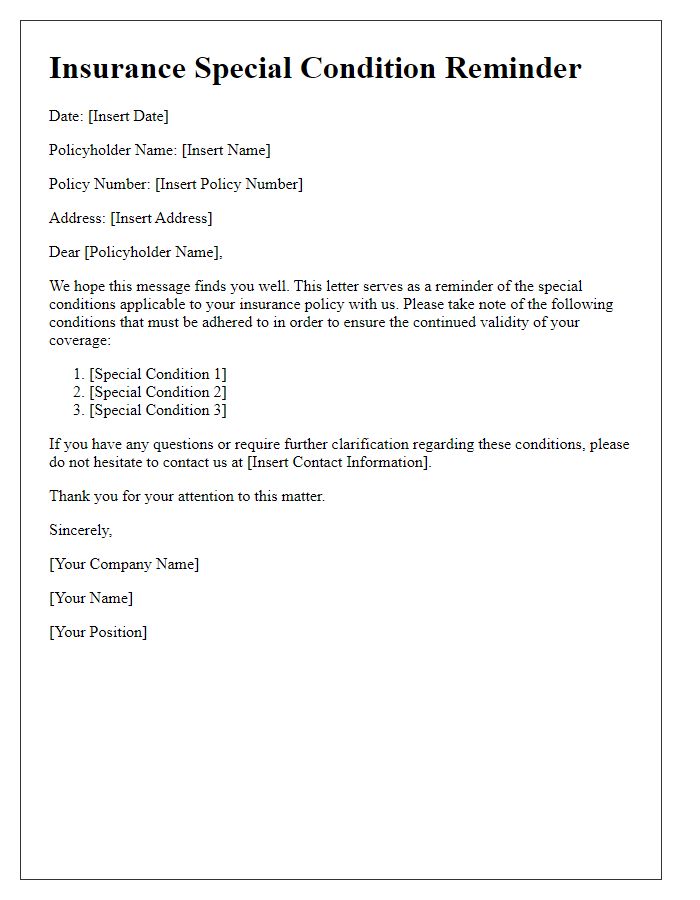

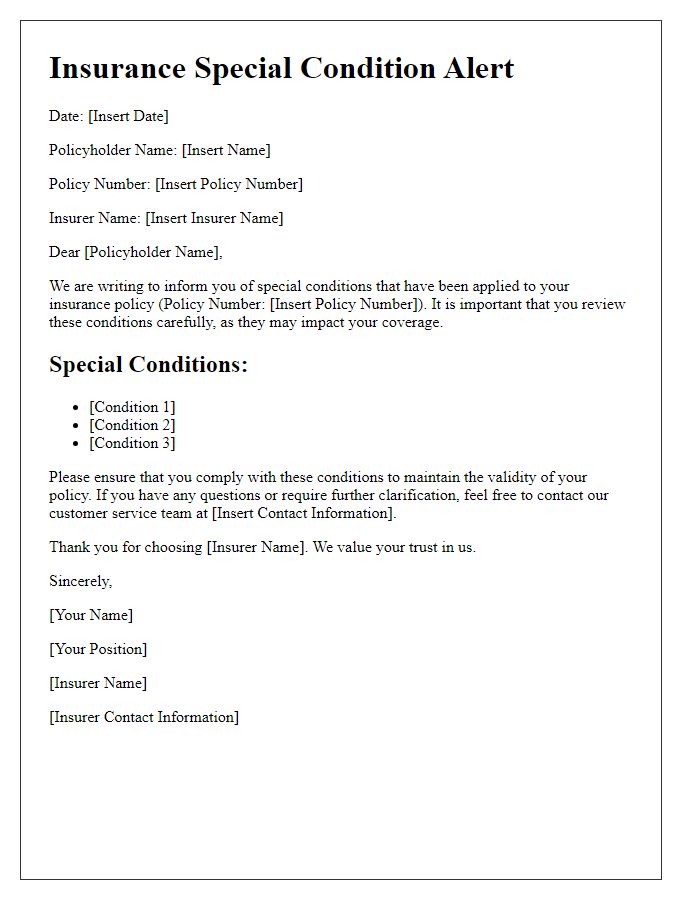

Clear policyholder identification is essential in insurance processes, especially when addressing claims and inquiries. Identification requirements typically include full legal name, current address, and policy number. For instance, precise name spelling and accurate policy numbers help streamline communication, reducing delays in claim processing. Insurance providers may request additional documentation such as a government-issued ID or proof of address like utility bills, particularly for verification. Proper identification practices enhance security, preventing fraudulent activities, thereby protecting both the insurer and the policyholder. Compliance with these identification protocols fosters trust and ensures clarity in insurance transactions.

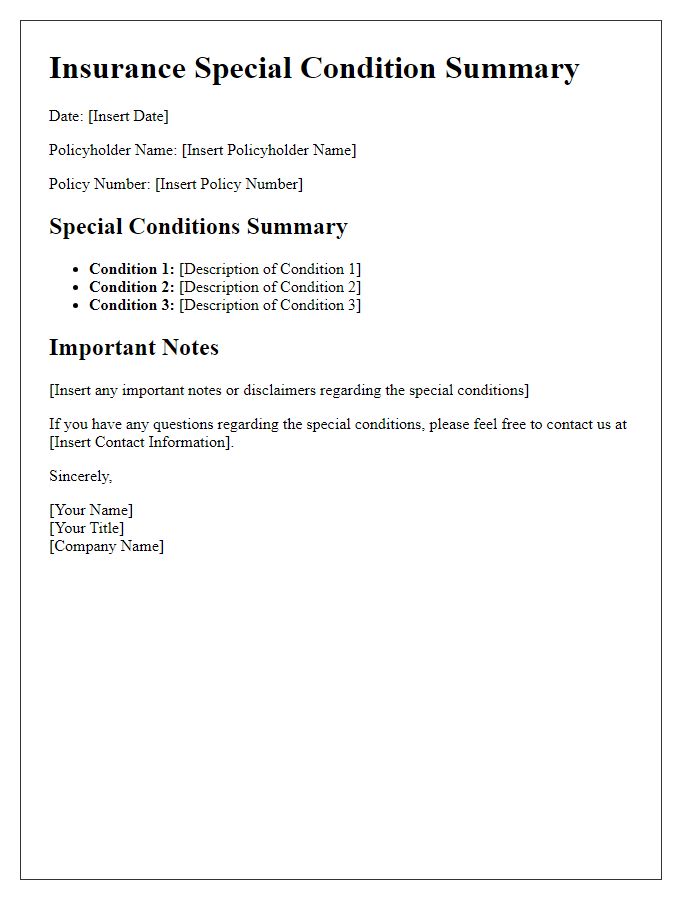

Specific Condition Details

Insurance policies often include specific conditions that must be met for coverage to apply. For example, a home insurance policy may have a clause regarding sump pump failure, which can lead to water damage claims. Sump pumps, crucial for preventing basement flooding, must be in good working order to qualify for coverage. Additionally, the insurance provider may require regular maintenance records, typically documenting inspections every six months, to validate that the sump pump has been serviced appropriately. Failure to adhere to these conditions could result in denied claims, underlining the importance of understanding and complying with specific policy requirements.

Impact on Coverage Explanation

Insurance policies often include specific conditions that can significantly alter the coverage provided to policyholders. For instance, policies might contain clauses regarding pre-existing conditions, which limit coverage for injuries or illnesses that existed before the policy's effective date. Additionally, certain activities, such as extreme sports or high-risk professions, may prompt coverage exclusions, leaving policyholders exposed to potential financial liabilities. Other special conditions could involve geographical boundaries, where coverage is limited to certain regions, impacting individuals traveling outside these areas. Understanding these conditions is crucial for policyholders, ensuring they are fully aware of their coverage limitations and obligations under the insurance contract.

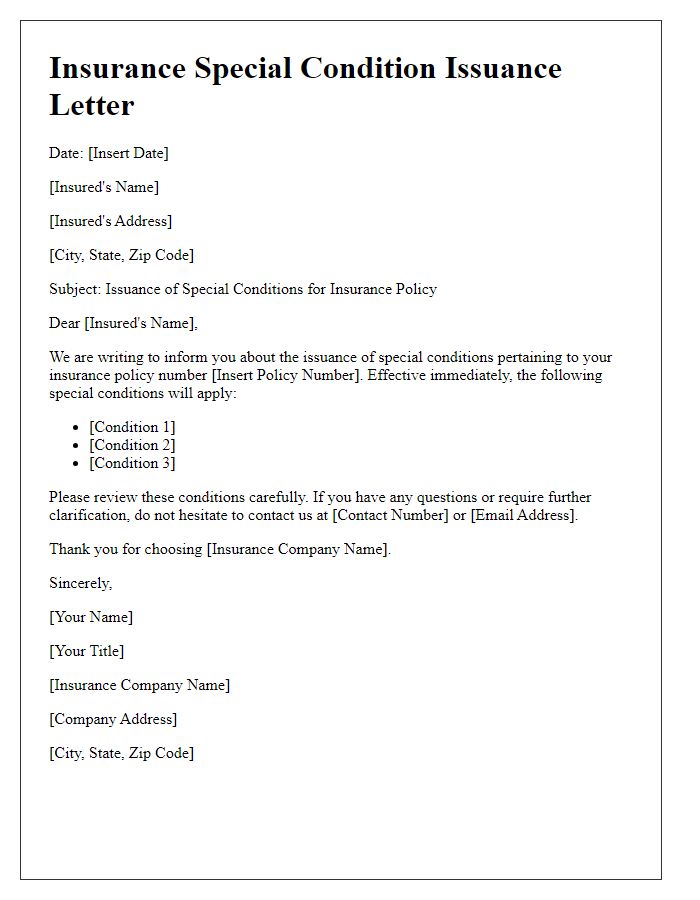

Contact Information for Queries

Insurance special condition notices often require detailed and clear communication regarding specific terms and conditions that could affect policyholders. For instance, should policyholders have inquiries regarding coverage limitations or special terms--such as exclusions for pre-existing conditions or additional documentation needed for claims--it's essential to provide accessible contact information. Typical avenues for queries include dedicated customer service hotlines, which operate from 9 AM to 5 PM on weekdays, or email support, allowing for written communication at the policyholder's convenience. Additionally, physical locations, such as regional offices or customer service centers, can enhance accessibility for those preferring face-to-face interactions. Ensuring this contact information is displayed prominently on the notice improves the likelihood that policyholders will seek clarification on any uncertainties related to their insurance coverage.

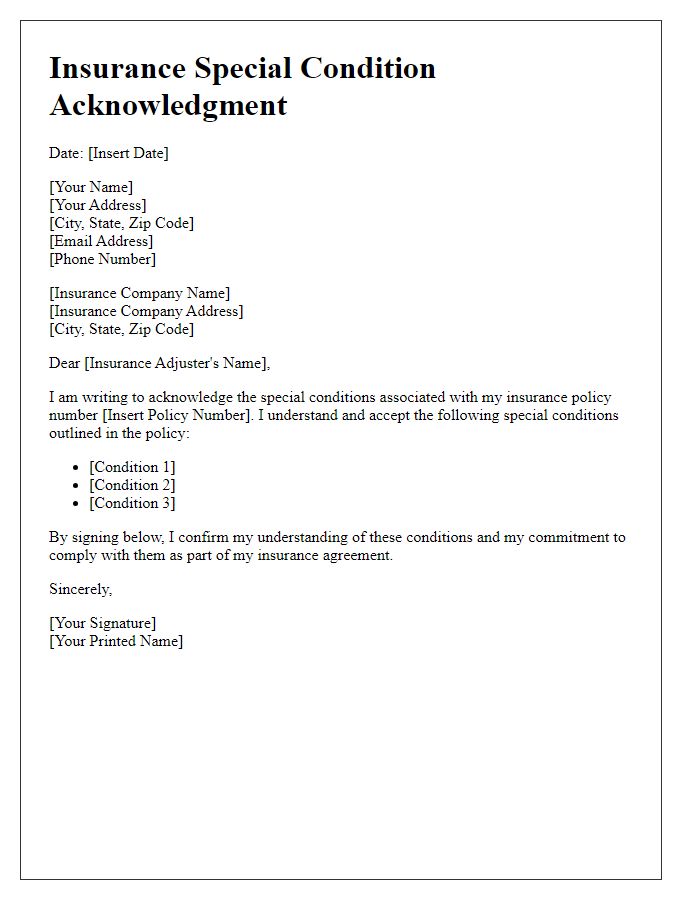

Signature and Date Fields

The special condition notice for insurance requires clear guidelines for adherence. Clients should provide a handwritten signature, ensuring authenticity and acknowledgment of the terms specified within the document. The date field necessitates the inclusion of the exact day, month, and year (format: DD/MM/YYYY) to establish a timeline of acceptance. This document, often integral in policies related to property, health, or auto insurance, may significantly affect the stipulations of coverage. Accurate completion of these fields is critical for the validity of the notice and adherence to the regulatory framework of the insurance industry. Failure to comply could result in legal complications or issues related to claims processing.

Comments