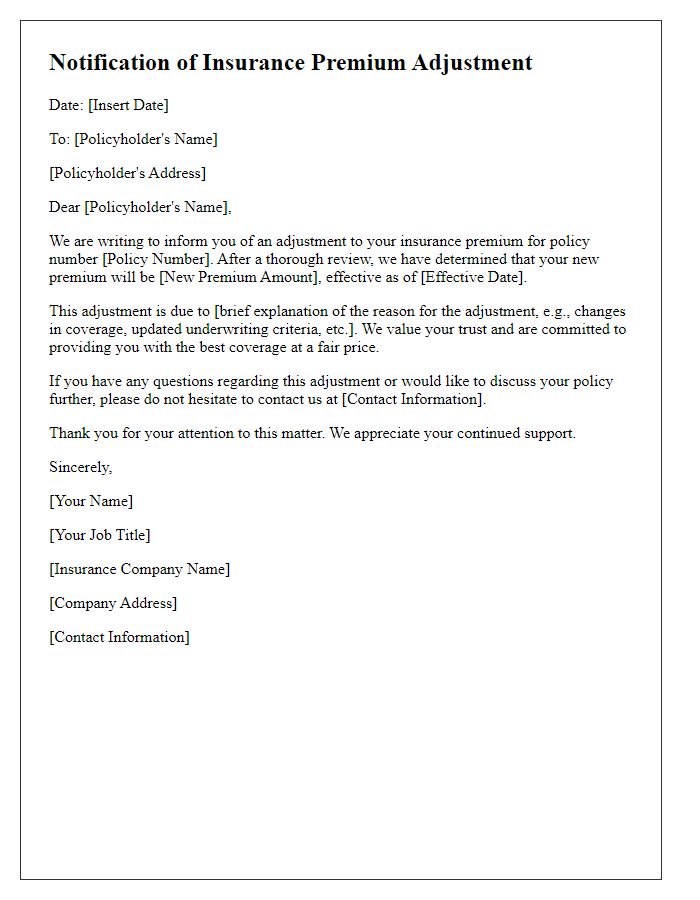

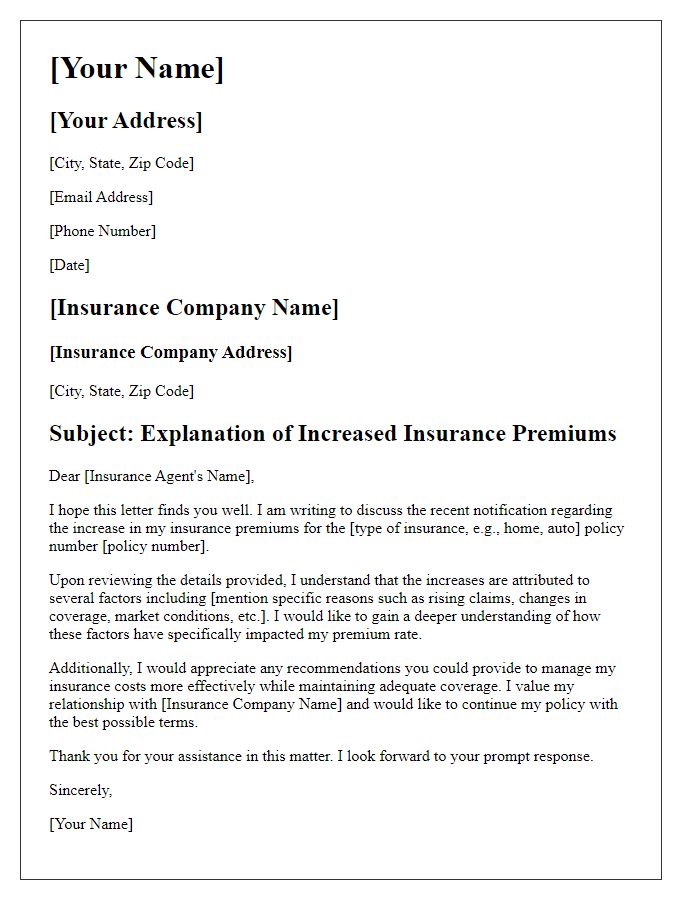

Are you confused about the recent increase in your insurance premium? It's a common concern, and understanding the reasons behind such changes can help clarify your financial planning. Factors like rising claim costs, regulatory changes, and improved coverage options can all contribute to this shift. Join us as we delve deeper into these explanations and offer insights on how to navigate this aspect of your policy effectively!

Detailed cost analysis breakdown.

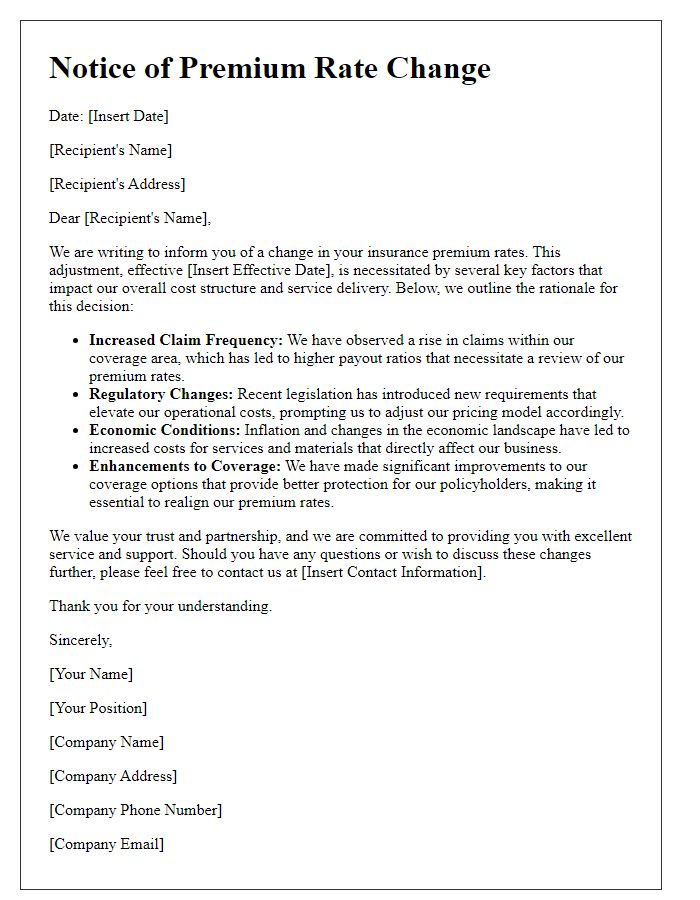

Insurance premium increases often result from various factors influencing overall operational costs. Claims experience plays a significant role; for example, a rise in the number of claims filed, especially costly ones, can necessitate a reassessment of premiums. Risk assessment also influences rates; areas prone to natural disasters, such as Florida's hurricane season or California's wildfire risks, lead insurers to adjust premiums accordingly. Administrative costs rise as well, particularly in response to increased compliance and regulatory requirements influenced by recent industry changes. Inflation affects everything, resulting in higher payouts correlating with increased medical costs, vehicle repair expenses, and property replacement values. Furthermore, reinsurance costs can escalate as global markets fluctuate, impacting overall collected premiums. Finally, investment income changes due to economic conditions affect funding for future claims, prompting adjustments in premium structures to maintain stability.

Statistical claims data.

Insurance premium increases can be justified by analyzing statistical claims data, which reveals significant trends and developments in risk assessment. For instance, increased claim frequency within demographic segments, such as individuals aged 25-34, can result in higher payouts that outpace premium income. Additionally, statistical models highlighting rising costs in medical expenses, particularly in urban areas like Los Angeles, illustrate the impact of inflation on healthcare. Catastrophic events, such as natural disasters in Florida, can drive up claims, necessitating adjustments in premium rates to maintain financial stability. Detailed analysis of historical claims data over the last five years, demonstrating a 20% increase in average claim amounts, underscores the need for premium reassessment to ensure comprehensive coverage and service sustainability.

Inflation rate impact.

Insurance premium adjustments often reflect broader economic changes, such as inflation rates influencing operating costs. The annual inflation rate in the United States reached 6.8% in November 2021, impacting service expenses, claims processing, and administrative overhead for insurance providers. This economic environment forces companies to increase premiums to maintain financial stability and cover rising costs. Additional factors such as higher repair costs from suppliers, increased labor wages, and regulatory expenses further compound the necessity for premium adjustments. Accordingly, the goal remains to ensure adequate coverage while responding to evolving financial realities.

Regulatory compliance adjustments.

Insurance premium increases often stem from regulatory compliance adjustments that insurance companies must adhere to, reflecting changes in state or federal laws. For instance, the introduction of new regulations in 2023 may require insurers to maintain higher reserves for claims, directly impacting premium calculations. Adjustments in risk assessment protocols could also arise from regulatory updates aimed at improving underwriting practices. Furthermore, increased oversight from entities like the National Association of Insurance Commissioners (NAIC) necessitates that insurers allocate additional resources to compliance and reporting, further justifying the need for premium hikes.

Enhanced service offerings.

In recent years, insurance companies have been enhancing their service offerings to provide customers with a more comprehensive and personalized experience. Improved customer service channels, including 24/7 support through dedicated hotlines and chat services, enhance accessibility for policyholders. The introduction of advanced technology tools, like AI-driven claims processing, has reduced processing times significantly, ensuring faster settlements. Additionally, expanded coverage options, which now include specialized plans for emerging risks such as cyber threats and natural disasters, cater to the evolving needs of customers. Enhanced educational resources, such as webinars and interactive materials, empower policyholders with knowledge about their policies and risk management. These value-added services justify a premium increase, reflecting the ongoing commitment to protecting and supporting customers effectively.

Comments