Are you looking to make changes to your insurance policy? Whether you need to add coverage, update personal information, or make any other adjustments, understanding the process of submitting an endorsement request can save you time and hassle. In this article, we'll break down the steps to create a clear and effective letter to your insurance provider. So, let's dive in and get your endorsement request started!

Policyholder Information

A policyholder's information is crucial for processing an insurance policy endorsement request. For instance, full name, such as Jonathan Smith, should be clearly stated for accurate identification. The policy number, like 123456789, must also be included to reference the specific policy being modified. Additionally, the contact information, including a current address on Elm Street, Anytown, such as 123 Elm St, Anytown, State, Zip code 12345, is essential for correspondence. Including a phone number, like (123) 456-7890, and an email address, like jonathansmith@email.com, ensures that the insurer can reach the policyholder for any clarifications or further actions needed. All these details streamline the endorsement process, ensuring efficient handling of requests such as coverage adjustments or updates to personal information.

Policy Details (including policy number)

The insurance policy endorsement request involves submitting specific information regarding the existing policy. The policy details must include the policy number, which uniquely identifies the insurance agreement made with the provider. The request should specify the type of endorsement desired, such as changes to coverage limits, adjustments to beneficiaries, or the addition of new insured locations. Including the effective date for the requested changes is crucial for processing. Clear identification of the policyholder's contact information, including a phone number and email address, ensures prompt communication regarding the endorsement status. Providing supporting documentation, if necessary, can facilitate a smoother endorsement process.

Specific Endorsement Request

Specific endorsement requests in insurance policies involve modifications to existing coverage in response to policyholder needs. These adjustments may pertain to specific valuables, like jewelry appraised at over $5,000, or changes in property occupancy status for a primary residence located in Los Angeles, California. The endorsement could also address exclusions, such as flood coverage for homes situated in high-risk zones, which FEMA identifies based on flood maps. Such requests often require supporting documentation, including updated appraisals, descriptions, or risk assessments to ensure adequate protection and compliance with the insurer's guidelines. Potential delays in processing endorsement requests may occur if additional underwriting review is necessary, impacting immediate coverage availability.

Justification or Reason for Endorsement

Insurance policy endorsements often require precise justifications to ensure proper coverage adjustments. Common reasons for endorsements may include significant life changes, such as marriage or divorce affecting beneficiaries, acquiring new assets like vehicles or properties requiring increased coverage, or adjustments due to increased risk factors like home renovations. Furthermore, businesses may need endorsements when expanding operations, adding liability coverages for new products, or changing business locations. Accurate and detailed explanations enhance the clarity and necessity of requested adjustments, ensuring a smooth endorsement process.

Contact Information for Follow-up

Effective communication is crucial for insurance policy endorsement requests. Including detailed contact information ensures timely follow-up. List your full name (e.g., John Smith), policy number (e.g., ABC123456), and relevant policy details (e.g., auto insurance, homeowner's insurance). Provide your primary contact number (e.g., (123) 456-7890) and email address (e.g., john.smith@email.com) for digital correspondence. Specify the preferred time for follow-up discussions (e.g., weekdays after 5 PM). Additionally, consider including an alternative contact number (e.g., (987) 654-3210) in case the primary number is unavailable. Clarity in your contact information fosters efficient communication and expedites the endorsement process.

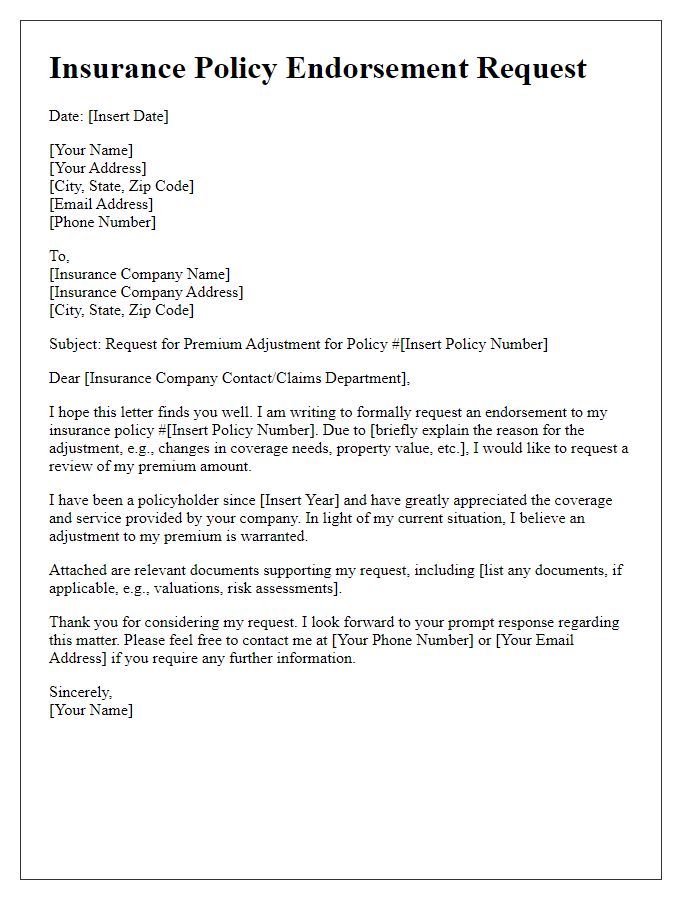

Letter Template For Insurance Policy Endorsement Request Samples

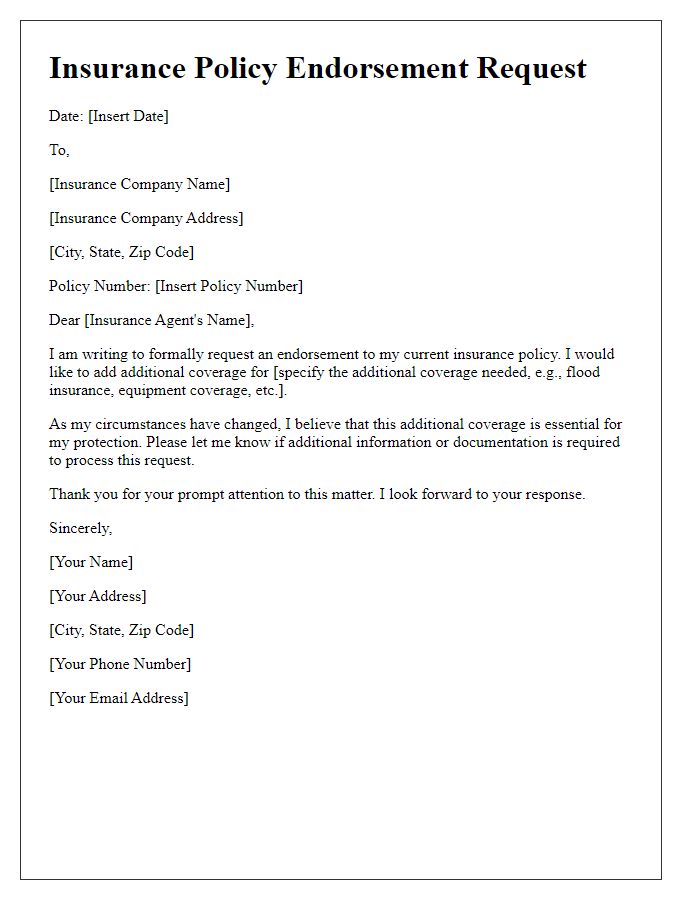

Letter template of insurance policy endorsement request for added coverage.

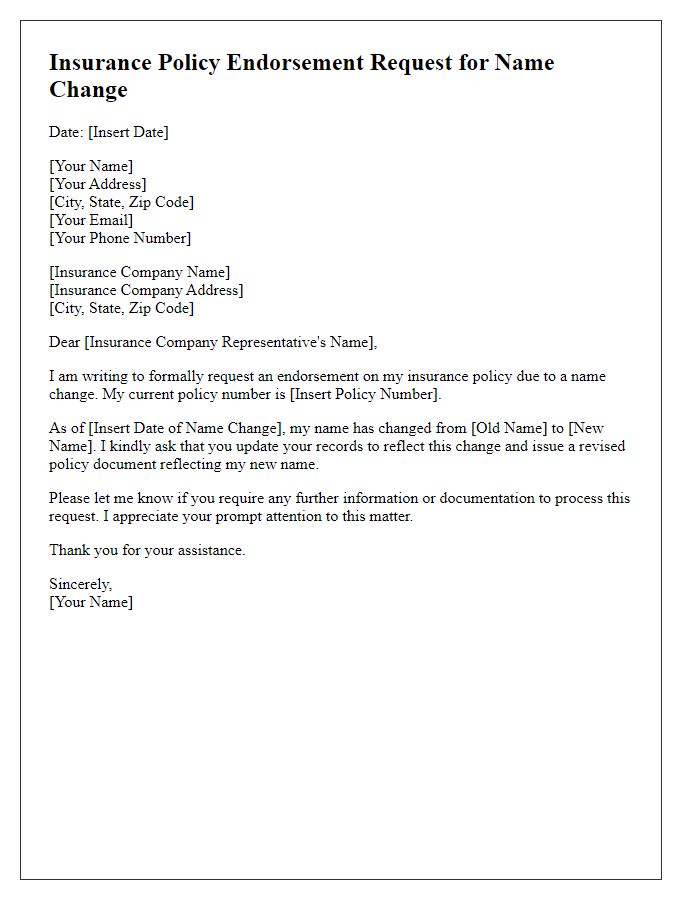

Letter template of insurance policy endorsement request for name change.

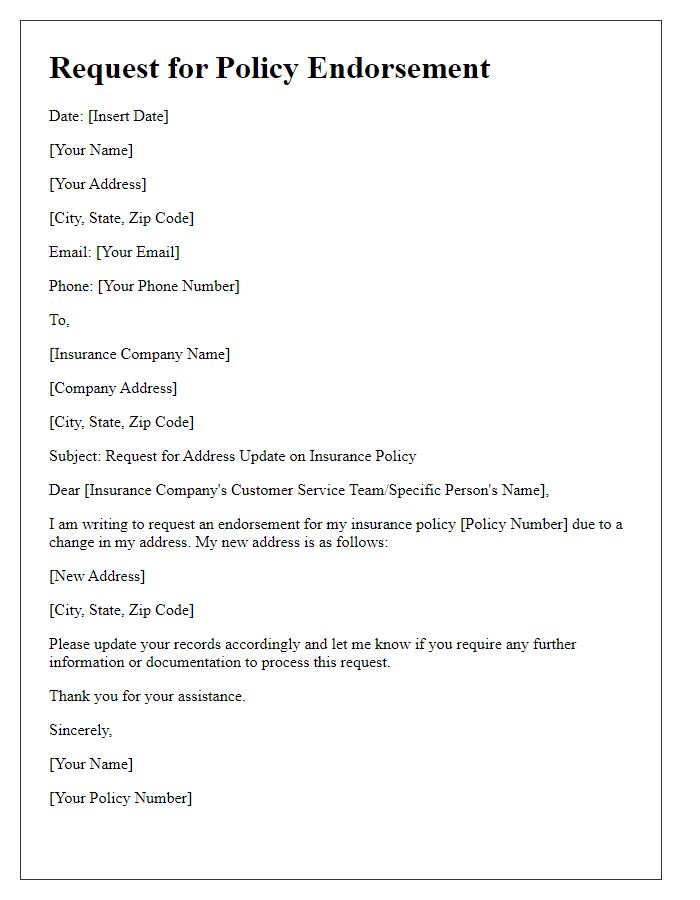

Letter template of insurance policy endorsement request for address update.

Letter template of insurance policy endorsement request for beneficiary modification.

Letter template of insurance policy endorsement request for vehicle addition.

Letter template of insurance policy endorsement request for increased liability limits.

Letter template of insurance policy endorsement request for removal of a driver.

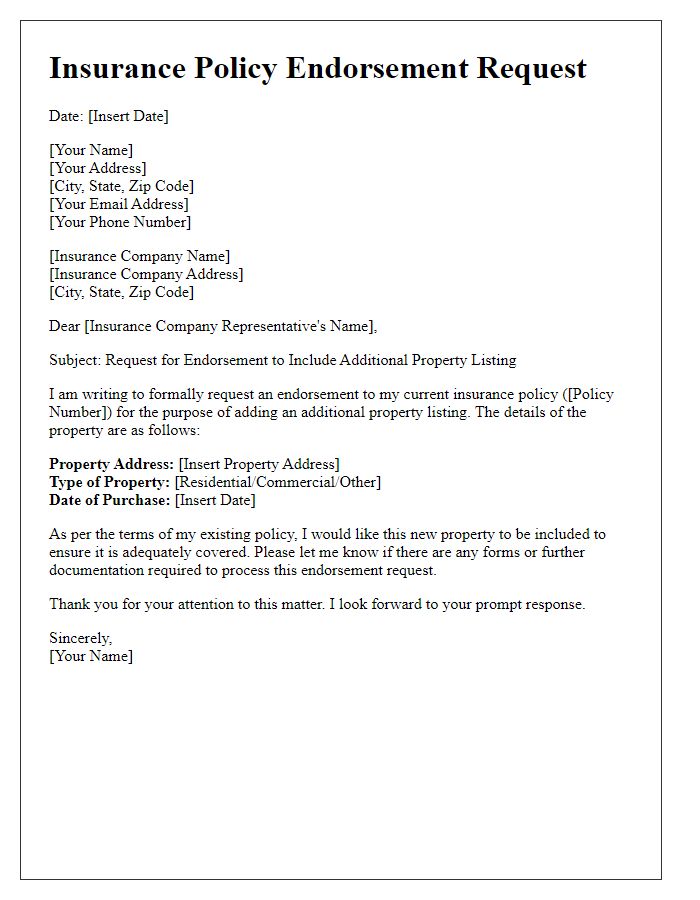

Letter template of insurance policy endorsement request for property listing addition.

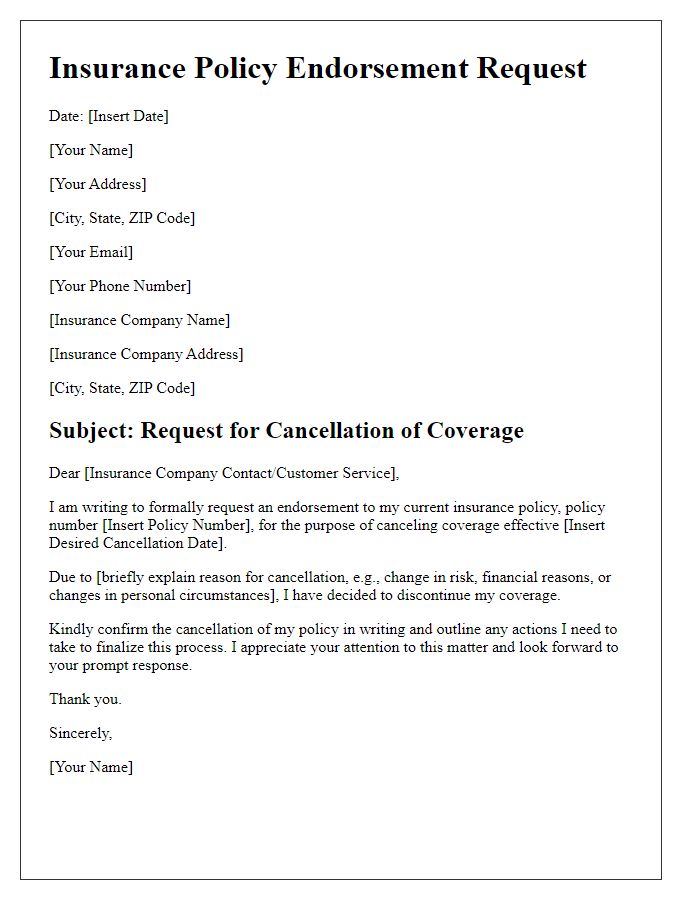

Letter template of insurance policy endorsement request for cancellation of coverage.

Comments