Are you in need of legal representation for your insurance case? It's crucial to have the right support by your side to navigate the complex world of insurance claims and disputes. This article will guide you through the process of confirming legal representation, ensuring you understand your rights and options. So, keep reading to discover how to secure the best representation for your insurance needs!

Policyholder Information

Legal representation in insurance matters often involves complex policies. Understanding essential terms, such as "policyholder"--the individual or entity that owns the insurance policy--is crucial for navigating disputes. Effective communication is necessary, particularly in regions like California, where state laws may dictate specific protocol in insurance claims handling. Engaging legal counsel can enhance the policyholder's position, especially in cases involving substantial claims or coverage denials. Comprehensive documentation, including claim numbers and relevant correspondence with insurance adjusters, is vital in this process to ensure clarity and effective advocacy.

Claim Details

Seeking confirmation for legal representation on insurance claims involves essential details such as claim number, policyholder's name, date of loss, and agent's information. The claim number serves as a unique identifier for tracking purpose within the insurance company's system. The policyholder's name must align with the insurance policy document, ensuring accurate correspondence. Date of loss, often pivotal in determining coverage eligibility, must be documented clearly. Agent's information, including name and contact number, facilitates communication between legal representatives and the insurance company. Each facet plays a crucial role in the efficient progression of the claim process.

Legal Representation Authorization

Legal representation authorization confirms the consent of the insured individual to appoint a legal representative for dealings related to insurance claims. This representation typically includes communication with insurance companies, negotiating settlements, and handling litigation if necessary. The legal representative, often an attorney specializing in insurance law, must be authorized to act on behalf of the insured in all matters related to the specific policy (for example, a homeowner's or auto insurance policy) and claims that arise. This authorization may require a written document outlining the scope of the legal representative's powers, ensuring that all actions are in the best interest of the insured. Proper notarization or witness signatures may accompany such documents to validate the agreement.

Terms and Conditions

Insurance legal representation confirmation entails a structured agreement containing essential terms and conditions. Each party involved must understand their responsibilities as outlined in the contract. The representation fee, which often includes hourly rates or flat fees, should be clearly stated to avoid misunderstandings. Coverage specifics refer to the scope of legal services provided, including advice on claims, litigation processes, and negotiation. A timeline for service delivery, which may extend across weeks or months depending on case complexity, is crucial. Confidentiality clauses protect sensitive information shared during representation, emphasizing the attorney-client privilege. Jurisdiction definitions clarify which laws govern the representation agreement, crucial for dispute resolution. Compliance with local laws and ethical standards, alongside detailed termination conditions outlining how either party may dissolve the agreement, is necessary for lawful engagement.

Signature and Date

Legal representation in insurance disputes often requires clear documentation, particularly around the confirmation of representation. An attorney's signature, alongside a date, serves as vital proof of engagement. This signature indicates the attorney's acceptance of responsibility to defend the client's interests in legal matters involving insurance claims. The date marks the commencement of their professional obligation, establishing a timeline for legal proceedings. Proper protocol necessitates ensuring that the document containing the signature and date is securely stored and readily accessible for future reference in any legal context.

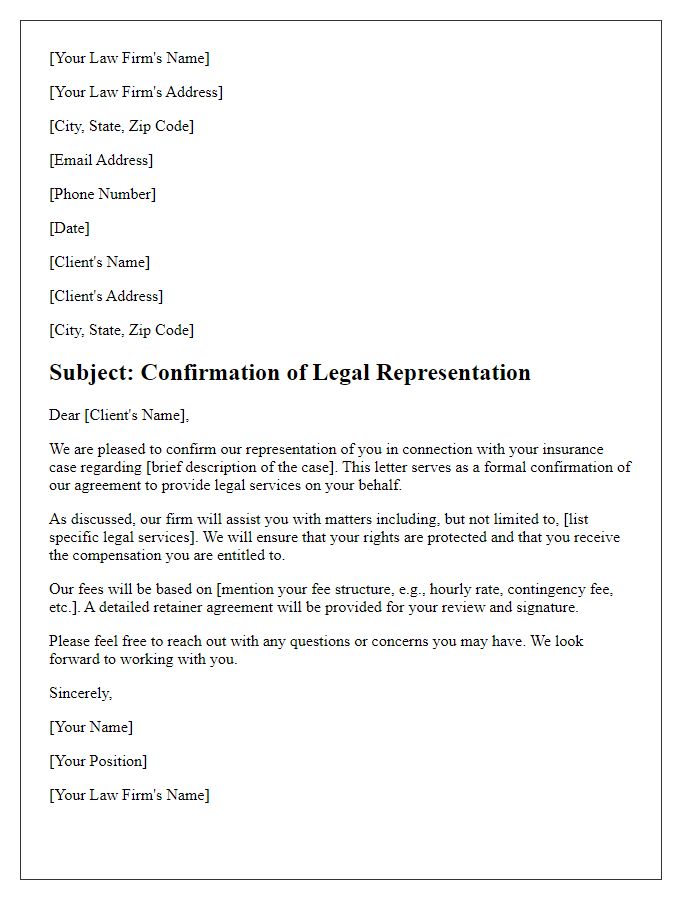

Letter Template For Insurance Legal Representation Confirmation Samples

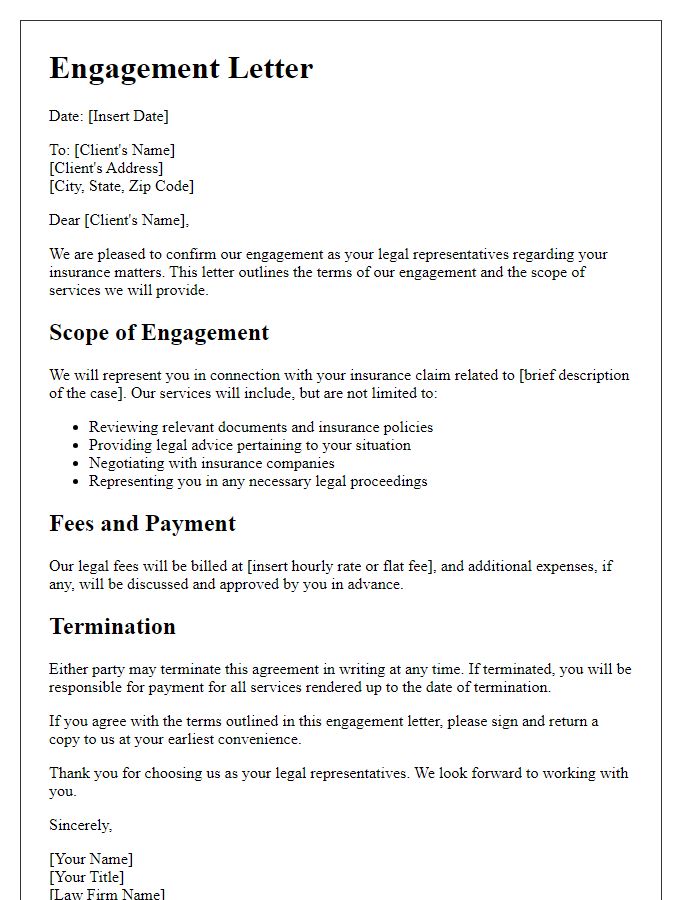

Letter template of legal representation confirmation for insurance claim.

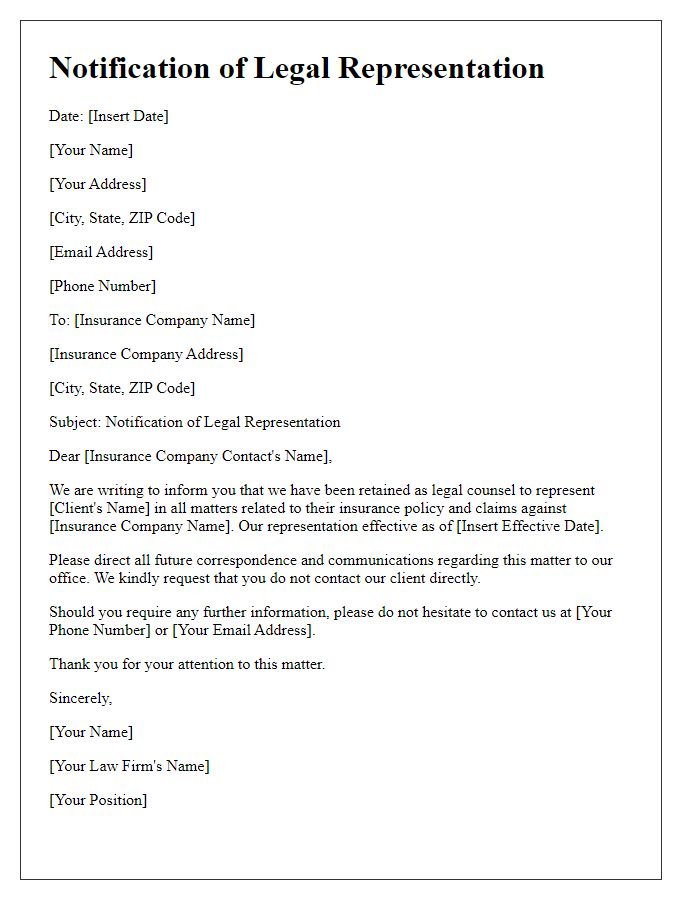

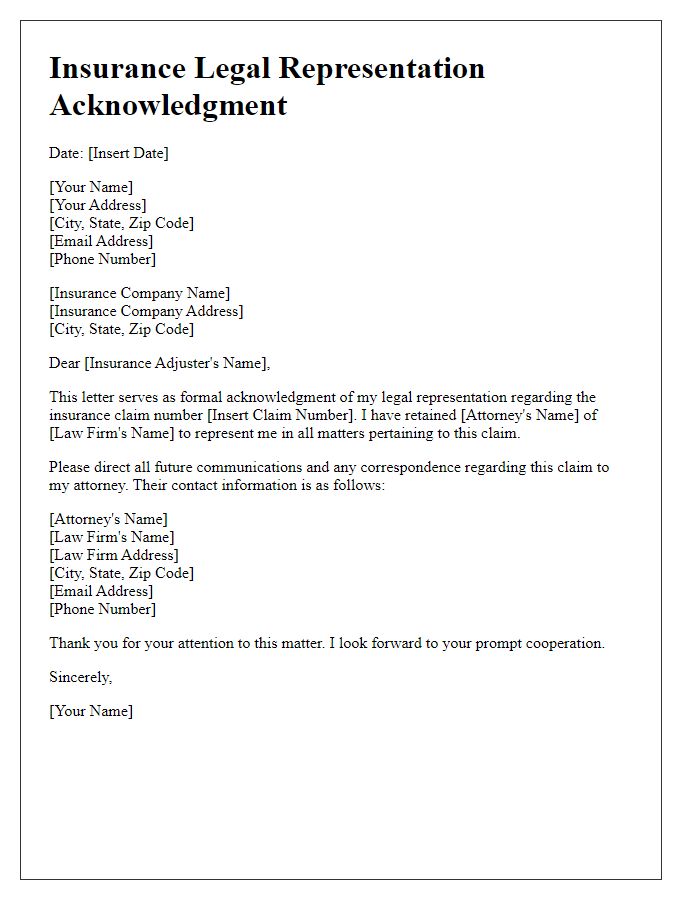

Letter template of notification for legal representation in insurance matters.

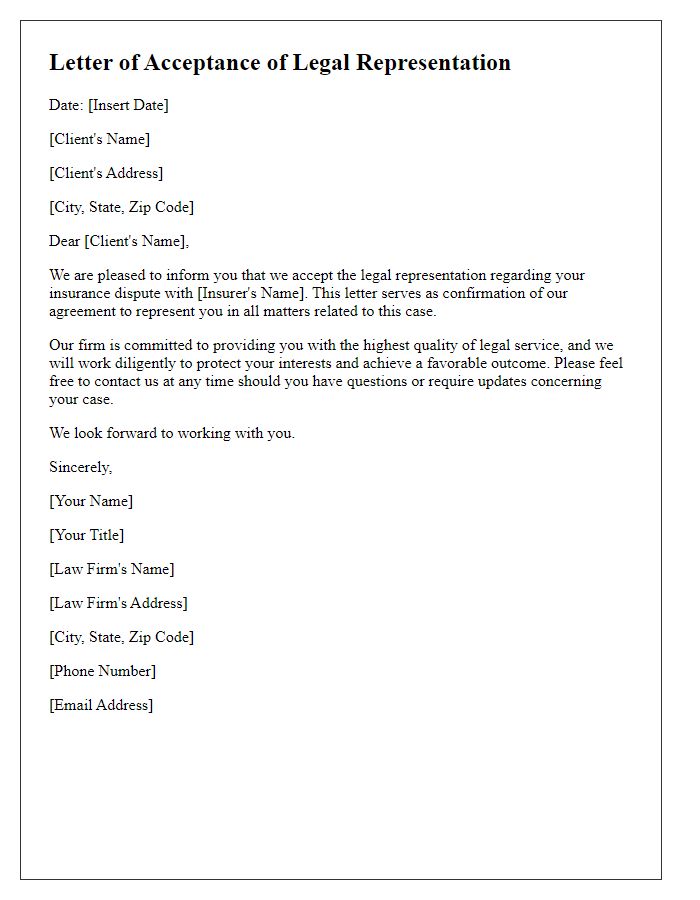

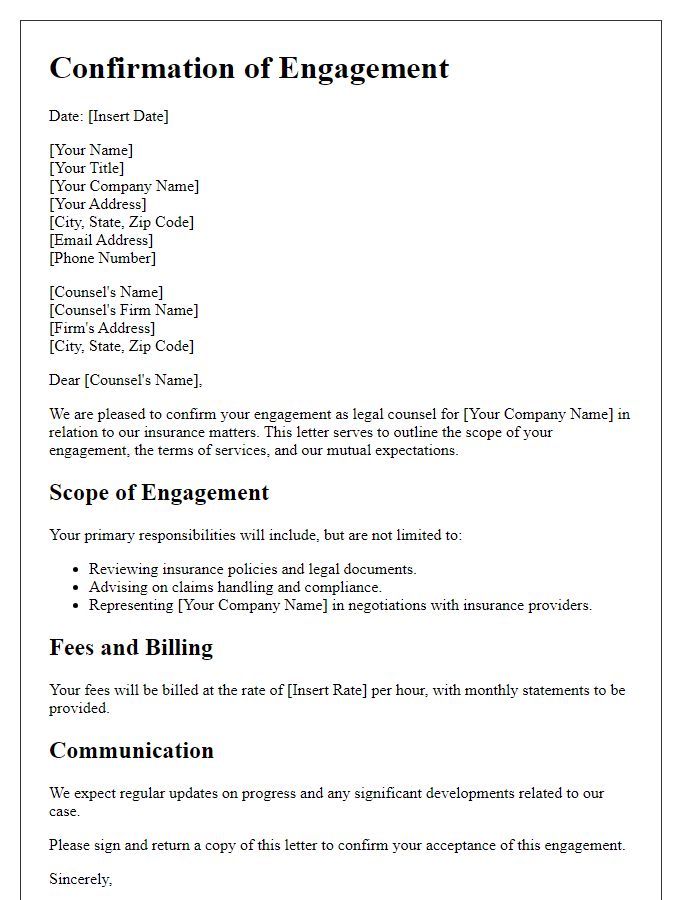

Letter template of acceptance of legal representation for insurance disputes.

Letter template of insurance legal representation agreement notification.

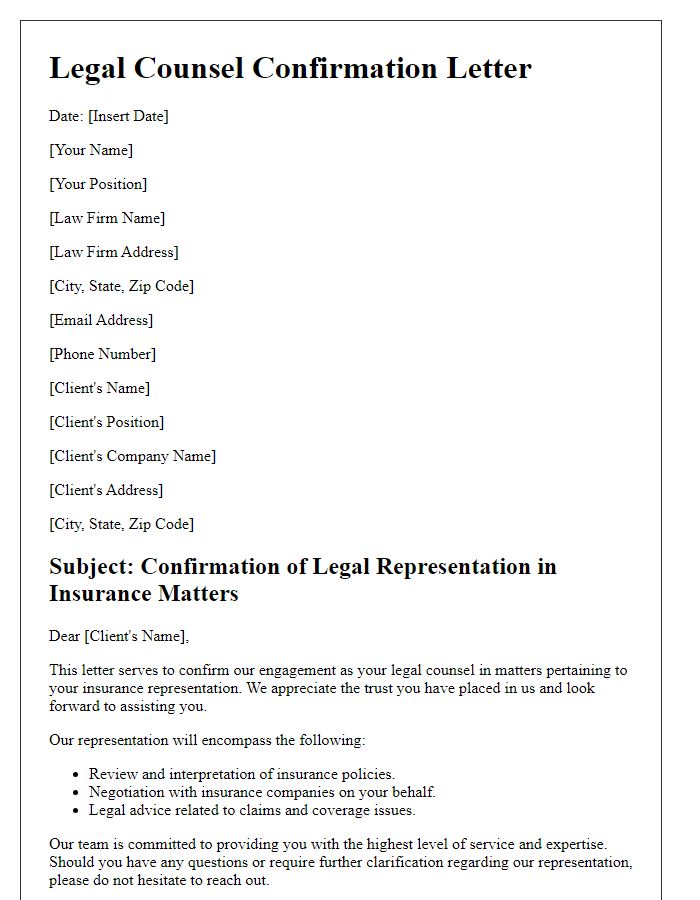

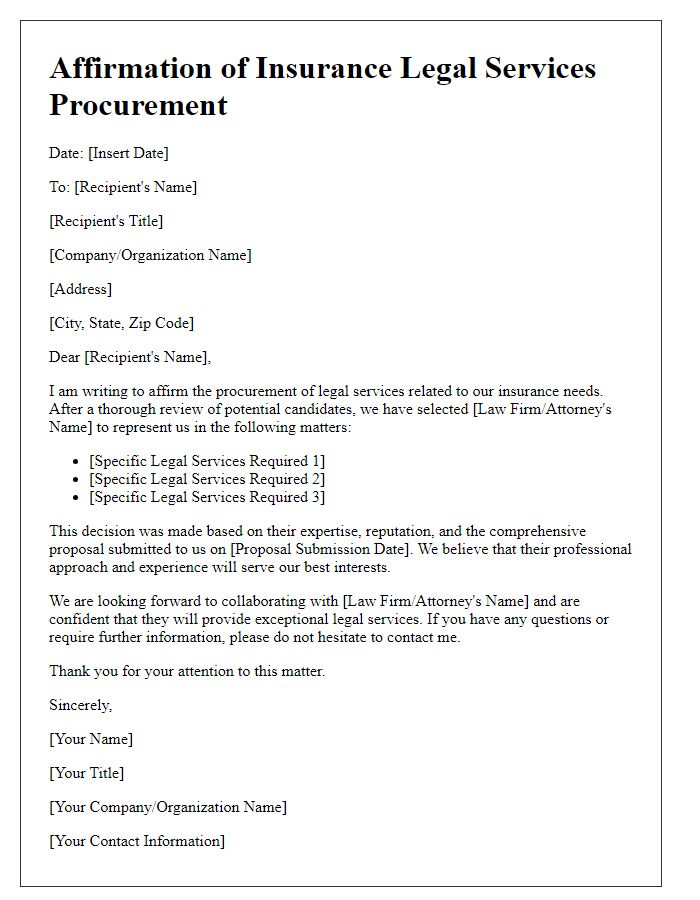

Letter template of legal counsel confirmation for insurance representation.

Letter template of engagement letter for insurance legal representation.

Comments