Are you finding it challenging to navigate the complex world of insurance policy terms and conditions? You're not aloneâmany people feel overwhelmed by the fine print and jargon often associated with these documents. Understanding these terms is essential for making informed decisions about your coverage and ensuring you're adequately protected. Join us as we break down the key components and clarify what you need to know to safeguard your interests. Read on to discover the essential insights you've been searching for!

Policy Coverage Details

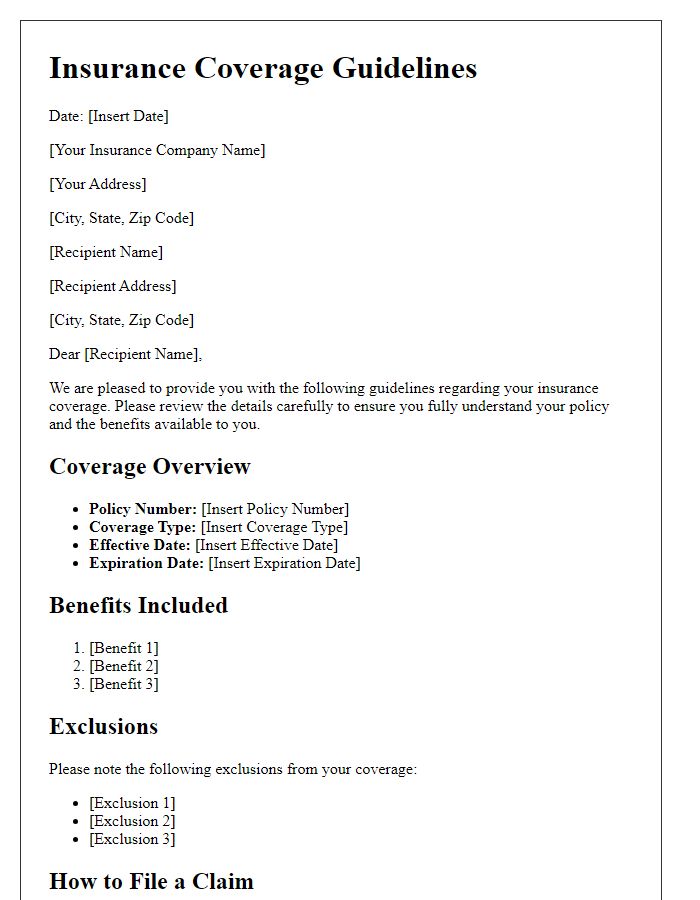

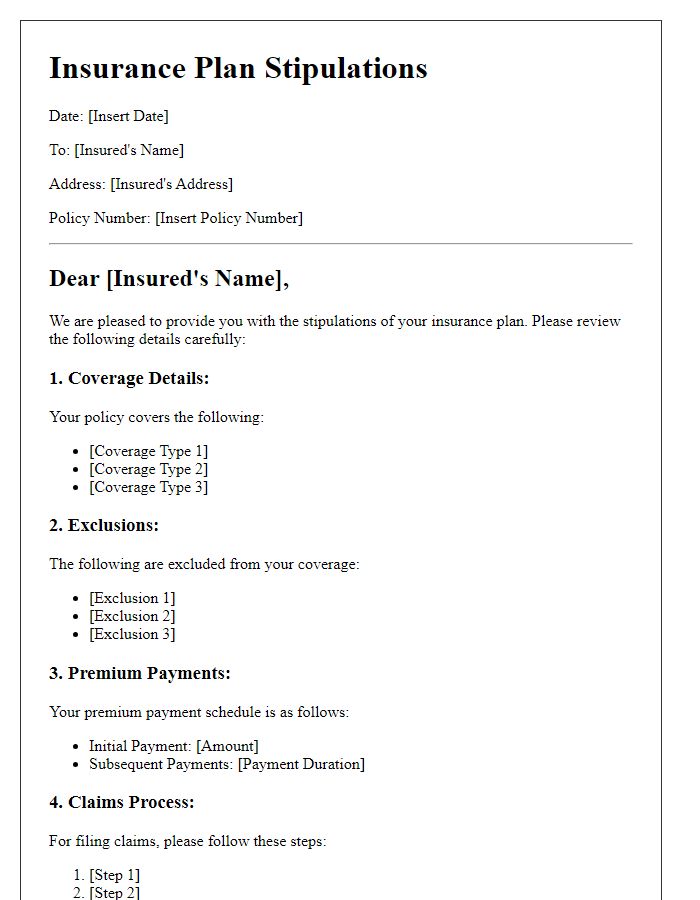

Insurance policy coverage details outline the specific protections offered under a particular plan. This may include aspects such as personal property protection (covering valuable items up to specific limits), liability coverage (providing financial protection against claims or lawsuits), and medical payments (offering coverage for injuries sustained on the policyholder's property). Additionally, there might be exclusions detailed, such as natural disasters (e.g., floods, earthquakes) which may require separate coverage options. The policy's terms also define the deductible amount (the out-of-pocket expense before insurance kicks in) and premium rates (the amounts paid periodically for coverage). Understanding these details is crucial for effectively managing risks and ensuring complete protection against unforeseen events.

Premium Payment Schedule

Insurance policy premium payment schedules outline the structured timeline and specific amounts required for maintaining coverage. Typically established at the policy's inception, these schedules define monthly, quarterly, semi-annual, or annual premium payments, depending on the insurer's offerings. For instance, a life insurance policy may necessitate a $150 monthly payment, while a homeowner's insurance may be billed quarterly at $450. Failure to meet the payment deadlines can lead to lapses in coverage or potential policy cancellation. Insurers often provide grace periods, typically ranging from 10 to 30 days, to accommodate late payments, ensuring policyholders remain protected under unforeseen circumstances. Understanding these schedules is crucial for maintaining continuous coverage and avoiding unexpected financial burdens.

Claim Procedures

The claim procedures for insurance policies, especially regarding events like accidents or damages, are outlined meticulously within the policy document. Typically, the insured party is required to notify the insurance company within a specified timeframe, often 30 days, following an incident (like theft or natural disaster). The notification must include essential details, including a detailed written account of the event, the date, and the location of the occurrence. Documentation such as photographs, police reports (in cases of theft or vehicular accidents), and any relevant receipts must accompany the claim submission. After the initial notification, an adjuster might be assigned to evaluate the claim's validity and assess damages, for example, at the site of a fire or car crash. The process may take weeks or even months, depending on the complexity of the claim and the insurance company's internal procedures. Prompt communication between the insured and the insurer is crucial to expedite this process and ensure a satisfactory resolution for all parties involved.

Exclusion Clauses

Insurance policies typically include exclusion clauses that outline specific situations in which coverage will not apply. These clauses are critical for both insurers and policyholders, as they clarify the boundaries of coverage. Common exclusions include acts of war, terrorism (events like 9/11), pre-existing conditions in health insurance, intentional damage caused by the policyholder, and natural disasters such as earthquakes or floods. It is essential for consumers to thoroughly review these exclusion clauses within their policy documents to ensure a comprehensive understanding of their insurance coverage, as many policies can reach tens of thousands of dollars. Understanding these terms helps in making informed decisions during purchasing and filing claims.

Renewal and Cancellation Terms

Insurance policy renewal terms dictate the timeline and conditions under which an existing policy can be renewed. Policyholders must typically receive a renewal notice at least 30 days prior to the expiration date, providing details about any changes in premiums or coverage limits. Cancellation terms, on the other hand, outline the protocol for terminating the policy before its expiration. Standard practices often include a notice period of 15 to 30 days, depending on the insurer's regulations and state laws. Involuntary cancellations can occur due to non-payment, misrepresentation, or significant changes in risk. Regular reviews of renewal and cancellation clauses ensure that policyholders remain informed and compliant, maintaining coverage with optimal benefits.

Comments