Writing an insurance claim reimbursement letter can feel daunting, but it doesn't have to be. In this article, we'll walk you through a simple and effective template that can streamline your process and ensure you get the compensation you deserve. With clear examples and helpful tips, we'll make it easy for you to articulate your needs with confidence. So grab your pen and let's dive into the essentials of creating your own reimbursement request!

Claimant's personal and contact information

The claimant's personal information includes essential details such as full name, mailing address, contact number, and email address. This information ensures the insurance company can identify the individual submitting the claim effectively. Additionally, the policy number is critical as it links the claim to the specific insurance account. Accurate personal identification enhances communication during the claims process and supports efficient resolution of reimbursement requests.

Insurance policy number and details

The insurance claim reimbursement process requires accurate documentation and relevant details, including the insurance policy number connected to the claim, typically issued by the insurance provider such as Aetna or State Farm. Comprehensive information about the incident leading to the claim, such as date (e.g., March 15, 2023), type of damage (e.g., water damage from a burst pipe), and total incurred cost (for instance, $5,000), should be included. Additional forms like the claims report, estimates from contractors or repair services, and medical bills (if applicable) will support the claim. Policy details such as policy limits, deductibles, and any amendments should be referenced to ensure adherence to the terms set by the insurance provider. Proper submission through the correct channels (online portal, mail, or in-person) is essential to expedite the reimbursement process.

Description of the event or incident

On October 15, 2023, at approximately 2:30 PM, an unexpected incident occurred at Riverbank Shopping Center in Springfield, resulting in significant damage to personal property. During a sudden rainstorm, water leakage from the ceiling caused flooding in the nearby electronics store. Merchandise, including high-value items such as laptops, smartphones, and televisions, sustained water damage. The estimated loss from this incident is approximately $15,000. Emergency services were called to assess the situation, and documentation, including photos and police reports, was collected for processing the insurance claim.

Itemized list of expenses or losses

An insurance claim for reimbursement often requires a detailed itemized list of expenses or losses incurred due to an incident, such as property damage or medical expenses. This list typically includes costs such as repair bills from local contractors, which can vary widely based on the extent of the damage; medical invoices from healthcare providers, which might include emergency room visits or follow-up treatments; and any personal property replacement costs, such as furniture or electronics lost in a fire or theft. Accurate documentation, including receipts, photographs of damaged items, and police reports (if applicable), is crucial in substantiating claims, ensuring a smoother reimbursement process from insurance companies like State Farm or Allstate. Timeliness is also important, as many policies require claims to be filed within a specific period, often 30 days from the date of the incident.

Required supporting documents and evidence

Submitting an insurance claim reimbursement requires specific supporting documents and evidence to validate the claim. Essential items include the claim form, which outlines the details of the incident, and a copy of the insurance policy, detailing covered benefits. Evidence often comprises photographs depicting the damage or loss, providing visual confirmation of the situation in question. Additionally, receipts or invoices for expenses incurred due to the incident demonstrate the financial impact on the claimant. Statements from witnesses, including names and contact information, can corroborate the events leading to the claim. Medical records may be necessary for health-related claims, illustrating treatment received within a certain timeframe. Maintaining meticulous records aids in expediting the reimbursement process and enhances the credibility of the claim submitted to the insurance provider.

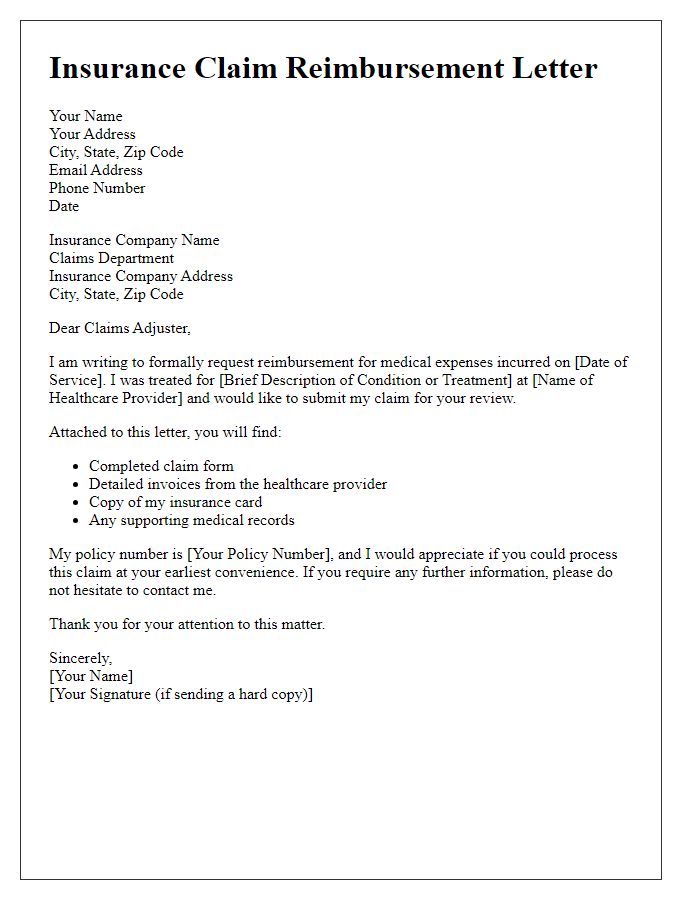

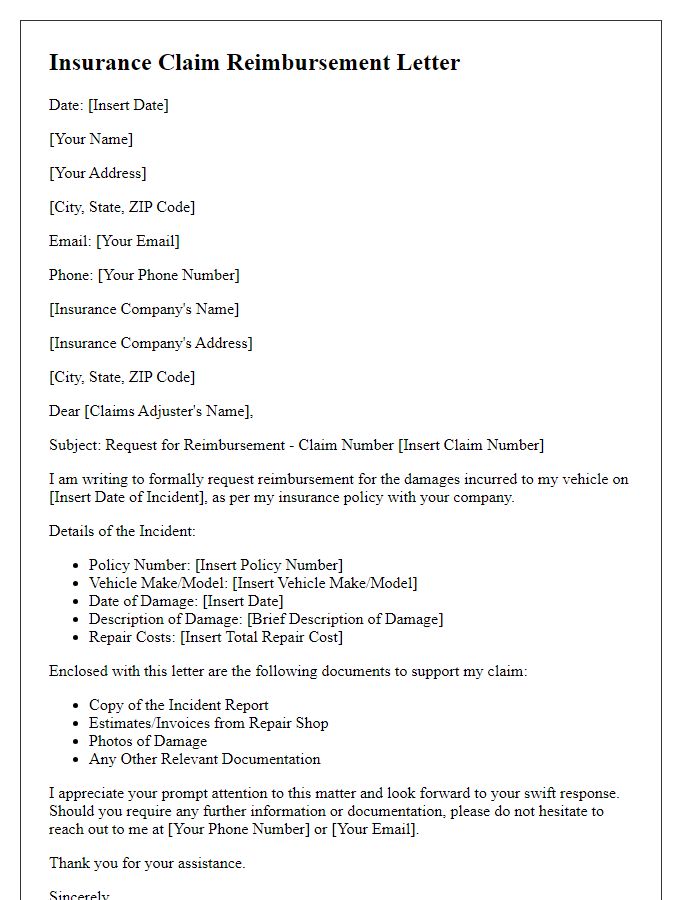

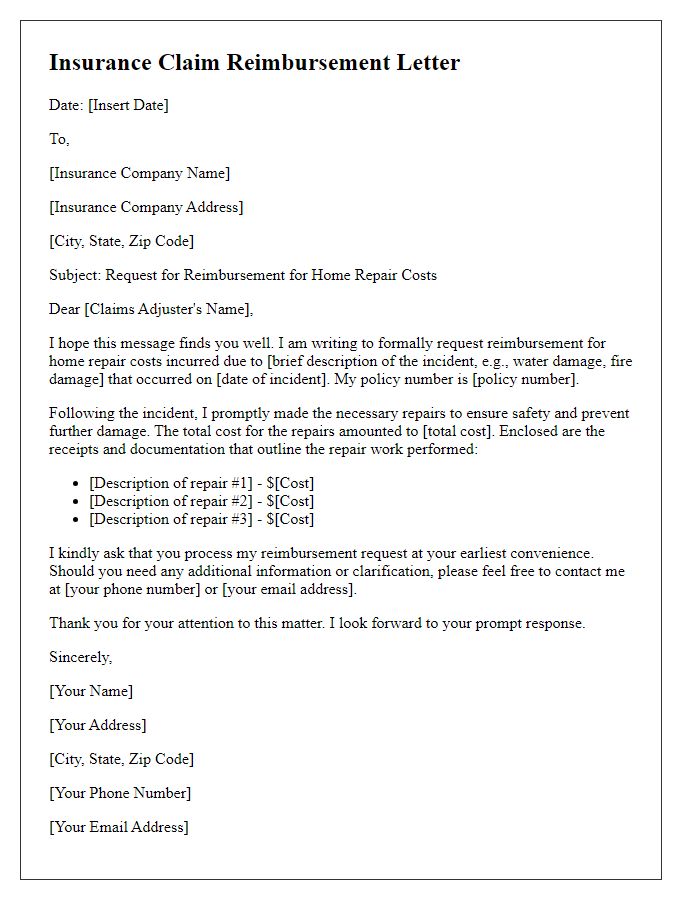

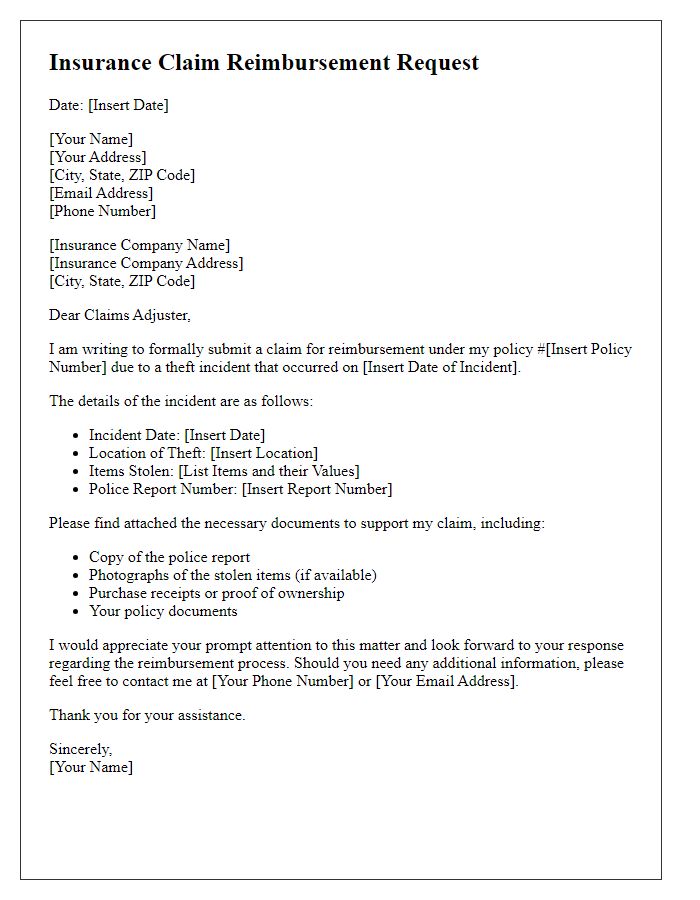

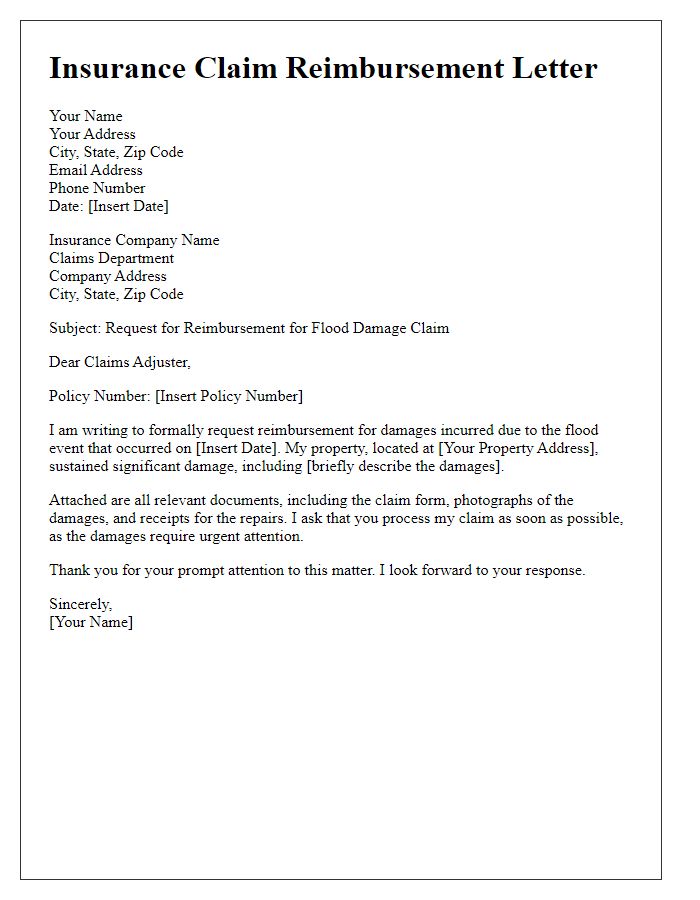

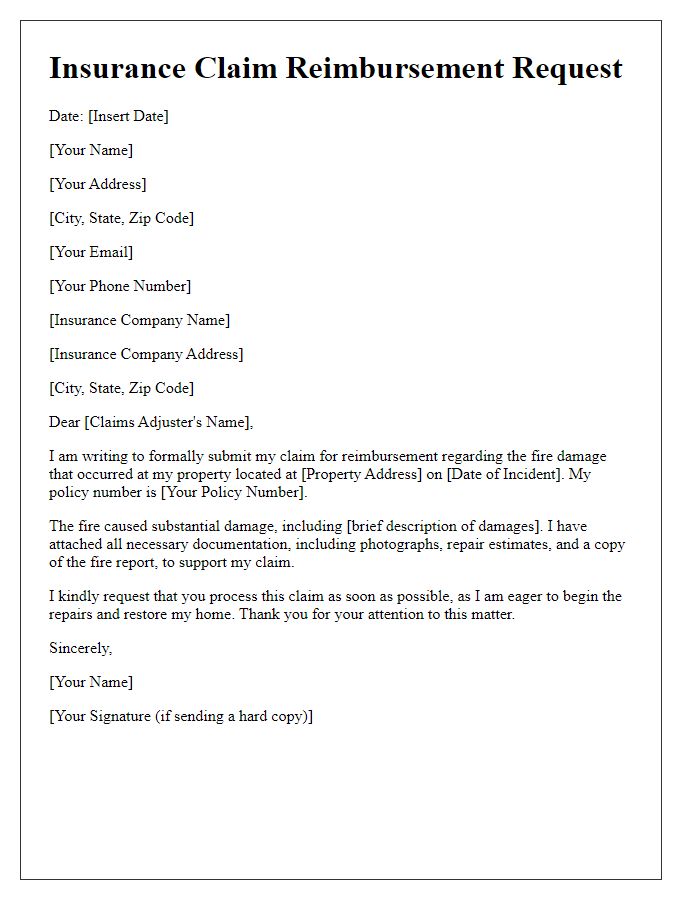

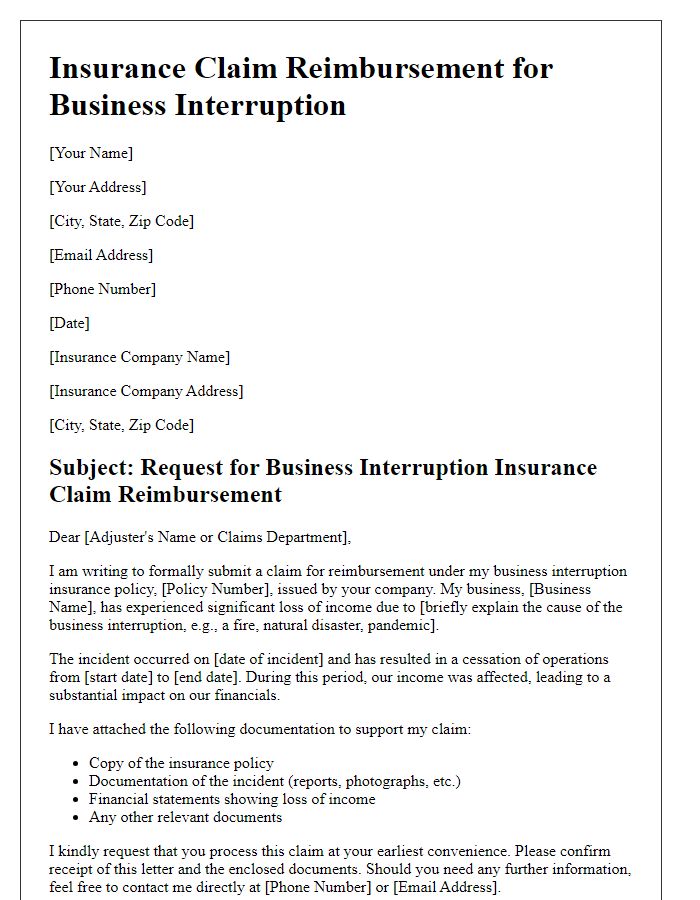

Letter Template For Insurance Claim Reimbursement Samples

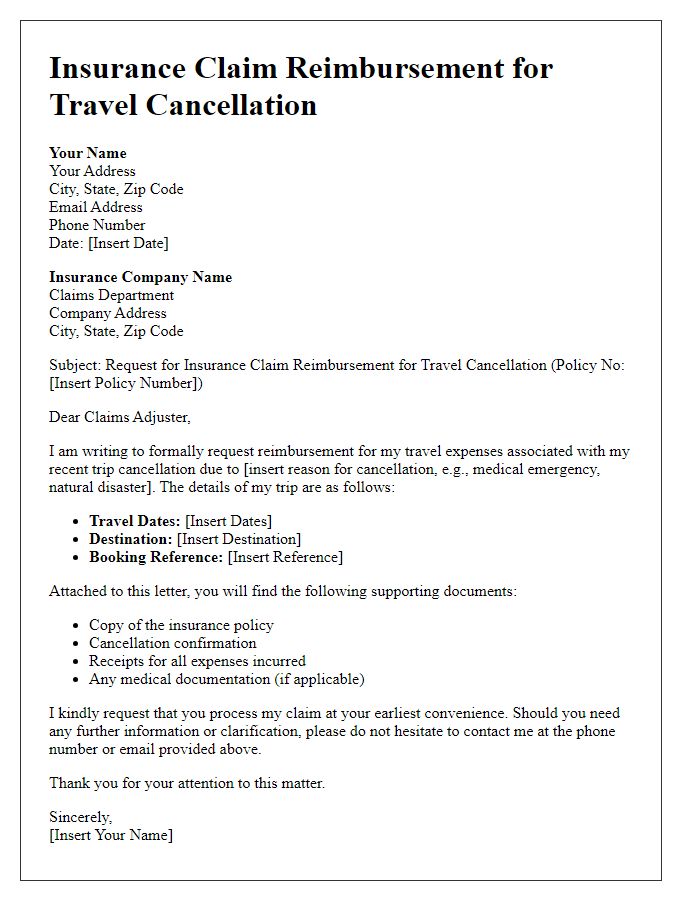

Letter template of insurance claim reimbursement for travel cancellation

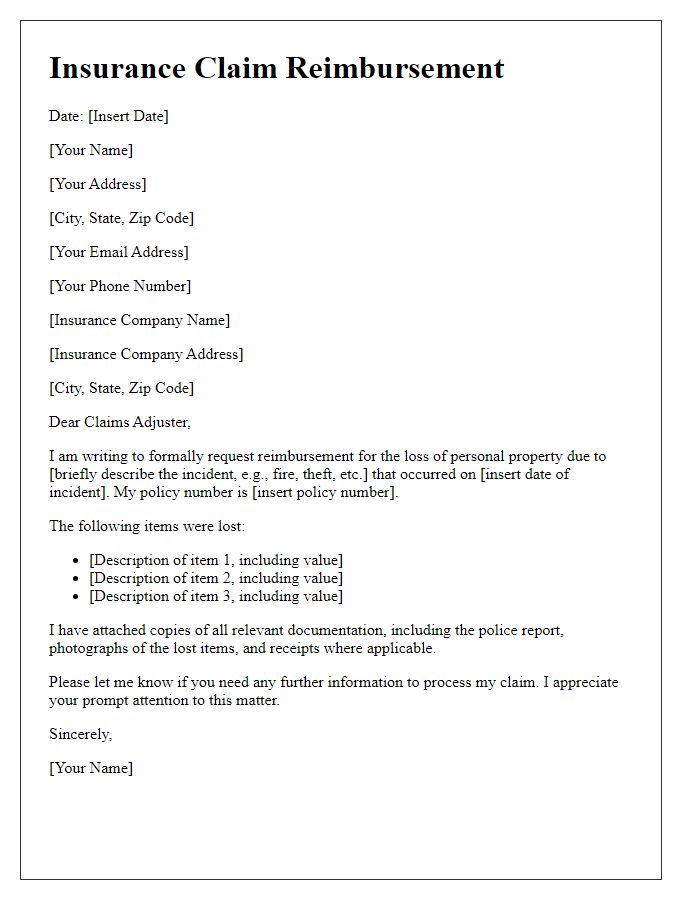

Letter template of insurance claim reimbursement for personal property loss

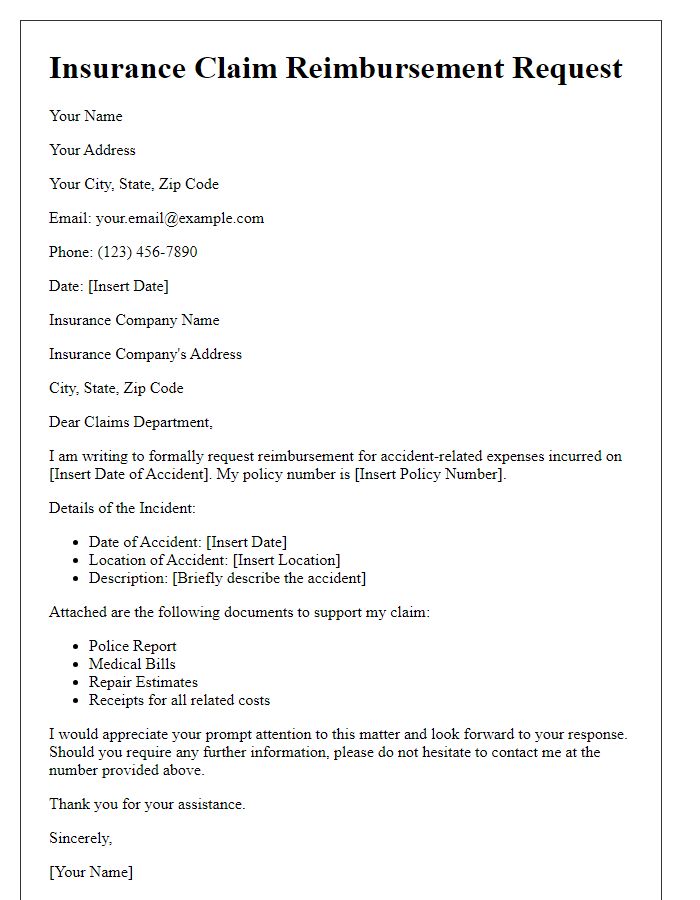

Letter template of insurance claim reimbursement for accident-related costs

Comments