Absolutely! When it comes to navigating insurance policies, understanding endorsements can be crucial. An endorsement confirmation letter can help clarify any changes to your coverage, ensuring you're fully aware of your protections. It's a simple yet essential document that keeps both the insurer and the insured on the same page about important adjustments. Interested in learning more about how to craft the perfect endorsement confirmation?

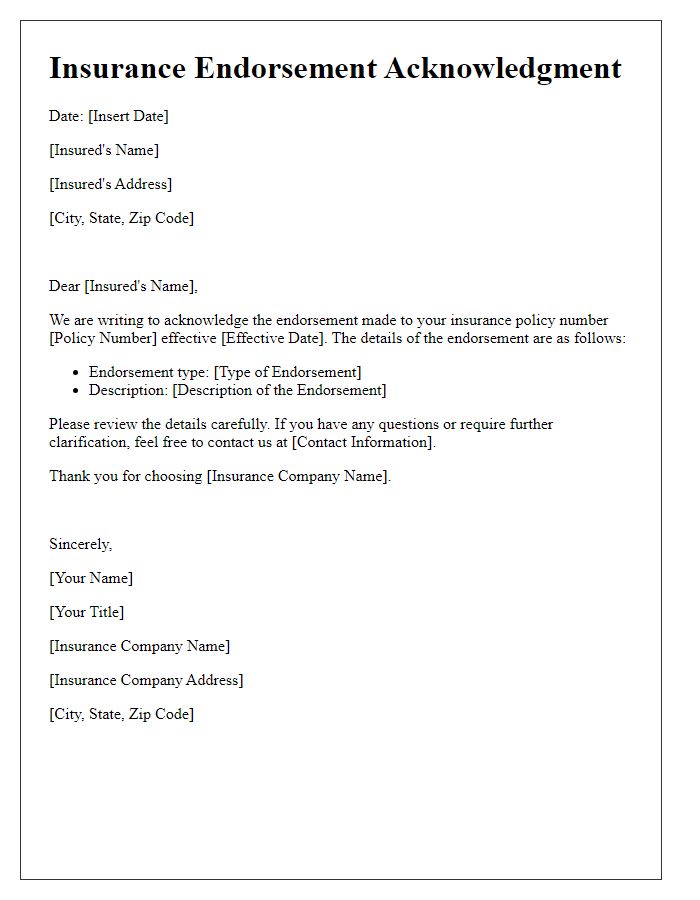

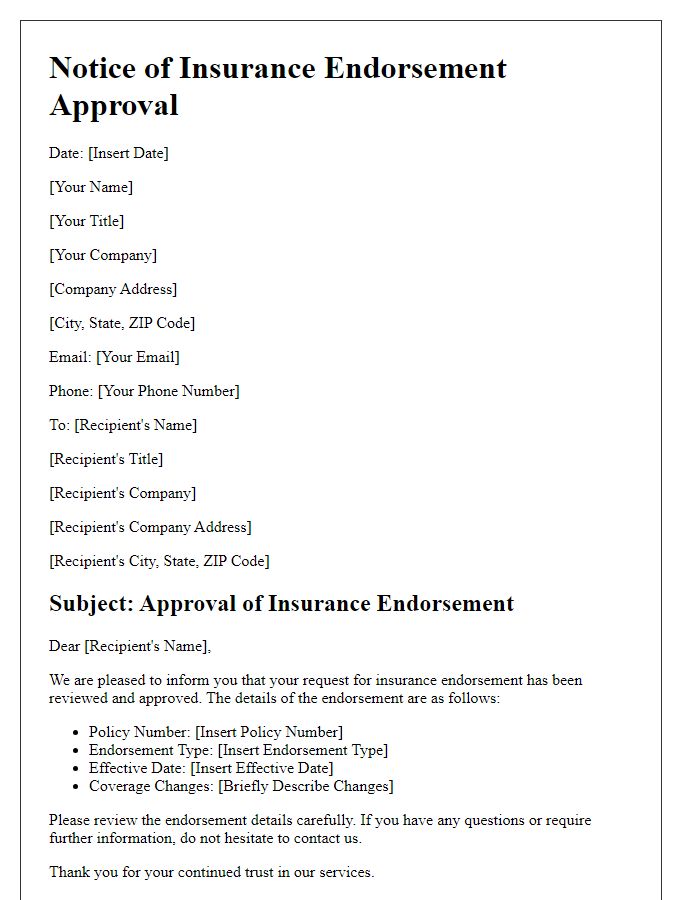

Policyholder Information

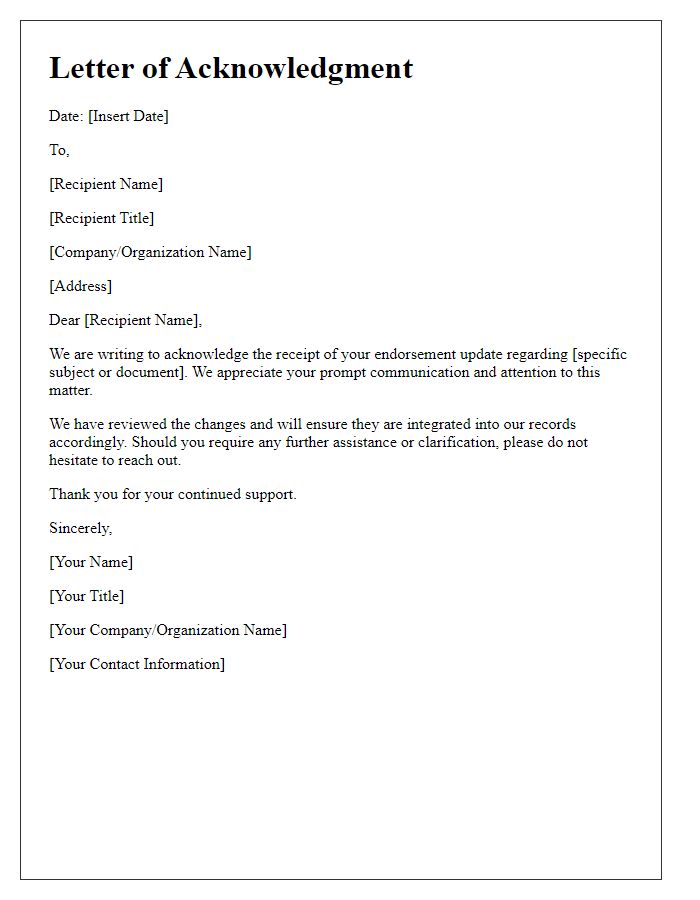

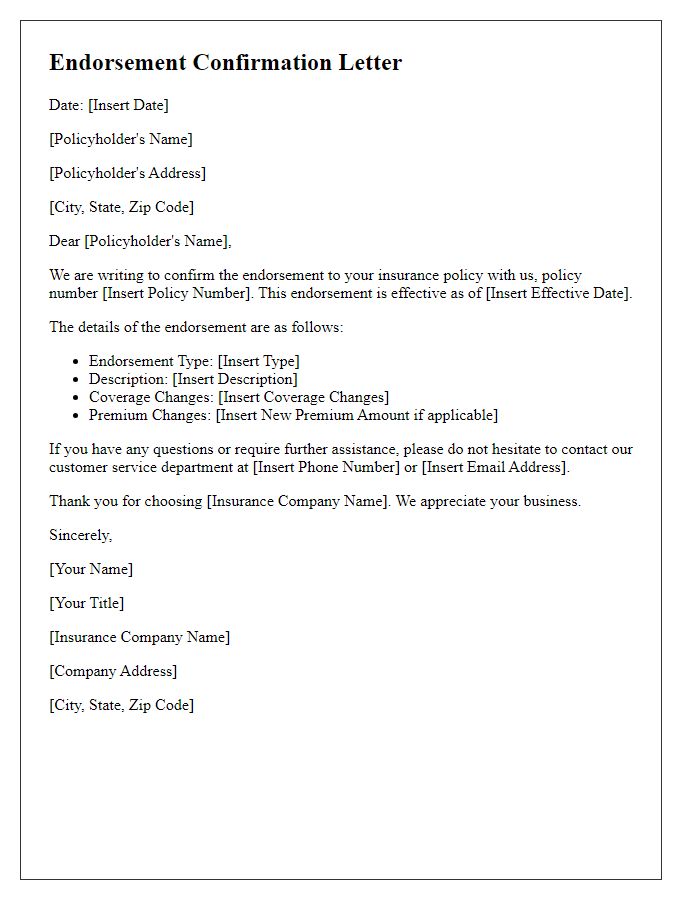

Insurance endorsements can provide additional coverage or modify existing policy details for policyholders. Important elements in confirmation letters include the name of the policyholder, the policy number (typically a series of digits designating the specific insurance contract), and the effective date of endorsement. This correspondence often outlines the specific changes made, such as added coverage for natural disasters (like hurricane protection in coastal areas) or alterations to liability limits (perhaps increasing from $1 million to $2 million). Additionally, the letter may highlight the implications of these changes on premiums, which could increase or decrease based on the new terms. Such endorsements may also include the contact information for the insurance agent or claims department, ensuring that the policyholder can easily reach out for further clarification or assistance.

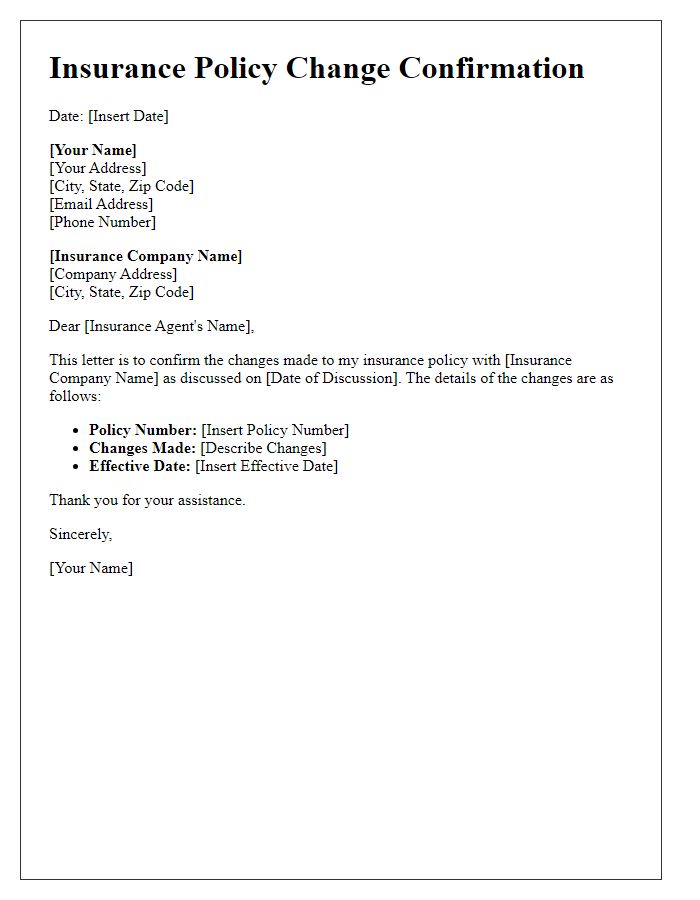

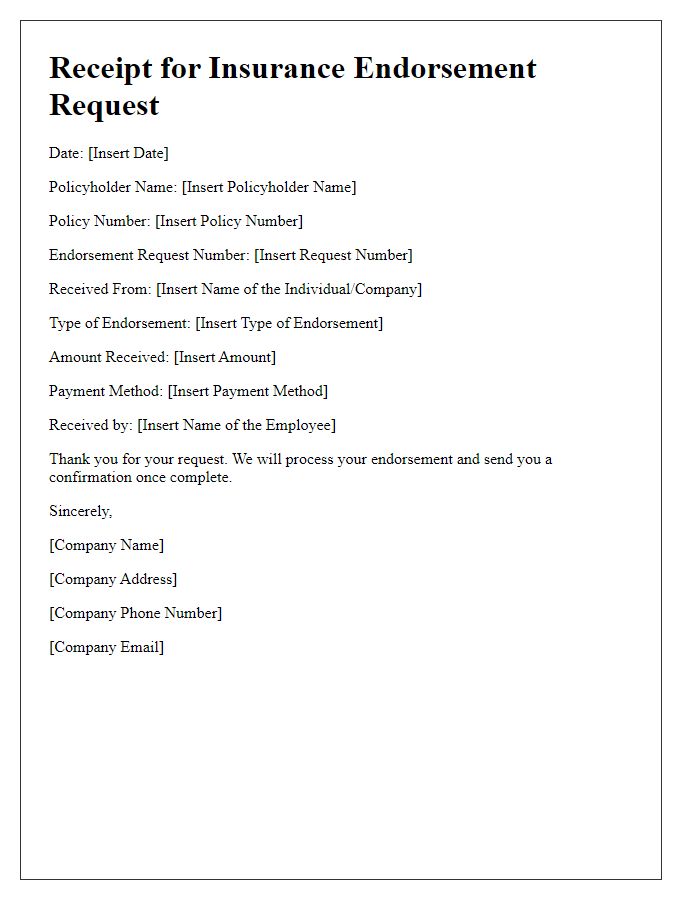

Policy Details

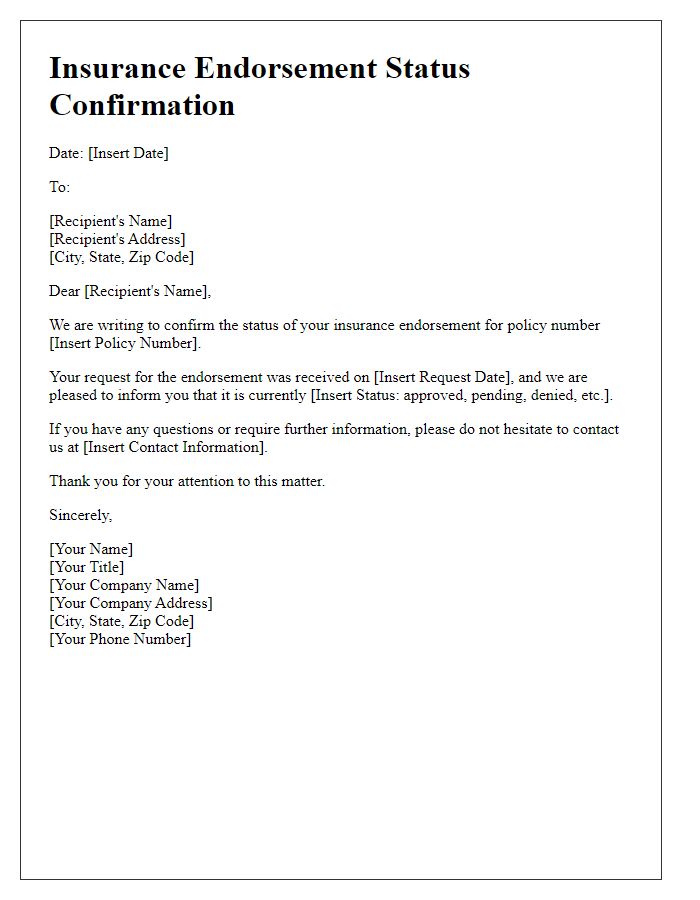

Insurance endorsement confirmation is crucial for policyholders to ensure that their coverage accurately reflects the changes made. Key components of the policy details include the policy number, effective date of the endorsement, and the specific changes being made. Premium adjustments may accompany endorsements, often calculated based on risk assessments and coverage limits. Endorsements can address various aspects, such as adding coverage for valuables or modifying deductible amounts. Timely confirmation of these changes is essential for maintaining continuous coverage, avoiding lapses, and ensuring claims are processed effectively. Policyholders should always retain copies of the endorsement confirmations for their records.

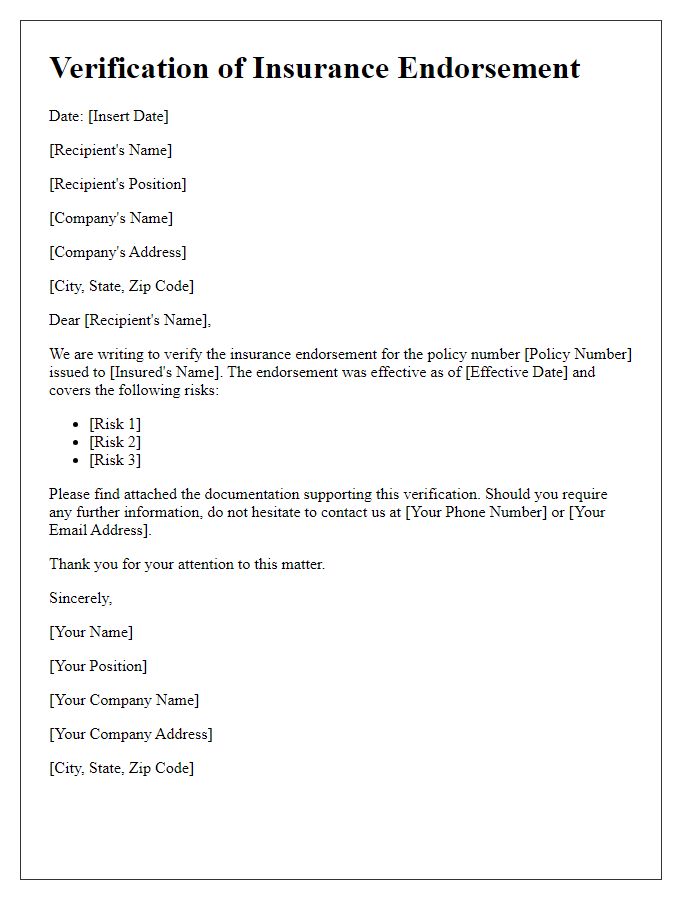

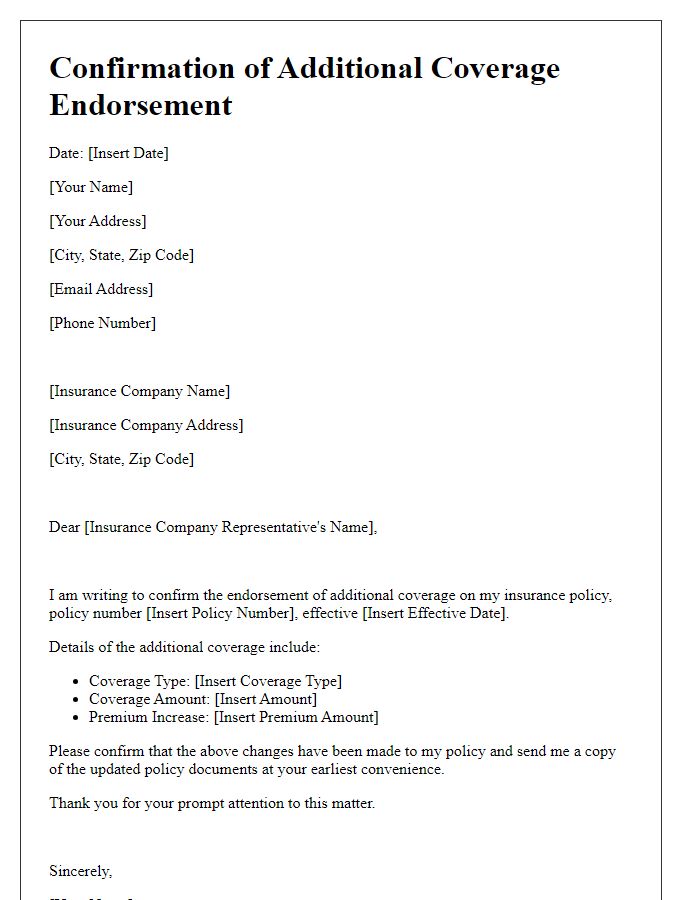

Endorsement Description

An insurance endorsement confirmation provides crucial updates regarding policy modifications within comprehensive insurance agreements, typically affecting property, liability, or vehicle coverage. Each endorsement describes specific changes, such as increased coverage limits, additional insured parties, or alterations in deductible amounts. For instance, a commercial property insurance policy might undergo an endorsement to extend coverage from $500,000 to $1 million following renovations in Chicago, Illinois, enhancing the protection of newly installed equipment. Moreover, endorsements often detail exclusions, clarifying situations not covered by the policy, such as natural disasters or specific incidents. Timely confirmation of these endorsements is essential to ensure policyholders understand new terms, especially during significant life events or business transitions.

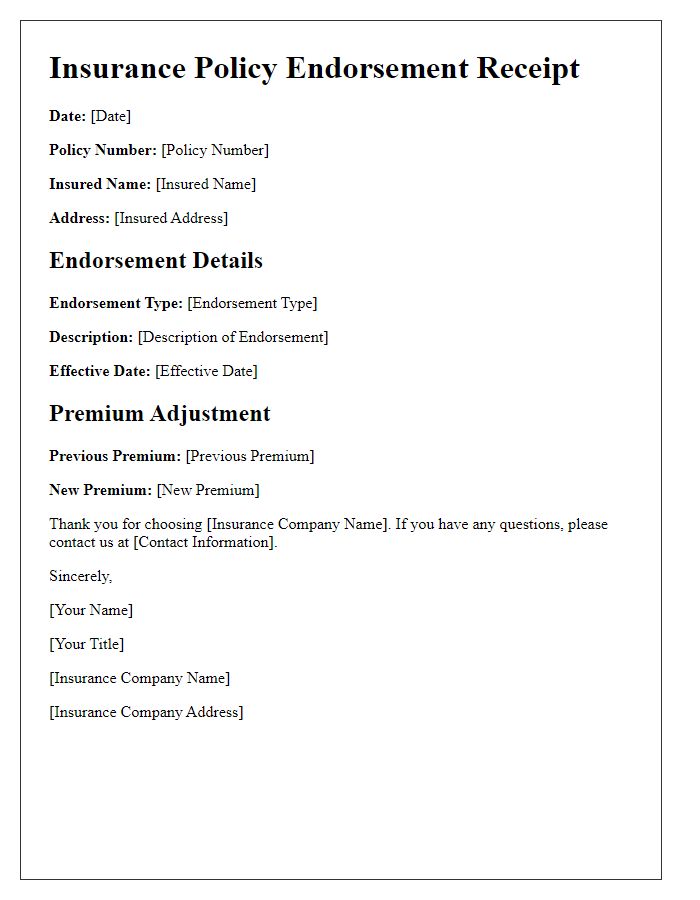

Effective Date of Endorsement

Insurance endorsements, crucial adjustments to existing policies, are formally acknowledged by the insurance provider. Each endorsement becomes effective on a specified date, which varies based on the nature of the change, whether it involves coverage modifications, named insured updates, or premium adjustments. This effective date is pivotal for policyholders, ensuring that the alterations in their coverage align with their needs and expectations. Insurance companies often issue confirmation notices that detail the endorsement's effective date, ensuring clarity and transparency. Understanding this date is essential for maintaining appropriate insurance coverage, preventing lapses or gaps in protection.

Contact Information for Queries

Insurance endorsement confirmations provide essential updates regarding policy modifications or adjustments. Typically, these confirmations include the insurance provider's name, policy number, and a detailed description of the changes made, such as increased coverage limits or added riders. They often feature contact information for queries, ensuring clients have immediate access to representatives. Details may include customer service phone numbers, email addresses, and office locations, facilitating effective communication. Additionally, time-sensitive endorsements may impact claims processing, and it is crucial for policyholders to understand these changes clearly. Accurate records of endorsements enhance transparency and trust between the insurer and the insured.

Comments