Are you feeling a bit confused about insurance deductibles and how they impact your policy? You're not aloneâmany people find themselves grappling with the ins and outs of their coverage. In this article, we'll break down the essentials of insurance deductibles, helping you understand what they are and why they matter. So grab a cup of coffee, sit back, and let's dive deeper into this important topic together!

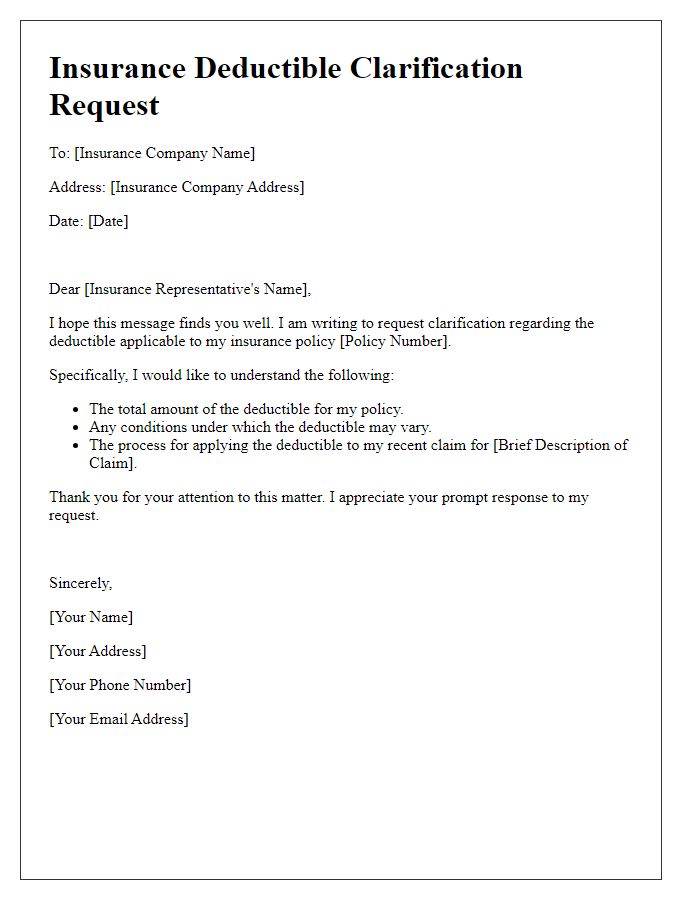

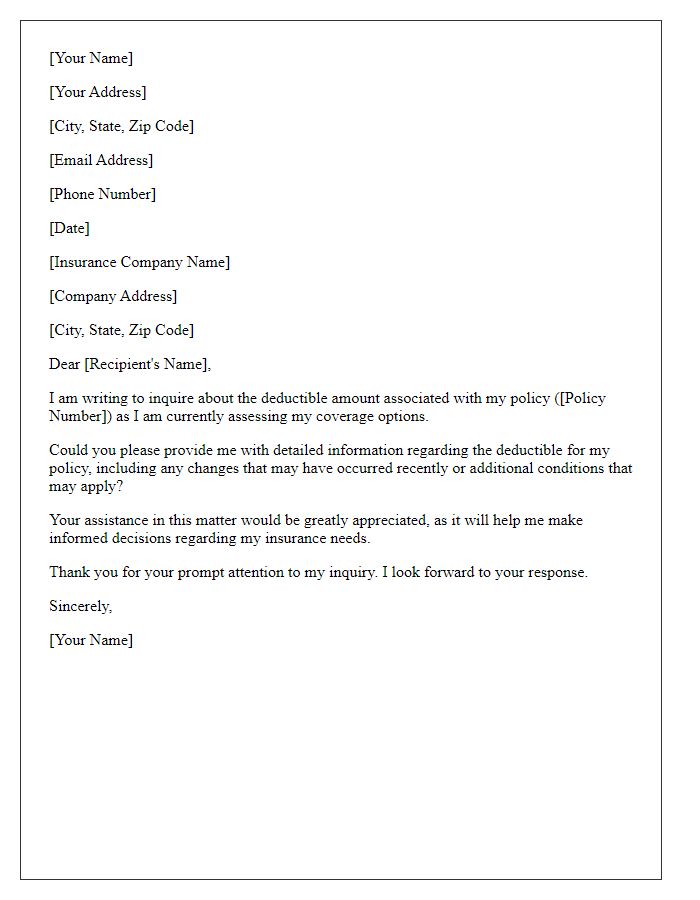

Formal Greeting and Introduction

Seeking clarification on insurance deductibles can greatly assist policyholders in understanding their financial responsibilities. Many insurance providers, such as State Farm Insurance or Allstate Corporation, set specific deductible amounts, influencing how much a policyholder pays out of pocket during a claim. These deductibles vary based on policies, with common figures often ranging from $500 to $1,500 depending on coverage levels. Additionally, distinguishing between comprehensive, collision, and liability deductibles is critical, as each type of coverage operates under different conditions. Understanding these financial obligations enhances a customer's capability to prepare adequately for potential costs associated with claims.

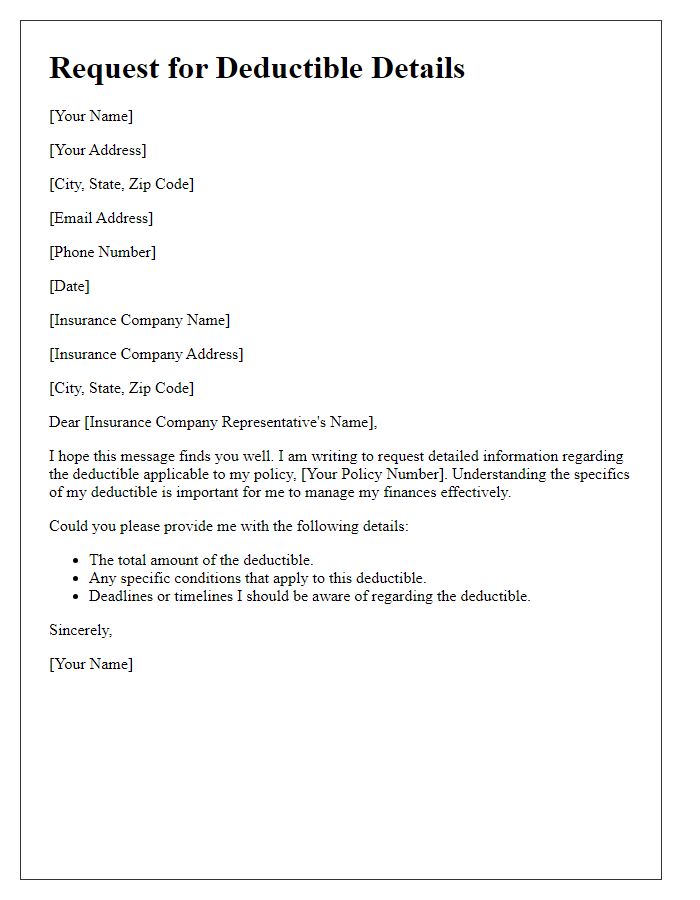

Policy and Claim Details

Insurance deductible inquiries require specific policy details and relevant claim information. Policy number serves as an identifier, typically consisting of a combination of letters and numbers unique to the insured individual. Deductible amount varies depending on the policy terms; common figures include $500 or $1,000. Claim details should include a claim number, usually assigned during the submission process, and the incident date, which might range from recent events to claims filed several months prior. Providing a clear description of the incident can assist in expediting the inquiry process, ensuring that the insurance provider has all necessary information to assess the deductible applicable to the claim.

Specific Deductible Inquiry

Insurance deductibles play a crucial role in determining the out-of-pocket expenses during a claim process. A specific deductible, such as the $1,000 amount often seen in health or auto insurance policies, represents the minimum cost an individual must pay before the insurance company covers the remaining expenses. Various factors influence deductible amounts, including policy types, coverage limits, and geographical location. Understanding these nuances is vital for policyholders, particularly in events like accidents or health emergencies where accurate deductible knowledge could impact financial planning and recovery strategies.

Request for Clarification and Documentation

Navigating insurance deductibles can often lead to confusion regarding payment responsibilities. Many policyholders find it challenging to understand specific deductible amounts, which can vary based on policy terms set by insurance providers, such as Allstate or State Farm. The deductible represents the initial out-of-pocket expense that must be covered by the insured before benefits kick in. For example, a $1,000 deductible means that once the insured pays this amount, the insurance company will cover the remaining eligible expenses. Additionally, the deductible amounts may differ by event types, such as accidents or natural disasters, affecting homeowner insurance specifically, which often includes hurricane deductibles or windstorm deductibles. Accurate documentation of previous claims may also be required to clarify individual circumstances and deductible application, ensuring policyholders fully understand their financial liabilities in times of need.

Contact Information and Closing

Insurance deductible processes can significantly influence the overall claim experience for policyholders. Understanding the specific deductible amount applicable to claims, such as property damage or medical expenses, is essential for effective financial planning. For example, a typical homeowner's insurance deductible may range from $500 to $2,500, depending on the policy terms set by providers like State Farm or Allstate. Additionally, contacting the insurance company (e.g., via phone or online portal) is critical for clarifying the deductible impacts on settlement amounts. Closing communications effectively ensures all parties are informed, fostering transparency and trust within the insurance process.

Comments