Are you looking to update your insurance policy with an endorsement change? Whether you've made a significant life change, acquired new assets, or need to adjust your coverage, navigating this process can feel overwhelming. Luckily, with the right guidance and a clear template, you can ensure your request is both thorough and professional. Dive into our article to discover a handy letter template that simplifies the insurance endorsement change process!

Policyholder Information

Insurance endorsements can modify the terms of a policy, affecting coverage and premiums. Essential details like policyholder information (name, address, contact number) must be accurate, as inaccurate data can lead to claim denials or coverage gaps. Specific endorsements (such as adding a driver to an auto policy or modifying property coverage limits) require thorough documentation from the policyholder to ensure compliance with insurance regulations. Date of the endorsement request might impact when changes take effect, potentially influencing premium adjustments. Clear communication with the insurance provider about these changes is crucial for maintaining proper coverage.

Policy Details

Insurance endorsements can modify coverage details, impacting the policyholder's protection under an insurance policy, such as an Auto Insurance or Homeowners Insurance policy. Specific policy details, including the policy number (a unique identifier for reference), effective dates (starting and ending coverage dates), and named insured (the person or entity who holds the policy), are crucial for clarity in communications about changes. These changes can involve adding or removing covered properties, increasing coverage limits (amounts that determine the maximum claims payout), or adjusting deductibles (the amounts paid out-of-pocket before coverage kicks in). Accurate documentation is essential, ensuring all parties have a clear understanding of the modifications made. Additionally, communicating these changes to agents and brokers via formal letters reinforces transparency and ensures that all records remain updated.

Endorsement Request Description

An endorsement request regarding an insurance policy involves updating specific details to ensure the coverage accurately reflects current needs. For instance, a homeowner in Los Angeles, affected by recent wildfire incidents, may seek to amend their policy to include additional fire protection measures, which could cost an additional premium of around 5% of the total policy value. Moreover, a business owner in New York City may require an endorsement to cover newly acquired equipment valued at $50,000, necessitating a revision of their commercial property insurance. Such adjustments aim to adequately safeguard assets and mitigate risks associated with evolving circumstances. Each endorsement request must articulate the nature of the change, including the effective date and any pertinent details about the coverage alterations.

Effective Date of Change

An insurance endorsement change denotes a modification in a policy, impacting coverage specifics, limits, or conditions. The effective date of change is crucial, signifying when adjustments to the insurance policy take effect, which could be on the first of the month (e.g., January 1, 2024) or on a specific date (e.g., March 15, 2024). This date is critical for policyholders to know, as it determines the timeframe during which the updated coverage applies, ensuring clarity for claims processing and compliance with terms. Accurate records of these changes help prevent disputes between the insurer (insurance company) and the insured (policyholder), establishing a clear understanding of the policy's active provisions.

Contact Information for Confirmation

Insurance policyholders must ensure that their contact information remains current for endorsement changes. Updated details include phone numbers, emails, and mailing addresses. Insurance providers rely on accurate data to confirm changes in coverage. This process often involves communication via customer service representatives or online portals. Regular verification, at least once a year, helps maintain effective communication. Policies usually state that any out-of-date information could lead to missed notifications regarding important changes or premium adjustments. Policyholders should keep meticulous records of their contact updates for reference.

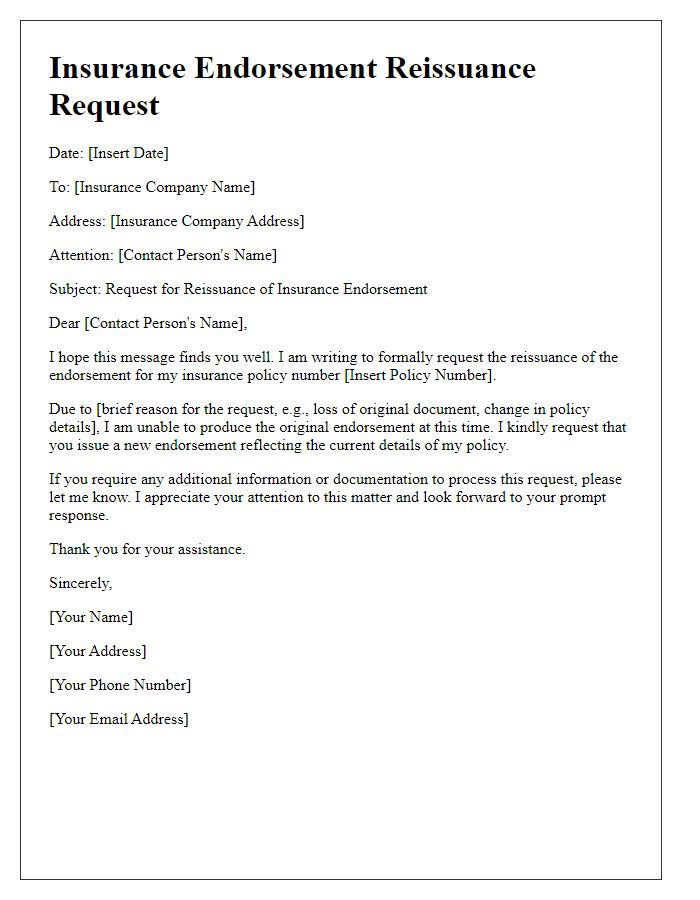

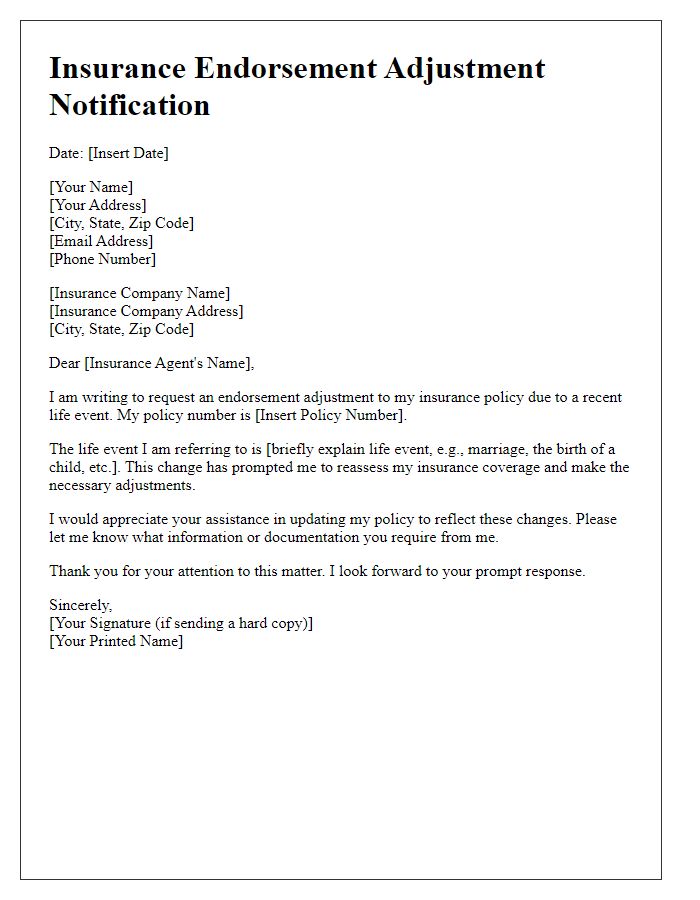

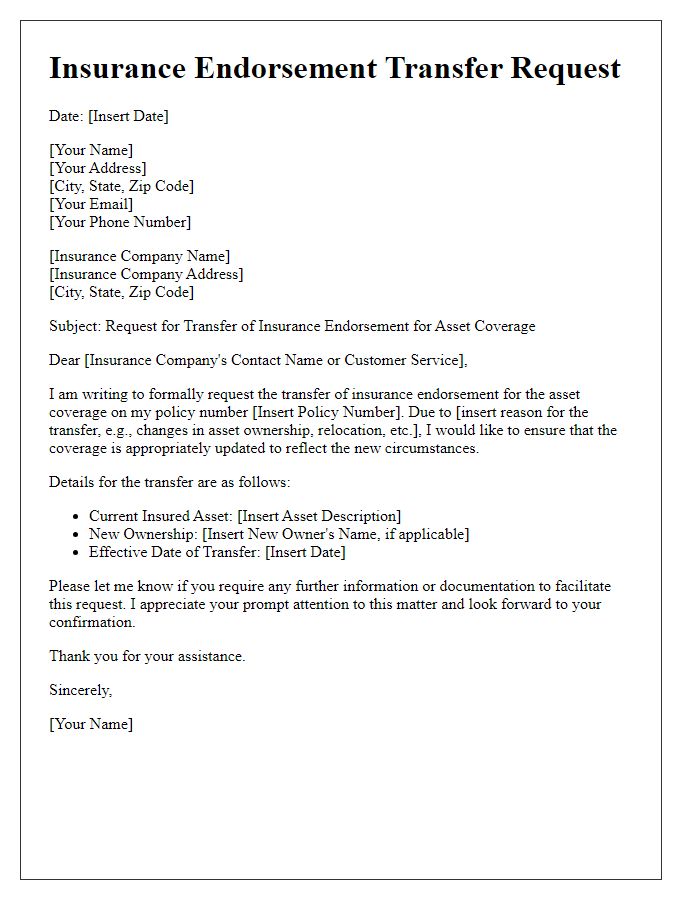

Letter Template For Insurance Endorsement Change Samples

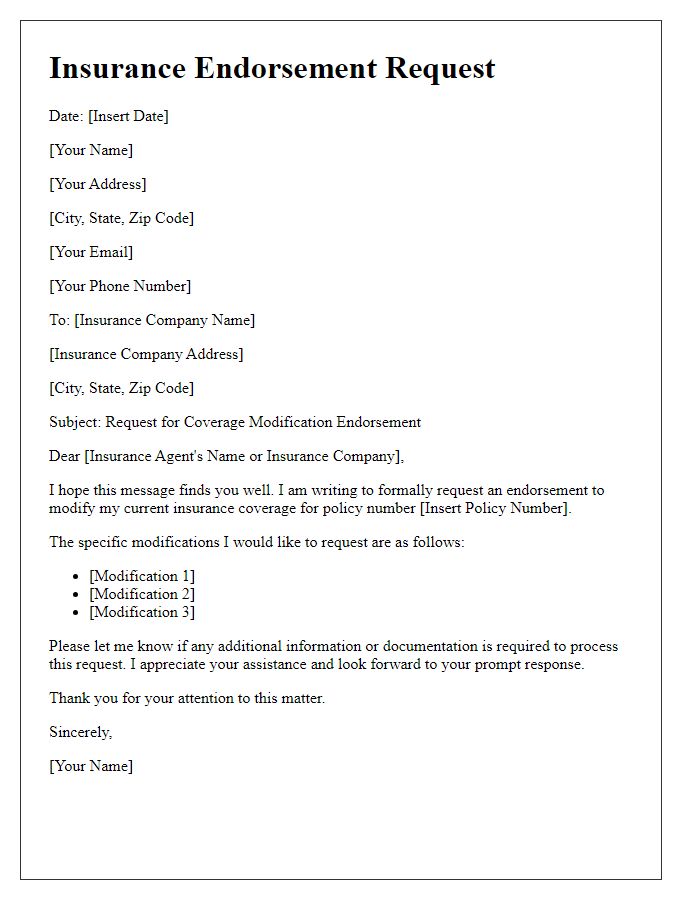

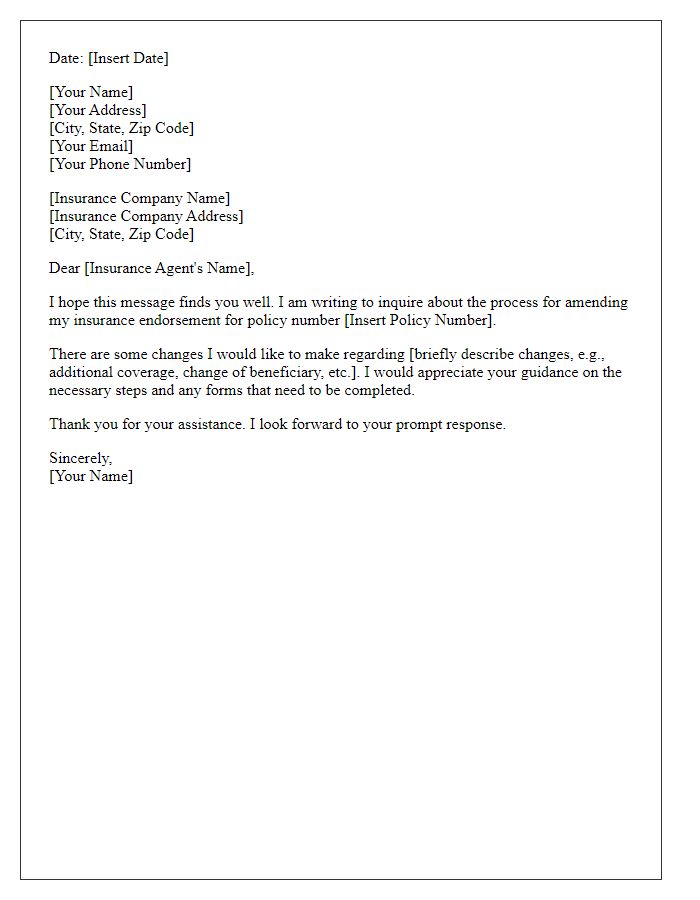

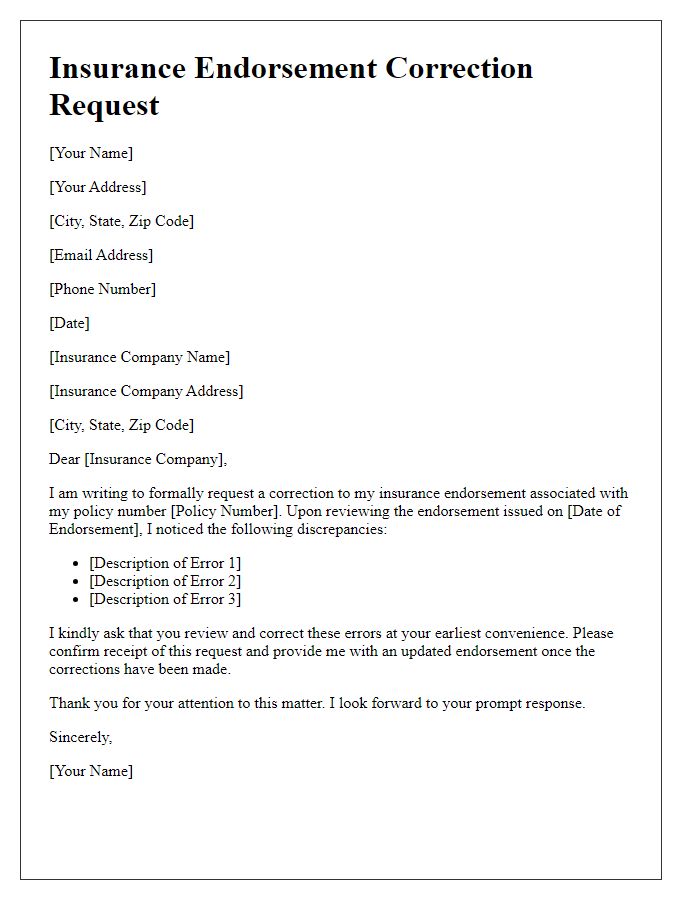

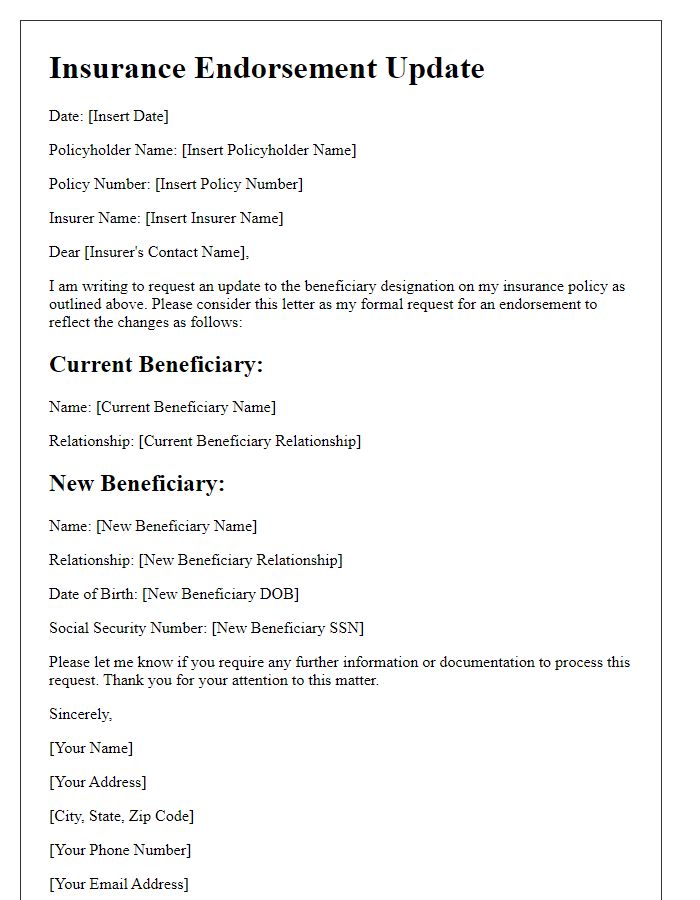

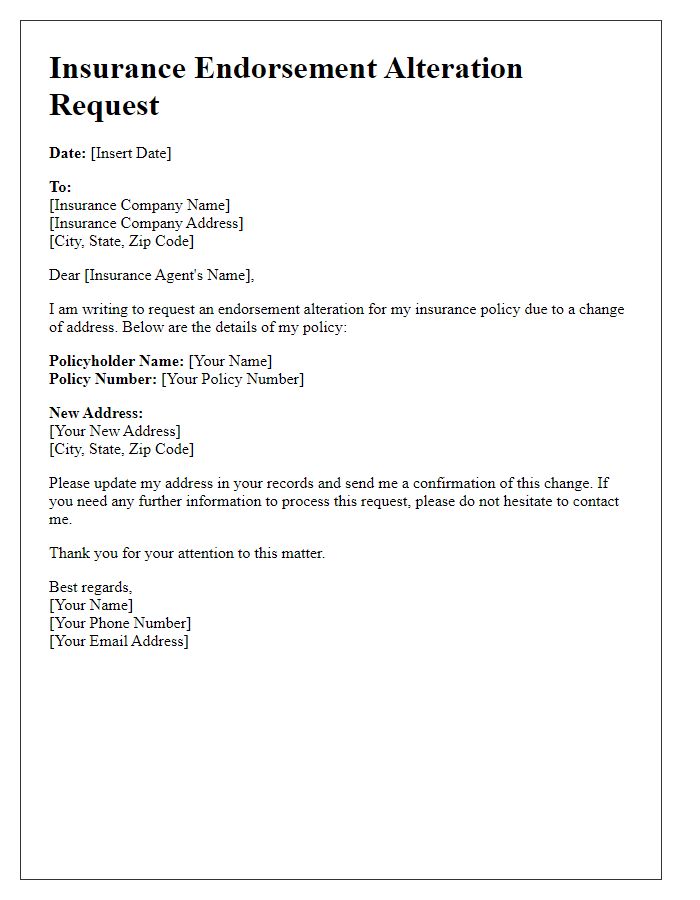

Letter template of insurance endorsement request for coverage modification

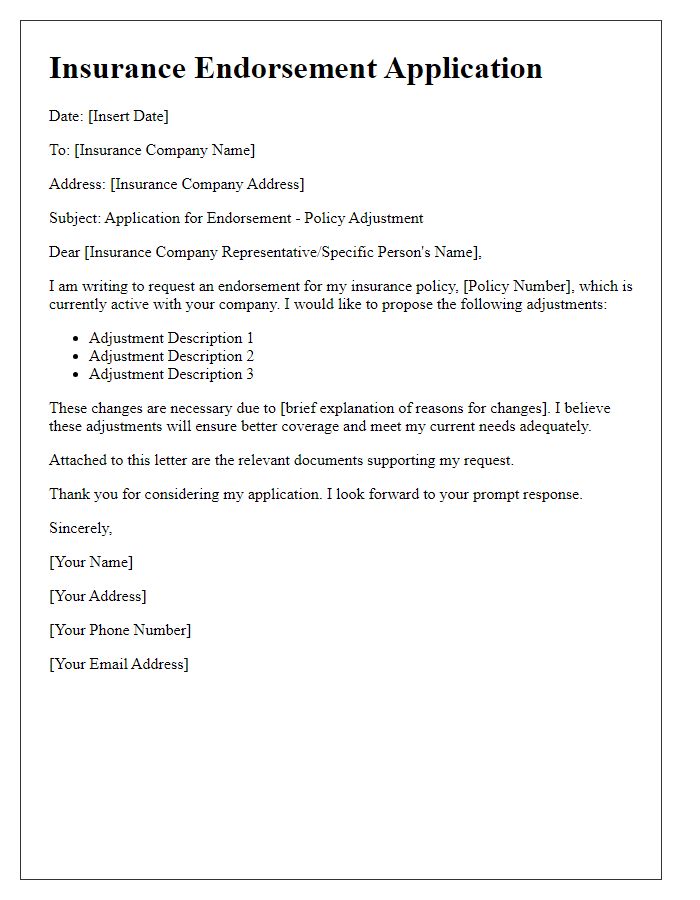

Letter template of insurance endorsement application for policy adjustment

Comments