Are you feeling overwhelmed trying to navigate the complexities of insurance grace periods? It can be confusing to understand what options are available to you, especially when deadlines are looming. Thankfully, requesting an extension isn't as daunting as it seems, and can offer you peace of mind during uncertain times. Want to learn how to effectively draft a request for that grace period extension? Read on for tips and a sample letter!

Policyholder Information

Insurance grace periods provide essential leeway for policyholders facing financial difficulties, allowing them to maintain their coverage without the immediate threat of cancellation. For instance, a standard grace period for life insurance policies can typically range from 30 to 60 days after the premium due date. During this time, policyholders like John Doe from Springfield may submit a request for an extension to their insurance provider, citing specific reasons such as unexpected medical expenses or job loss. Important documentation, including recent bank statements and medical bills, can substantiate the request, increasing the likelihood of approval. Maintaining open communication with the insurer, such as ABC Insurance Company located in New York City, can facilitate a smoother negotiation process for grace period extensions.

Policy Details

Insurance policies often include grace periods, which allow policyholders to make late premium payments without risking policy cancellation. For instance, a health insurance policy under XYZ Insurance with policy number H123456 typically allows a 30-day grace period after the due date for premium payments. During this time, coverage remains intact, ensuring continued access to medical services. Many insurers, such as ABC Life Insurance, may offer an extension of grace periods under certain conditions, like job loss or medical emergencies, where policyholders can request additional time, usually up to 60 days. Communication with the insurer regarding the request for a grace period extension is vital to ensure clarity and maintain policy benefits.

Reason for Extension Request

Insurance grace period extensions allow policyholders additional time to pay premiums without losing coverage. Valid reasons for requesting an extension include financial hardship due to unexpected medical expenses, unemployment, or other significant life events such as the birth of a child or a home purchase. Specific situations, such as the COVID-19 pandemic, have also created widespread financial strain, impacting individuals' ability to meet payment deadlines. Policyholders should provide detailed documentation, including income statements or medical bills, to substantiate their request to the insurance company. Each insurer may have unique policies regarding extensions, often influenced by state regulations or internal guidelines, highlighting the importance of clear communication during the process.

Proposed New Timeline

Insurance grace periods often provide policyholders with additional time, typically ranging from 15 to 30 days, to make premium payments without risking coverage lapse. This extension can be crucial for individuals facing unexpected financial hardships, such as job loss or medical emergencies, ensuring continuous protection of assets and family well-being. During this grace period, it is essential for policyholders to communicate with their insurance provider, providing notice of financial distress and a proposed timeline for payment. For example, suggesting a new payment date, such as the end of the next month, can demonstrate commitment while allowing for necessary financial planning. Each insurance company, such as Allstate or Geico, may have specific policies regarding grace periods; understanding these can help optimize negotiations for extensions.

Contact Information

Addressing a request for a grace period extension for an insurance policy requires precise details. The contact information must be complete, including the policyholder's full name, current address, phone number, and email address. The insurance company name, along with their customer service address or claims department contact details, is crucial. Including the policy number can streamline the process, clarifying which policy the request pertains to. Ensure to mention any relevant dates, such as the original due date for the payment, to highlight the necessity of the extension. Always provide alternative contact methods, ensuring accessibility for potential follow-up from the insurance provider.

Letter Template For Insurance Grace Period Extension Samples

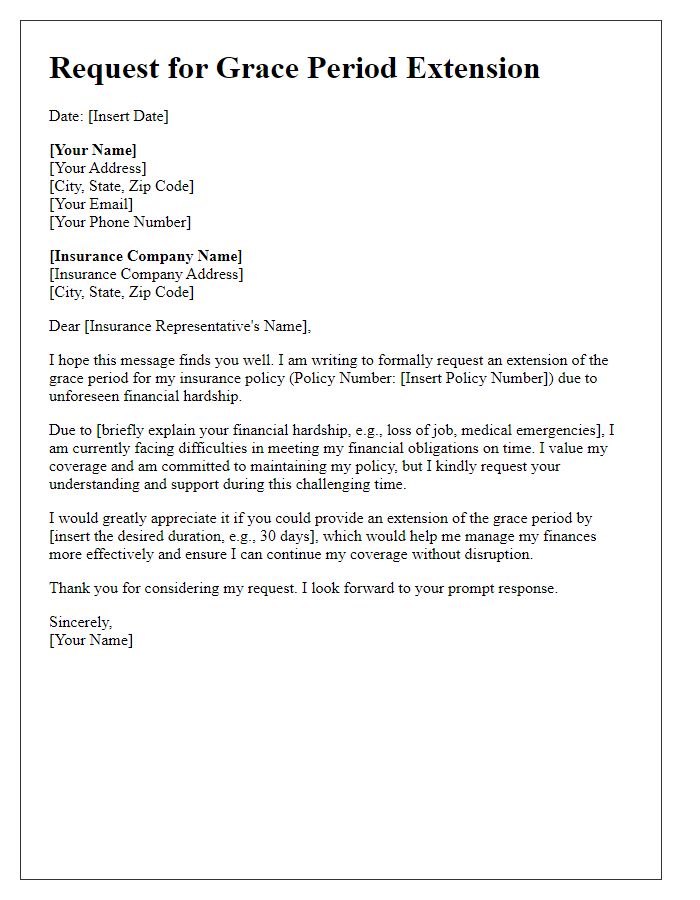

Letter template of request for insurance grace period extension due to financial hardship.

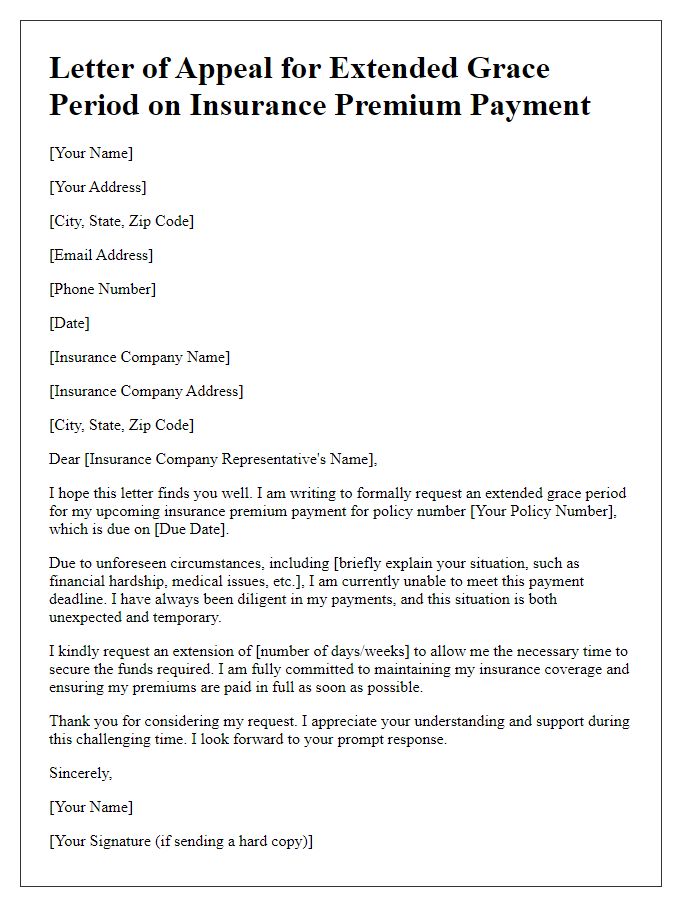

Letter template of appeal for extended grace period on insurance premium payment.

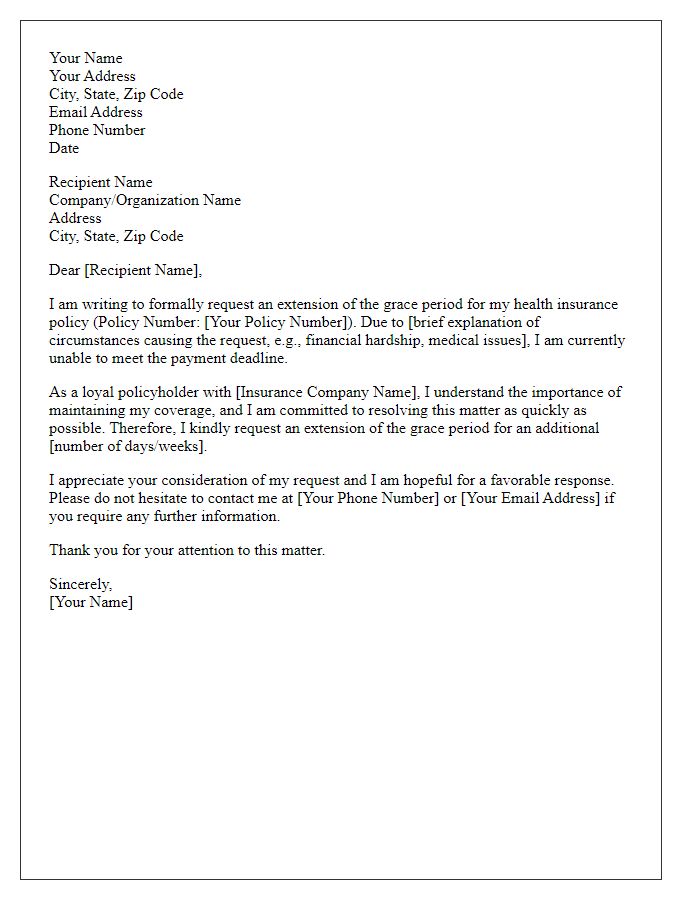

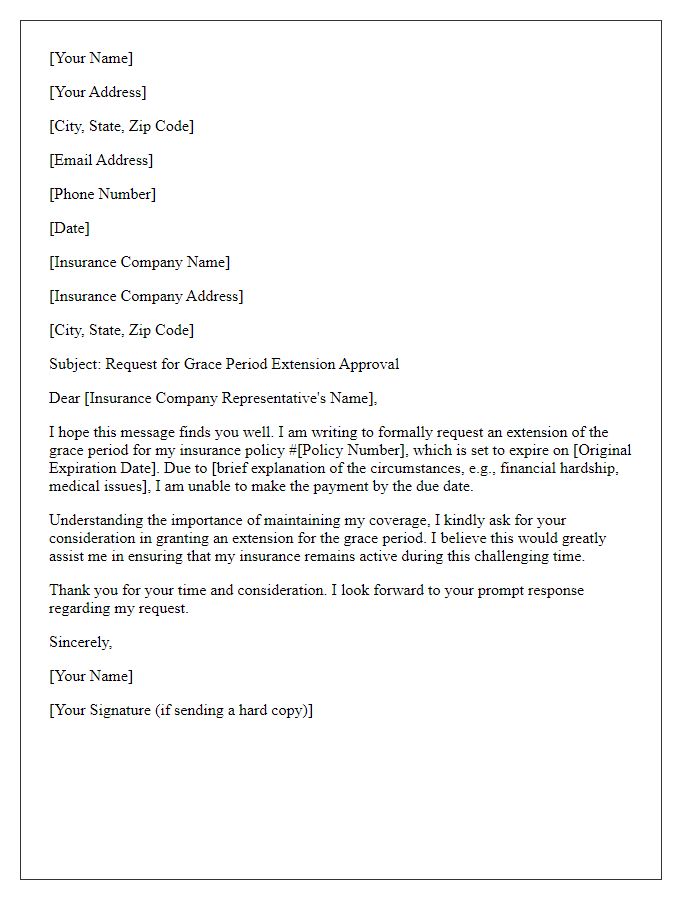

Letter template of formal request for a grace period extension on health insurance.

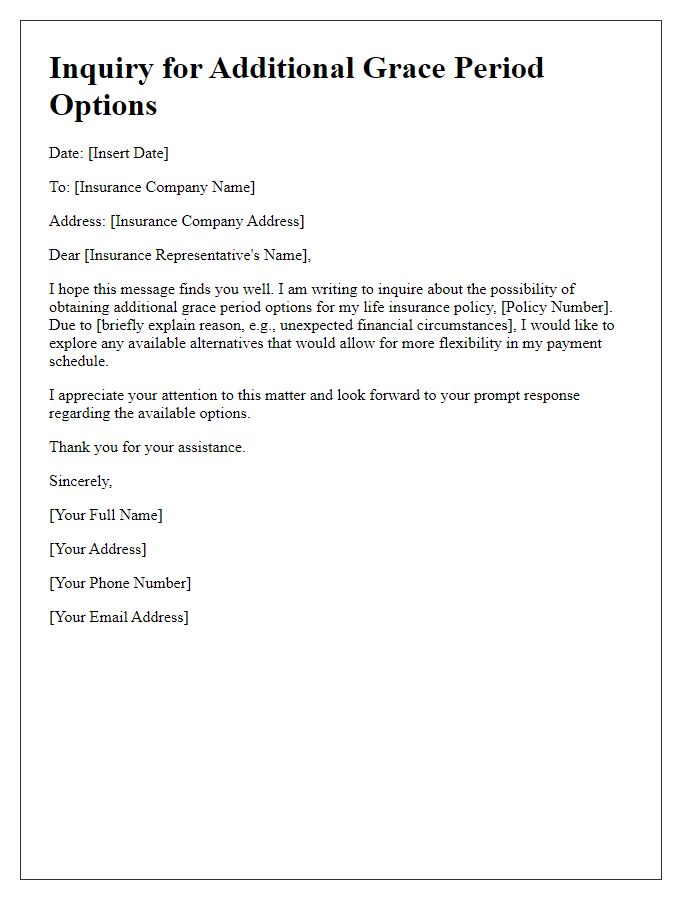

Letter template of inquiry for additional grace period options for life insurance payments.

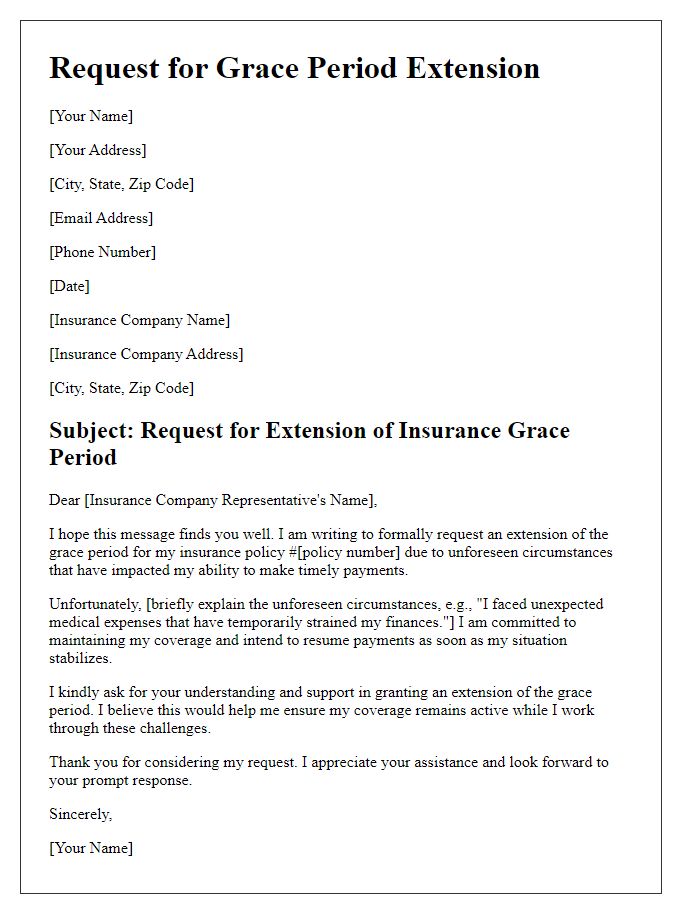

Letter template of notification for requesting insurance grace period extension for unforeseen circumstances.

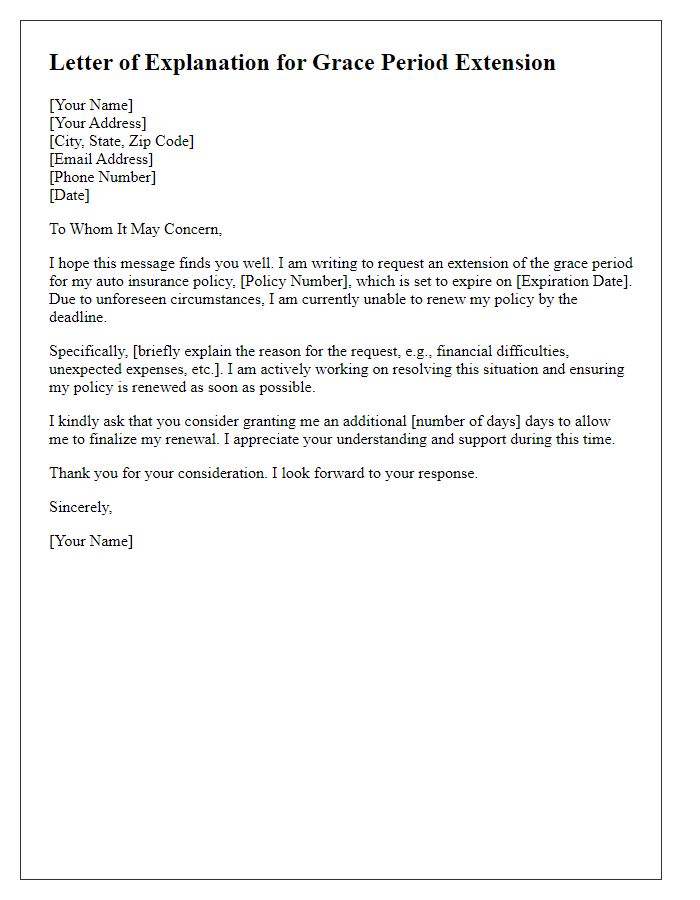

Letter template of explanation for needing a grace period extension on auto insurance.

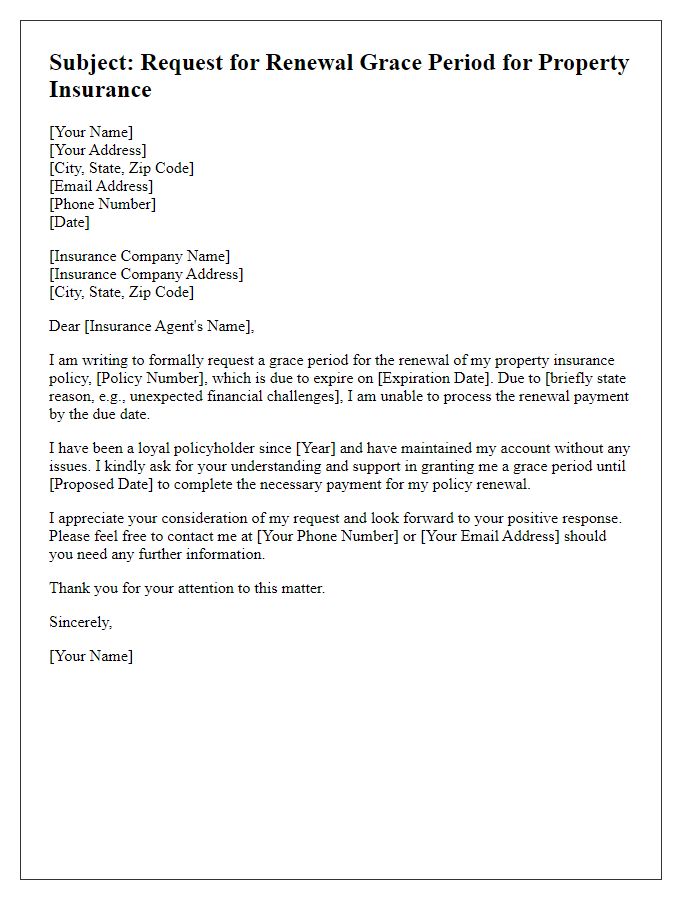

Letter template of submission for renewal grace period request on property insurance.

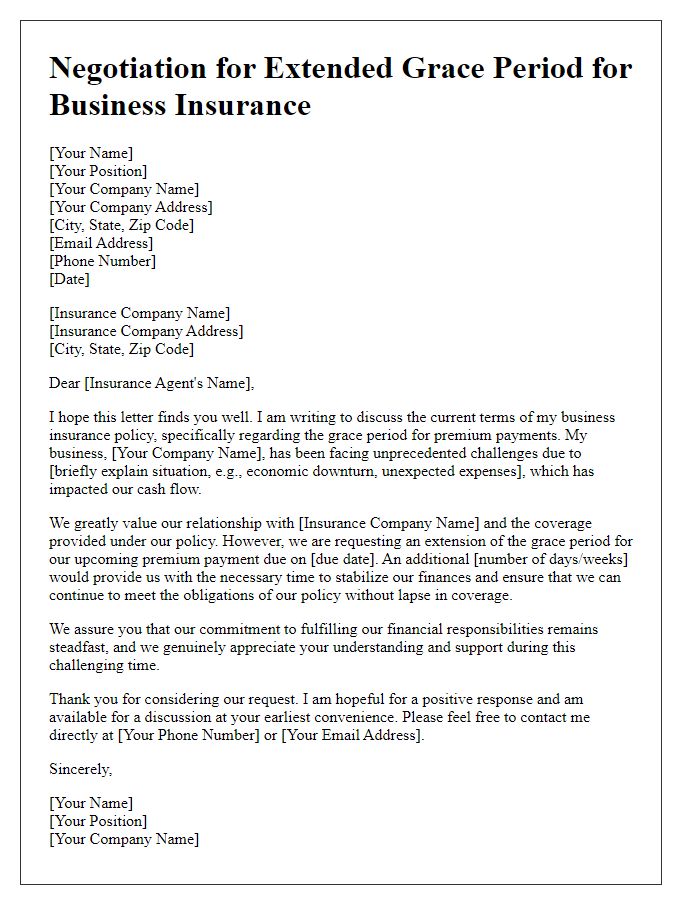

Letter template of negotiation for an extended grace period for business insurance.

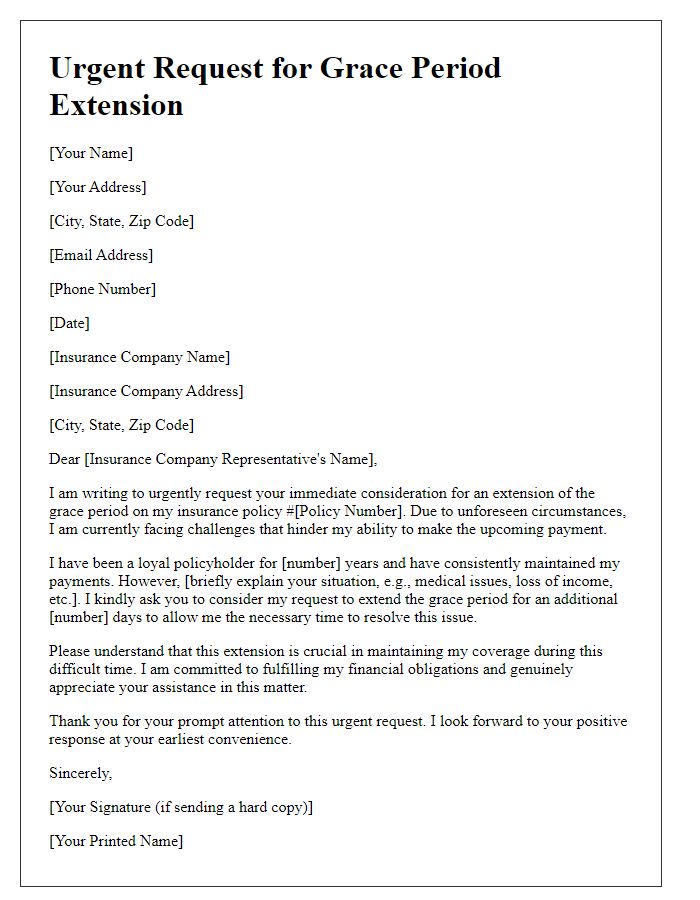

Letter template of urgency for immediate consideration of insurance grace period extension.

Comments