When life throws unexpected challenges our way, it's not uncommon to find ourselves in need of a bit more time to navigate through them. If you've been facing difficulties in submitting your insurance claim on time, requesting an extension can provide the relief you need. This article will guide you through crafting a compelling letter for your insurance claim deadline extensionâone that clearly communicates your situation and increases your chances of approval. Ready to learn how to make your case? Let's dive in!

Policyholder Information

Policyholders seeking an extension for submitting insurance claims must provide essential details to facilitate the process. The policy number serves as a unique identifier for the insurance account, maintaining accurate records. The full name of the policyholder is crucial for verifying identity and ensuring proper communication. Contact information, including a current telephone number and email address, allows the insurance company to reach the policyholder efficiently. Additionally, a brief description of the incident leading to the claim, such as a car accident or property damage due to flooding, should include relevant dates and locations to provide context. Relevant documentation, such as police reports, appraisal estimates, or photos of the damage, should also be prepared to support the request. Understanding the specific extension deadlines set by the insurance company is essential to avoid issues with the claim's validity.

Policy Number and Claim Details

Insurance claim deadlines can become challenging, especially when unforeseen circumstances arise. For instance, a policyholder may request an extension for submitting necessary documents related to claim number 123456789, under Policy Number ABC12345, due to medical emergencies or natural disasters impacting gathering evidence. Insurers, such as State Farm or Allstate, often have specific guidelines--typically 30 days--to accommodate such requests, ensuring policyholders can effectively compile required materials without losing their rights to compensation. Communicating directly through official channels, like the insurance company's claims department, remains vital for preserving the integrity of the claim process while adhering to stipulated timelines.

Reason for Extension Request

Submitting an insurance claim requires strict adherence to deadlines. Individuals facing unforeseen circumstances such as natural disasters or medical emergencies often need additional time for accurate documentation. For instance, severe flooding events in specific regions might disrupt access to necessary records or impede communication with insurance representatives. Medical emergencies can hinder one's ability to gather required paperwork or consult with specialists. Requesting an extension must include clear explanations, specific timelines, and any supporting evidence such as hospital bills or damage reports that validate the delay. Properly documenting these elements increases the likelihood of approval for a deadline extension.

Supporting Documentation

An insurance claim deadline extension can significantly impact the processing of a claim, particularly when it pertains to documentation submission. Insurers typically require supporting documentation, such as police reports for auto claims, medical records for health-related claims, or repair estimates for property damage. The initial deadline is often set within a specific period, like 30 days from the incident date or claim initiation, depending on the insurance policy. Delays in gathering requisite documents, which may include evidence like photographs, witness statements, or receipts, sometimes necessitate an extension request. Effective communication with the insurance adjuster is vital, ensuring that all reasons for the delay are clearly outlined. Understanding the insurance company's policies and the implications of missing deadlines can greatly assist in submitting a thorough and timely claim.

Contact Information for Further Communication

To extend an insurance claim deadline, clear communication is essential. When writing an email or letter, include contact information at the end for further correspondence. Provide your full name, the claim number associated with your case, and preferred communication method. Include your phone number, ensuring it is reachable during business hours (generally 9 AM to 5 PM), and an email address for written correspondence. If applicable, state your mailing address for formal communications. This information enables the insurance company to quickly respond and process your request effectively.

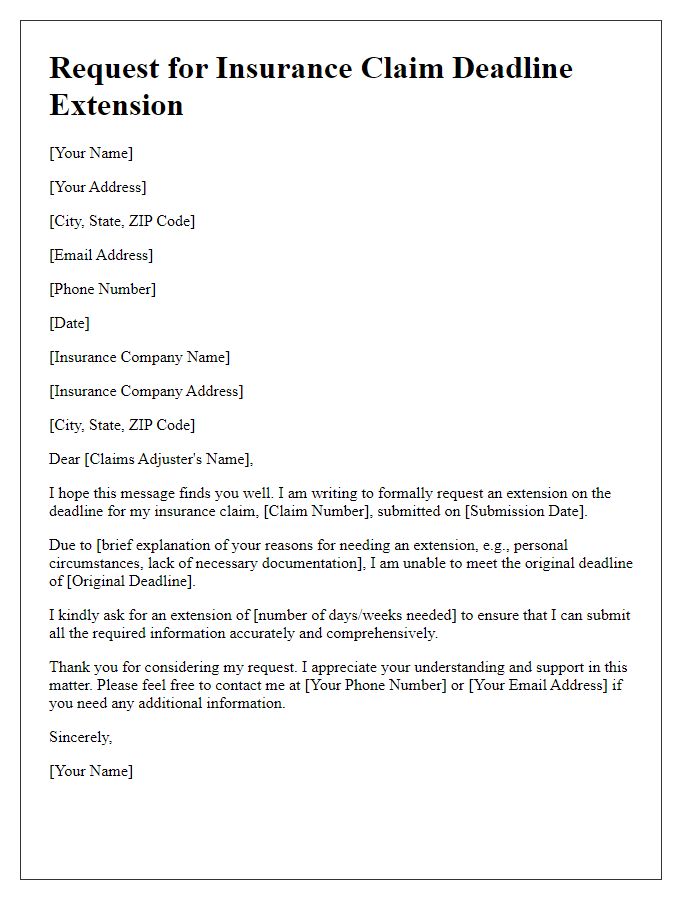

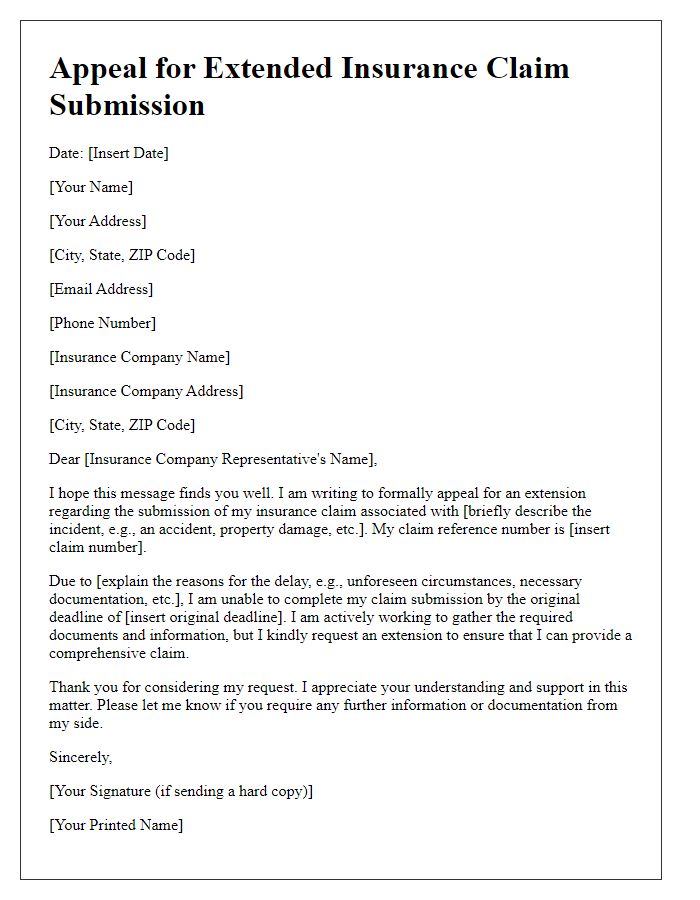

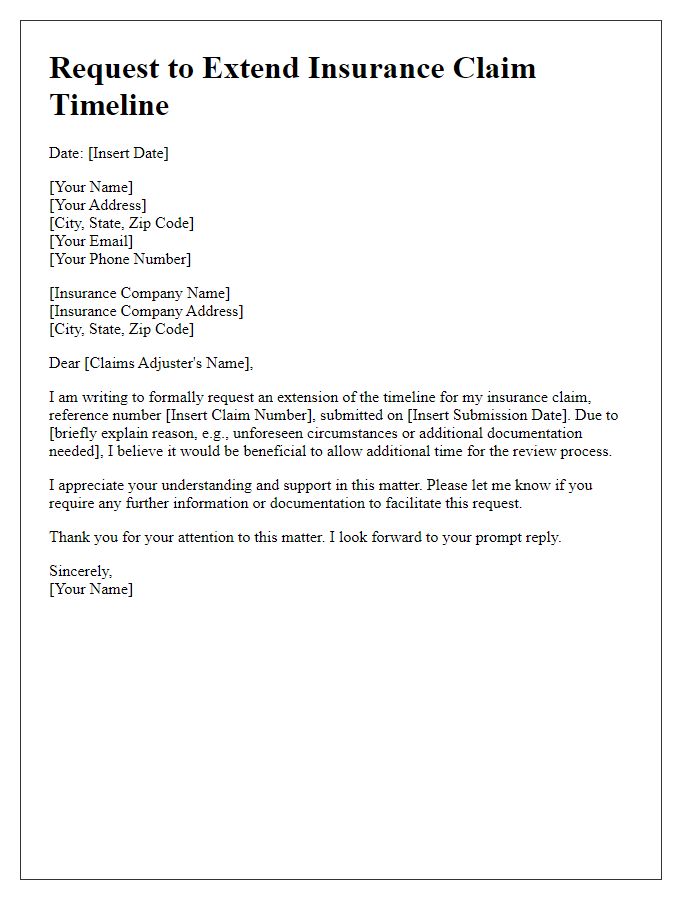

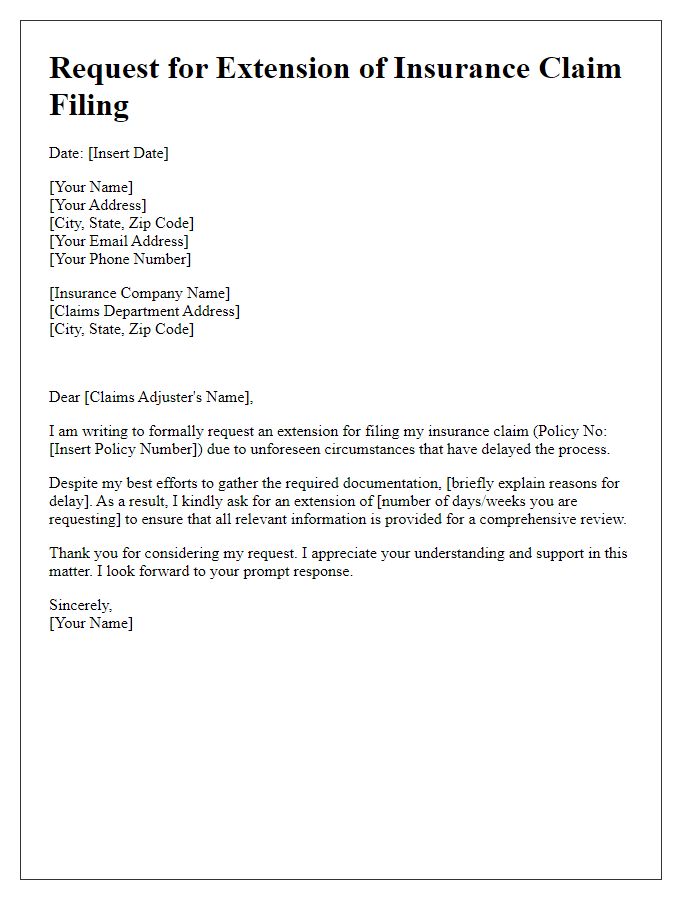

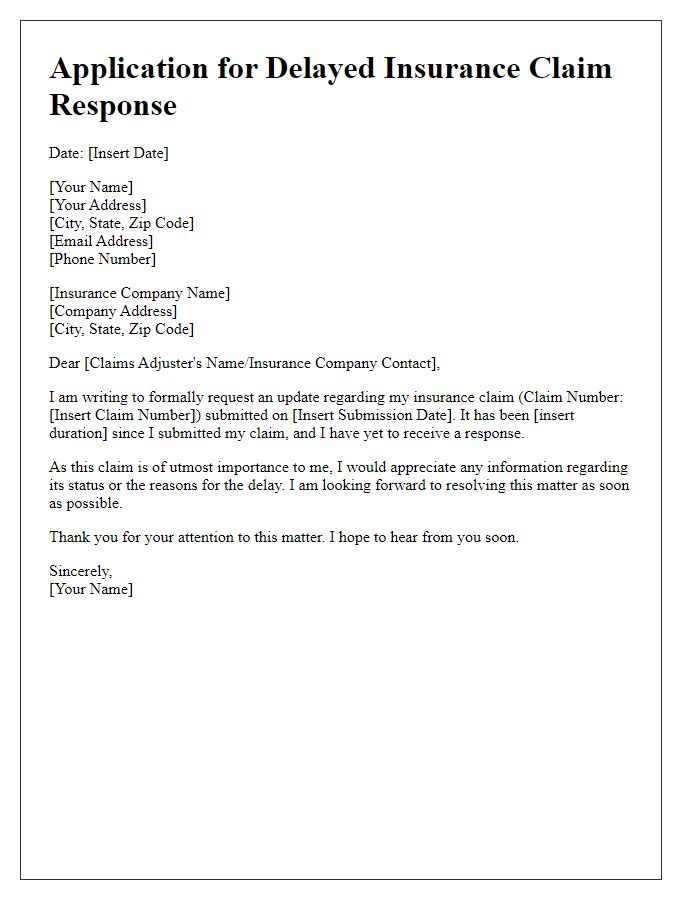

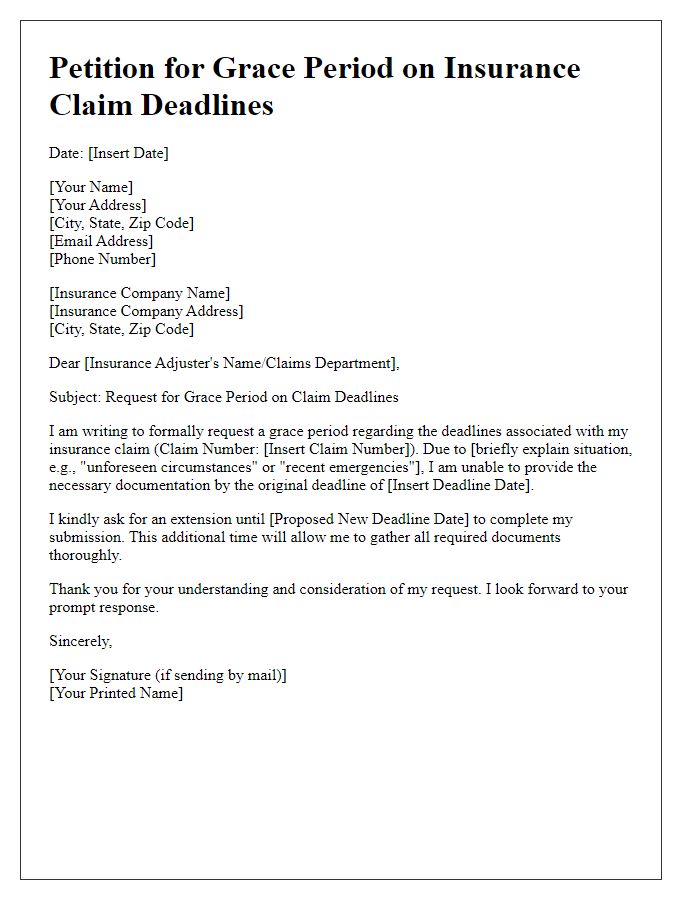

Letter Template For Insurance Claim Deadline Extension Samples

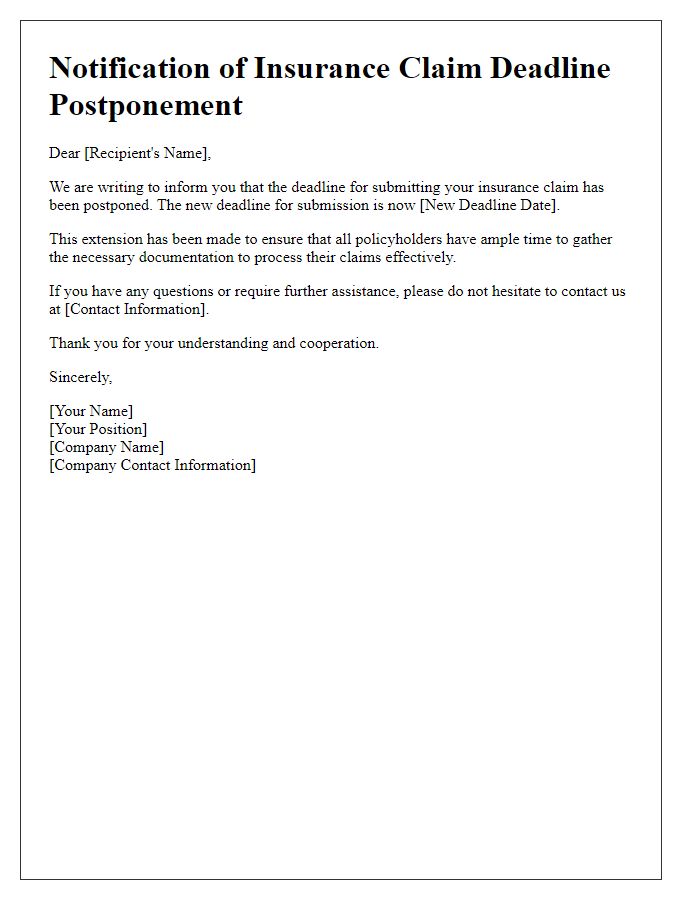

Letter template of notification for insurance claim deadline postponement

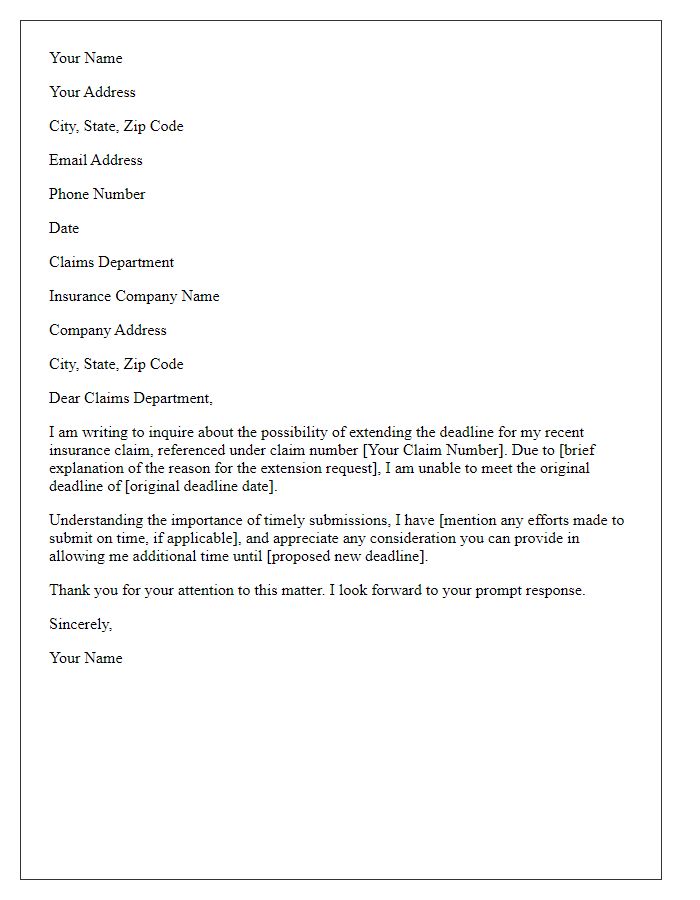

Letter template of inquiry for extending the deadline on an insurance claim

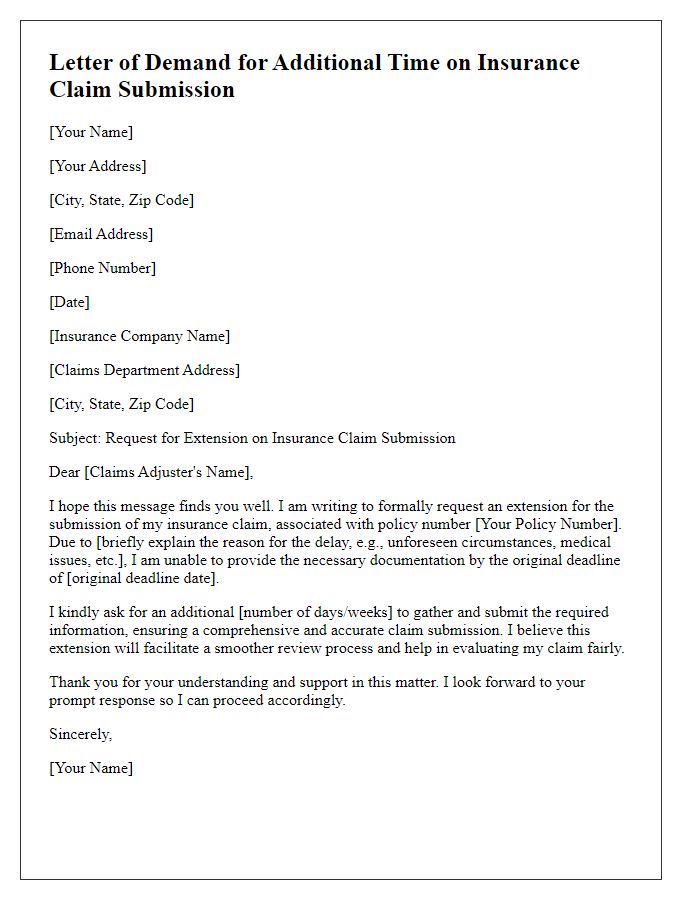

Letter template of demand for additional time on insurance claim submission

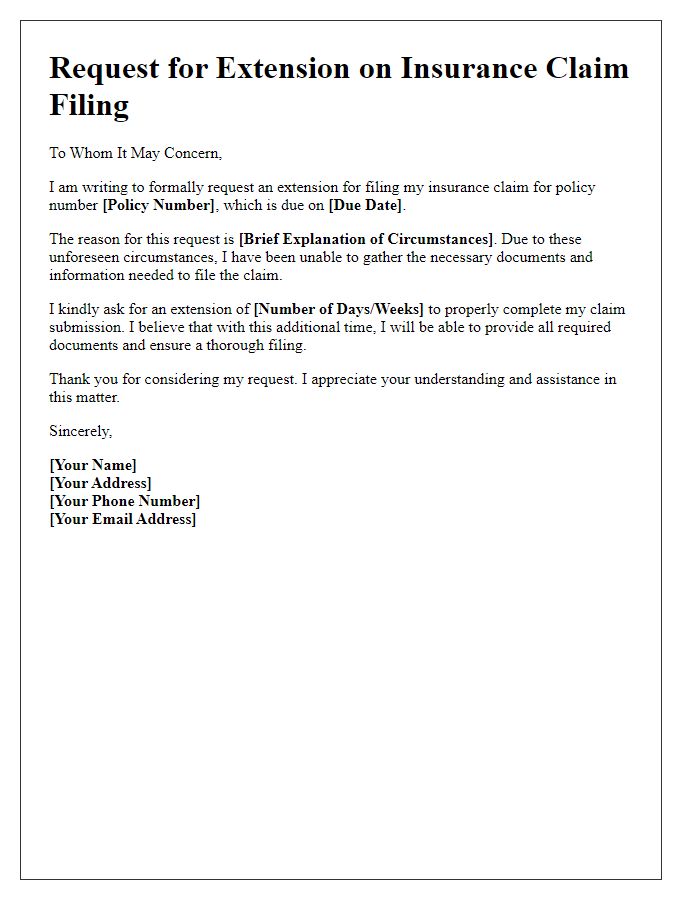

Letter template of justification for extension on insurance claim filing

Comments