Are you looking to enhance your insurance agent performance review process? Crafting a well-structured letter can set the groundwork for meaningful conversations and constructive feedback. In this article, we'll explore effective strategies to frame your performance reviews, ensuring they resonate with your agents and encourage growth. Join us as we delve into practical tips and templates that can elevate your review discussions!

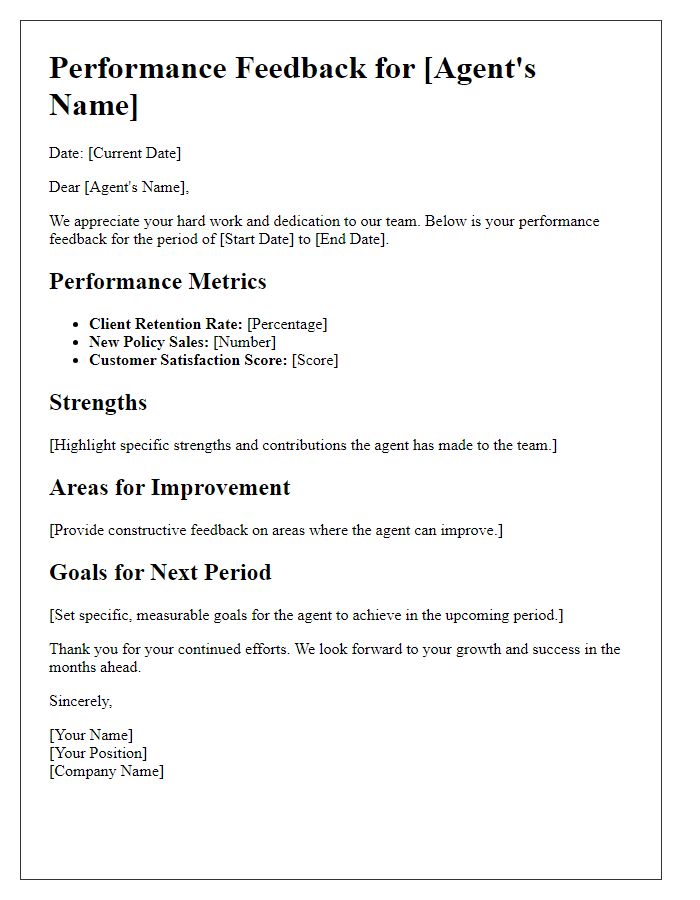

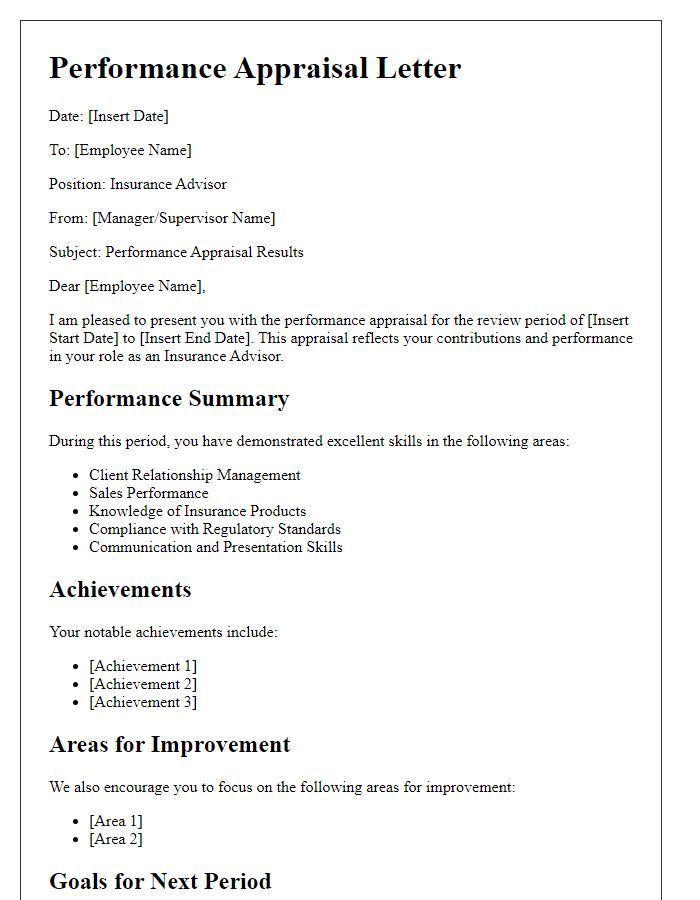

Personal details and performance metrics

An insurance agent's performance review provides a comprehensive analysis of their professional achievements and personal details. Key metrics such as total premium volume sold (for instance, $1 million in 2023), year-over-year growth percentages (up by 15% compared to 2022), and client retention rates (90% retention rate) illustrate the agent's contributions to the agency. Personal details such as the agent's tenure (5 years of industry experience) and specializations (like life insurance, auto insurance) highlight their expertise. Additionally, details on completed training programs (such as advanced underwriting courses) and customer satisfaction scores (average rating of 4.8 out of 5 from clients) further contextualize their overall performance and commitment to excellence in service delivery.

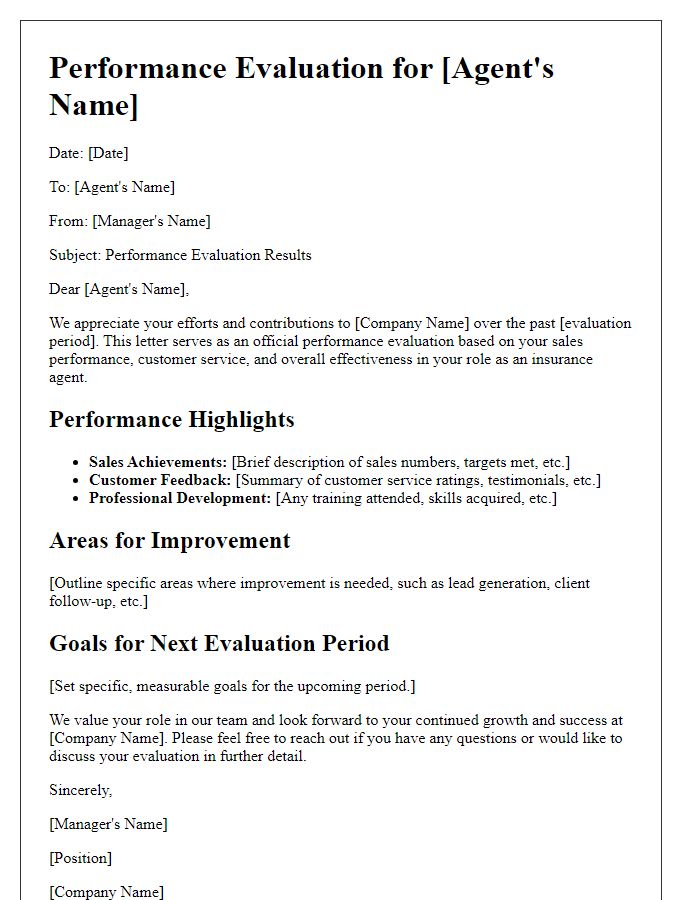

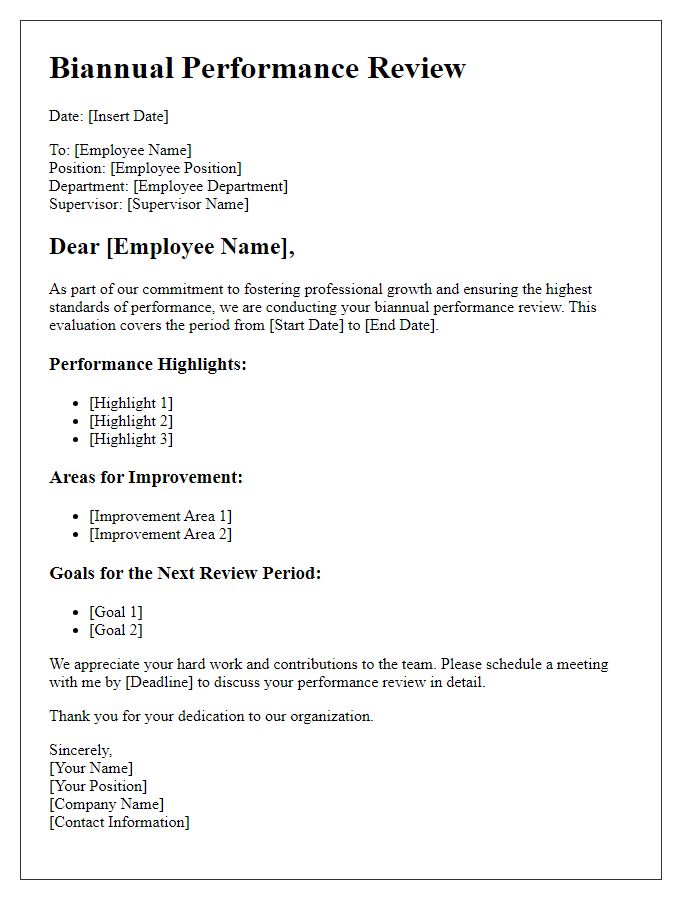

Goal achievement and sales targets

Insurance agents play a crucial role in the financial services sector by providing clients with essential coverage options and advice. Performance reviews often emphasize goal achievement and sales targets, highlighting metrics such as the number of policies sold, premium revenue generated, and client retention rates. For example, exceeding annual sales targets of $500,000 can demonstrate exceptional performance, while maintaining a client satisfaction score of 90% or higher reflects strong interpersonal skills. Evaluations also consider professional development achievements, such as obtaining additional certifications (e.g., Chartered Property Casualty Underwriter) or completing specialized training programs, enhancing an agent's knowledge and credibility in the competitive insurance market.

Client satisfaction and feedback

Client satisfaction plays a crucial role in evaluating the performance of insurance agents. Positive feedback from clients regarding prompt service, clarity in communication, and successful claims processing often indicates effective relationship management. On the other hand, negative comments concerning responsiveness or difficulty in understanding policy details can highlight areas needing improvement. Regular surveys or follow-up calls, typically conducted after policy renewals (which occur annually for most clients), provide valuable insights into client perceptions. In addition, analyzing Net Promoter Scores (NPS) can reveal clients' likelihood to recommend the agent to others, reflecting overall satisfaction. Addressing client feedback, whether regarding slow response times or confusing policy language, is essential for fostering long-term relationships and improving overall performance metrics.

Professional development and growth

Insurance agents can significantly enhance their performance and professional development through targeted training programs, such as those offered by the National Association of Insurance Commissioners (NAIC). Continuous education, including certifications like the Chartered Property Casualty Underwriter (CPCU) designation, can deepen knowledge of complex insurance products. Emphasizing skills, such as customer relationship management (CRM), agents can build rapport with clients by utilizing software platforms like Salesforce or Zoho to streamline communication and track client interactions. Engaging in regular performance reviews, ideally quarterly, allows agents to set concrete goals and receive constructive feedback from supervisors. Attending industry conferences, such as the Insurance Innovators Summit, can provide invaluable insights into emerging trends and networking opportunities with peers and seasoned professionals. Adopting a growth mindset, agents can stay adaptable to changes in regulations, such as those introduced by the Affordable Care Act (ACA), ensuring they provide clients with up-to-date advice and options.

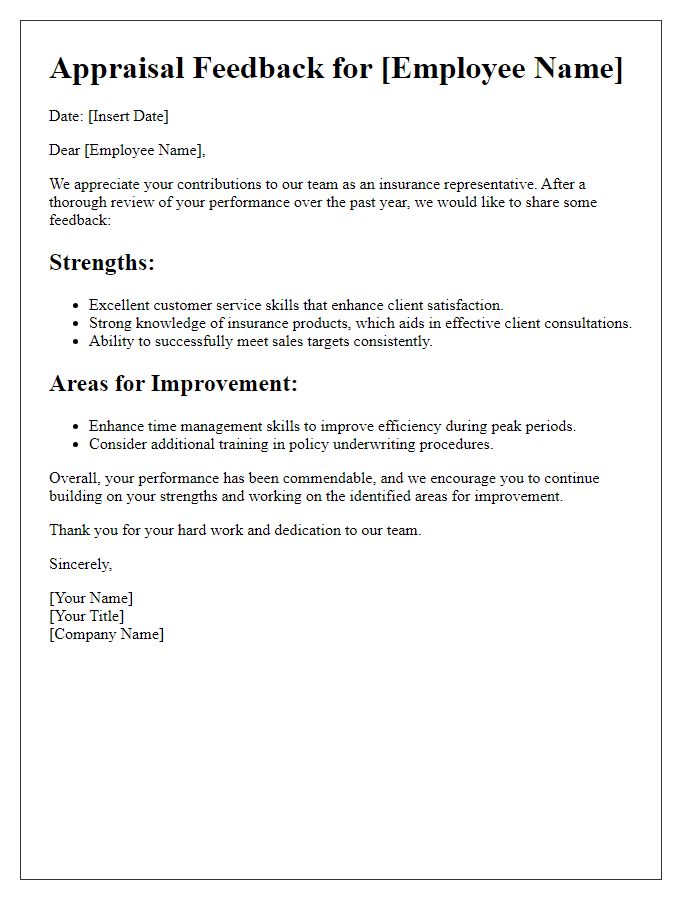

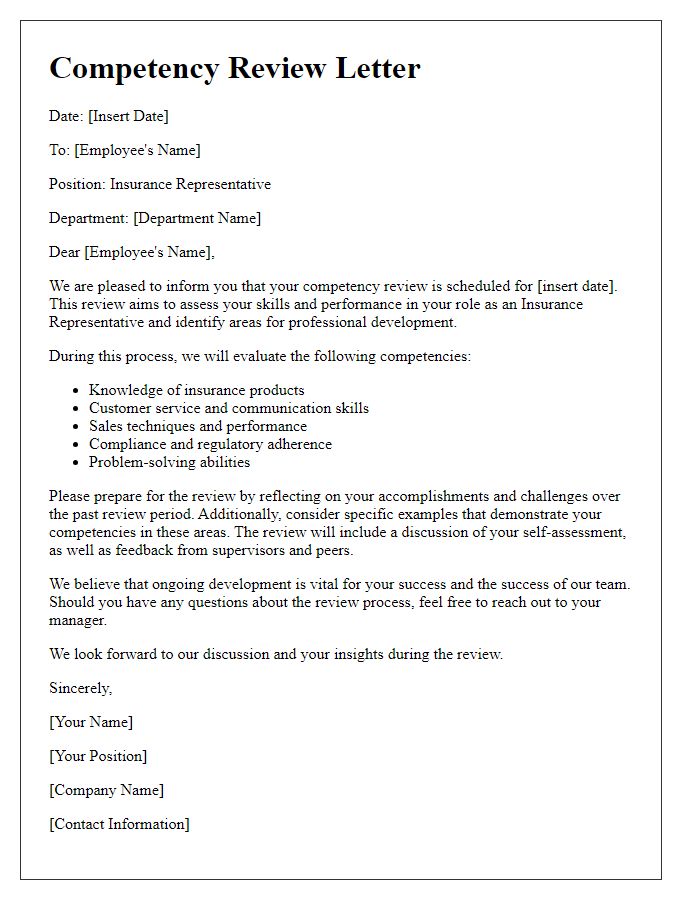

Improvement areas and action plans

An insurance agent's performance review highlights key areas for improvement. Focus on client communication (ensuring clarity and prompt responses) and policy knowledge (deepening understanding of products like life insurance and property coverage). Additionally, assess lead generation strategies (utilizing social media platforms such as Facebook and LinkedIn) to enhance clientele outreach. Action plans could include enrolling in continued education courses (e.g., several online certifications available through the National Association of Insurance Commissioners) to stay updated on industry trends. Regular mentoring sessions with a senior agent can provide valuable insights on effective sales techniques. Setting quarterly performance targets (such as increasing client acquisition by 20%) may also encourage measurable growth.

Letter Template For Insurance Agent Performance Review Samples

Letter template of agent performance feedback for insurance professionals

Comments