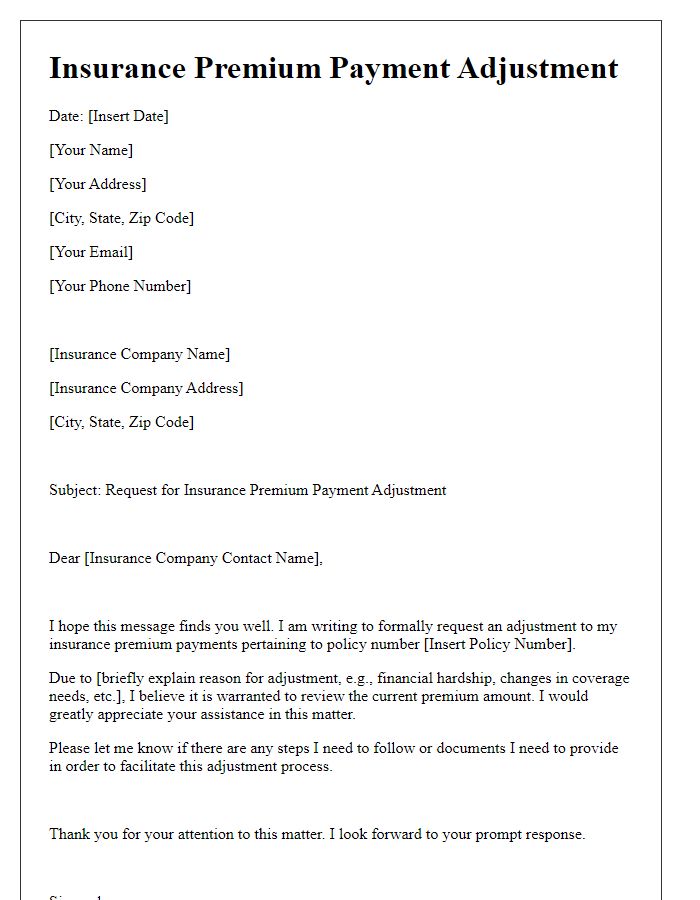

Are you feeling overwhelmed by your insurance premium payments? You're not aloneâmany people find themselves in the same boat, navigating the occasionally tricky waters of financial responsibilities. It's important to stay informed and prepared, ensuring that your coverage remains uninterrupted while managing your budget effectively. So, let's dive in and explore some practical advice on handling your insurance premium payments, and I invite you to read more for helpful tips!

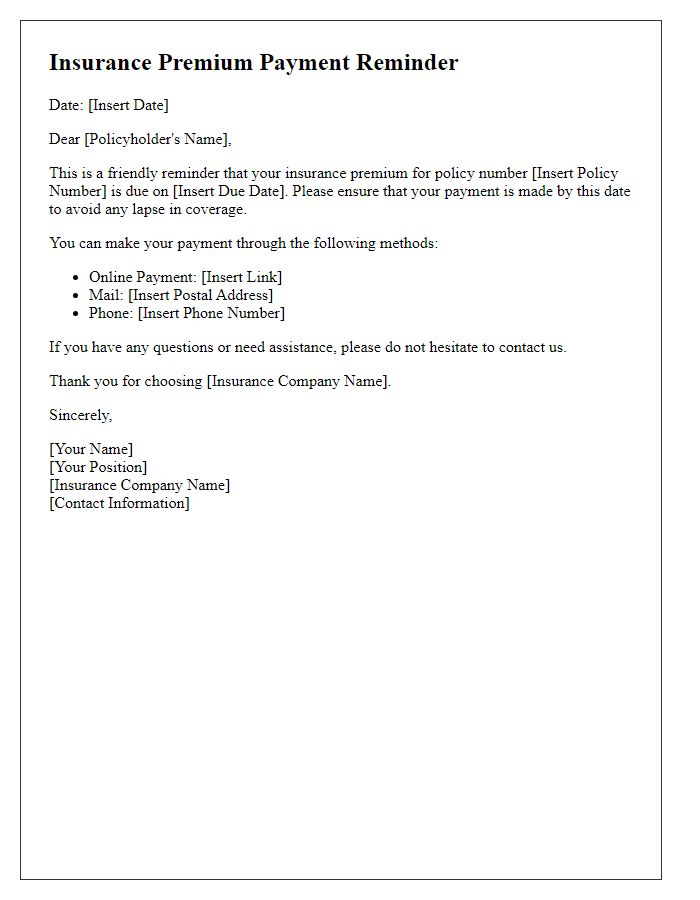

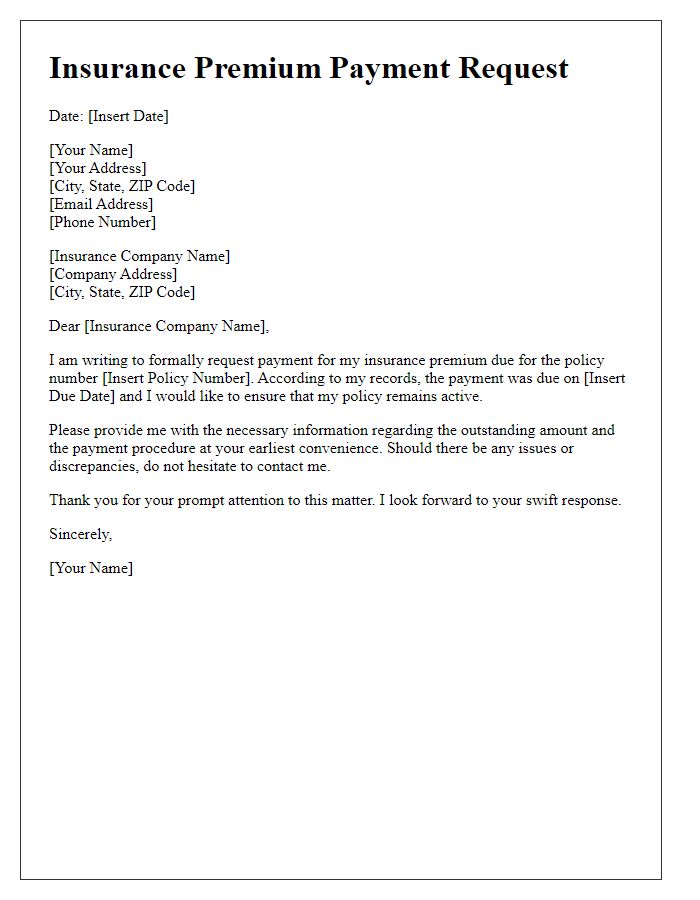

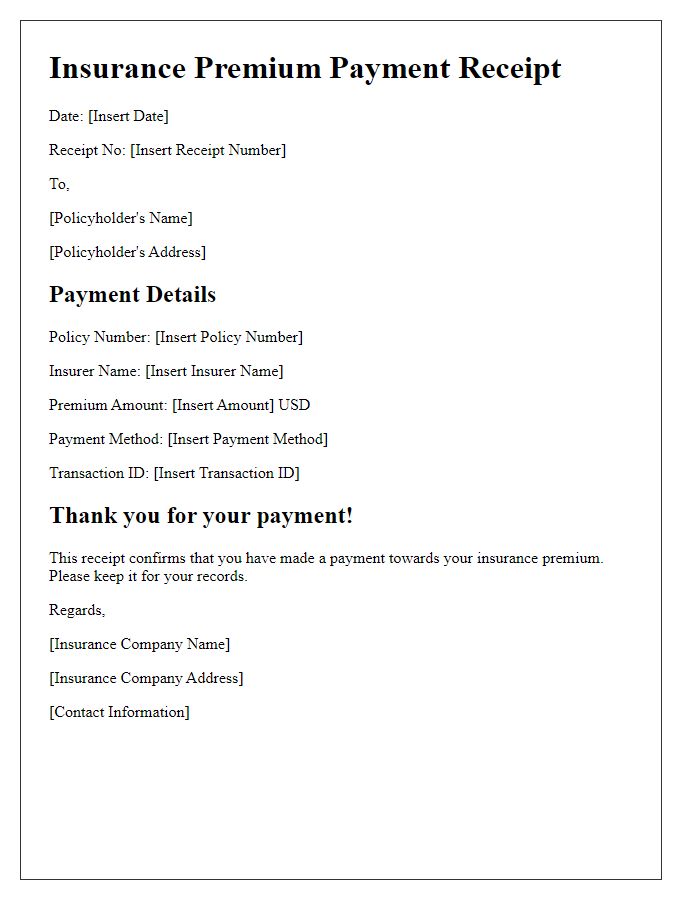

Clear identification of policyholder and policy number

Timely insurance premium payments are crucial for maintaining coverage for policyholders, such as John Smith, with a policy number 123456789. The policyholder, residing at 123 Main Street, Springfield, has coverage through XYZ Insurance Company, renowned for their comprehensive plans. Payment due dates are specified in the insurance contract, often on the first of each month. Late payments may incur fees or policy lapses, leading to potential gaps in coverage. Maintaining documentation of payments and communications with the insurance provider, including receipts and confirmation emails, is essential for record-keeping and dispute resolution. Regular monitoring of payment schedules can ensure uninterrupted coverage and peace of mind.

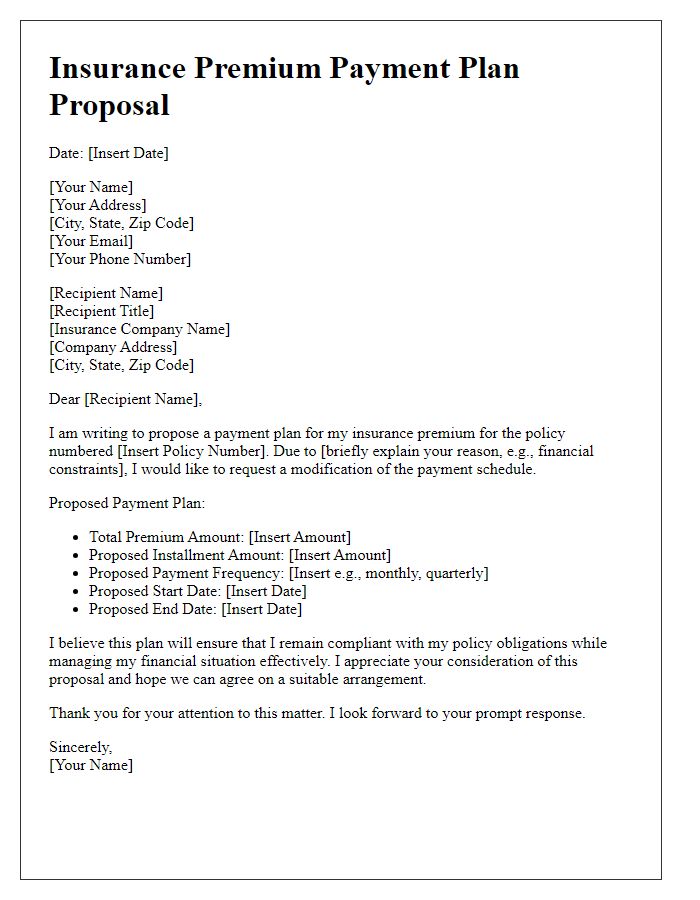

Detailed premium amount and due date

The insurance premium payment of $500 for the comprehensive health insurance policy (Policy Number: HCP123456) is due on November 15, 2023. This premium covers medical expenses, including hospitalization and specialist consultations, ensuring financial protection for unforeseen health issues. Timely payment is crucial to maintain the policy's active status and avoid coverage interruptions.

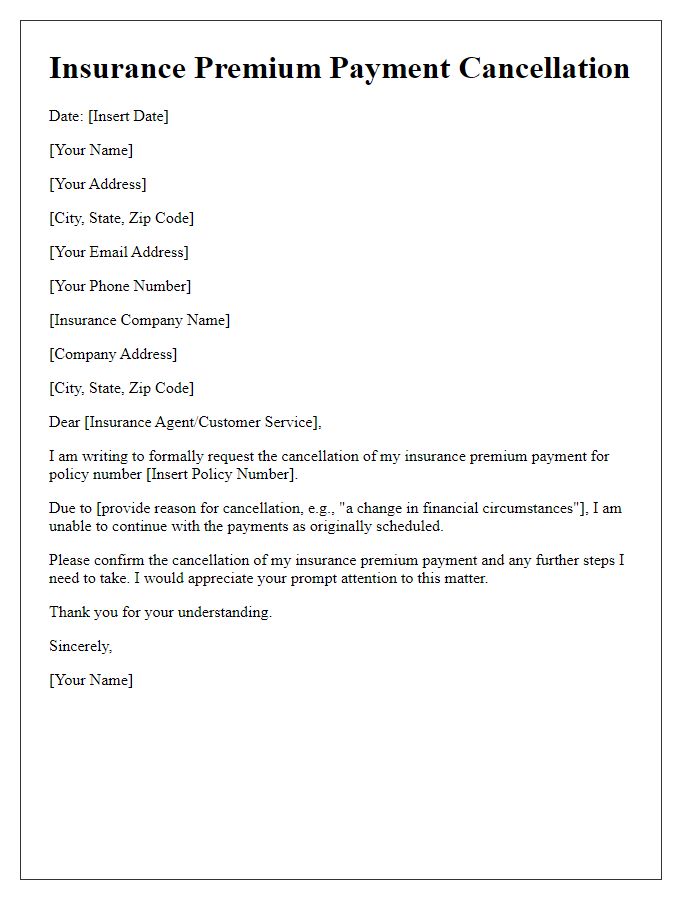

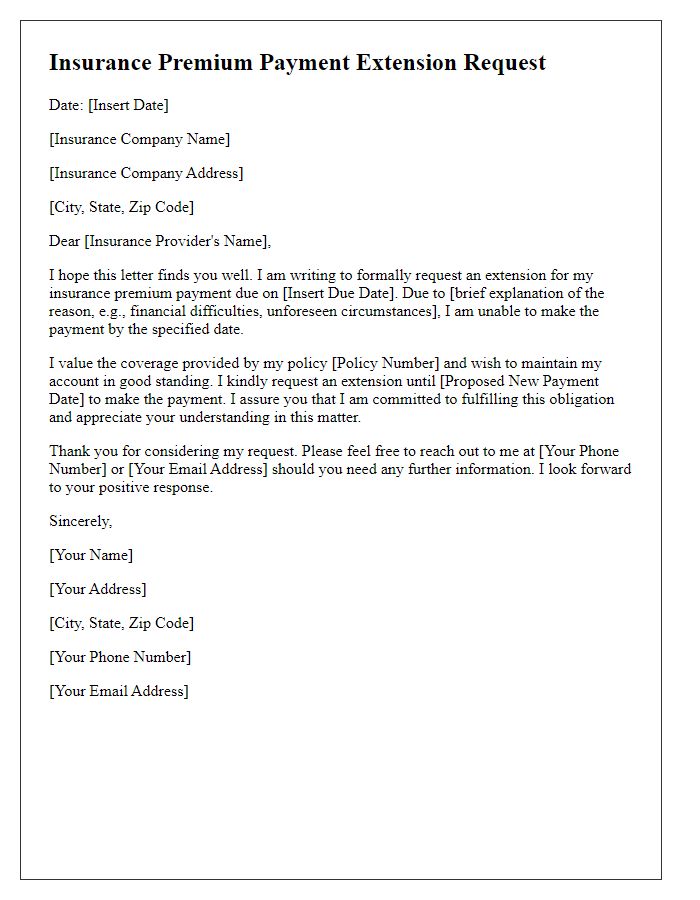

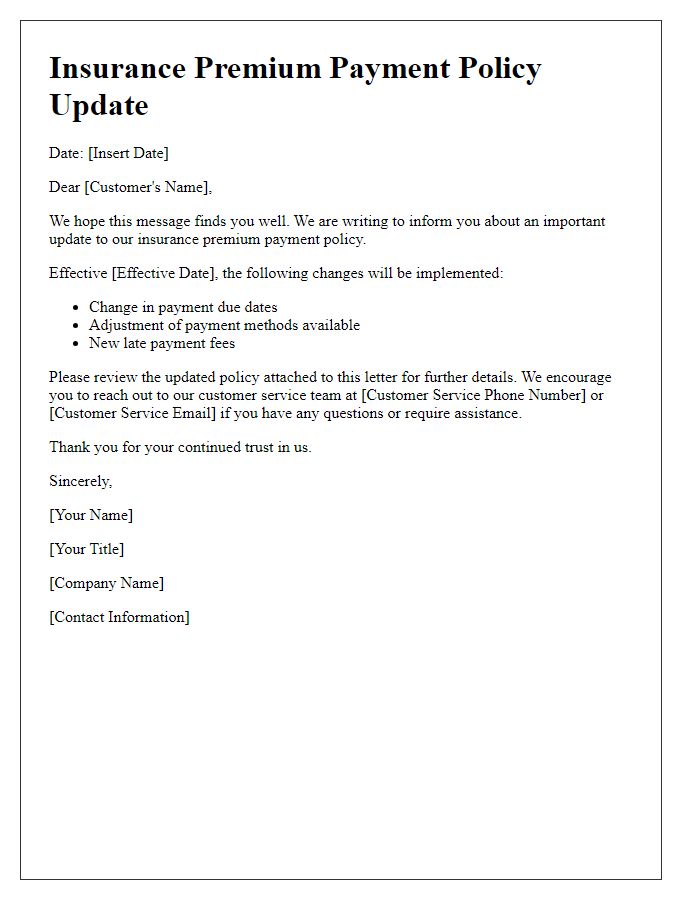

Payment methods and options available

Insurance premium payments can be made through various convenient options to ensure seamless transactions. Online payment portals allow customers to use credit cards, debit cards, or electronic bank transfers securely, typically available 24/7. Monthly auto-pay plans provide hassle-free payments, deducting the premium directly from bank accounts on scheduled dates, thus avoiding late fees. Additionally, payments can be made via mobile apps, enabling users to manage their policies on the go. Some insurance companies still accept traditional methods, such as mailed checks or in-person payments at local offices, catering to diverse customer preferences. Electronic funds transfer ensures quick processing, usually within 1-2 business days. Each payment method is designed to enhance accessibility and cater to individual customer needs.

Contact information for queries or assistance

For any queries or assistance regarding your insurance premium payment, please contact our customer service team. Our office is located at 123 Insurance Way, Suite 456, Springfield, State, ZIP Code. You can reach us by telephone at (555) 123-4567 or via email at support@insurancecompany.com. Our dedicated representatives are available Monday through Friday, from 9 AM to 5 PM Eastern Standard Time (EST), ensuring you receive prompt and helpful service. Additionally, for your convenience, our website offers a comprehensive FAQ section and online chat feature, available 24/7, to address common concerns and facilitate immediate support.

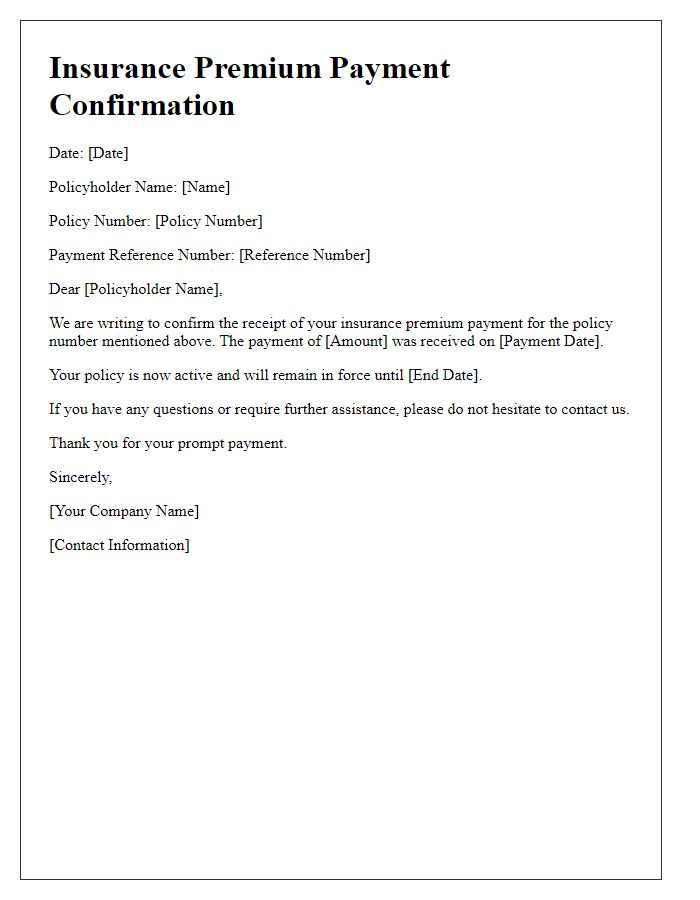

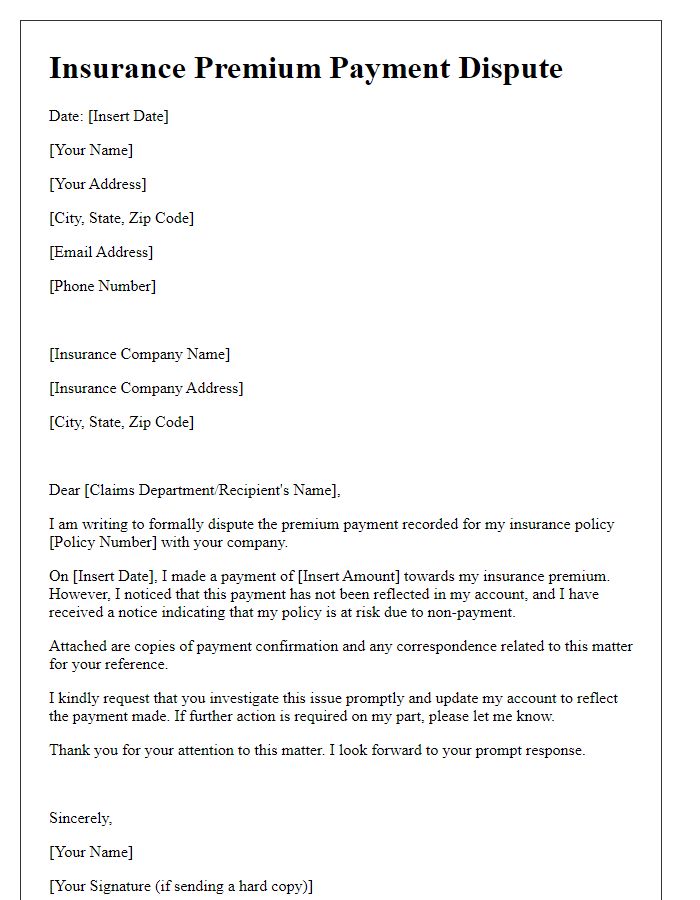

Acknowledgment and confirmation of previous transactions

Acknowledgment of insurance premium payment ensures clarity in financial commitments. The payment receipt serves as a vital document for auditing purposes. Policyholders should note the transaction ID, date of payment, and amount paid to verify their compliance with the terms set forth in the insurance contract. Insurance companies typically provide a confirmation email or letter outlining previous transactions, providing peace of mind for clients. Should discrepancies arise, having detailed records can facilitate rapid resolution with customer service representatives, preserving both trust and transparency in the relationship between the policyholder and the insurance provider.

Comments