Are you feeling overwhelmed by the intricacies of insurance policy guarantees? You're not alone! Many people find the details confusing, but an effective letter can clarify your coverage and reinforce your peace of mind. In this article, we'll provide a straightforward template and tips to help you craft the perfect letter for your insurance policy guaranteeâso let's dive in!

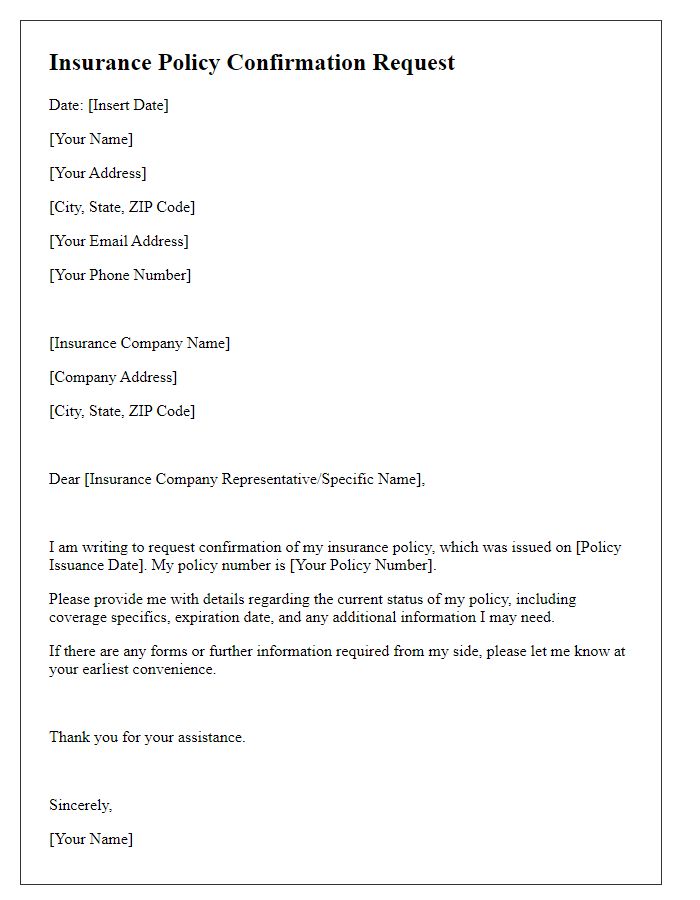

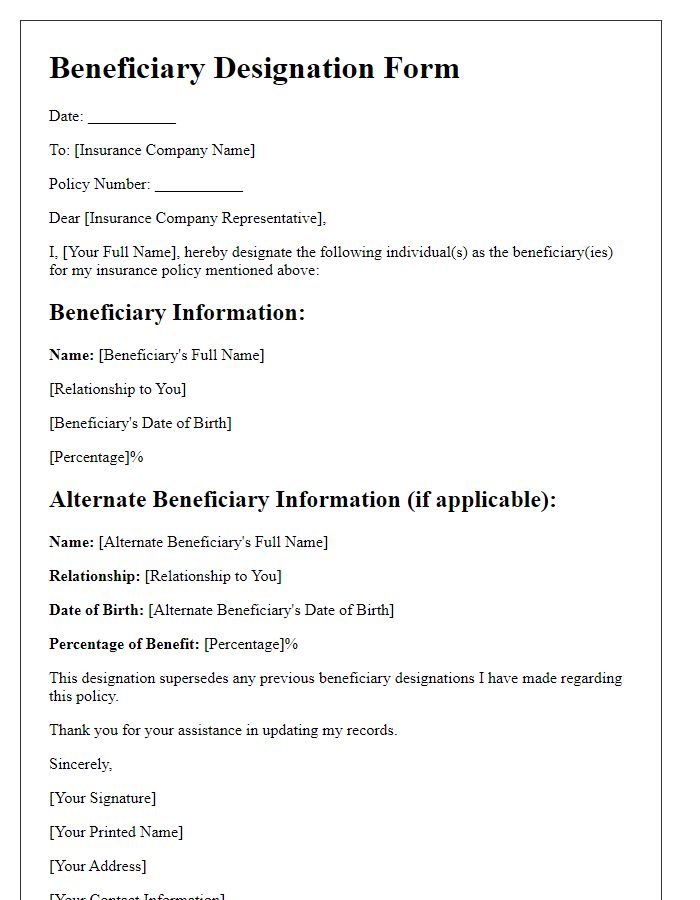

Policyholder Information

The insurance policy guarantee provides vital protection for policyholders, individuals holding a formal agreement with an insurance company, assigning coverage for specified risks or losses. Essential details include the policy number, a unique identifier for each specific agreement, the policyholder's name, the registered individual's full legal name as per their identification documents, and contact information, including phone numbers and email addresses, which ensure seamless communication. Additional information like the effective date, marking the start of coverage, and the expiration date, denoting the policy's end, should also be clearly stated. Effective premium amount, the financial cost paid to maintain the policy, along with coverage limits, outlining the maximum amount the insurer will pay in the event of a claim, are crucial to understanding the insurance contract's scope and limitations. Furthermore, details about any riders or endorsements, supplemental provisions that modify the policy's terms, enhance clarity and transparency in the agreement between the policyholder and the insurer.

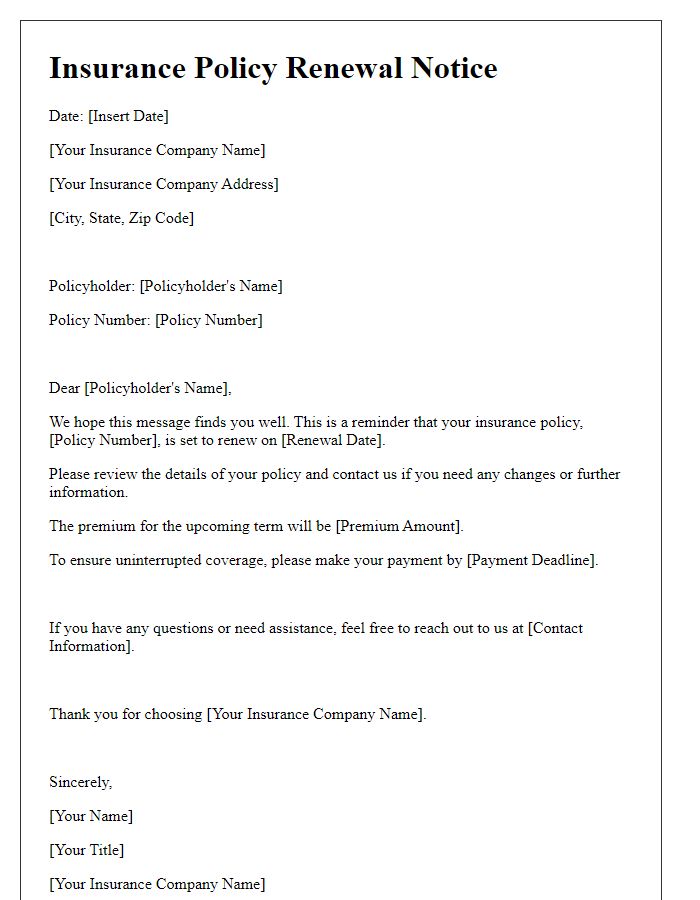

Coverage Details

Insurance policies, particularly those pertaining to property protection, often outline specific coverage details that provide clients with a comprehensive understanding of what is included. For instance, dwelling coverage typically offers protection up to a limit of $300,000 for damages caused by incidents like fire or natural disasters. Personal property coverage, usually up to 70% of the dwelling limit, safeguards belongings within the home, including electronics and furniture. Liability coverage often extends up to $500,000 to protect policyholders against claims arising from injuries or damages occurring on the insured property. Additionally, there may be endorsements available for specialized items such as jewelry, which might require appraisals for coverage exceeding standard limits. Understanding these key details allows policyholders to navigate their coverage effectively and ensure adequate protection for their assets.

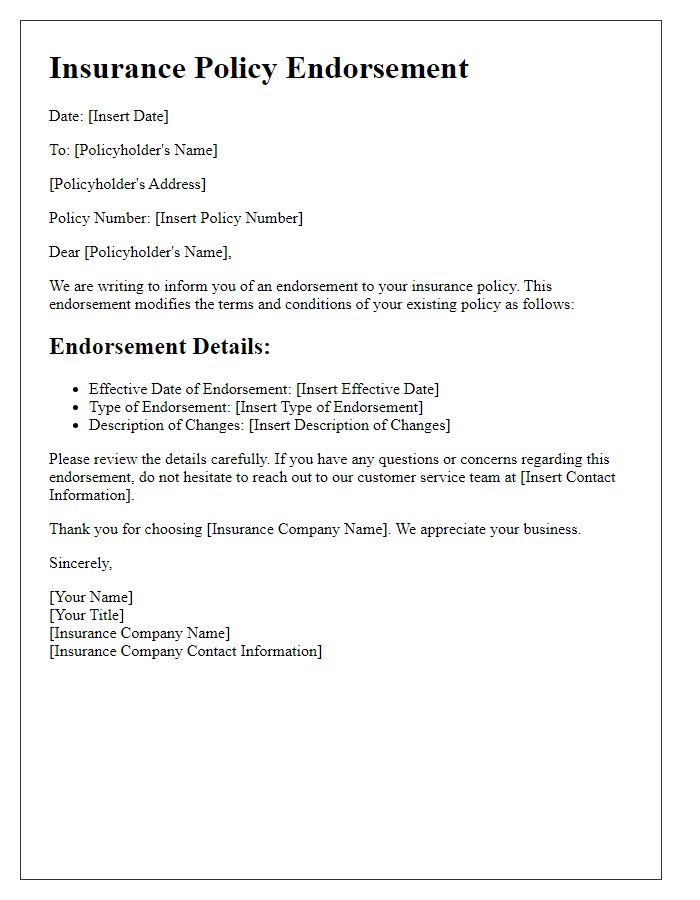

Guarantee Terms

Insurance policy guarantees provide assurance to policyholders regarding their coverage and the financial security of their claims. They detail key terms such as the policyholder's rights, types of coverage (including life, health, auto, and property), benefits, and exclusions. Guarantee terms typically include a clear outline of the duration of coverage, conditions under which claims are valid, and any deductibles or co-payments required. Additionally, these terms specify the claim process, documentation needed, and timeframes for payments upon successful claim approval. Understanding these guarantee terms is crucial for policyholders to navigate their insurance agreements effectively and ensure financial protection in times of need.

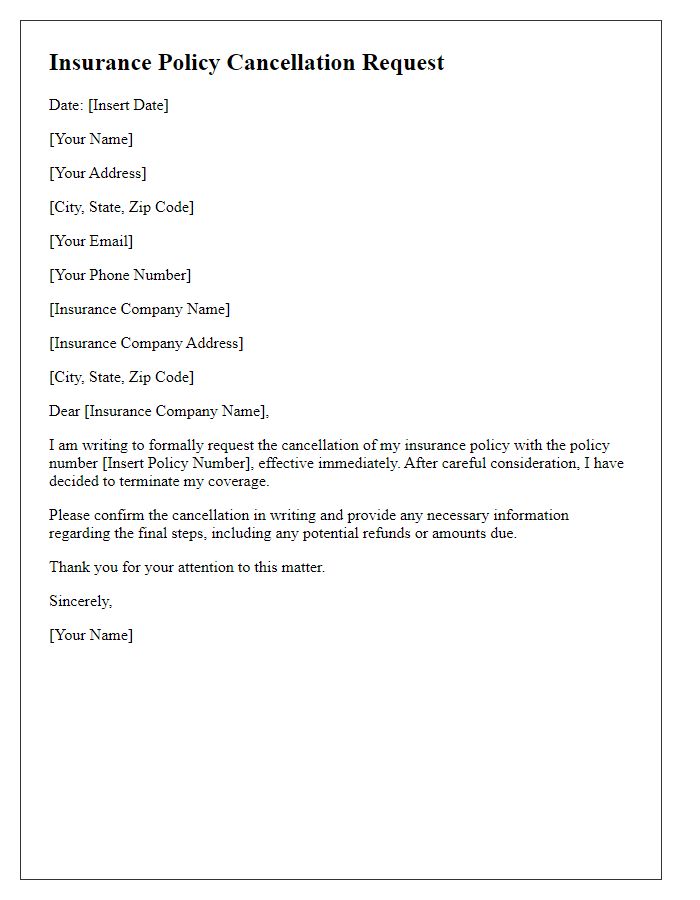

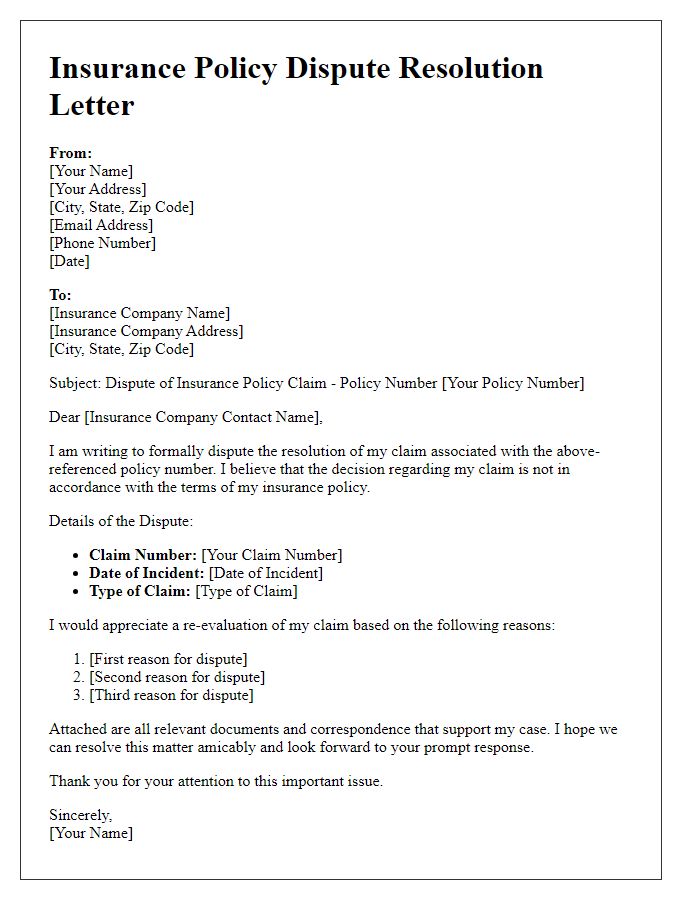

Claim Procedures

Claim procedures for insurance policies involve a systematic approach to ensure a smooth process when filing for compensation. Policyholders must first notify their insurance provider, such as State Farm or Allstate, often within a specific timeframe, usually 30 days from the incident date. Gathering essential documentation is crucial, including photographs of damage, medical reports, and police reports, relevant for automobile or property claims. Each insurer typically has dedicated claims adjusters who assess the situation, evaluate the evidence (such as repair estimates), and determine the coverage applicability based on the policy terms. Deadlines for submitting claims may vary, but often fall within 60 days post-incident, necessitating timely actions by the insured to avoid potential denial. A follow-up call or email to the claims department may help expedite the process, ensuring all questions regarding reconciliation or outstanding documents are addressed efficiently.

Exclusion Clauses

Exclusion clauses in insurance policies serve as critical components that define coverage limitations and specific circumstances under which claims may be denied. These clauses often outline particular events, such as natural disasters (e.g., floods, earthquakes), that are not covered by the policy, creating an essential understanding of the insured's risks. Other notable exclusions may include actions such as fraud, reckless behavior, or driving under the influence, which could invalidate a claim and result in financial loss for the policyholder. Furthermore, pre-existing conditions in health insurance policies often limit benefits, emphasizing the importance of thoroughly reviewing these exclusions during the policy selection process to ensure adequate protection and peace of mind.

Comments