Are you in need of an insurance declaration document but unsure how to request it? Don't worry; crafting a clear and concise letter can make all the difference. In this article, we'll guide you through a simple letter template that outlines your request while ensuring it captures all necessary details. So, let's dive in and streamline your document request process!

Policyholder information

Policyholder information plays a crucial role in insurance declaration documents. This includes full name (often multiple names if joint policies), residential address (detailed with city, state, and ZIP code), contact number (landline or mobile), email address (for correspondence), and policy number (unique identifier for the insurance agreement). Additional details such as date of birth (to verify identity), social security number (for record keeping), and employment information (may impact coverage terms) are often requested for comprehensive processing. Clarity in providing this information ensures efficient handling of insurance requests and compliance with policy terms.

Policy number

An insurance declaration document, crucial for policyholders, contains essential details regarding coverage and claims. Policy number, a unique identifier assigned to each insurance contract, facilitates easy access to specific information regarding the insured items or services. The declaration serves as proof of coverage, summarizing key terms, insured limits, and effective dates, typically issued by prominent insurance companies like State Farm or Allstate. Requesting this document is vital during claims processes, mortgage applications, or for verification during legal proceedings, ensuring stakeholders have accurate information about the insurance agreement in question.

Type of insurance coverage

Insurance coverage types, such as health insurance or auto insurance, provide essential financial protection against unforeseen events. Health insurance, covering medical expenses, includes various plans like HMO (Health Maintenance Organization), PPO (Preferred Provider Organization), and EPO (Exclusive Provider Organization). Auto insurance, protecting against vehicle damage, comprises liability, collision, and comprehensive coverage. Insurance providers issue policies that specify the extent of coverage, premiums, and deductibles. Additionally, claims processes may differ based on the type of insurance, requiring documentation for validation and compensation during incidents such as accidents or health emergencies. Understanding the nuances of each coverage type is crucial for adequate protection and financial planning.

Specific documents requested

Insurance companies often require specific documentation to process a declaration related to a claim or policy. Necessary documents may include proof of loss (such as photographs or police reports), receipts for damaged items, witness statements, and any relevant medical records. Additionally, the insurer may ask for a completed claim form or policy number, clearly detailing the nature of the request. It's essential to ensure that all requested documents are complete and accurate to expedite the processing time, which can vary depending on the insurer's internal protocols and the complexity of the claim.

Contact details for follow-up communication

Precise contact details play a vital role in streamlining follow-up communication regarding an insurance declaration document request. Essential information includes your full name (for identification purposes), phone number (preferably a mobile number for immediate response), email address (ensuring prompt digital correspondence), and a physical address (for any postal communication that may be required). This comprehensive information enables the insurance agency, such as State Farm or Allstate, to easily reach out and verify any additional information needed to process the request efficiently, ultimately facilitating a smoother claims process.

Letter Template For Insurance Declaration Document Request Samples

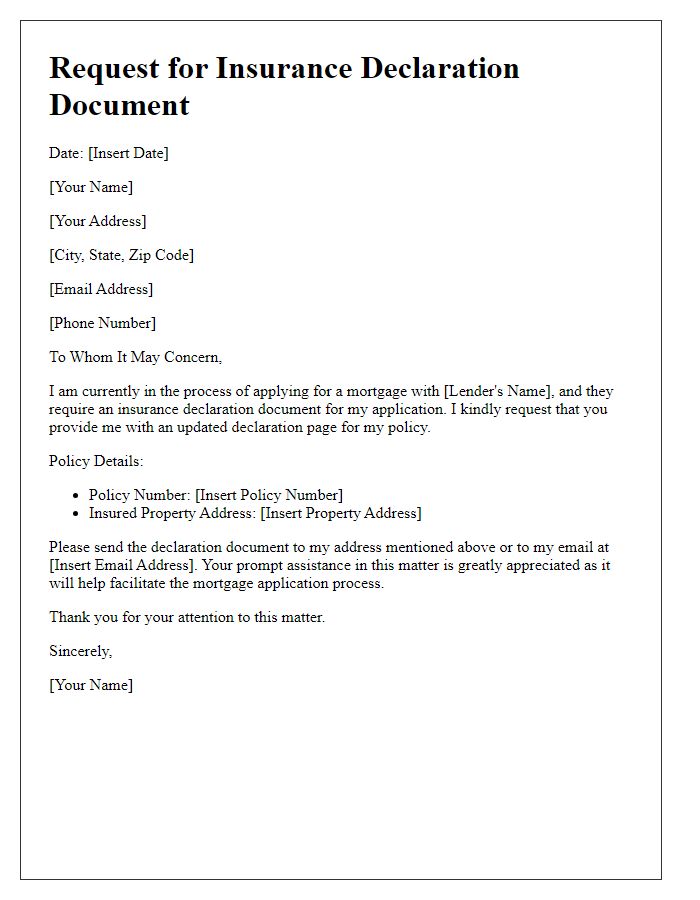

Letter template of insurance declaration document request for mortgage application.

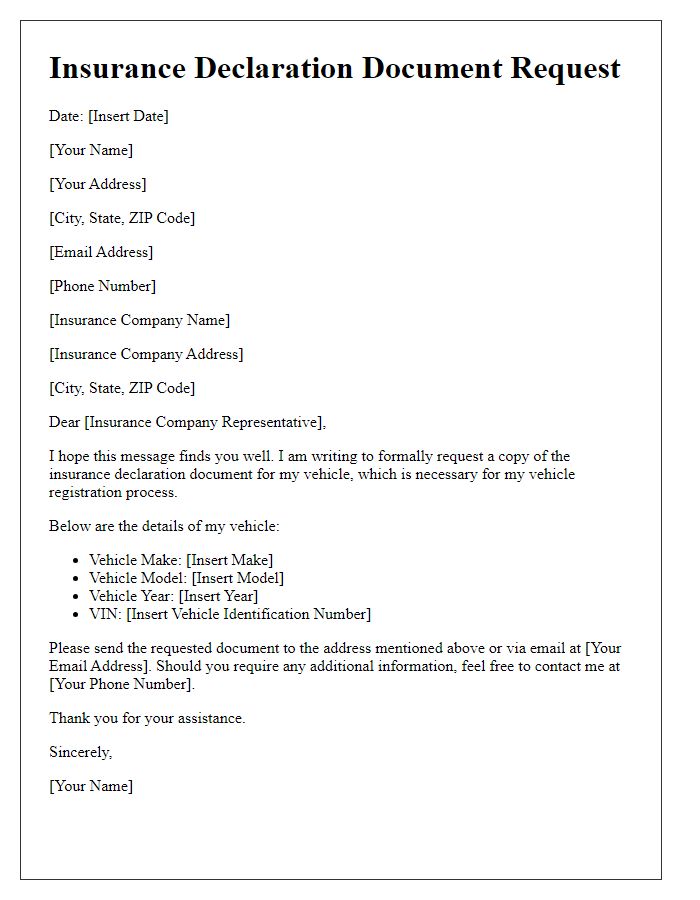

Letter template of insurance declaration document request for vehicle registration.

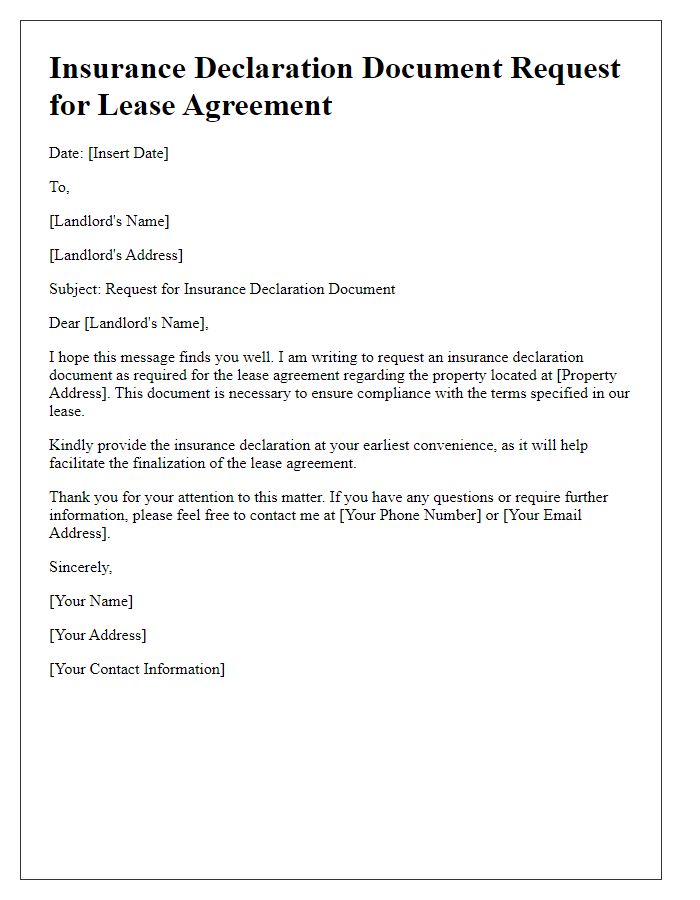

Letter template of insurance declaration document request for lease agreement.

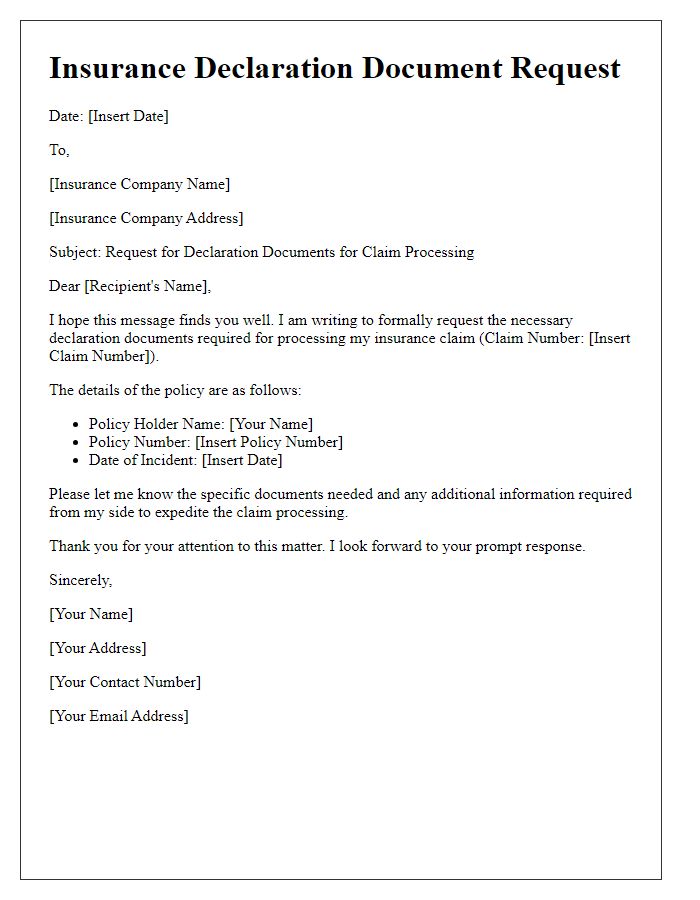

Letter template of insurance declaration document request for claim processing.

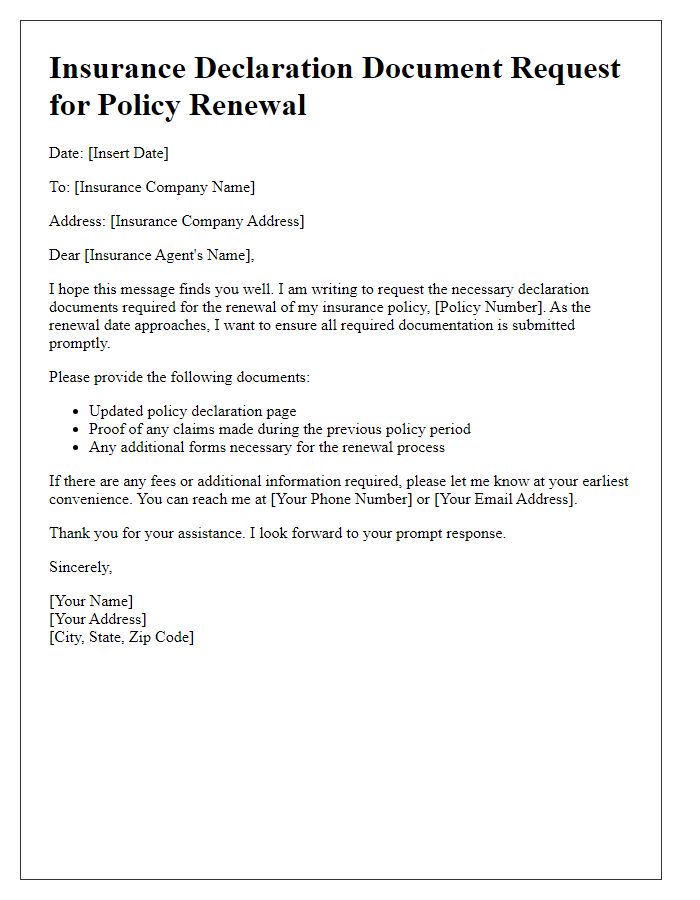

Letter template of insurance declaration document request for policy renewal.

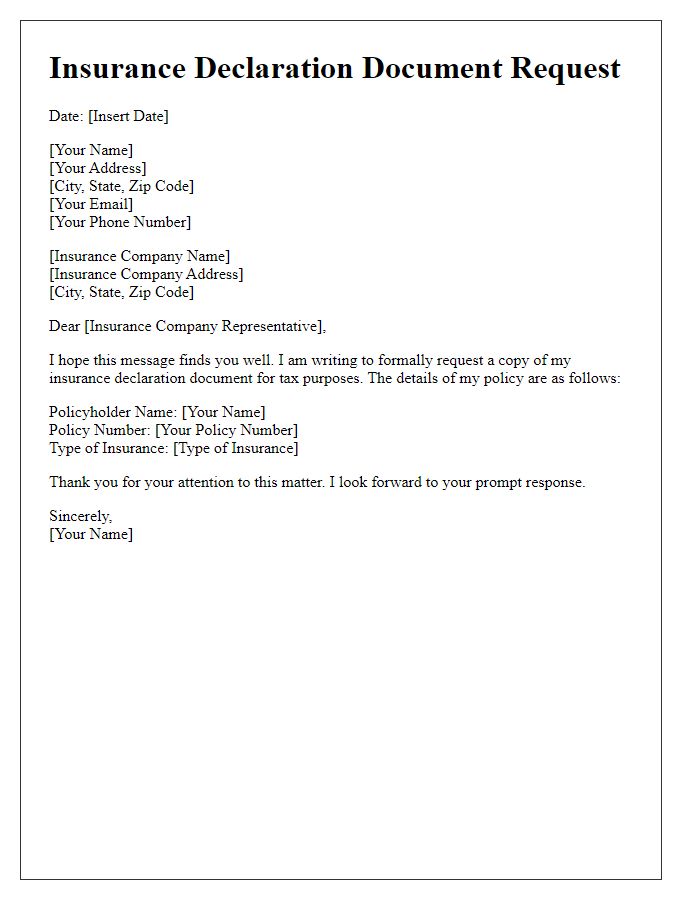

Letter template of insurance declaration document request for tax purposes.

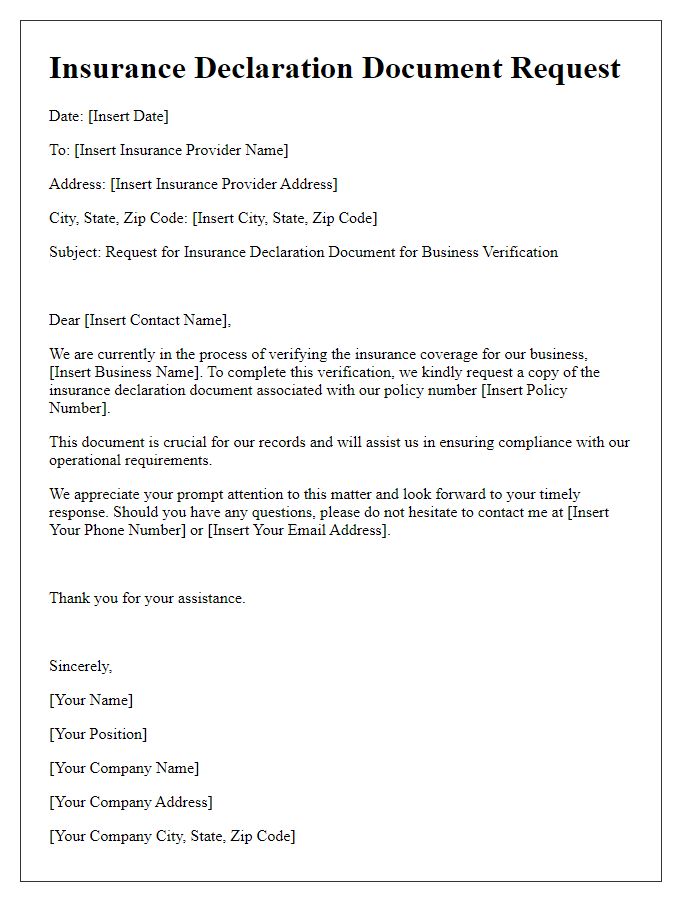

Letter template of insurance declaration document request for business verification.

Letter template of insurance declaration document request for loan approval.

Letter template of insurance declaration document request for compliance audit.

Comments