Are you feeling a bit confused about your insurance deductibles? You're not alone! Many people find it tricky to navigate the ins and outs of their policies and how these deductibles truly work. In this article, we'll break down the key points and simplify the concepts around insurance deductibles, making it easier for you to manage your coverage effectively. Let's dive in!

Policyholder Information

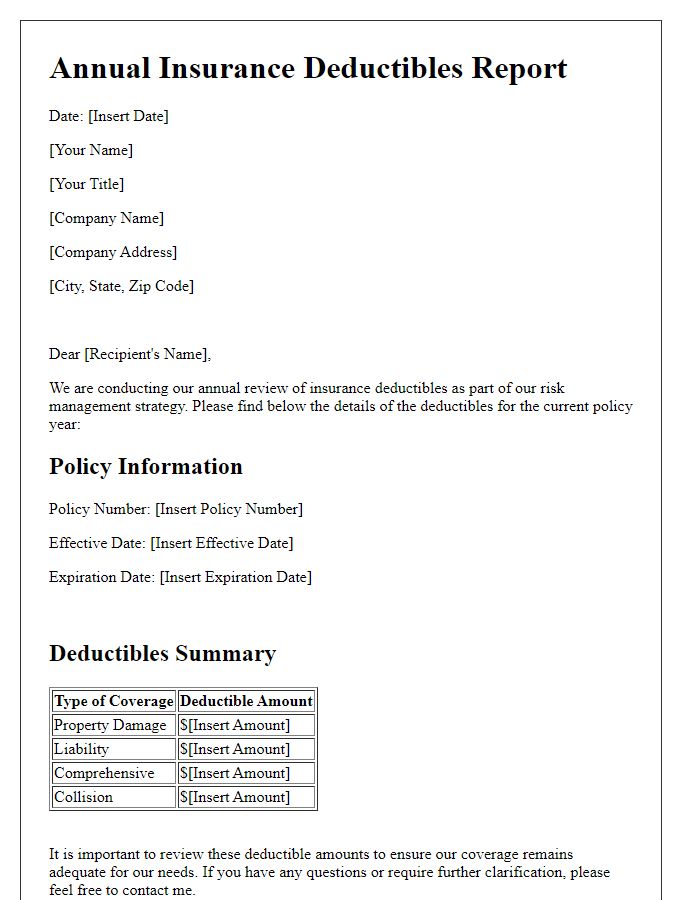

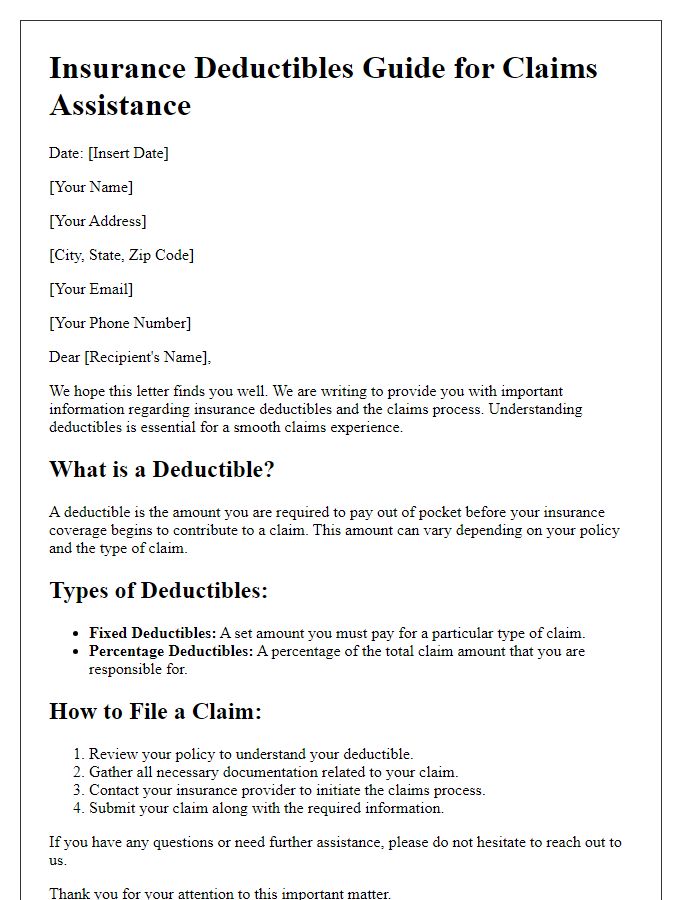

Insurance deductibles represent the amount a policyholder must pay out-of-pocket before their insurance coverage kicks in. Each insurance policy, such as auto or health insurance, typically specifies distinct deductible amounts that vary based on coverage levels and specific events. For example, an auto insurance policy may have a $500 deductible for collision claims, while a health insurance plan could impose a $1,000 deductible for inpatient hospital stays. An insurance company, like Allstate or Geico, may also outline separate deductibles for specific incidents or types of claims. Understanding these figures is crucial for policyholders, as it affects overall financial responsibility during claims processing. Transparency in deductible amounts enhances financial planning and decision-making for insurance claims.

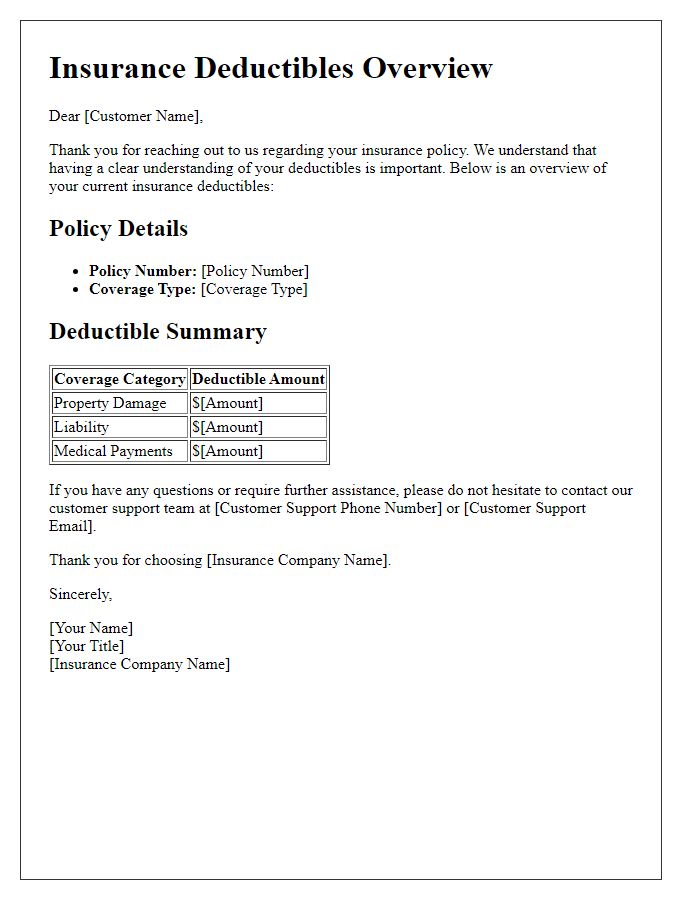

Policy Details

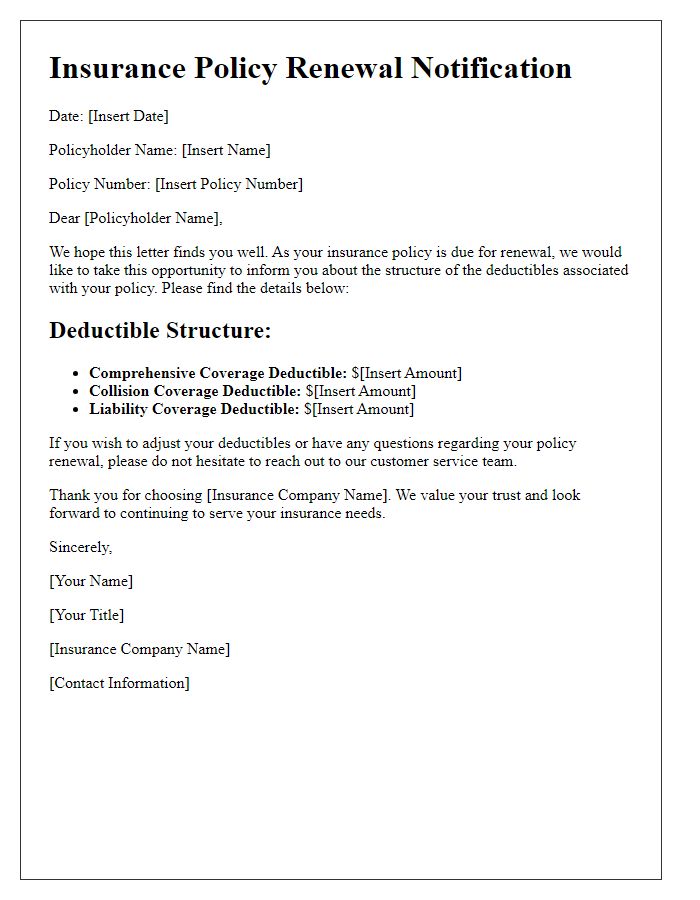

Understanding insurance deductibles is essential for policyholders seeking clarity on financial responsibilities during claims. A typical deductible might range from $500 to $5,000, depending on the policy type, such as health, auto, or homeowners insurance. For example, with a homeowners insurance policy issued by State Farm in 2023, a standard deductible of $1,000 may apply to property damage claims, meaning the homeowner would pay the first $1,000 of repair costs before the insurance coverage kicks in. In auto insurance, a $500 deductible is common for collision claims, while comprehensive claims might have a higher deductible of $1,000 to minimize smaller claims. Policy details vary by provider and state, with some policies offering options for lower deductibles at higher premium costs, thereby serving as a strategic decision for the insured regarding risk versus financial exposure.

Deductible Explanation

Insurance deductibles represent the amount a policyholder must pay out-of-pocket before their insurance coverage begins to pay for claims. For example, a health insurance plan might have a deductible of $1,500 for individual coverage or $3,000 for family coverage. In the case of auto insurance, a common deductible could range from $500 to $1,000, impacting the cost of repairs after an accident. Homeowners insurance deductibles often depend on the type of claim, with standard deductibles around 1% to 2% of the home's insured value. Understanding the deductible structure is critical for financial planning, as it influences the overall premium costs and potential out-of-pocket expenses during coverage periods.

Coverage Breakdown

Insurance coverage breakdown outlines the specifics of policy provisions, including various deductible amounts applicable to claims. For example, a standard homeowner's insurance policy may feature a $1,000 deductible for property damage, meaning the policyholder must pay this amount before insurance coverage kicks in. In addition, health insurance policies may impose separate deductibles for in-network ($500) and out-of-network services ($1,000), affecting the total out-of-pocket expenses incurred during medical treatments. Auto insurance deductibles can vary significantly, with common figures being $250, $500, and $1,000, determining the financial responsibility of the policyholder when filing a claim for incidents such as collisions or theft. Understanding these nuances aids policyholders in better managing their financial liabilities and making informed decisions regarding their coverage options.

Contact Information

Insurance deductibles play a crucial role in determining out-of-pocket expenses when filing a claim. For example, health insurance policies, such as those offered by Blue Cross Blue Shield, may have deductibles ranging from $500 to $5,000 annually, which indicates the amount policyholders must pay before coverage kicks in. Homeowners insurance, particularly with providers like State Farm, may have separate deductibles for specific perils, such as windstorm or hail, often set at 2% to 5% of the home's insured value. Auto insurance deductibles, typically ranging from $250 to $1,000, impact claims for vehicle damage or theft. Understanding these amounts enables insured individuals to make informed decisions about their coverage options and financial responsibilities during the claims process.

Letter Template For Insurance Deductibles Breakdown Samples

Letter template of insurance deductibles clarification for account holders

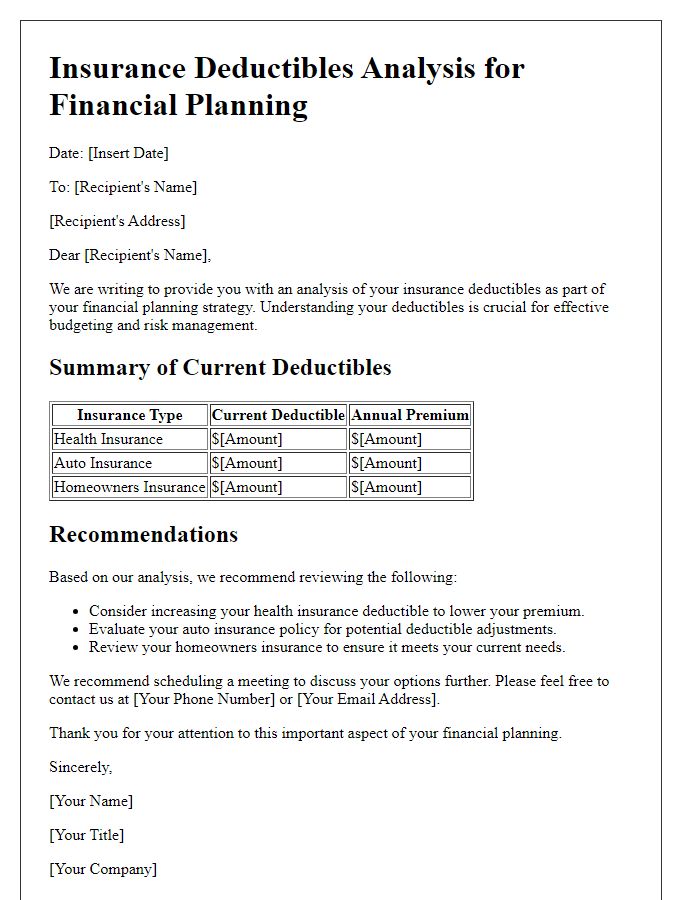

Letter template of insurance deductibles analysis for financial planning

Comments