Are you feeling uncertain about your insurance coverage and the protection plans available to you? Understanding the ins and outs of insurance can often be overwhelming, but it's crucial for peace of mind. In this article, we'll break down the key details of various insurance protection plans, highlighting their benefits and suitability for your needs. So, grab a cup of coffee and dive in to discover more about securing your future!

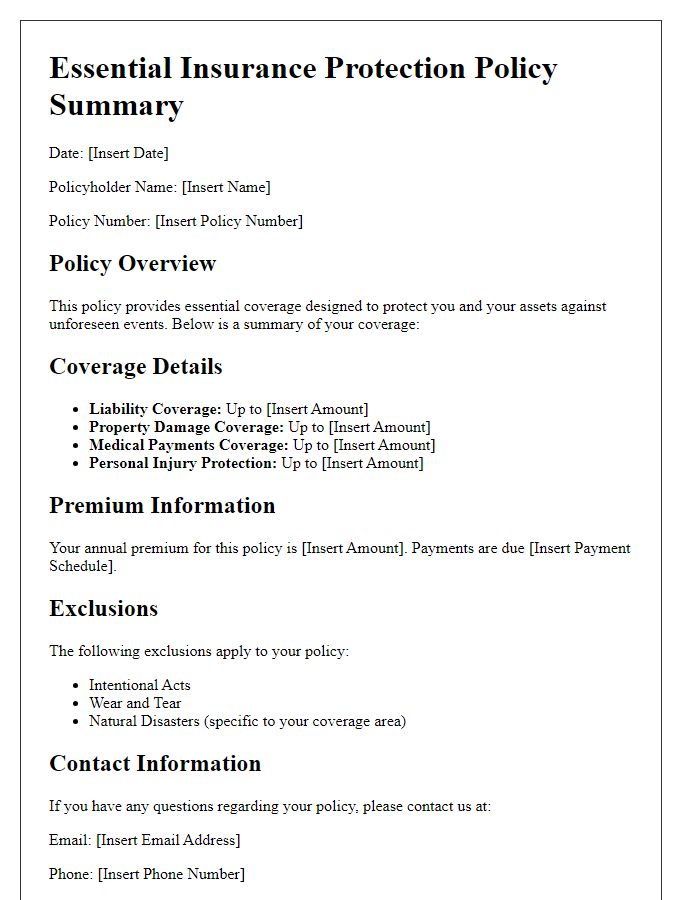

Policy coverage breakdown

An insurance protection plan typically includes various types of coverage designed to safeguard against unexpected events such as accidents, illnesses, or property damage. Comprehensive coverage often encompasses liability protection, which might cover legal fees and settlements resulting from lawsuits, as well as personal property coverage that protects possessions within the insured dwelling, often valued up to hundreds of thousands of dollars. Health insurance may vary widely, with plans often covering essential services like hospitalization, outpatient care, and preventive services, aligning with the Affordable Care Act guidelines. Additionally, many policies provide specific benefits for catastrophic events, such as natural disasters like hurricanes or earthquakes, where coverage limits can reach millions of dollars depending on the region and risk assessment. Understanding policy exclusions, deductibles, which can range from $500 to $5,000, and premiums is essential for ensuring adequate coverage and financial security.

Premium payment terms

An insurance protection plan provides crucial financial security in times of uncertainty, with premium payment terms dictating how policyholders manage their contributions. Typically, premiums are payable monthly, quarterly, or annually, based on the insurance coverage amount (often ranging from $10,000 to $1 million) selected by the policyholder. Different plans may offer variations in payment methods, including automatic bank transfers (commonly set up through ACH) or credit card payments, ensuring convenience for customers. Some insurance providers may offer discounts for long-term commitment, such as a 10% reduction for annual payments, incentivizing policyholders to stay protected over extended periods. Understanding these terms is essential for maintaining uninterrupted coverage throughout the duration of the policy, often spanning 10 to 30 years, depending on the policy type.

Claim process instructions

The claim process for an insurance protection plan typically involves several key steps to ensure a smooth and efficient handling of your claim. First, policyholders must gather essential documentation including the policy number (often found on your insurance card), incident details (date, time, and location of the event), and any supporting evidence such as photographs or police reports. Next, contact the insurance provider's claims department--often available 24/7--via the dedicated phone number or online portal. Many insurance companies implement a formal claims form that must be filled out accurately to initiate the process. After submission, policyholders should keep track of their claim status through online account access or by requesting updates directly from a claims adjuster. Finally, it's important to be aware of any deadlines for filing claims to ensure eligibility for benefits, as well as the potential for further documentation or interviews that may be required during the assessment phase.

Contact information for queries

An insurance protection plan provides comprehensive coverage for unforeseen events, such as natural disasters, accidents, or theft. Detailed policy documents define coverage limits, premium amounts, and deductibles, ensuring customers understand their responsibilities. Customers can access additional information or assistance through dedicated contact channels, including phone support or online chat. Certain policies may offer annual reviews, which assess coverage adequacy in light of lifestyle changes, ensuring continued protection. Contact information typically includes a customer service hotline, email support, and an online portal, allowing for efficient communication between policyholders and insurers.

Policyholder responsibilities

Policyholders with insurance protection plans hold significant responsibilities essential for maintaining coverage and ensuring claims are processed efficiently. It is vital for policyholders to understand the importance of timely premium payments, which safeguard against lapses in coverage that could jeopardize protection. Additionally, providing accurate information during the application process is crucial, as discrepancies may lead to claim denials or policy cancellations. Policyholders should promptly report any changes in personal circumstances, such as address changes or modifications in health conditions, to ensure that the policy reflects current risks. Regularly reviewing the policy details, including coverage limits, exclusions, and renewal dates, allows policyholders to remain informed and make necessary adjustments as their needs evolve. Lastly, maintaining proper documentation of incidents or losses, including receipts and photographs, is essential when filing claims, as this evidence supports the validity of the request and expedites the claims process.

Comments