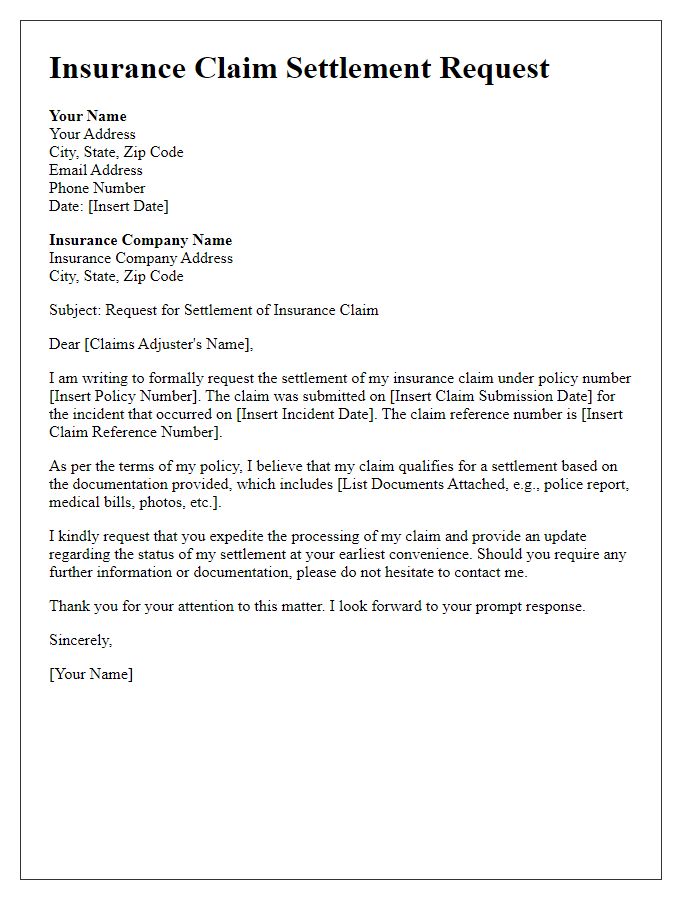

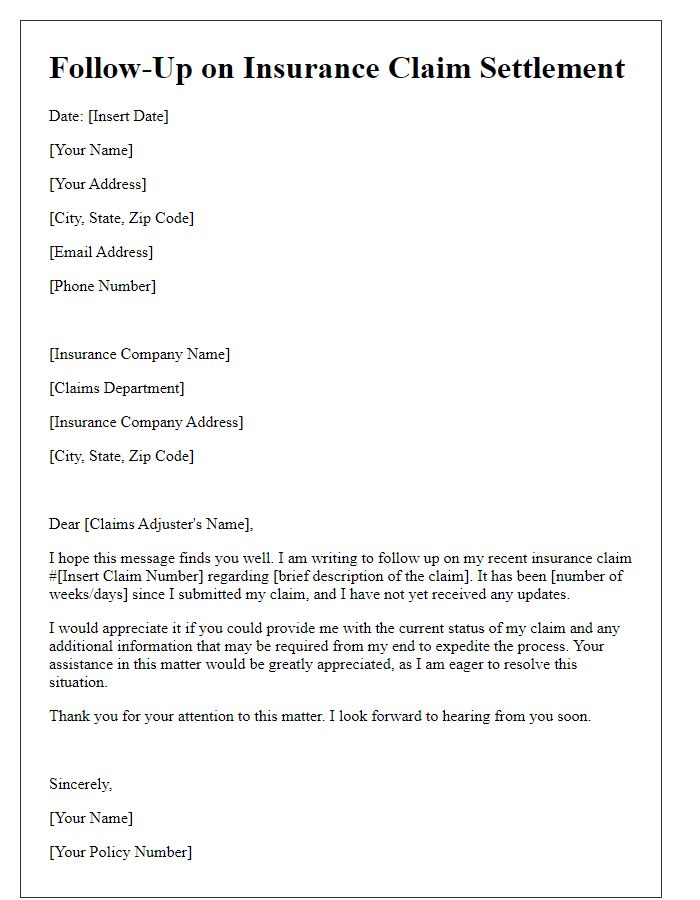

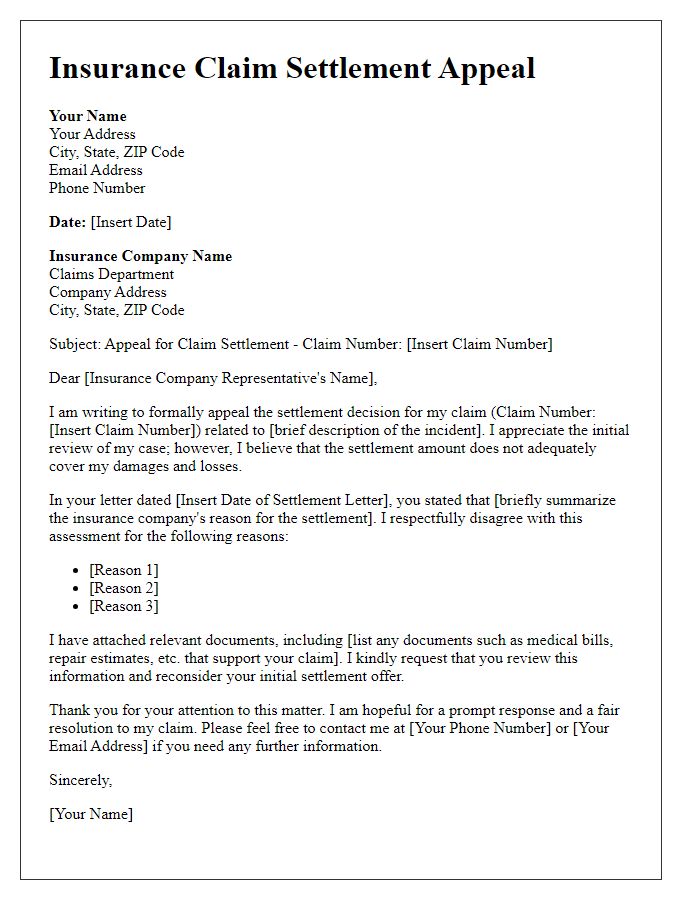

Navigating the insurance claim process can often feel overwhelming, but having a well-structured letter can make all the difference. This letter template is designed to streamline your communication with the insurance company, ensuring that all necessary details are clearly conveyed and understood. Whether you're dealing with property damage or a medical claim, this guide will help you articulate your needs effectively. Ready to get your claim settled? Let's dive in!

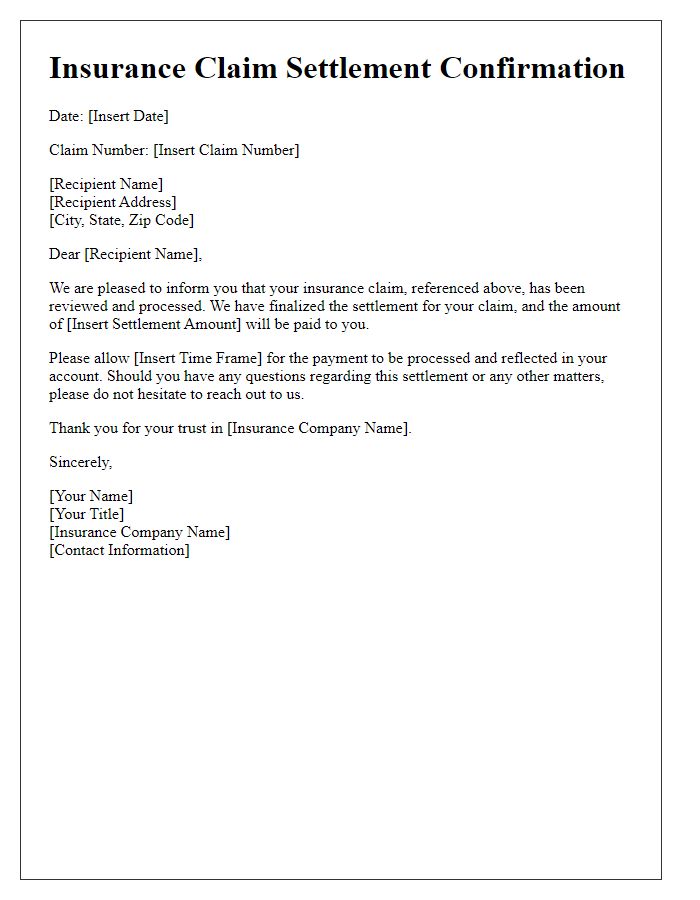

Claim Details

Filing an insurance claim involves accurate documentation and clear presentation of events. The claim details should include essential elements such as the policy number, which identifies your insurance coverage, and the date of the incident, providing a timeline of events. Additionally, the location where the incident occurred, such as an address or GPS coordinates, gives context to the situation. Description of the incident should be thorough, including specific damages or losses, which might involve monetary values or estimates from a licensed appraiser. Relevant supporting documents, like police reports or photographs of the damages, enhance the credibility of the claim. Clear articulation of desired settlement amount based on appraised losses is crucial to expedite the review process by the insurance adjuster, ensuring all key information is presented concisely for a swift resolution.

Policy Information

A comprehensive insurance claim settlement requires detailed documentation of policy information. Key elements include the policy number, typically a unique identifier (10-15 digits) assigned by the insurer, and the coverage type, which might encompass areas such as property damage, liability, or medical expenses. Additionally, the policyholder's name and contact information, including address and phone number, should be clearly stated to establish ownership. Effective dates are crucial; these indicate the start and end of coverage, often specified as month and year. Lastly, including the insurance company's name and claims department contact details facilitates efficient communication, ensuring a streamlined claim process.

Incident Description

The incident involving the vehicle collision occurred on October 5, 2023, at the intersection of Maple Avenue and Oak Street in Springfield. A red sedan, registered under license plate XYZ-1234, was struck by a blue pickup truck while making a left turn. The pickup truck, traveling at an estimated speed of 45 miles per hour, failed to stop at a red light. The impact caused significant damage to the sedan's front-end, estimating repair costs at approximately $5,000. Emergency services arrived promptly at the scene. Both drivers provided their insurance information, with the pickup truck insured by Greenfield Insurance. Police report number 789456 was filed detailing the incident, providing eyewitness accounts confirming the red light violation. The driver of the sedan sustained minor injuries, requiring on-site medical assistance before being cleared to leave. This claim seeks compensation for vehicle repairs, medical expenses, and other related costs stemming from this unfortunate event.

Supporting Documentation

Insurance claim settlements often require comprehensive supporting documentation to expedite the approval process. Essential items typically include the original policy document, detailing coverage limits and exclusions, along with a completed claim form, which outlines the specifics of the incident. Photographic evidence should demonstrate the damages or losses, capturing various angles to provide clarity. Relevant medical records (if applicable) are necessary for health-related claims, including hospital bills and treatment summaries. Repair estimates or invoices from licensed contractors also support property damage claims, illustrating the cost of recovery or replacement. Additionally, police reports or incident reports can substantiate claims related to theft or accidents, offering official documentation of the event. All documents must be organized chronologically to ensure easy navigation for the insurance adjuster during the review process.

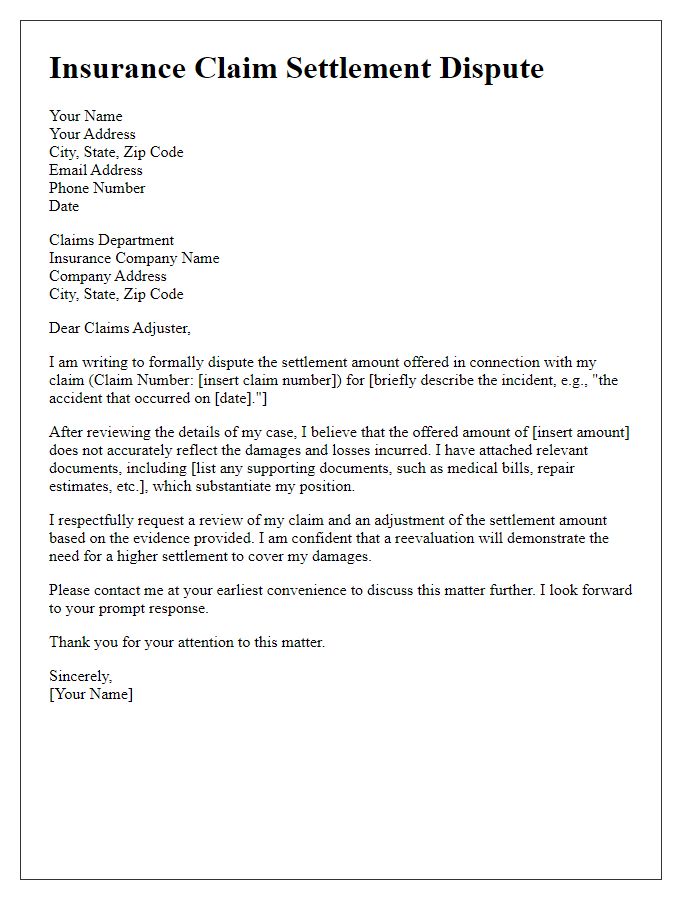

Settlement Request

Submitting an insurance claim settlement request requires clear documentation and detailed information. Collect relevant data such as policy number, date of the incident (e.g., November 15, 2023), and a brief description of the event (e.g., car accident on Maple Street in Springfield). Include details of damages incurred, estimated repair costs, and attachments of supporting documents (e.g., police report, photographs of the damage, medical bills). Clearly state the desired settlement amount, justifying it with evidence (e.g., quotes from repair shops or medical providers). Timing is crucial, emphasizing any deadlines stipulated in the insurance policy for claim submissions or responses. Ensure that all documents are securely organized to facilitate the insurance adjuster's review process.

Comments