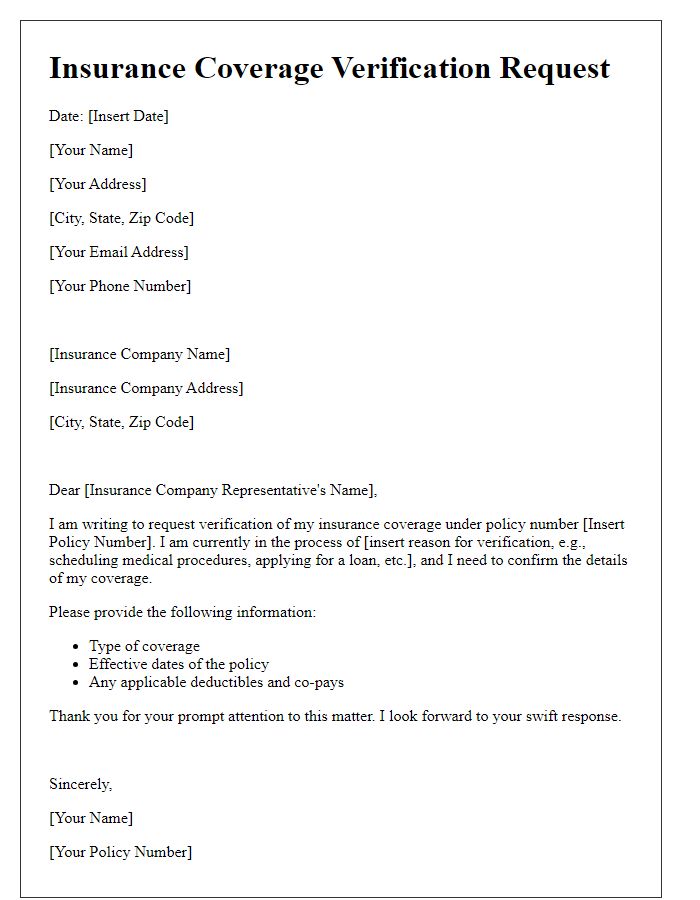

Are you ready to take the next step in securing your peace of mind? Having the right insurance coverage is essential for protecting what matters most to you, and a confirmation letter is often the first formal step in ensuring you're fully covered. This letter not only reassures you of your coverage specifics but also serves as a critical document for any future claims. If you want to learn more about crafting the perfect insurance coverage confirmation letter, keep reading!

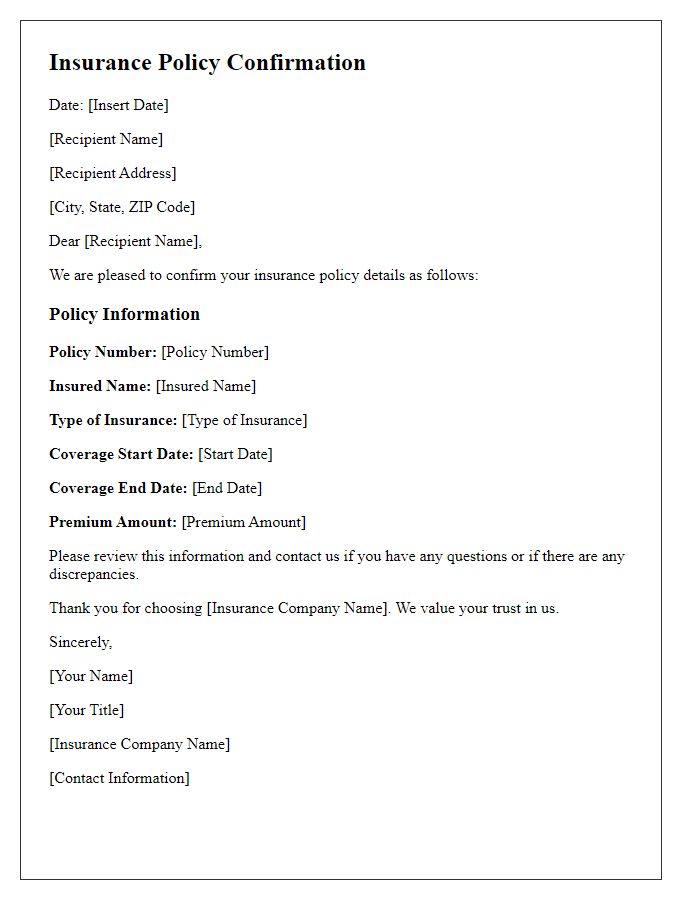

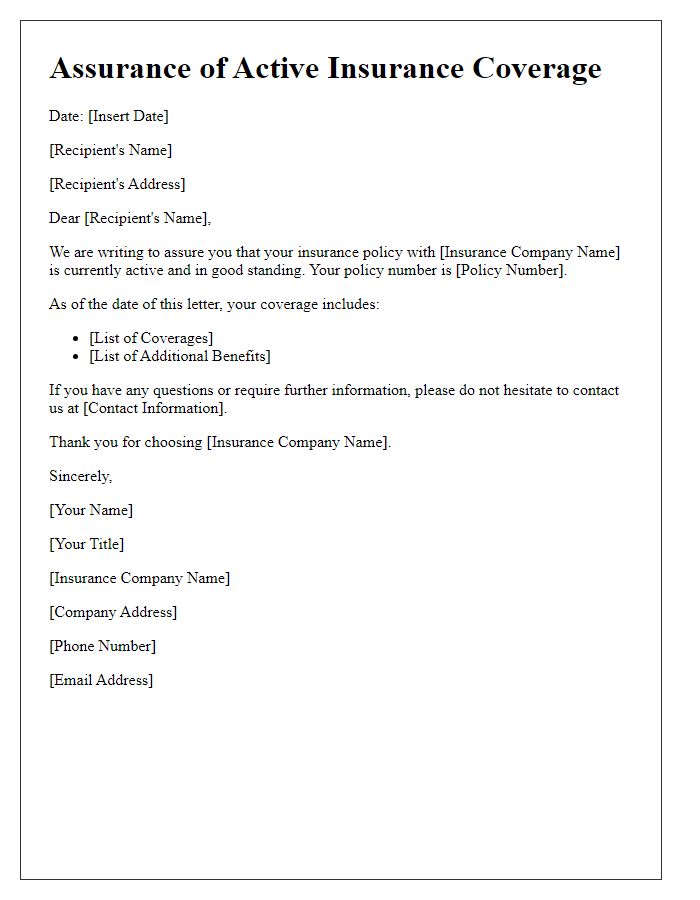

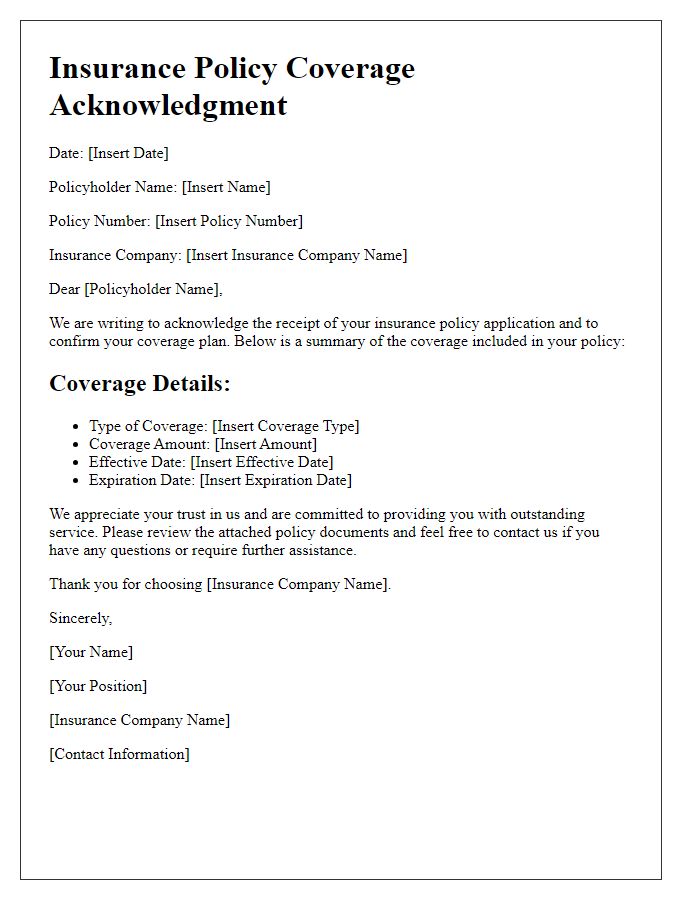

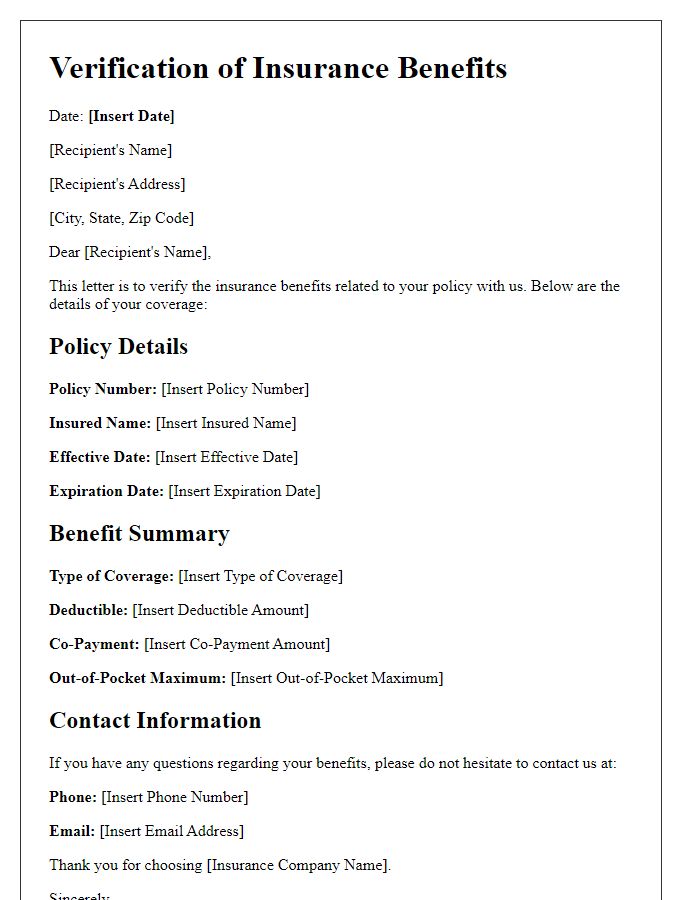

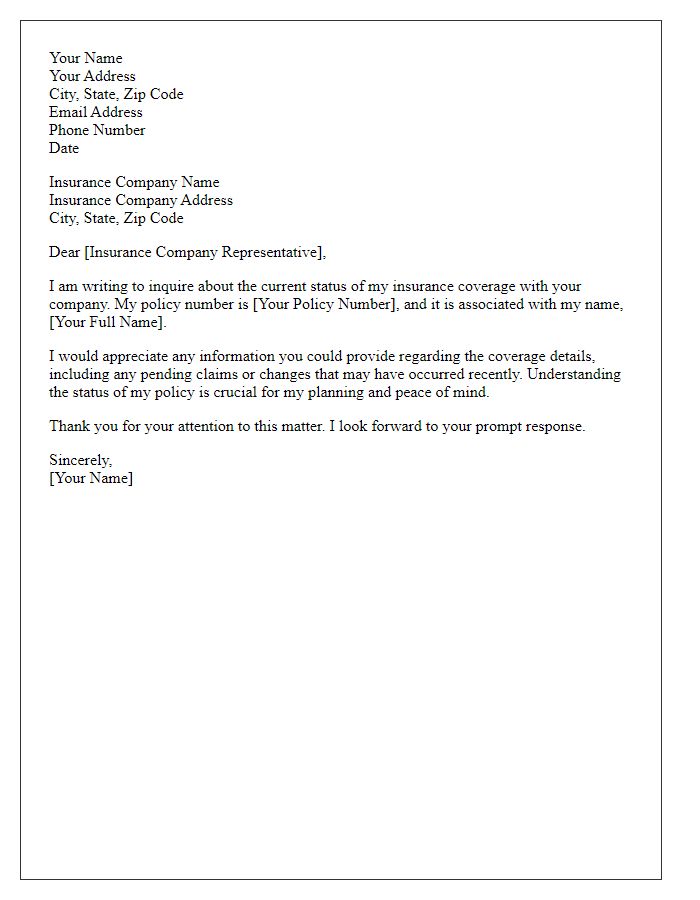

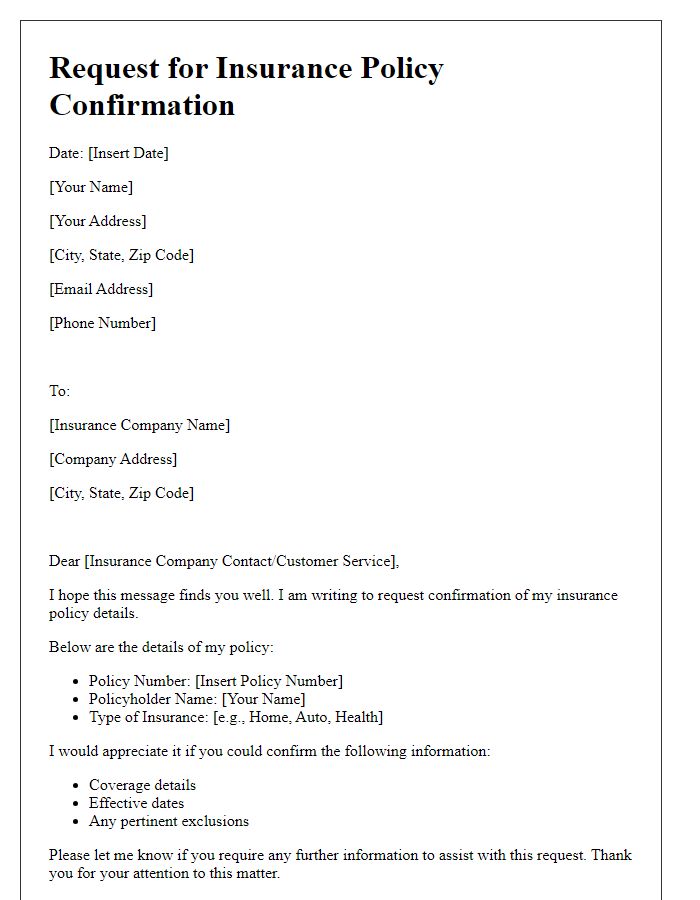

Policyholder Information

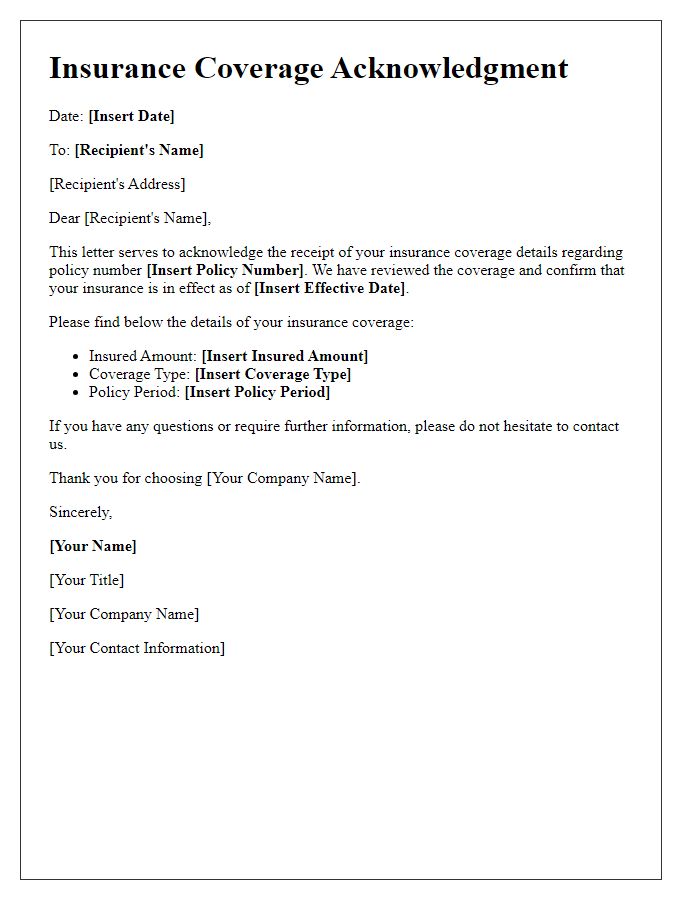

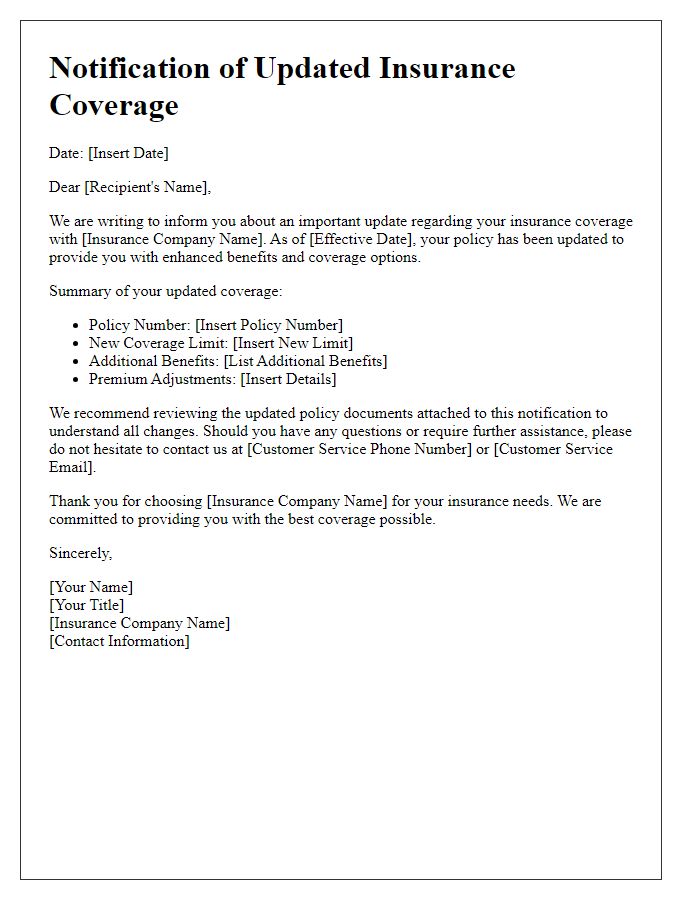

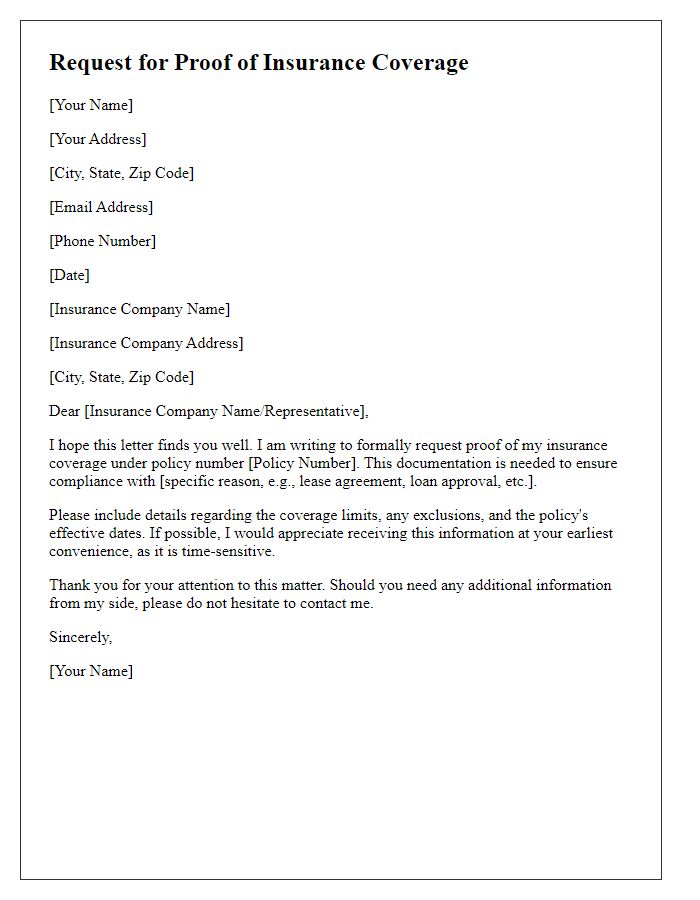

Insurance coverage confirmation is essential for understanding the details associated with the policyholder, including personal identification and policy specifics. The policyholder information typically includes full name, contact number, and address, which are vital for correspondence. The policy number serves as a unique identifier that associates the individual with their specific insurance plan. Coverage details should specify the type of insurance, such as health, auto, or home, along with limits and exclusions. Accurate representation of effective dates ensures clarity regarding the duration of the coverage, while the premium amount listed reflects the financial commitment required from the policyholder to maintain coverage.

Coverage Details

Insurance coverage confirmation documents outline the essential details of coverage agreements. Policyholders receive information regarding coverage types, such as comprehensive, collision, and liability, which are vital for understanding protection during vehicular incidents. The document specifies the policy number (unique identifier for tracking purposes), effective dates (start and end date of the coverage period), and insured individuals (names of each covered driver). Notably, it includes premium amounts and payment schedules, which are critical for financial planning. Terms and conditions attached to the policy are also detailed, indicating any exclusions or limitations that may affect claims. This confirmation serves as an official record for both the insurer and the insured, often required for verification during vehicle registration or claims processing.

Policy Number

Insurance coverage confirmation involves communicating essential details about a specific policy, such as the policy number, coverage limits, and exclusions. The policy number serves as a unique identifier for the insurance agreement, enabling efficient tracking and reference. Coverage limits indicate the maximum amount the insurer will pay for covered losses, often outlined per occurrence or annually. Exclusions specify certain situations or damages that are not covered, which can vary significantly across different insurance providers and policy types. Providing clear confirmation of these elements ensures that both the insurer and policyholder are aligned on the terms of coverage, minimizing potential disputes in the event of a claim.

Effective Date

Insurance coverage confirmation details emphasize crucial information. Policy effective date refers to the precise moment (often at 12:01 AM on the specified date) when coverage begins. This date is essential for understanding when the insured is fully protected under the terms outlined in the insurance policy (such as auto, home, or health insurance). The confirmation document should include the policyholder's name, policy number, and coverage details. It is advisable to retain this confirmation for future reference, especially during claims processing or for renewing the policy. Proper documentation helps ensure that the insured benefits from the protection expected.

Contact Information

Insurance coverage confirmation often requires clear details. Personal information includes name, address, phone number, and email address for verification purposes. Policy number uniquely identifies coverage details and claim transactions. Insurer's name and contact details provide necessary communication channels. Effective dates define the duration of coverage, indicating when protection begins and ends. Additionally, coverage limits specify the maximum payout under various conditions, while exclusions outline circumstances that are not covered. This information helps ensure that all parties understand the terms and conditions related to insurance policies.

Comments