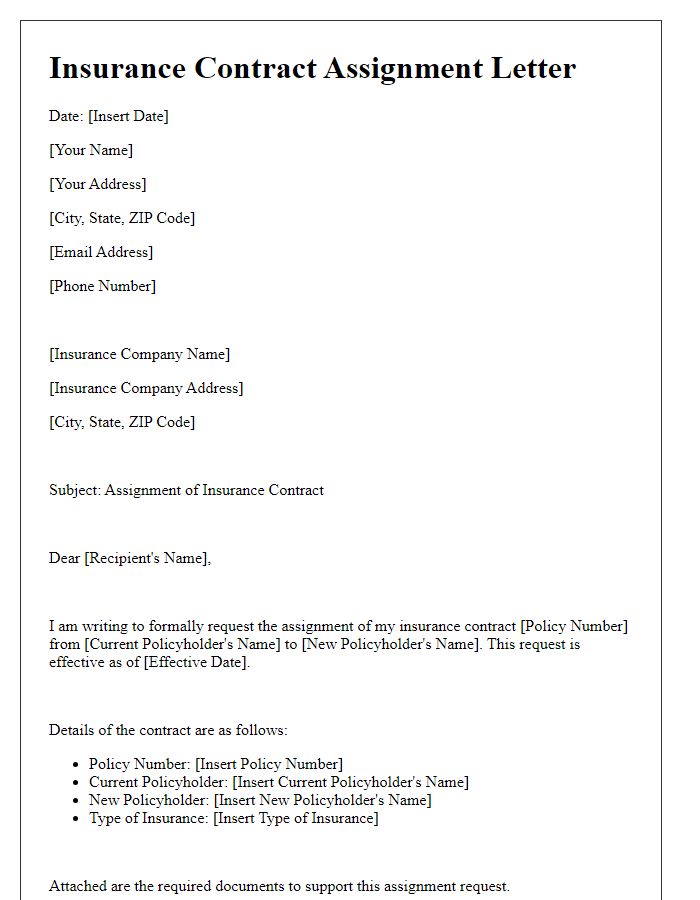

Are you looking for an efficient way to notify clients about their insurance assignments? Crafting the perfect letter can make all the difference in clear communication and professionalism. In this article, we'll share a straightforward letter template that ensures your essential information is conveyed effectively. So, let's dive in and explore how to streamline this important process!

Policyholder Information

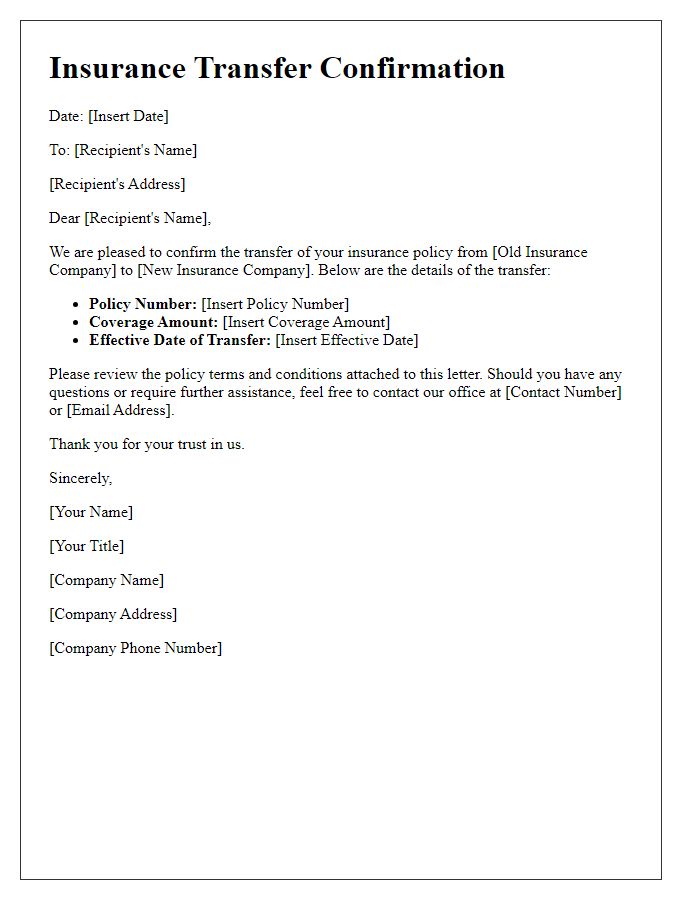

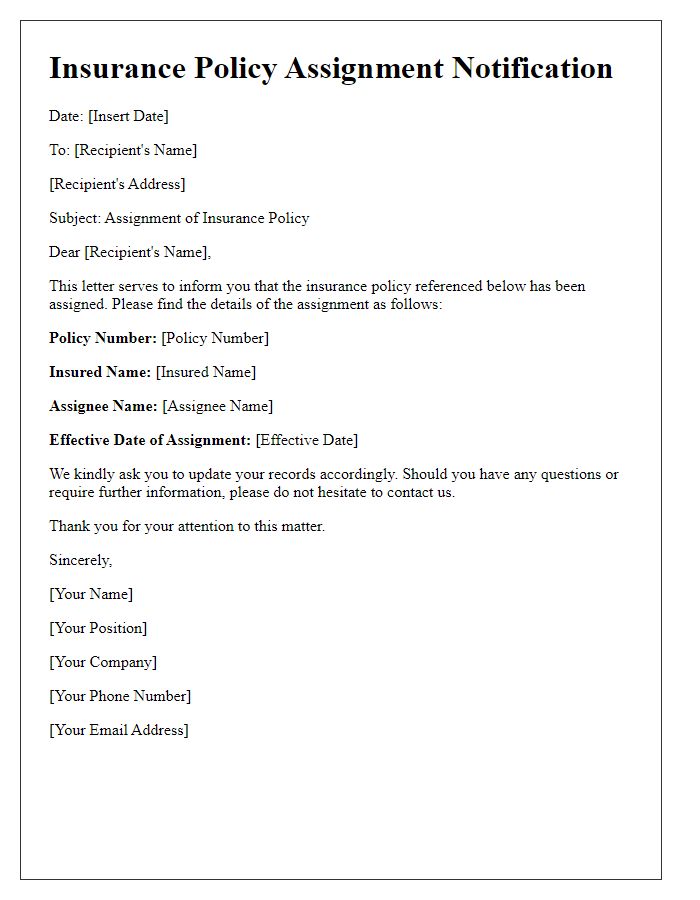

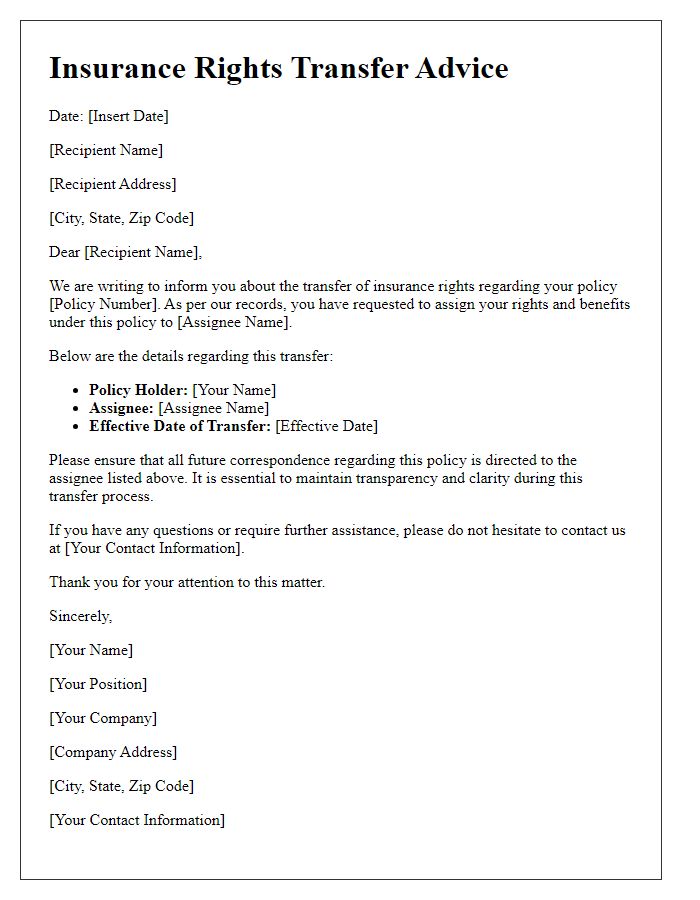

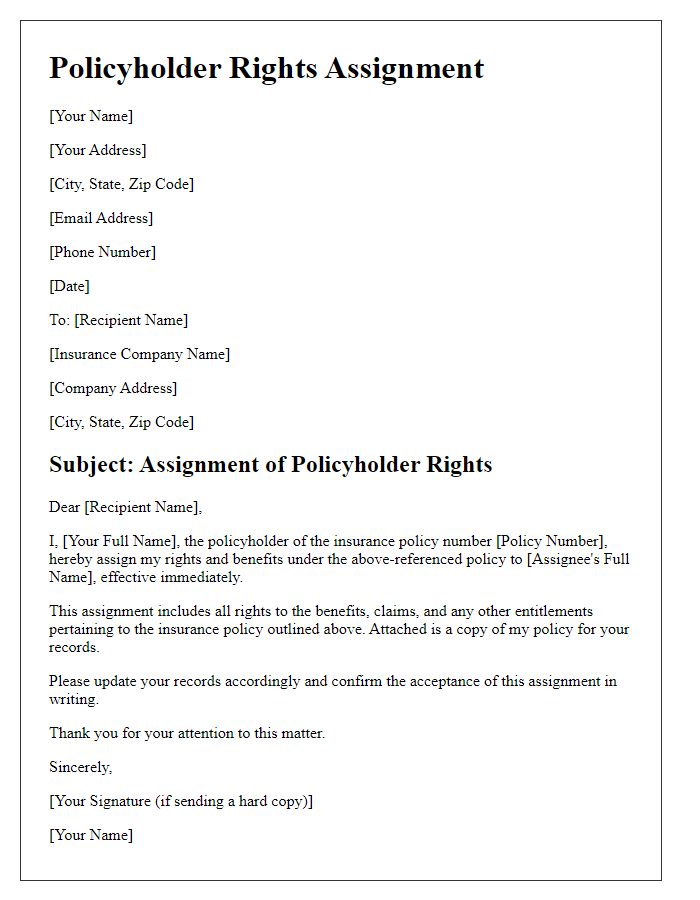

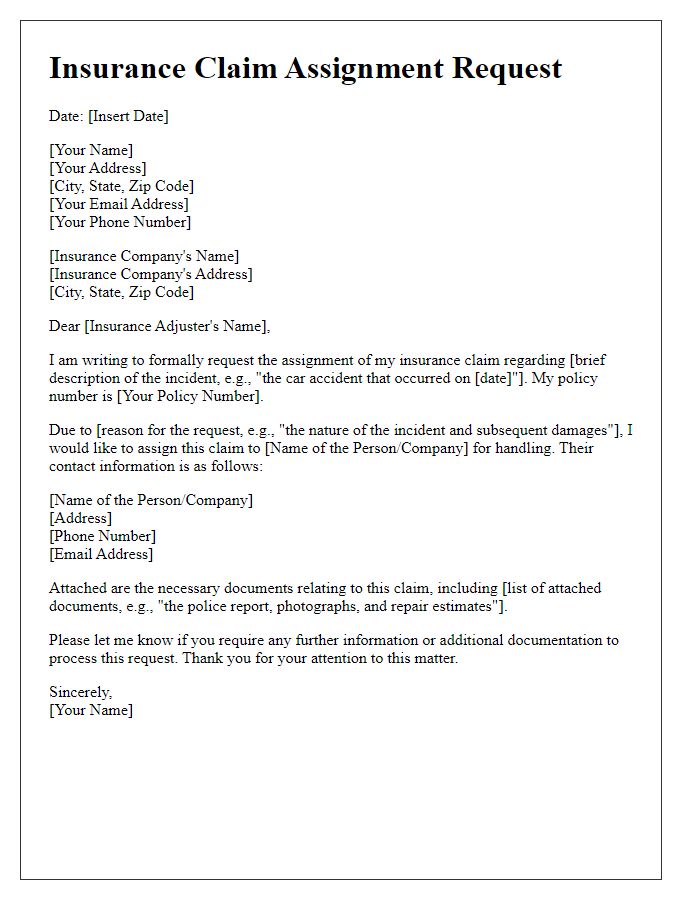

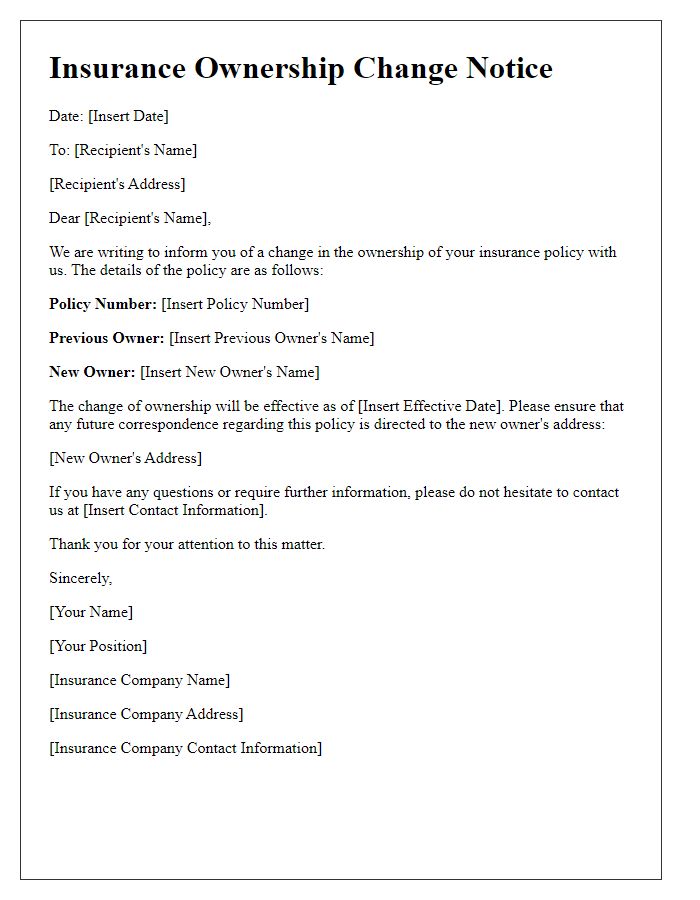

Policyholders must notify their insurance providers regarding any assignments or transfers of coverage related to their insurance policies. This notification ensures that all details, such as the policy number (often a unique identifier, typically 10-15 digits), effective date (the specific date when the coverage begins), and the assigned entity (which could be a beneficiary, financial institution, or legal representative), are clearly communicated. Accurate information about the policyholder's current contact details, including address (street, city, ZIP code), phone number, and email address, is vital for maintaining open channels of communication and facilitating smooth transitions during claims processing. Documentation of the original policy terms and conditions (which includes coverage limits and exclusions) may also be required for accurate assignment of responsibility and benefits.

Policy Details

An insurance assignment notification effectively communicates essential policy details, such as policy number 123456789, commencement date January 1, 2022, and insured amount of $250,000 for property coverage. The policyholder, John Smith, residing at 123 Elm Street, Springfield, must ensure all requirements for beneficiary designation are met under the terms outlined in Section 4, which stipulates necessary documentation. Additionally, the referenced insurance company, ABC Insurance Corp., established in 1990, provides a 24/7 customer support hotline for inquiries related to coverage modifications, claims submissions, or any updates required to maintain compliance. Timely notification is crucial to uphold the integrity of the agreement and ensure seamless continuity of coverage.

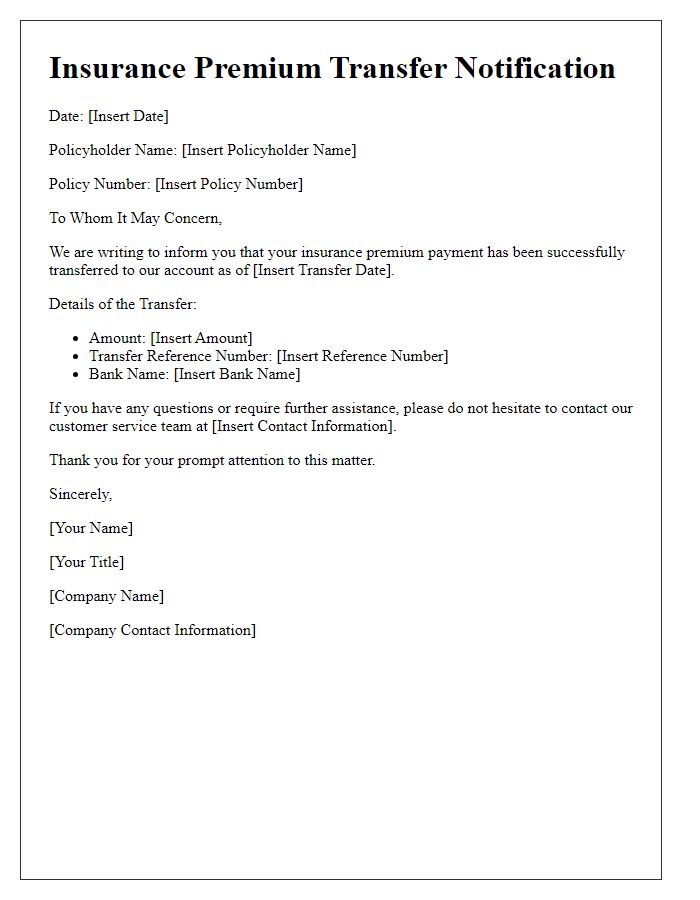

Effective Date of Assignment

Notification of insurance assignment is crucial for policyholders and beneficiaries. The effective date of assignment signifies when the rights to an insurance policy, such as life insurance or property insurance, have been transferred to a new party. This date, often marked on official documentation, serves as a legal reference for both the original policyholder and the assignee. The assignment process typically involves filling out a specific form, often required by the insurance company (for instance, companies like State Farm or Allstate), and must be submitted alongside identification verification. Accurate documentation ensures seamless access to policy benefits, which can include death benefits, cash value, or coverage claims, protecting the interests of all involved parties in situations such as estate planning or financial reassessment.

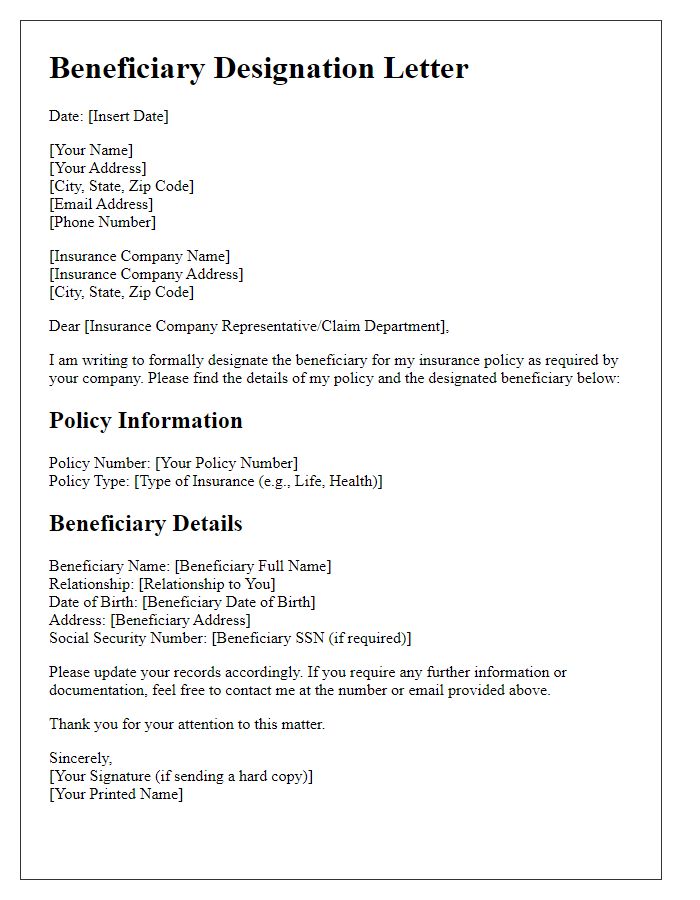

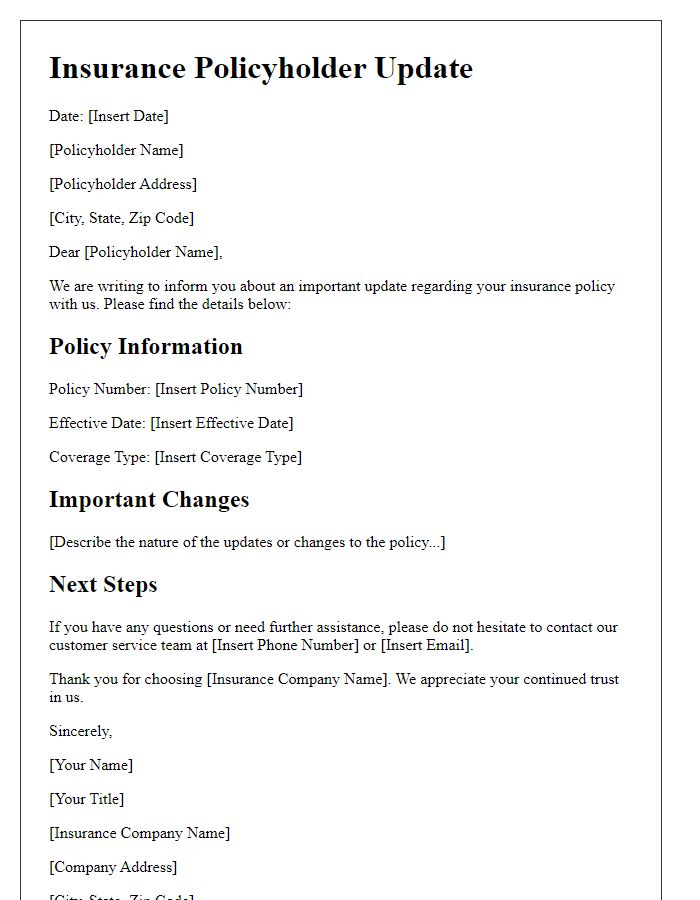

Assignment Beneficiary Information

An assignment beneficiary notification is a formal document informing relevant parties of updates regarding beneficiary details related to insurance policies. This document typically includes critical information such as beneficiary names, their relationship to the policyholder, and percentage allocations (e.g., 50% to spouse, 50% to child). Additionally, policy details like policy number, insurance provider name (such as State Farm or Allstate), and date of assignment (e.g., October 15, 2023) should be clearly outlined. It is essential to ensure that the notification is signed by the policyholder, confirming their intent and authorization of the change, and includes contact information for follow-up, if necessary.

Signature and Authorization

Insurance assignment notifications require a signature and authorization to validate the transfer of rights. The signatory must provide clear identification, such as a driver's license number or social security number, for verification purposes. This document often includes specific details about the insurance policy, such as the policy number and coverage details, as well as the names of the parties involved in the assignment. Proper documentation ensures compliance with regulatory standards, safeguarding both the assignor's and assignee's interests during the transition of benefits. Failure to include accurate signatures and authorization can result in delays or denial of claims.

Comments