Hey there! If you've ever faced the daunting task of filing an insurance claim, you know how crucial it is to have all your documentation in order. Whether it's a minor incident or something more significant, having the right letters prepared can streamline the process and lighten the load. In this article, we'll guide you through a simple letter template for requesting the necessary documentation from your insurance provider. So grab a cup of coffee and let's dive in to ensure you're well-prepared for your claim!

Clarity and Precision

Insurance claim documentation requests require clear and precise communication to ensure all necessary information is provided efficiently. Specific document types like police reports, medical records, or photographs of the damage need to be explicitly listed to facilitate the claims process. Including claim numbers for tracking, policy details such as the policyholder's name, and the incident date will streamline verification. Timelines for submission highlight urgency, while contact information ensures prompt communication. Ensuring that documentation adheres to stated guidelines increases the likelihood of claim approval without delays or complications.

Necessary Identification Information

Necessary identification information is crucial for processing an insurance claim efficiently. Personal identification elements include the full name of the policyholder, designated policy number, and the date of the incident. Address information should include the full residential address, including city, state, and zip code for verification purposes. Dates of birth for all covered individuals may be required alongside contact information such as phone number or email address for updates. Additionally, identification documents like a government-issued ID (passport, driver's license) may be necessary to verify the identity of the claimant, ensuring proper handling of sensitive claims information.

Specifics of the Claim

The insurance claim process involves detailed documentation that specifies the claim's nature, amount, and circumstances. For instance, a home insurance claim may arise from water damage due to a burst pipe, necessitating an inventory of damaged property and photographs of the incident. Claim reference numbers issued by insurance companies, such as State Farm or Allstate, help categorize claims within their systems. Essential documentation includes police reports for theft claims, repair estimates from certified contractors, and medical records for health-related claims. Timely submission of these documents ensures adherence to deadlines, typically within 30 days of the incident, and expedites the claims process, allowing policyholders to receive necessary compensation efficiently.

Documentation Checklist

The documentation checklist for insurance claims is a critical component in ensuring a smooth and efficient processing of your claim. Essential items often include a completed claim form, which outlines the specifics of the incident, as well as supporting evidence such as photographs of damage, which provide visual confirmation of the loss. Medical records may also be necessary, detailing any injuries sustained during the event; these records should include dates, treatment types, and healthcare provider information. Additionally, police reports, especially in cases of theft or accidents, serve as authoritative evidence of the incident, with incident numbers and officer details. Estimates or invoices related to repairs, showcasing costs incurred, help substantiate the claim amount. Finally, any correspondence regarding the claim is vital for maintaining an accurate timeline and understanding of communications with the insurance company.

Contact Information for Queries

When filing an insurance claim, providing accurate contact information is critical for efficient communication and timely processing. Ensure you include your full name, policy number (reference number for your specific insurance plan, such as an auto or health policy), phone number (a direct line, preferably with a local area code, to ensure prompt replies), and email address (a monitored account for formal communication). Additionally, specify your best times for communication (like weekdays 9 AM to 5 PM) to align with the insurance company's office hours. If applicable, include secondary contacts (like a family member or attorney) to assist with inquiries and updates regarding the claim process.

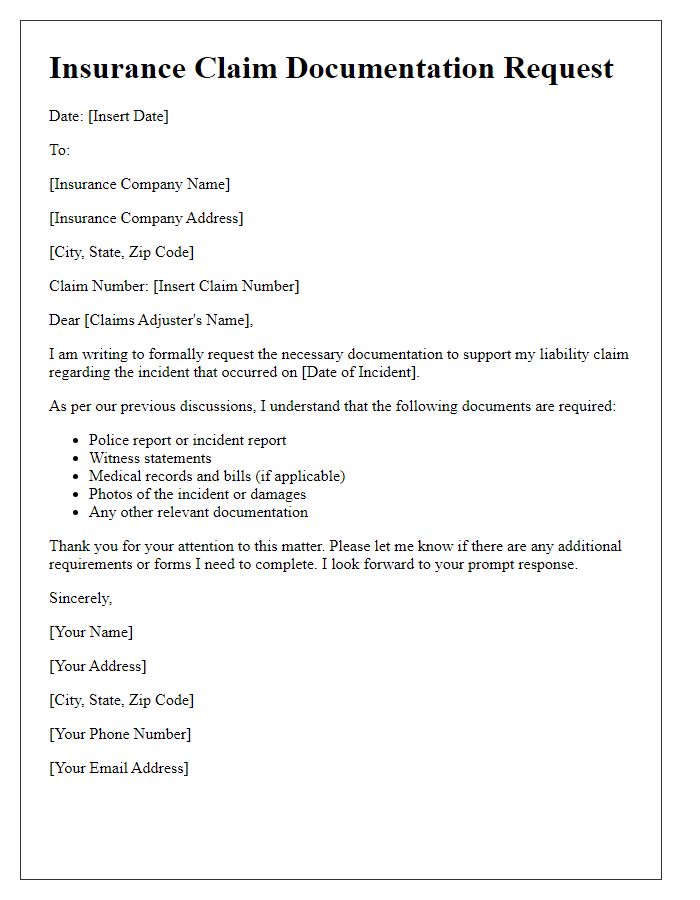

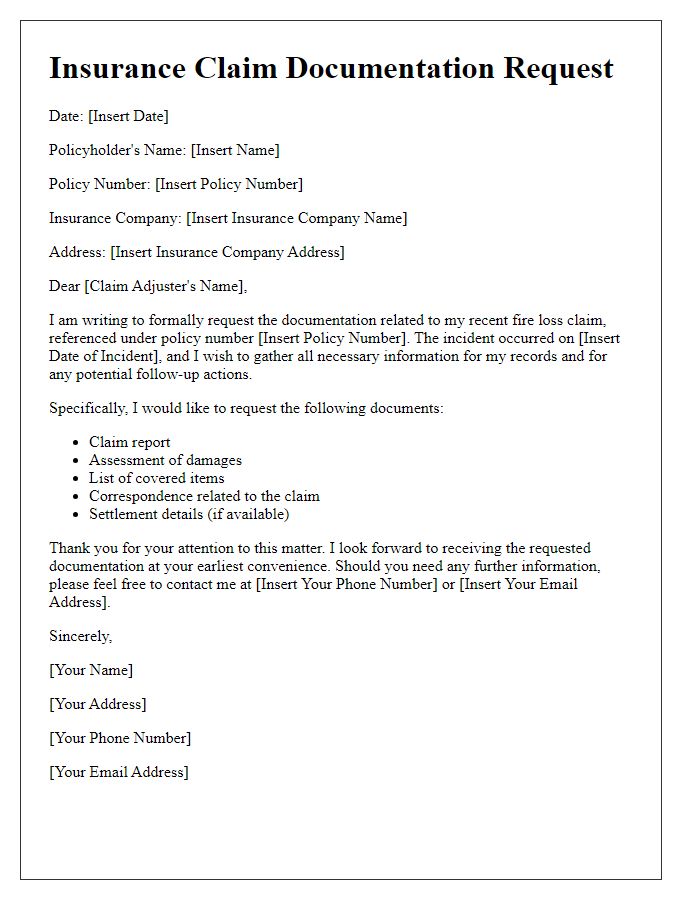

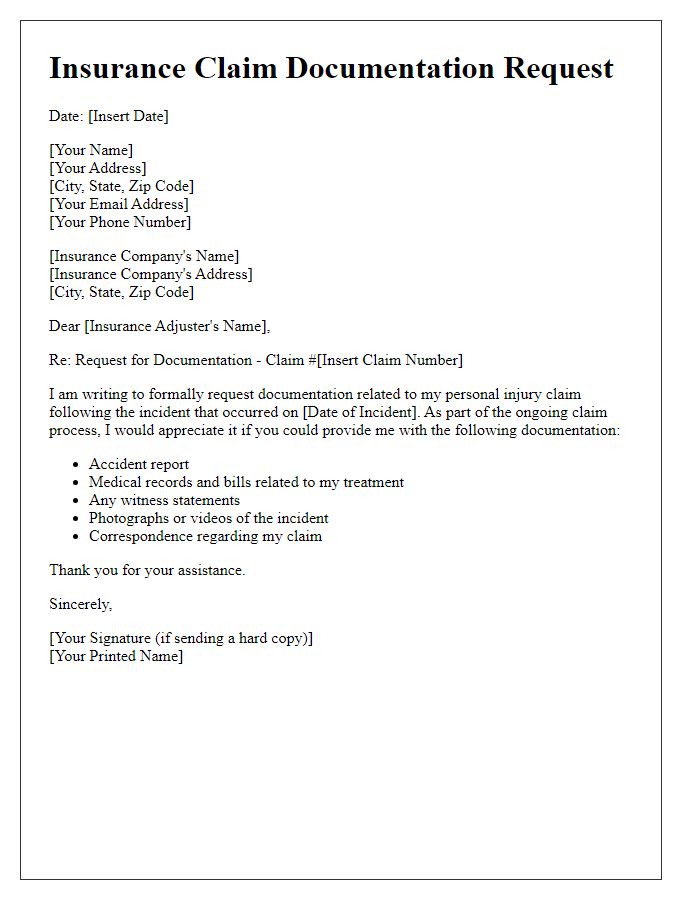

Letter Template For Insurance Claim Documentation Request Samples

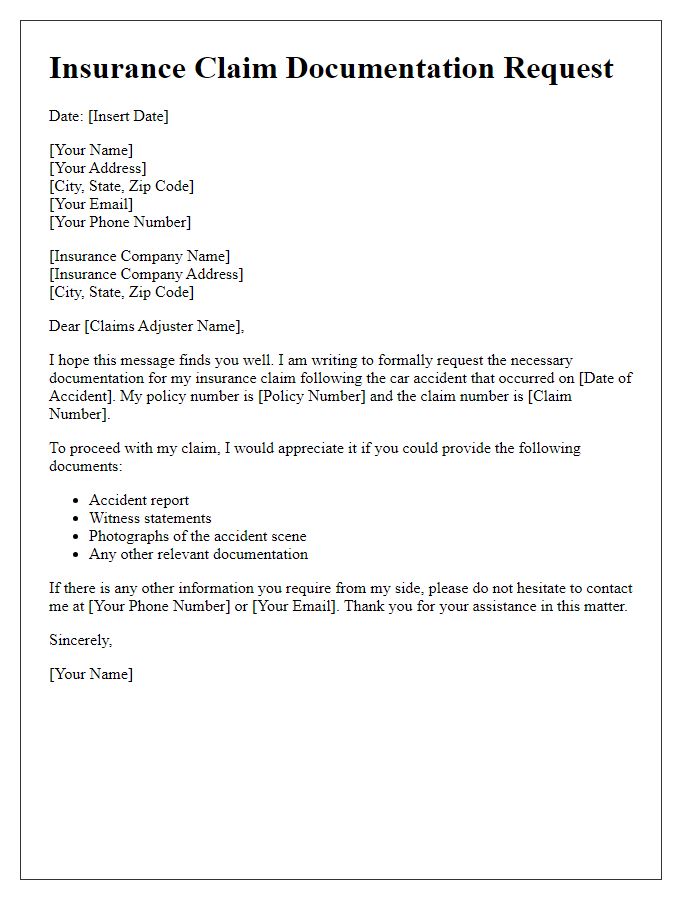

Letter template of insurance claim documentation request for car accident.

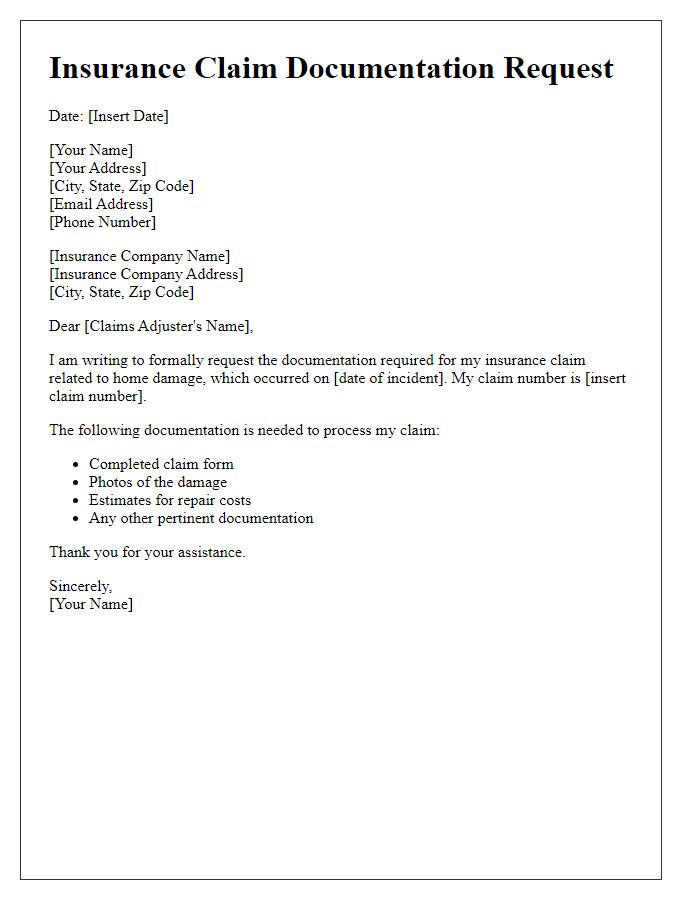

Letter template of insurance claim documentation request for home damage.

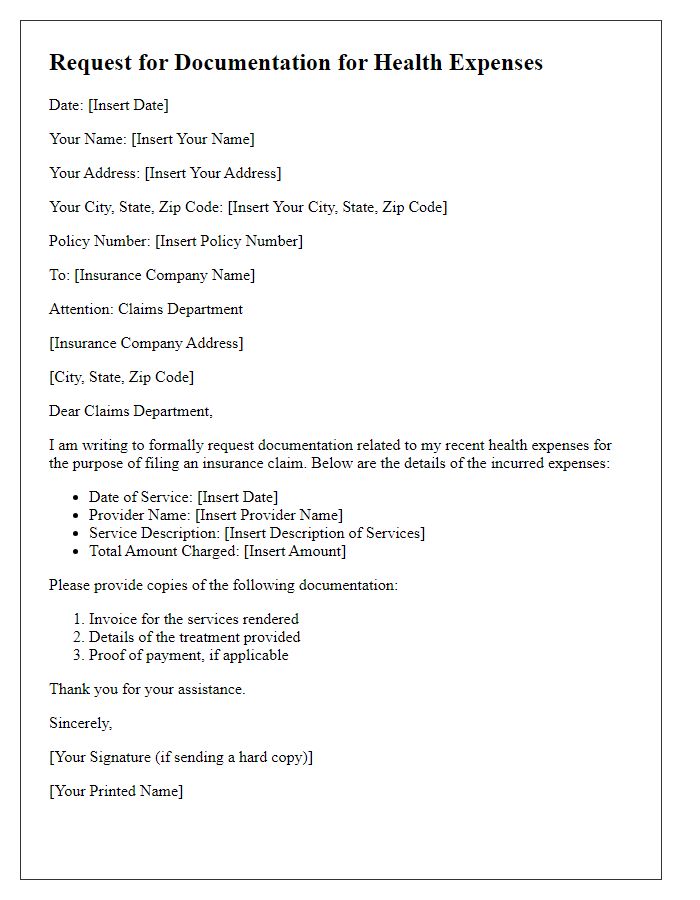

Letter template of insurance claim documentation request for health expenses.

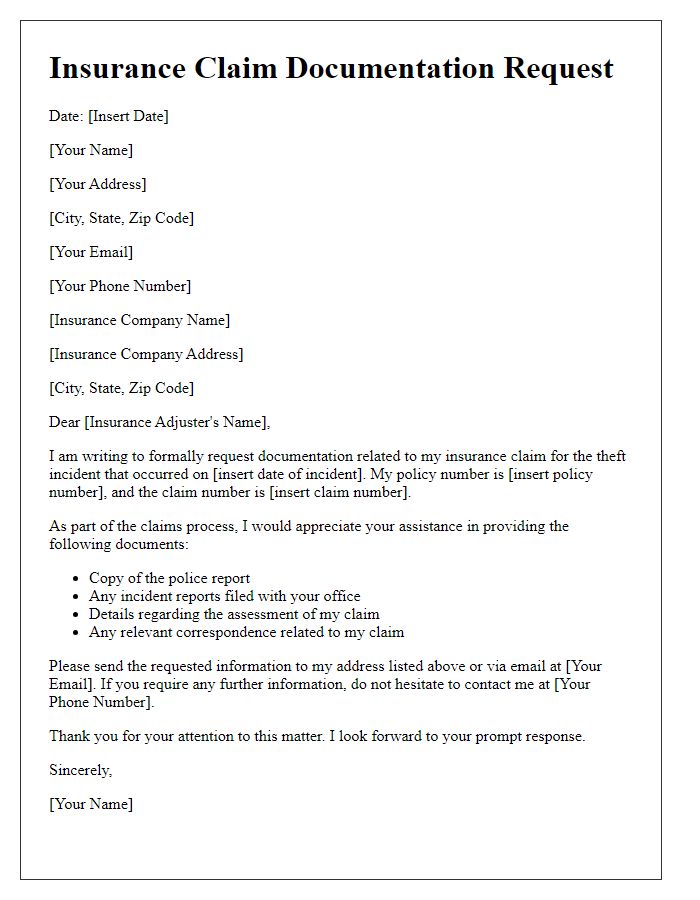

Letter template of insurance claim documentation request for theft incident.

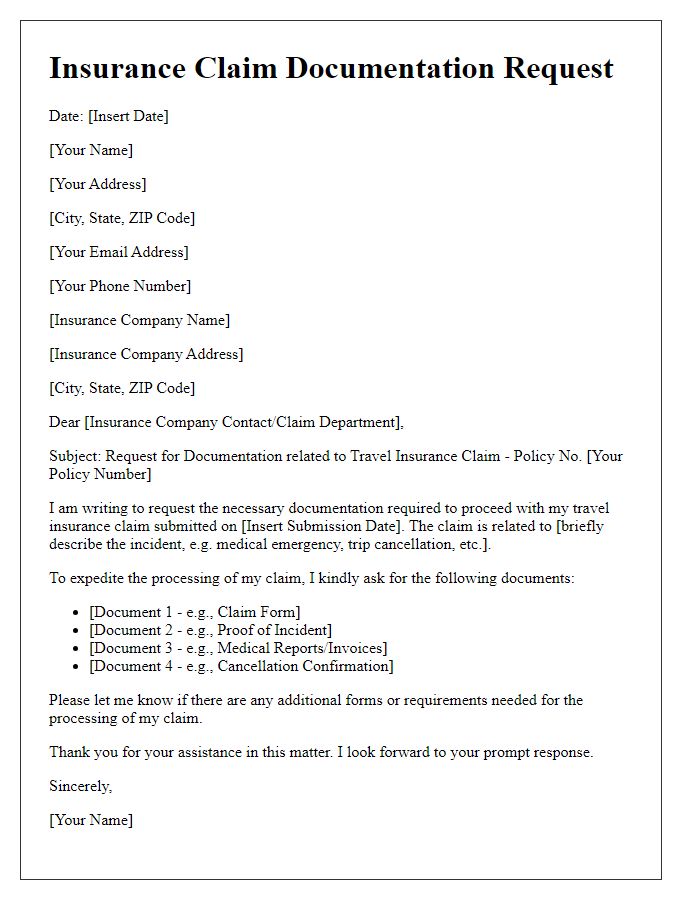

Letter template of insurance claim documentation request for travel insurance.

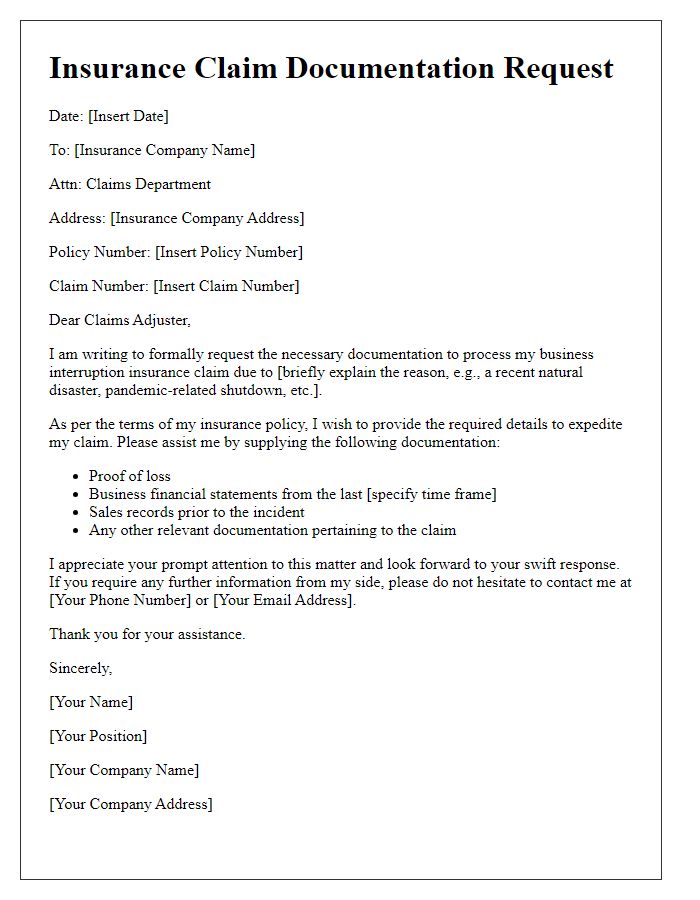

Letter template of insurance claim documentation request for business interruption.

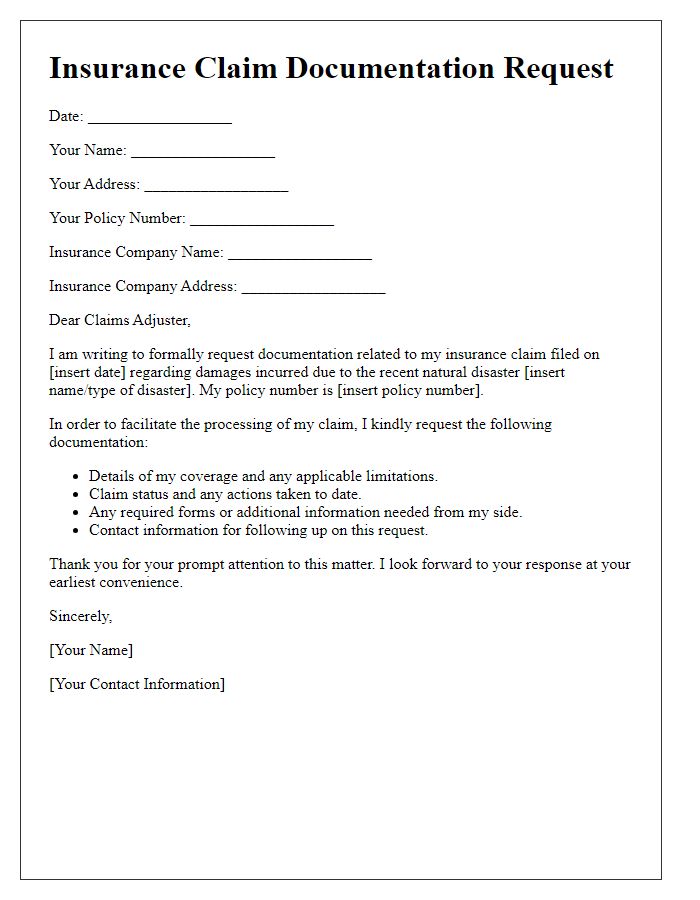

Letter template of insurance claim documentation request for natural disaster.

Letter template of insurance claim documentation request for liability claim.

Comments