Updating your insurance beneficiary is an essential step to ensure that your loved ones are taken care of in the event of unforeseen circumstances. Whether it's a marriage, divorce, or simply a change in your life situation, keeping your beneficiary information current is crucial. It can feel overwhelming to navigate the paperwork, but it doesn't have to be complicated or stressful. Join us as we dive deeper into the steps and tips for effectively updating your insurance beneficiary, ensuring peace of mind for you and your family.

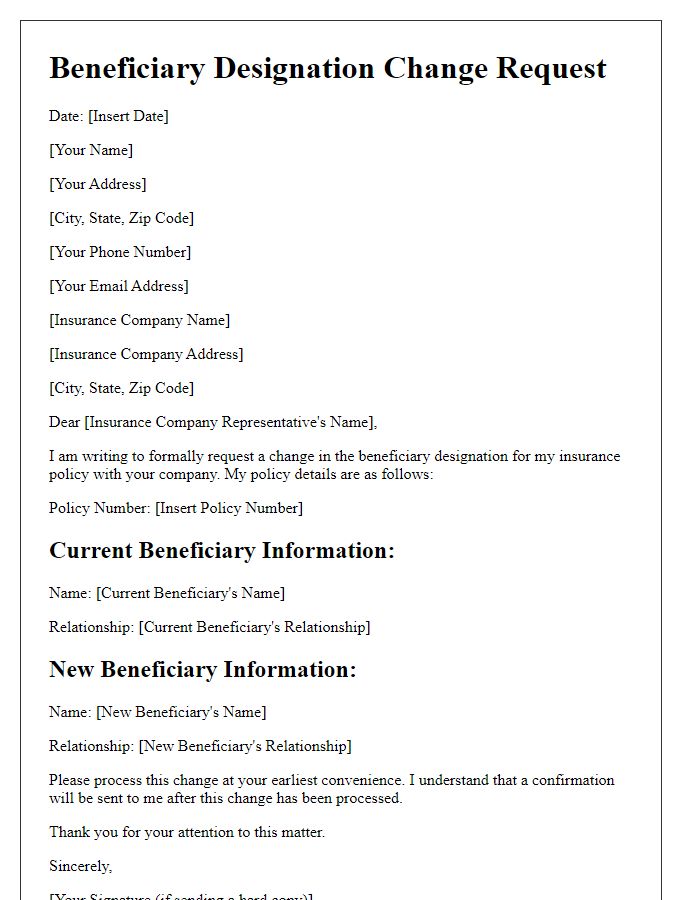

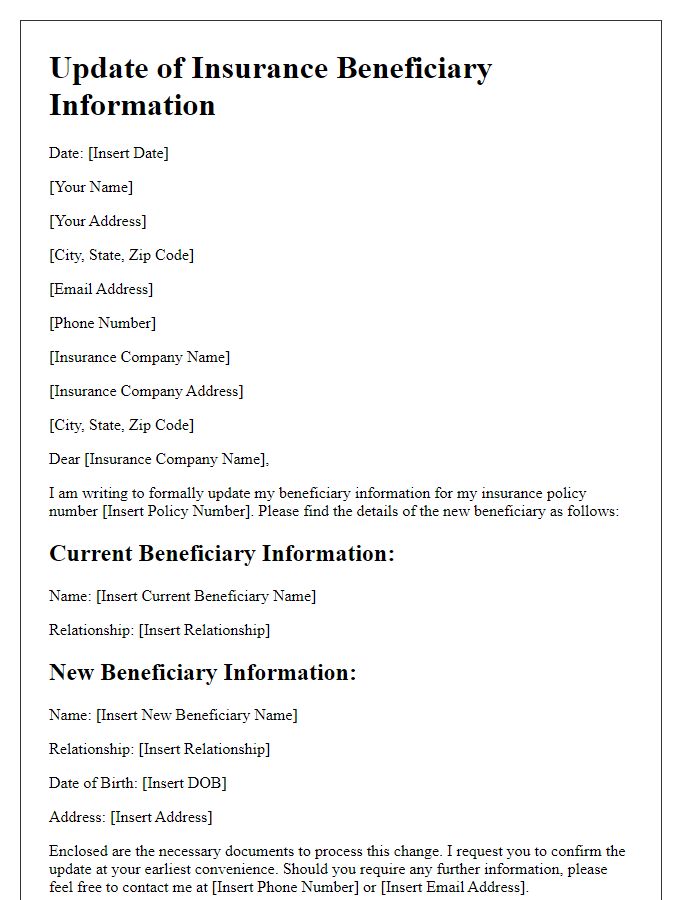

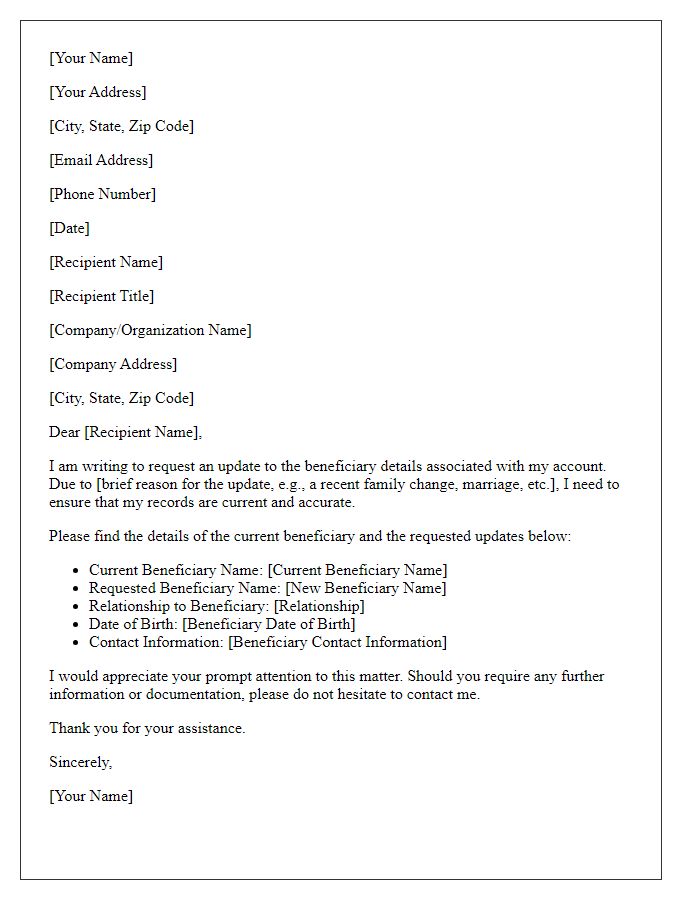

Policyholder's full name and contact information

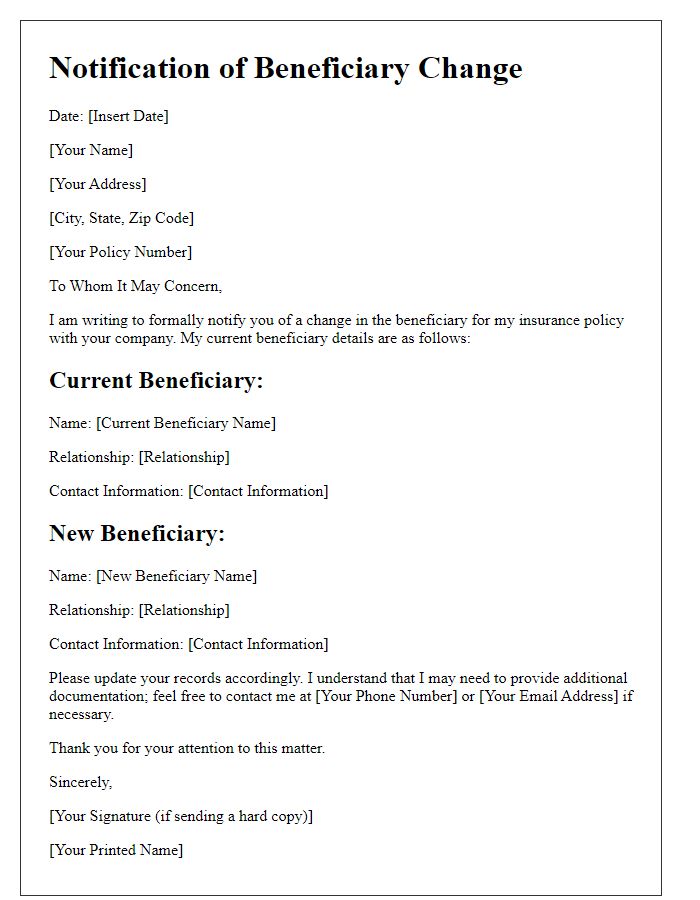

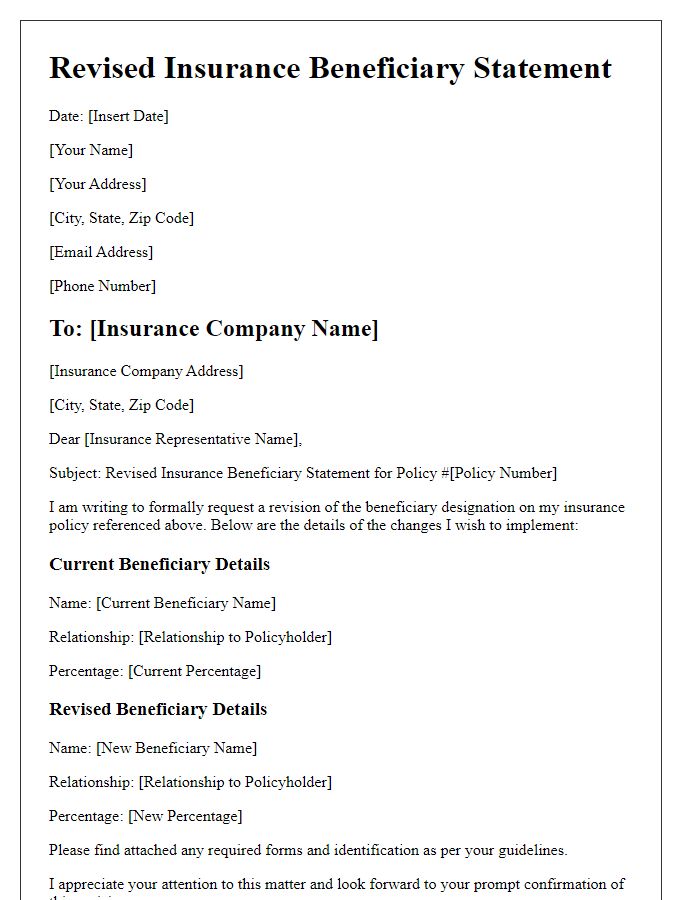

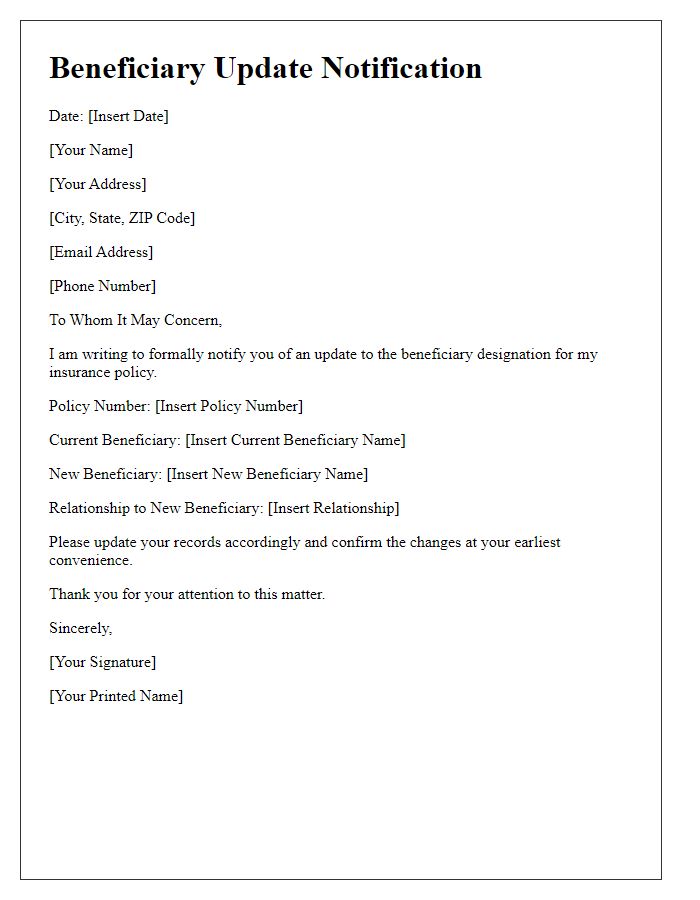

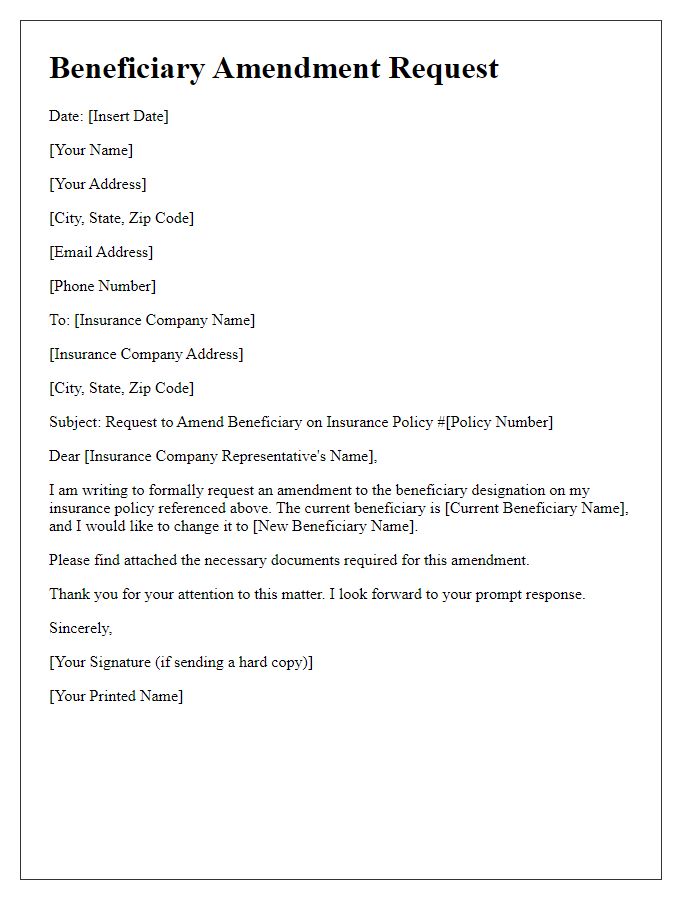

An insurance beneficiary update requires specific details to ensure accurate processing by the insurance company. Policyholder's full name includes both first name and last name, which uniquely identifies the individual in the insurance database. Contact information must include current email address and phone number, providing multiple ways for the insurance company's representatives to reach the policyholder for any necessary clarifications or confirmations. Ensuring that all details are correctly filled out can prevent delays in updating beneficiary information associated with various policies, such as life insurance or health insurance.

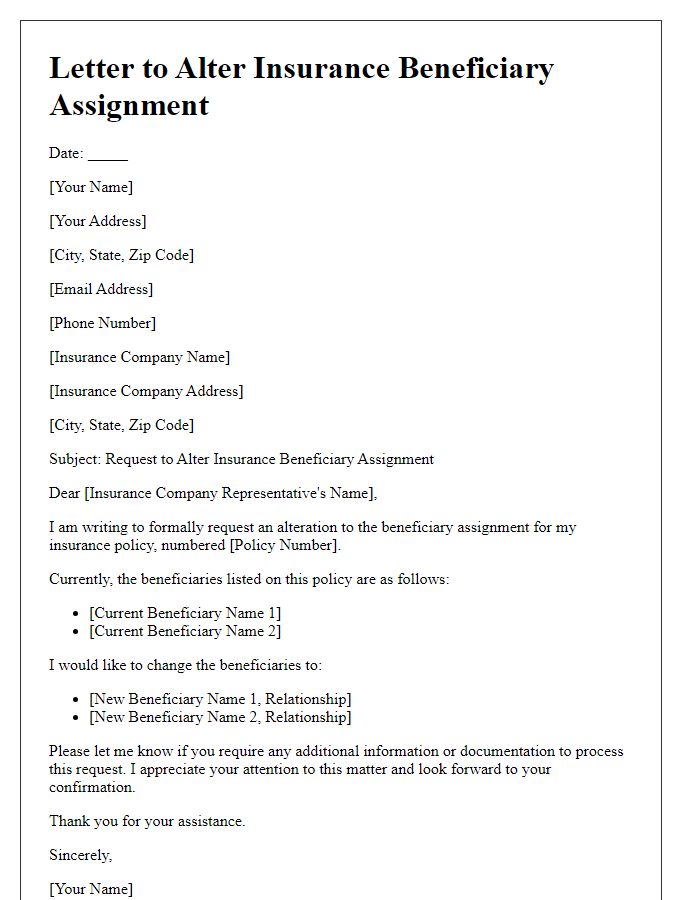

Policy number and type

Insurance policy updates are crucial to ensure the designated beneficiaries receive appropriate benefits. Policy number 123456789, associated with a whole life insurance type, requires an update to the beneficiary information. This policy, issued by XYZ Insurance Company, provides financial support covering funeral costs and outstanding debts, helping loved ones during difficult times. It's essential to keep records accurate, reflecting the current wishes and life changes such as marriage, divorce, or shifts in personal relationships. Adding or changing beneficiaries can facilitate smoother claims processing and avoid potential disputes in the future.

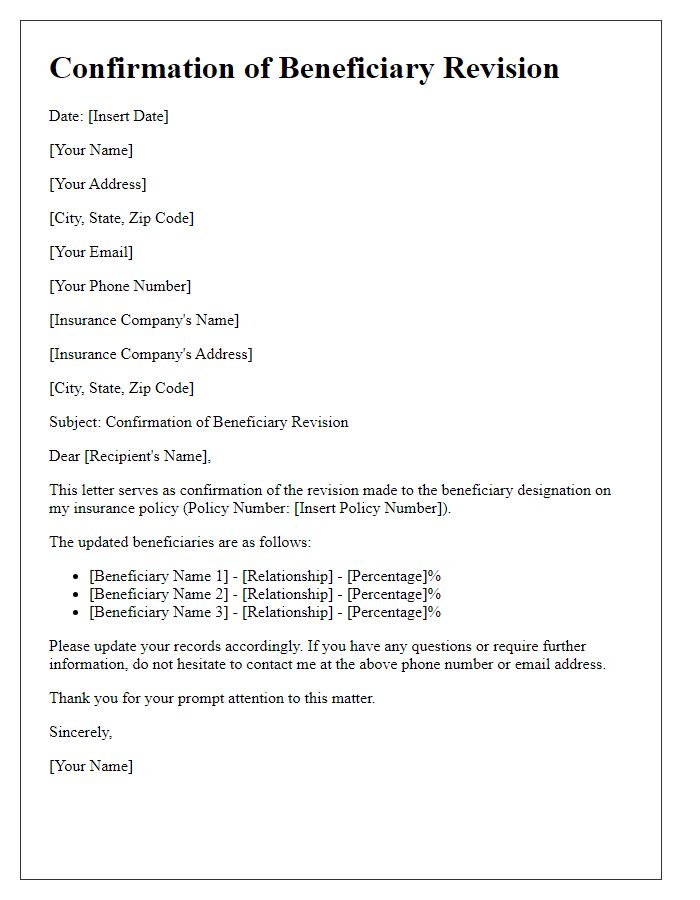

Current and updated beneficiary details

Updating beneficiary details ensures clarity and compliance with insurance policies. In the current beneficiary section, include the individual's full name, relationship to the policyholder, social security number, and percentage allocation of benefits. For the updated beneficiary section, list the new beneficiary's full name, relationship, social security number, and the intended percentage of benefits. Accurate details in these fields are crucial for the seamless transfer of benefits upon the policyholder's passing. Additionally, it is advisable to review the insurance company's guidelines to ensure all required documentation accompanies the update.

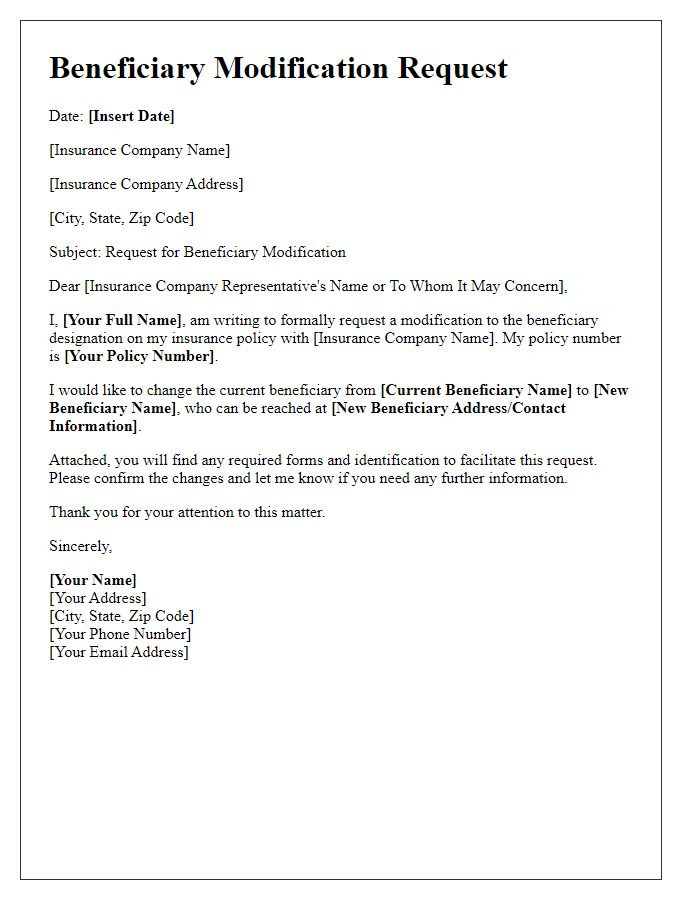

Reason for beneficiary update

Updating insurance beneficiaries is crucial for ensuring that proceeds go to the intended individuals upon the policyholder's passing. Reasons for this update may include life changes such as marriage, divorce, the birth of a child, or the death of a previous beneficiary. It is essential to keep beneficiary designations current to reflect one's current wishes and family dynamics. For instance, in the event of a divorce, a policyholder may wish to remove an ex-spouse and designate a new partner or family member. Similarly, the birth of a child may prompt the addition of that child as a beneficiary, ensuring financial protection for the new family member. Regular reviews of beneficiary designations can prevent potential legal disputes or unintended distributions after death.

Signature and date fields for validation

Updating the beneficiary information for an insurance policy is vital to ensure that the intended recipients receive benefits in the event of the policyholder's passing. The documentation must be filled out accurately and include the policyholder's full name, policy number, and details of the new beneficiary, such as name, relationship, and contact information. It is essential to have designated signature fields for both the policyholder and a witness, along with a current date for validation purposes, preventing any disputes regarding the authenticity of the update. Properly notifying the insurance company of these changes is crucial for the protection of the beneficiary's rights.

Comments