When it comes to navigating the complexities of insurance coverage, having a solid understanding of your policy is key. Whether you're seeking to verify your existing coverage or simply want to ensure you're adequately protected, drafting a clear and concise letter can make all the difference. In this article, we'll provide a practical template for creating an effective insurance coverage verification letter that addresses your needs. So, let's dive in and empower you to take control of your insurance journey!

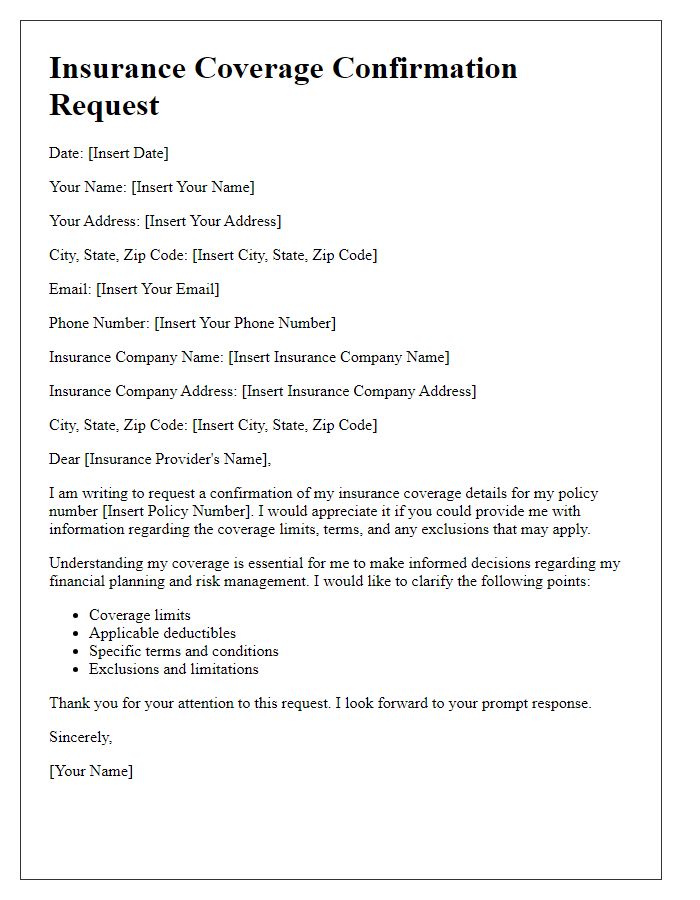

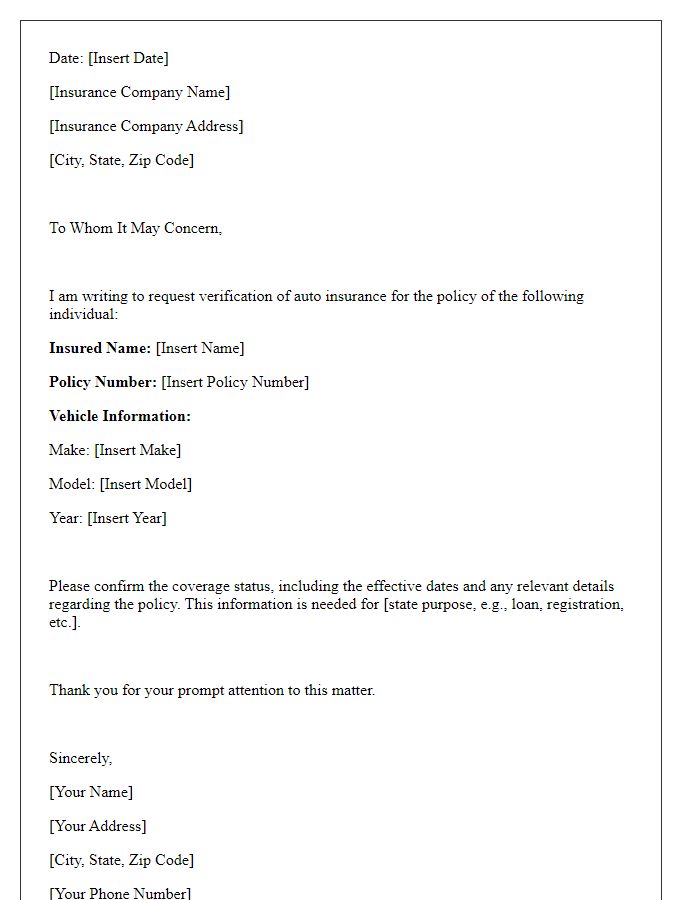

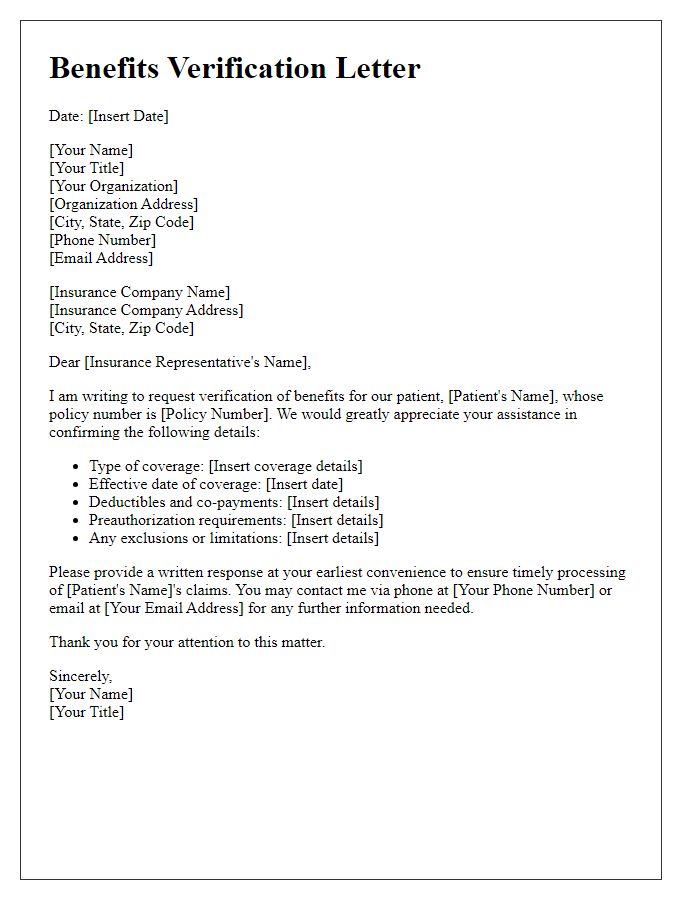

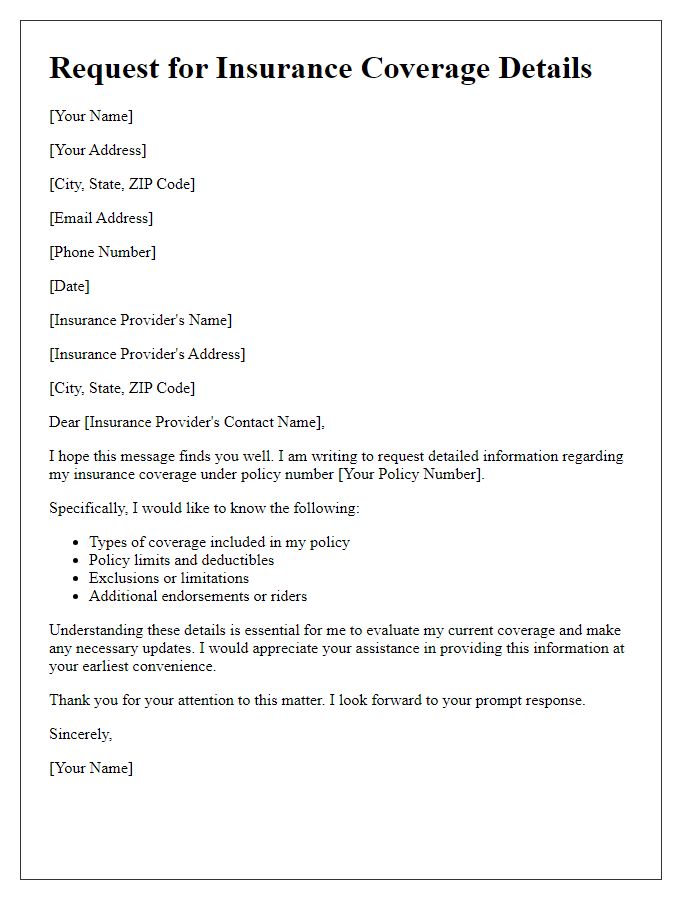

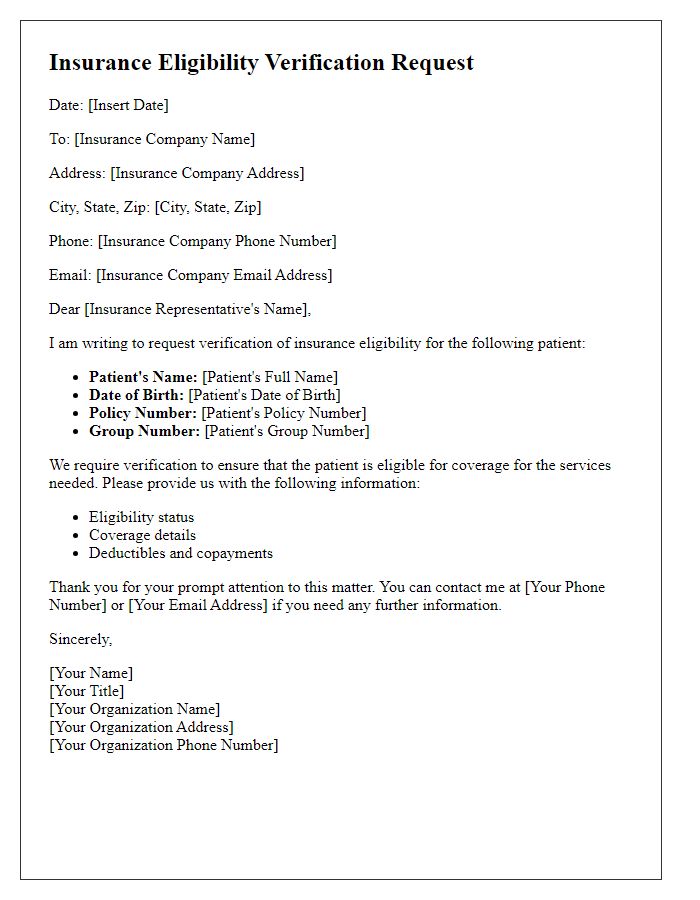

Policyholder information

The verification of insurance coverage for policyholders requires accurate and detailed information. Essential details include the policyholder's full name (such as John Smith), address (for instance, 123 Elm Street, Springfield), contact number (like (555) 123-4567), email address (example: jsmith@email.com), and date of birth (e.g., January 15, 1985). Additionally, insurance policy details must be included, such as the policy number (for example, POL12345678), coverage start and end dates (like March 1, 2023, to March 1, 2024), and the type of insurance (such as health insurance, auto insurance, or homeowners insurance). Any pertinent claims history or outstanding payments may also be relevant to confirm the insurance coverage status effectively.

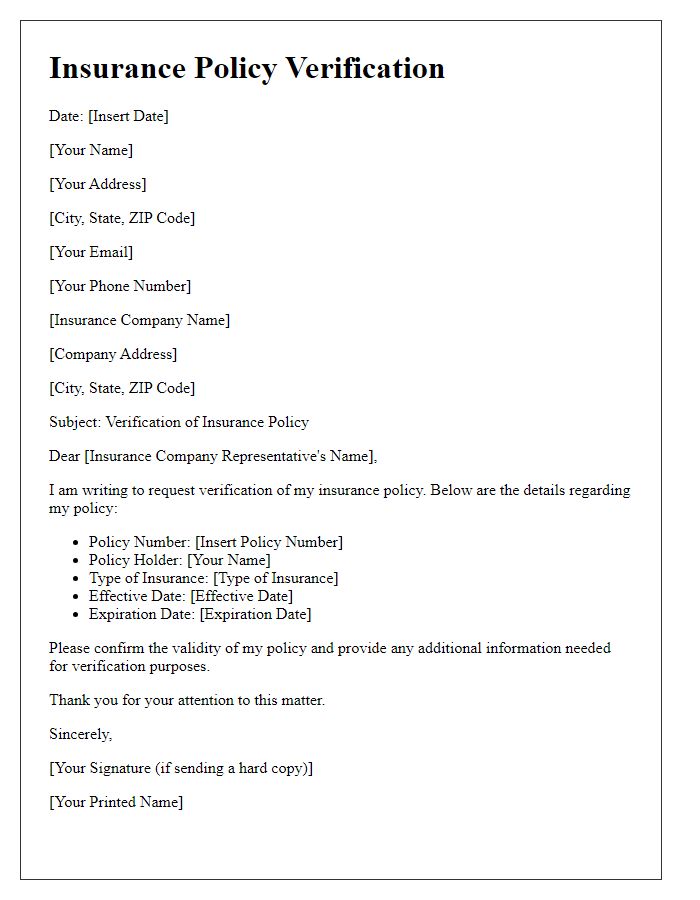

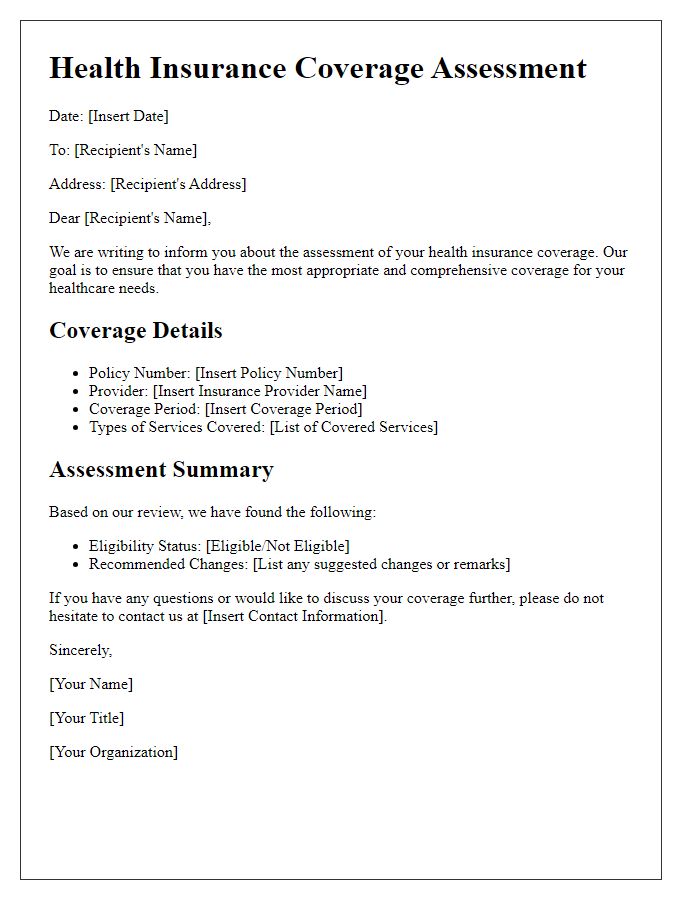

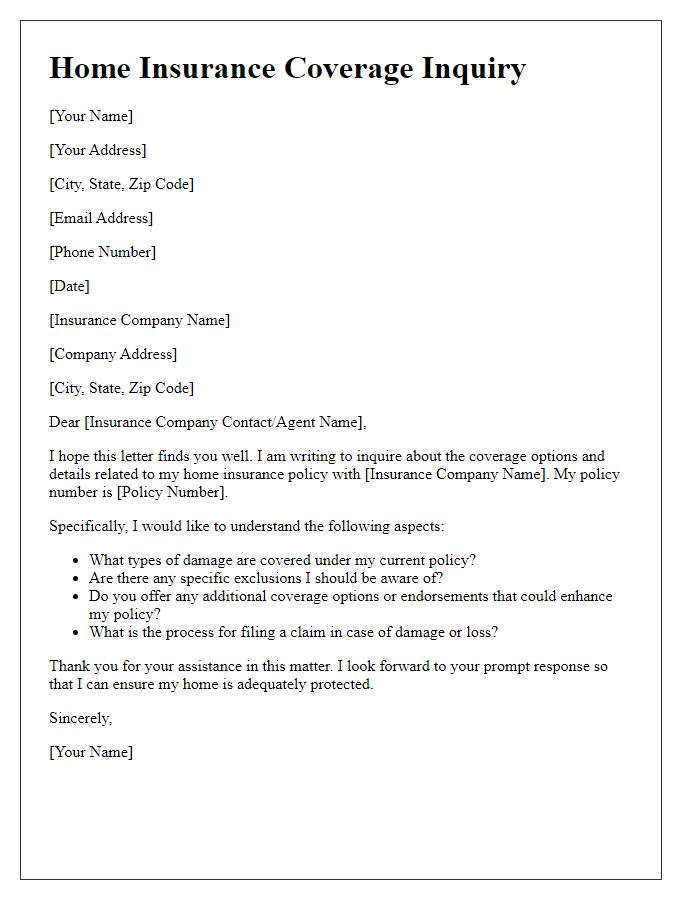

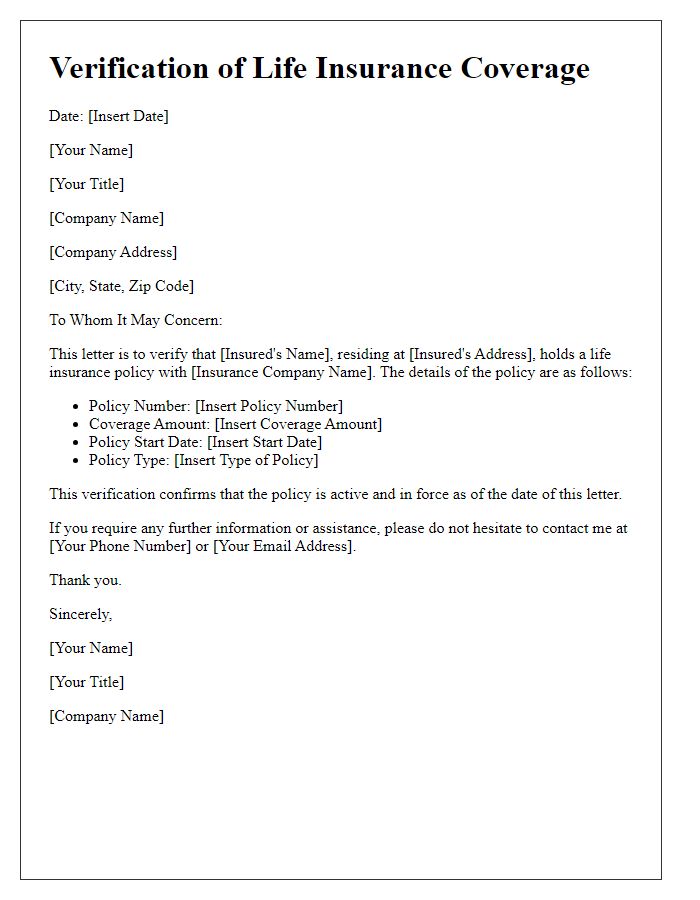

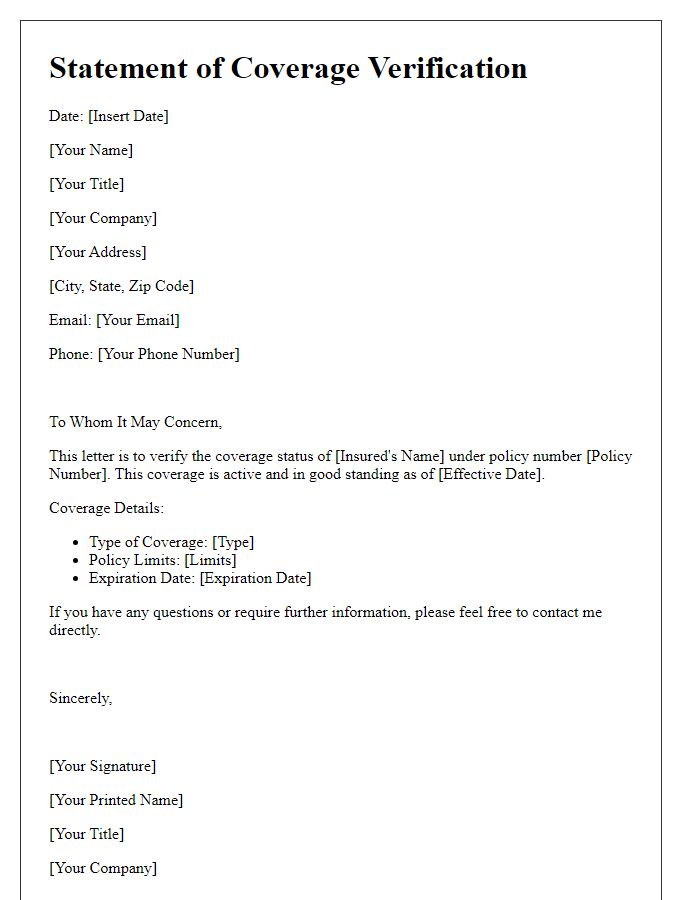

Policy details and coverage limits

Insurance coverage verification requires precise details about the policy and its associated limits. For instance, a standard auto insurance policy may encompass liability coverage with limits of $100,000 per person and $300,000 per accident, ensuring protection against bodily injury claims. Property damage coverage might offer limits of $50,000, safeguarding against damages incurred to another person's property. When evaluating homeowners insurance, coverage limits typically range from $100,000 to $500,000 for dwelling coverage, protecting the physical structure of the home located in cities like San Francisco or Miami. Additional living expenses coverage could also be included, providing up to $30,000 for temporary housing if the home becomes uninhabitable due to a covered peril such as fire or flood. Understanding these specifics is crucial for an accurate verification process.

Effective dates of coverage

Insurance coverage verification involves confirming specific details regarding policyholder protection. Effective dates of coverage indicate the start and end periods when a policy provides benefits, critical for claims processing. For instance, an auto insurance policy may state it is active from January 1, 2023, to December 31, 2023, providing crucial information for incident liability. Accurate verification ensures that individuals are aware of their coverage status during life events, such as accidents or medical emergencies. Insurers may require policy numbers, personal identification, and additional documentation to confirm these dates robustly, facilitating smooth claims management.

Contact information for verification

Insurance coverage verification requires specific contact information to ensure accurate communication. Primary contacts typically include the insurance provider's customer service phone number, often found on the insurance card, which allows for direct inquiries regarding policy details. Email addresses dedicated to claims or customer service support facilitate efficient written communication, particularly for documentation requests. Additionally, ensuring the name of the policyholder and policy number, essential identifiers, streamlines the verification process with agents. An office address for formal correspondence may also be necessary, mainly when submitting claims or policy amendments.

Statement of verification request conclusion

Verification requests for insurance coverage ensure the accurate assessment of policy details. Insurance policies, such as Auto, Health, and Homeowners, often require this verification process to establish eligibility for claims. Key elements include coverage limits, effective dates, and exclusions. In 2023, many companies utilize automated systems to process these requests quickly, reducing response times to as little as 24 hours. Policyholders benefit when insurers maintain clear communication regarding verification statuses, preventing potential delays in claims processes. Comprehensive documentation of coverage can significantly aid in dispute resolution, ensuring that customer needs are met efficiently.

Comments