Are you considering boosting your insurance coverage but unsure how to go about it? Crafting a compelling request letter can be the first step in securing the additional protection you need for your peace of mind. In this article, we'll guide you through creating a clear and effective letter template to request an insurance coverage increase. So, grab your pen and let's dive into the details!

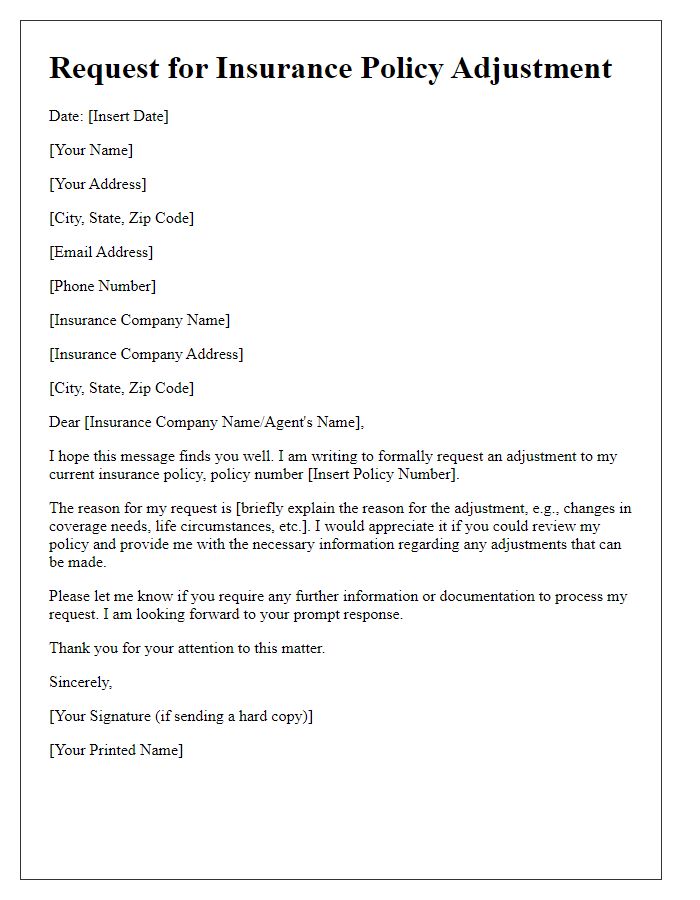

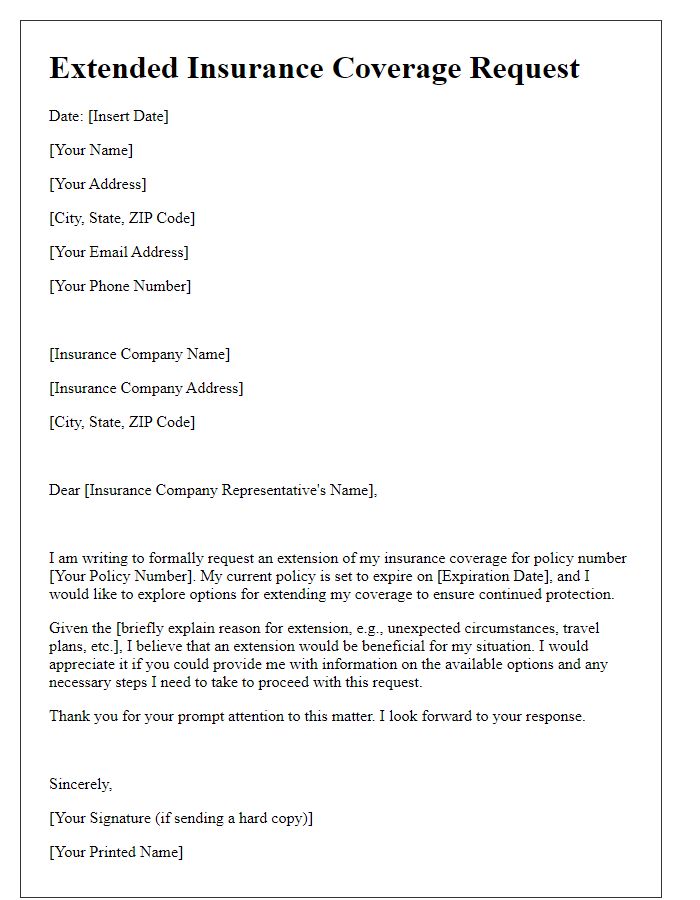

Personal Information

Personal information is crucial in insurance coverage increase requests, ensuring accurate processing of your application. This typically includes full name, address (including city and zip code), date of birth, and contact information (phone number and email). Policy number associates you with a specific insurance agreement. Moreover, employment details and income level help insurers assess risks and determine updated premiums, ensuring coverage aligns with your current financial situation. Including these details fosters clear communication with the insurance provider, facilitating a swift review process.

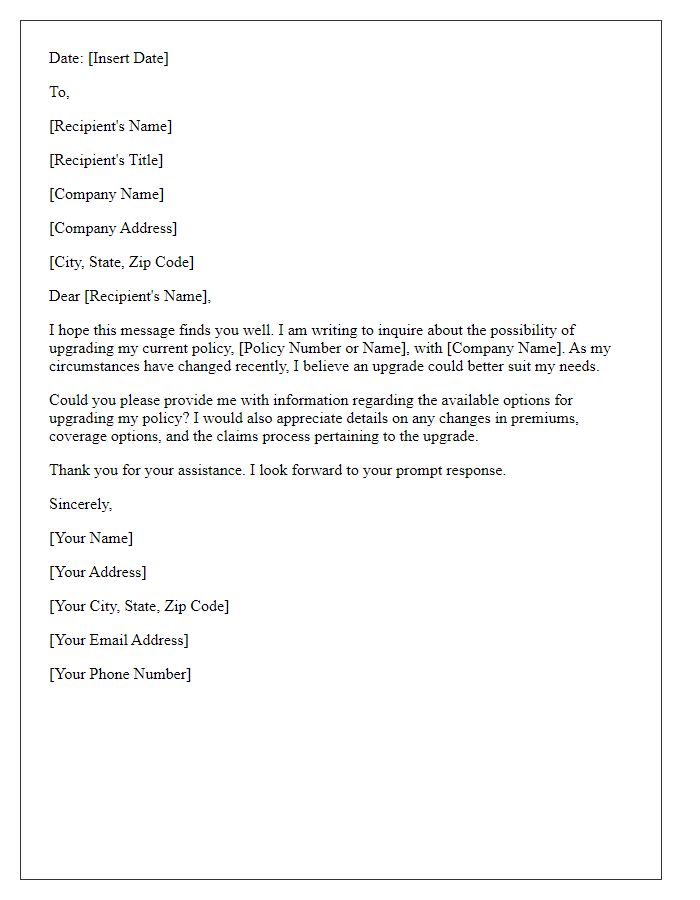

Current Policy Details

Current insurance policy details include the policy number, which identifies the specific agreement between the insured and the insurance provider. Coverage limits denote the maximum amount the insurance company will pay in the event of a claim, while deductibles indicate the out-of-pocket costs before coverage kicks in. The insured's personal information, such as name, address, and contact details, ensures that the policy remains accurate and up-to-date. Additionally, start and end dates of the policy outline the duration of coverage, providing clarity on renewal and expiration terms. Having detailed information about premiums paid and claims history is essential for negotiating an increase in coverage effectively.

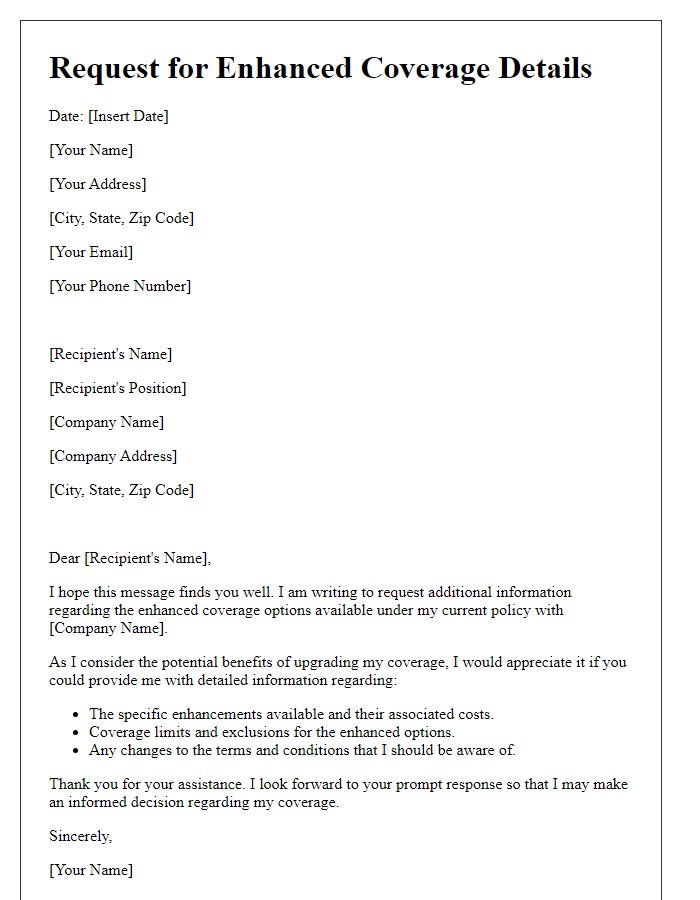

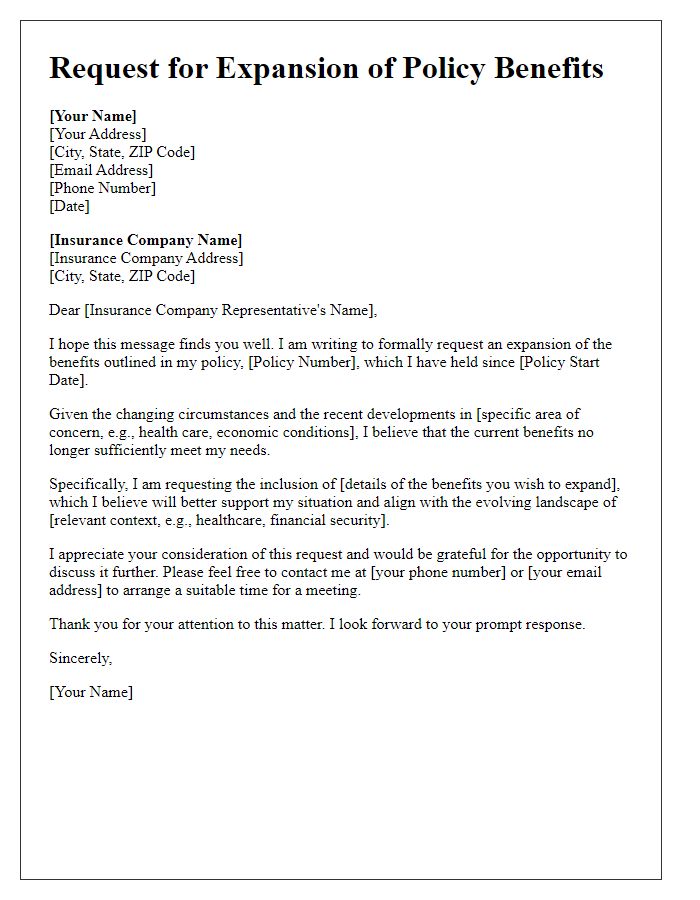

Specific Coverage Increase Request

A specific coverage increase request addresses the need for enhanced protection in insurance policies, particularly regarding health insurance and property insurance. Policyholders may seek to raise coverage limits (for instance, from $100,000 to $250,000) to safeguard against unexpected expenses that could arise from severe medical emergencies or property damages. This request typically includes the policy number, details of current coverage terms, and the rationale for the increase, such as changes in personal circumstances, inflation, or new assets acquired, which require additional coverage to ensure peace of mind and financial security against unforeseen events.

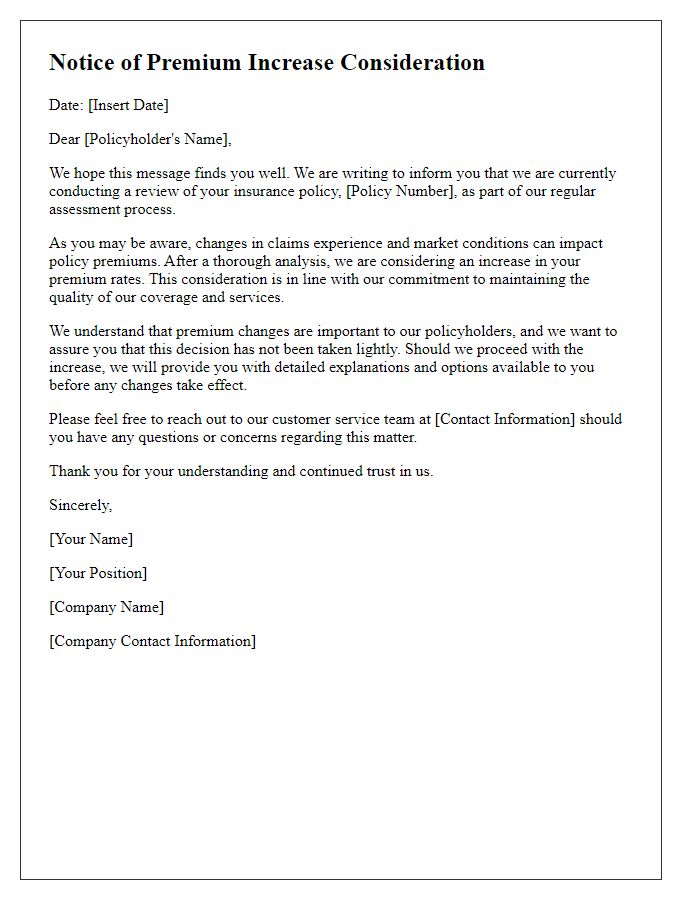

Justification for Increase

Several factors contribute to the necessity of an insurance coverage increase for homeowners in areas prone to natural disasters, like hurricanes and wildfires. Rising property values in cities, particularly in regions such as Miami, Florida, where median home prices surged to over $400,000 in 2023, necessitate adjustments to existing policies. Additionally, the frequency of severe weather events has markedly increased, with the National Oceanic and Atmospheric Administration recording a 30% rise in major storm occurrences since 2020, emphasizing the need for enhanced coverage. Inflation rates, currently hovering around 6.2%, further impact the replacement cost of property and belongings, compelling homeowners to seek increased limits. Lastly, advancements in home technology systems necessitate reevaluation of current coverage to encompass the latest devices and security systems, ensuring comprehensive protection against unforeseen circumstances.

Contact Information for Follow-up

Contact information for follow-up regarding insurance coverage increase requests should be detailed clearly for effective communication. Include full name, email address, and phone number to reach out easily. Specify the mailing address, which may include street name, city, state, and zip code for any written correspondence. Additionally, it can be helpful to mention the specific insurance policy number associated with the coverage increase request, ensuring the insurance provider can quickly reference relevant documents. Consider providing alternative contact methods such as a secondary email or phone number for urgent matters.

Comments