Are you considering vehicle insurance but feeling overwhelmed by the options? You're not aloneâmany people find it challenging to navigate the various coverage levels, premiums, and providers available. Whether you're a first-time buyer or looking to switch policies, understanding your choices can help you make an informed decision. Read on to learn how to create a letter template for your vehicle insurance inquiry that will simplify the process and get you the best coverage for your needs.

Personal and Contact Information

Inquiring about vehicle insurance often requires personal details to be fully processed. Essential personal information includes full name, which identifies the insured individual, date of birth, reflecting eligibility for various age-based discounts or coverages, and driver's license number, essential for verifying driving history and credentials. Address (including city, state, and ZIP code) is crucial for determining locality-based factors influencing insurance rates. Contact number provides immediate access for follow-up correspondence, while email address ensures the exchange of documents and confirmations in a timely manner. Furthermore, vehicle details such as make, model, year, and VIN (Vehicle Identification Number) play a significant role in tailoring the insurance policy, reflecting the unique attributes and risks associated with the specific automobile.

Vehicle Details

Inquiring about vehicle insurance coverage for a 2021 Honda Accord, a midsize sedan known for its reliability and advanced safety features. The car is registered in California, with an odometer reading of 15,000 miles. It has a clean title and has never been involved in any accidents, maintaining its market value estimated at approximately $28,000. Additionally, considering comprehensive and collision coverage, along with roadside assistance options, is essential for ensuring adequate protection against potential damages or theft. Include information regarding driver history, such as a clean record over the last five years, and inquire about potential discounts for bundling policies or safe driving practices.

Specific Coverage Requirements

Comprehensive vehicle insurance policies often include specific coverage options tailored to individual needs, such as collision coverage, which covers damage from accidents regardless of fault. Additional features may encompass uninsured motorist coverage, protecting against drivers lacking insurance, and personal injury protection, covering medical expenses for the driver and passengers. In 2023, certain regions also mandate coverage for theft and vandalism, especially in high-crime areas like urban centers. Furthermore, policies may offer roadside assistance services and rental reimbursement plans, ensuring mobility during claim processing. Selecting appropriate coverage options can vary significantly based on vehicle value, state regulations, and personal risk tolerance.

Premium and Deductible Queries

Inquire about vehicle insurance premium rates and deductible options for comprehensive coverage. Companies like State Farm, Geico, and Allstate each offer unique pricing structures influenced by factors such as the vehicle model (e.g., 2023 Honda Civic, 2022 Ford F-150), driver history (accidents, claims), and location (urban, rural). Specific premium amounts can vary significantly, with average ranges from $600 to $1,500 annually for standard policies. Additionally, deductible amounts (typically between $250 and $1,000) determine out-of-pocket expenses during claims. Understanding these aspects ensures informed decisions on coverage levels and financial commitments.

Request for Discounts and Special Offers

When seeking vehicle insurance, potential savings through discounts and special offers can significantly lower premiums. Many insurance providers feature incentives for safe driving records, such as no claims discounts which can amount to up to 30% annually. Various factors contribute to reduced rates, including bundled policies, where clients combine home and auto insurance, resulting in savings of 10-20%. Additionally, affiliations with organizations, such as AAA or certain university alumni associations, can unlock exclusive discounts. Understanding the eligibility criteria for student discounts, defensive driving course completions, or vehicle safety features can maximize savings. Researching region-specific offers in places like California or Texas may unveil unique opportunities tailored to local regulations or risk assessments. Regular inquiries about promotional periods, particularly during spring or year-end reviews, can ensure clients do not miss potential savings.

Letter Template For Vehicle Insurance Enquiry Samples

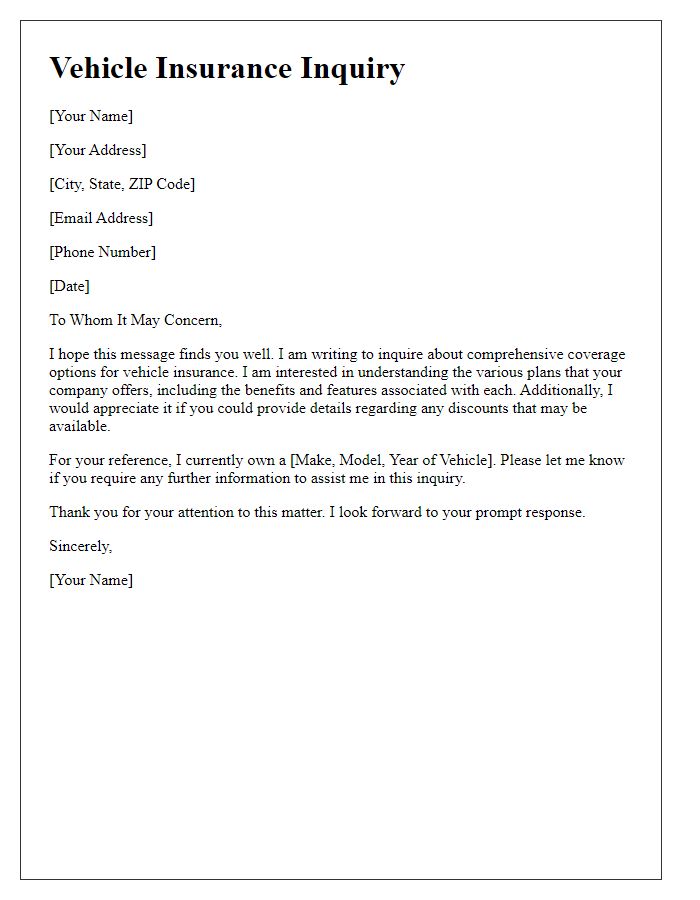

Letter template of vehicle insurance inquiry for comprehensive coverage options.

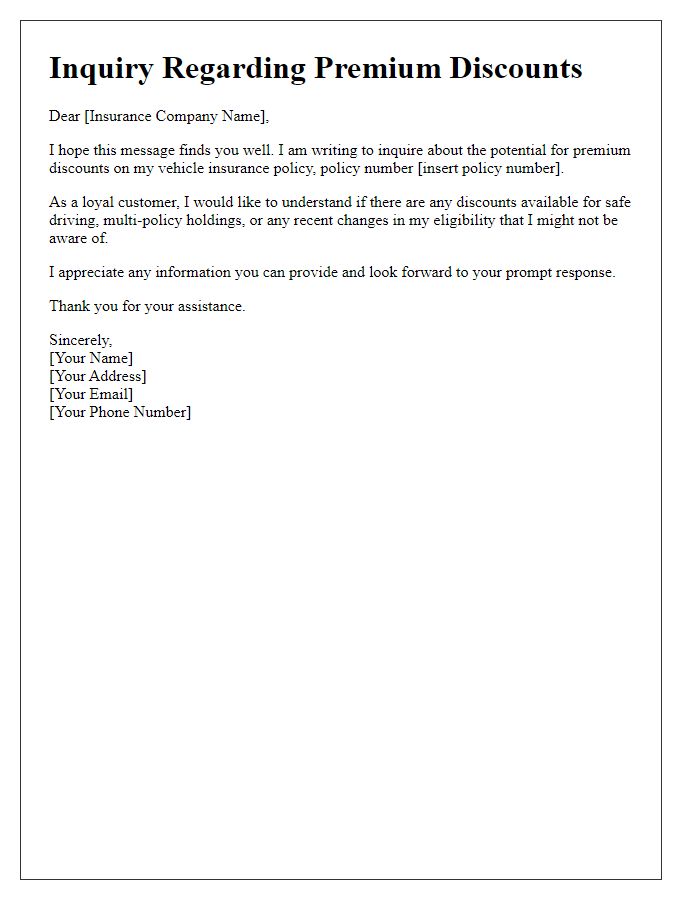

Letter template of vehicle insurance inquiry regarding premium discounts.

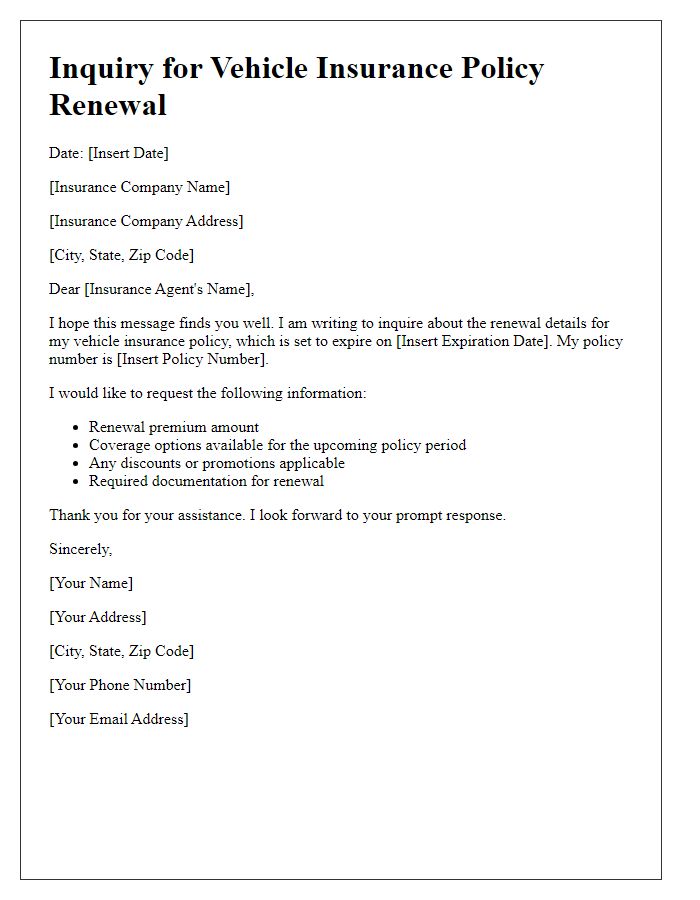

Letter template of vehicle insurance inquiry for policy renewal details.

Letter template of vehicle insurance inquiry about claims process and requirements.

Letter template of vehicle insurance inquiry for adding additional drivers.

Letter template of vehicle insurance inquiry concerning coverage for electric vehicles.

Letter template of vehicle insurance inquiry about roadside assistance services.

Letter template of vehicle insurance inquiry for policy cancellation procedures.

Letter template of vehicle insurance inquiry regarding coverage limits and exclusions.

Comments