Are you considering enhancing your peace of mind with extra insurance coverage? It's always a good idea to reassess your current policies to ensure they meet your needs, especially as life circumstances change. In this article, we're diving into the essential steps for crafting a compelling request for additional insurance coverage that resonates with your provider. So, let's explore the ins and outs of presenting your case effectivelyâread on to learn more!

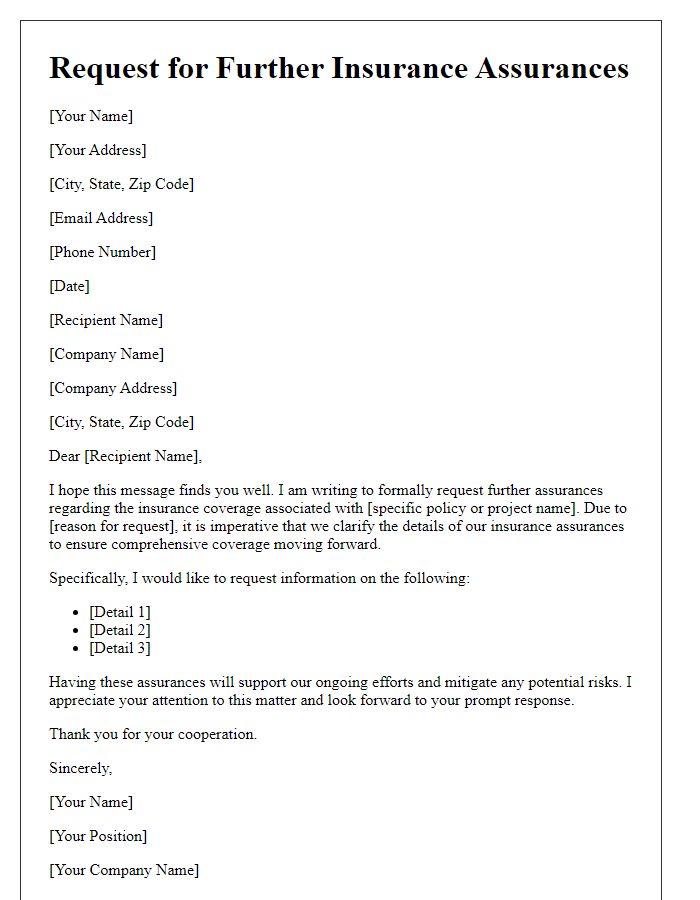

Specific insurance policy details

Requesting additional insurance coverage is crucial for enhancing protection. An individual may seek changes to a property insurance policy (for example, a homeowner's insurance policy from ABC Insurance Company) to expand coverage limits from $250,000 to $500,000, safeguarding against potential losses due to natural disasters, theft, or damage. Specific coverage add-ons may include personal property protection against theft, increased liability limits (for instance, raising from $100,000 to $300,000), or umbrella insurance, which provides extra liability coverage beyond standard policies. Engaging with the insurance provider on the potential costs associated with these enhancements and the implications for premium payments is essential for informed decision-making.

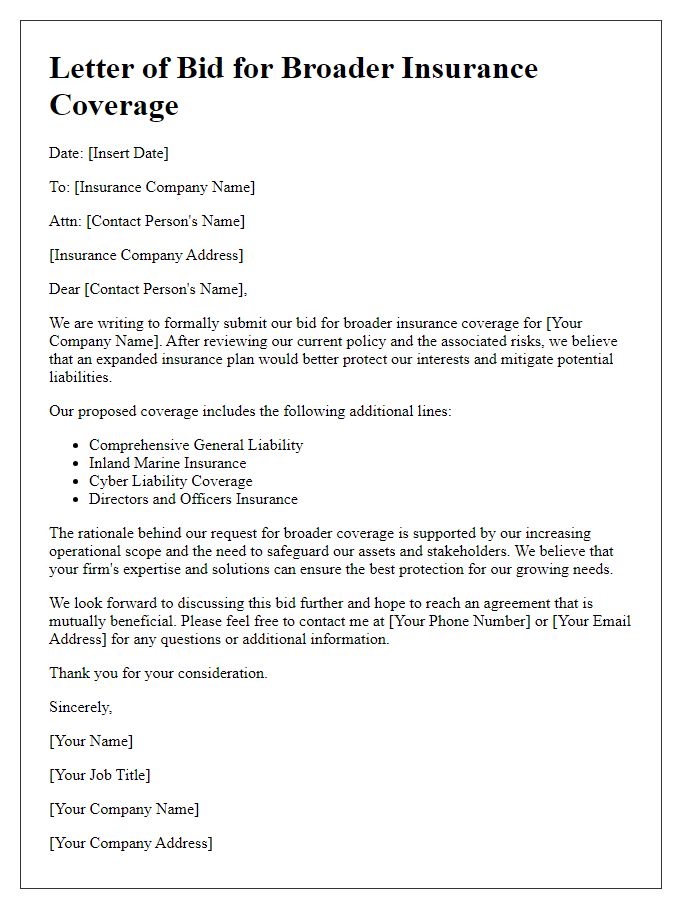

Purpose for additional coverage

Many homeowners seek additional insurance coverage to safeguard against unforeseen natural disasters, such as hurricanes or floods, especially in high-risk areas like Florida. Standard homeowner policies often provide limited protection, leaving significant gaps in coverage. Premium increases may occur due to rising property values or changes in local regulations, prompting individuals to consider supplemental policies. Furthermore, high-value assets, including collectibles or jewelry, require specific endorsements to ensure adequate protection. In addition, potential liability claims arising from accidents on one's property necessitate enhanced liability coverage to protect personal finances.

Current coverage limitations

Many individuals with automotive insurance may find their current coverage limitations inadequate for their specific needs. For example, some policies provide minimal liability coverage, often around $25,000 per person for injuries and $50,000 per accident, which may not sufficiently cover medical expenses following an accident. Additionally, collision coverage may only pay for the actual cash value of the vehicle, leaving gaps when it comes to high-value cars or those with custom modifications. Comprehensive coverage often excludes certain events like natural disasters or thefts occurring in less secure parking areas. Furthermore, uninsured motorist coverage, which protects drivers in accidents involving uninsured motorists, may be limited to state minimums, typically around $15,000. Many drivers consider enhancing their policies by increasing coverage limits or adding supplementary options like personal injury protection (PIP) and roadside assistance to ensure more comprehensive financial protection in various scenarios.

Financial implications or benefits

Additional insurance coverage can provide significant financial security during unforeseen events, such as natural disasters or health emergencies. The costs associated with accidents, such as medical expenses that can reach thousands of dollars or property damages that can easily exceed home values in high-risk areas like California, underline the importance of sufficient coverage. Enhanced policies often include provisions for increased liabilities, which are essential given the rising legal costs associated with personal injury lawsuits. Moreover, additional coverage can lead to lower out-of-pocket expenses during claims, ensuring that individuals do not experience financial hardship when facing unexpected losses. Investing in comprehensive supplemental insurance plans can ultimately safeguard personal assets while promoting peace of mind.

Contact information for further discussion

Contact information is crucial for enhancing communication regarding additional insurance coverage requests. A dedicated phone number, such as (555) 123-4567, allows for direct conversations about policy details. An email address, for instance, support@insurancecompany.com, provides a written medium for sharing documents or clarifying terms. Additionally, including a physical address, like 123 Insurance St., Suite 100, City, State, ZIP, ensures formal correspondence can occur when needed. Establishing these points of contact facilitates timely responses and provides clarity in discussions surrounding tailored coverage options.

Comments