Are you considering aviation insurance but feeling a bit overwhelmed by the options available? It's a smart move to protect your aircraft and investments, yet the variety of policies can be daunting. In this article, we'll break down everything you need to know about aviation insurance, from coverage types to key factors to consider. So, buckle up and join us as we navigate the skies of aviation insurance together!

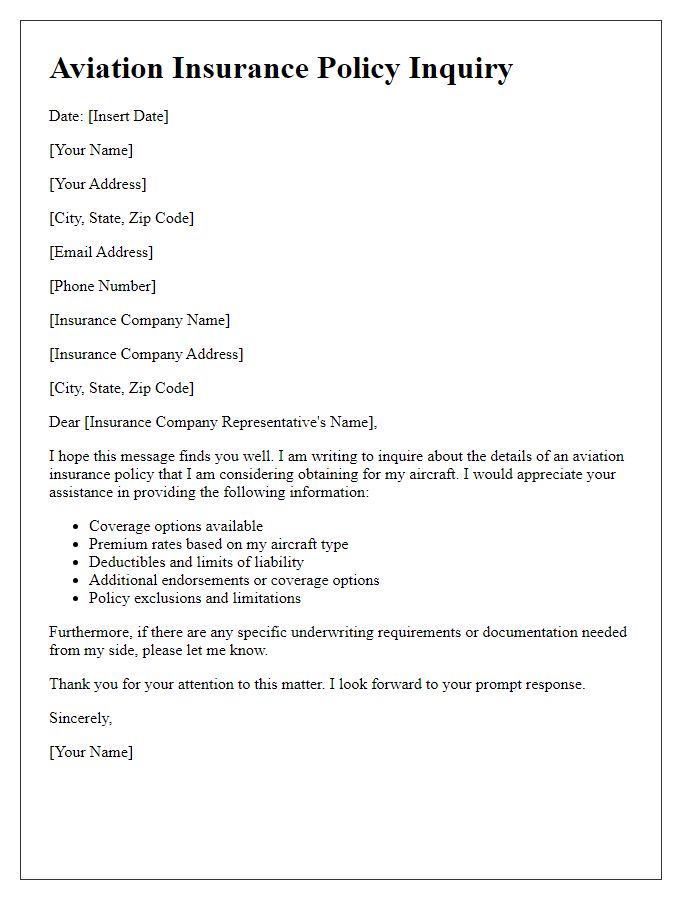

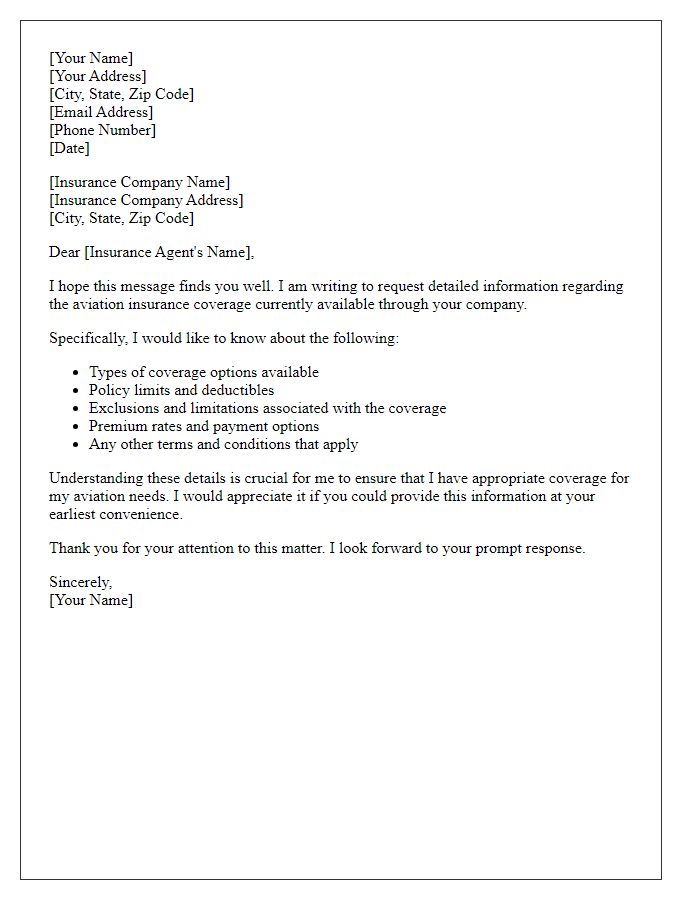

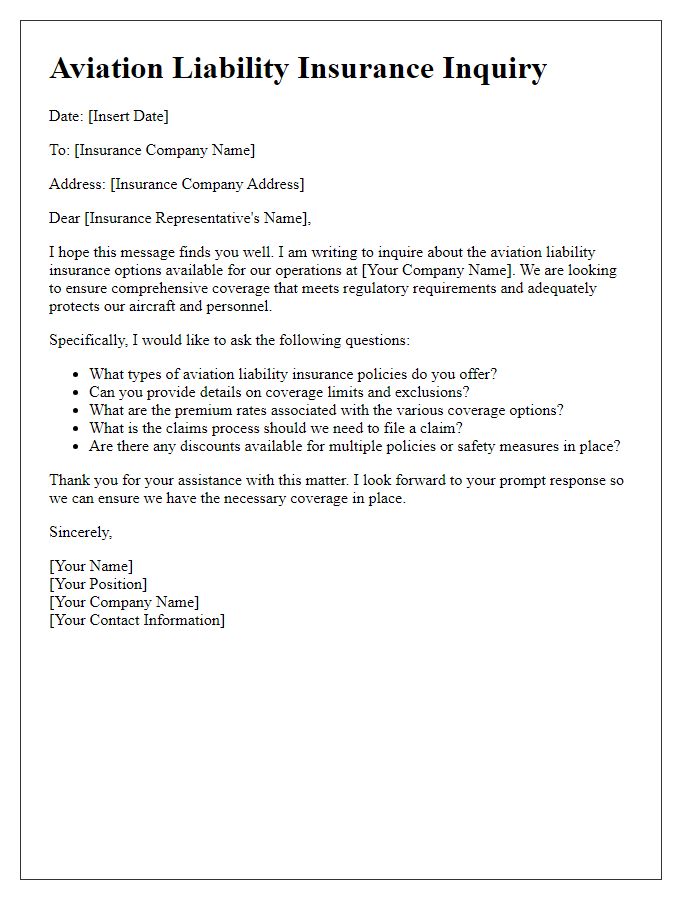

Addressee and Contact Information

Aviation insurance serves to protect aircraft owners against financial loss due to damage, theft, or liability associated with aviation operations. Key elements include hull insurance covering physical damage to the aircraft, which may exceed hundreds of thousands to millions of dollars, and liability insurance, safeguarding against claims exceeding millions per incident. Aviation insurance policies can vary based on aircraft type, such as private jets or commercial airliners, and operational use, including charter flights or flight schools. The location of operations, like busy airports such as Los Angeles International Airport or regional airstrips, can also influence premium costs and coverage requirements. Each policy may include specific endorsements tailored to unique needs, ensuring comprehensive protection for operators and passengers alike.

Detailed Aircraft Specifications

Aviation insurance inquiries require comprehensive data to assess coverage options for aircraft. Aircraft specifications should include the make and model, such as Boeing 737 or Cessna 172, alongside registration number for identification purposes. Engine type, whether turbocharged or piston-driven, significantly influences policy parameters due to differing risk profiles. Airframe details, including total hours flown and maintenance history, reflect operational safety and conditions. Payload capacity, for instance, maximum takeoff weight (MTOW) in pounds or kilograms, may also affect premium rates. Additionally, details regarding any custom modifications, like avionics upgrades or enhanced safety features, warrant documentation. This meticulous detailing is crucial for accurate risk assessment in aviation insurance quotes.

Type of Coverage Required

Aviation insurance covers various aspects related to the operation and ownership of aircraft, including hull insurance, liability coverage, and passenger coverage. Hull insurance protects against physical damage to the aircraft, typically valued in the millions depending on the aircraft type, such as single-engine Cessna 172 or multi-engine Bombardier Global 7500. Liability coverage protects against claims made by third parties for injuries or damages resulting from aircraft operations, often with limits ranging from $1 million to $100 million. Passenger coverage ensures protection for individuals aboard the aircraft, addressing injuries and fatalities, with considerations for the number of seats, such as a small private jet accommodating six or a commercial airliner with 300 seats. Understanding specific aviation activities, such as flight training, charter services, or cargo transport, is essential for determining appropriate policy limits and premiums.

Operational Geographical Scope

Operational geographical scope in aviation insurance refers to the regions where an aircraft is permitted to operate under the terms of the insurance policy. This scope can encompass specific countries, including risk factors, restrictions, or endorsements for areas like Europe, Asia, or North America. Insurers may assess risks related to local regulations, environmental conditions, and air traffic management in these regions. Understanding the geographical limitations ensures compliance with both insurance terms and aviation authority regulations. Clear guidelines regarding operational zones protect against potential claims arising from accidents or incidents occurring outside the agreed geographical areas. This aspect is crucial for airlines, private operators, and charter companies to determine coverage adequacy while planning flight routes.

Desired Policy Limits and Deductibles

Inquiring about aviation insurance often requires specific details regarding desired policy limits and deductibles for optimal coverage. Notably, the policy limits indicate the maximum payout for claims, which can vary significantly depending on the aircraft type (e.g., single-engine, multi-engine, or helicopters) and its use (private, commercial, or agricultural). Common policy limits usually range from $1 million to $10 million, reflecting the potential risk profile of the aircraft operation. Deductibles, which represent the amount an insured person pays out of pocket before the insurance policy kicks in, typically span from $500 to $10,000 or more, depending on the insured value and specific circumstances. Understanding the aviation laws in various jurisdictions, such as the Federal Aviation Administration guidelines in the United States, can also impact coverage decisions. Ultimately, the selection of limits and deductibles plays a critical role in balancing premium costs with risk management strategies in the aviation industry.

Comments