Hey there! If you've recently updated your insurance policy, you might be wondering how that affects your coverage and what steps you need to take next. Understanding these changes is crucial, as they can impact your peace of mind and financial security. In this article, we'll break down everything you need to know about your updated insurance policy, including key details and what to watch for. So, grab a cup of coffee, and let's dive in!

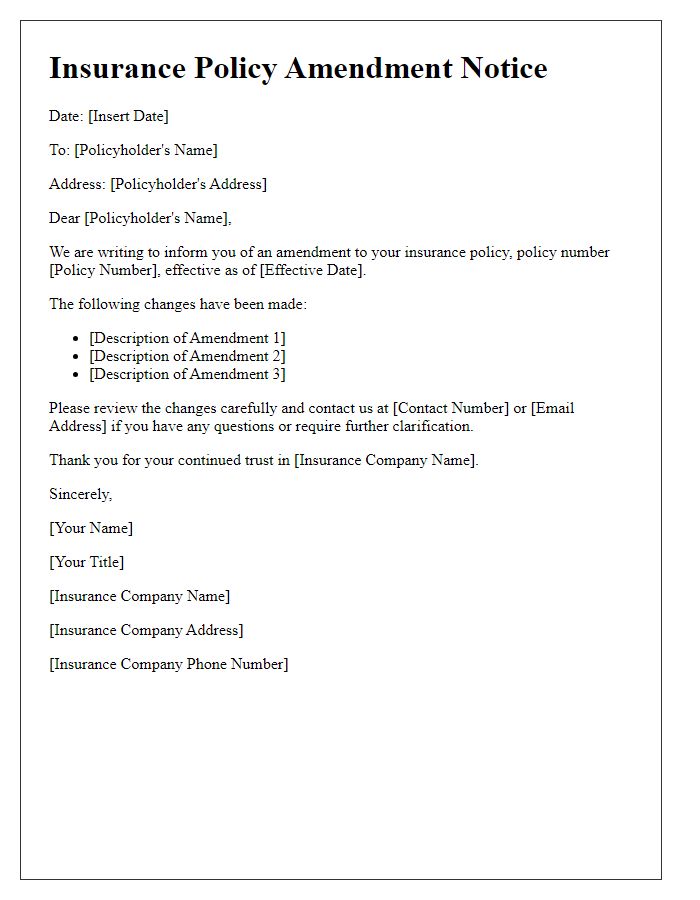

Policyholder's contact details

Policyholder contact details include essential information such as the name, mailing address, email address, and phone number of the individual or entity holding the insurance policy. Accurate contact information ensures timely notifications regarding policy updates, claims, or changes in coverage. In many instances, such details are listed in a designated section of insurance documents or managed online through the insurer's customer portal. It is crucial for policyholders, especially in places like California, Texas, or New York, to keep this information current to avoid lapses in communication that could impact their insurance coverage or claims.

Policy number and specifics

Insurance policy updates can include crucial information that affects coverage and terms. An insurance policy number uniquely identifies an individual's contract, ensuring smooth processing of claims and inquiries. Specific details, such as policy limits, deductibles, and coverage types, are essential for understanding the extent of protection. Changes in the insured entity's status or property may necessitate updates, particularly if they involve high-value assets like homes or vehicles. Notifications often indicate the effective date of changes, which is crucial for timely compliance with new terms. Reviewing updated policies allows policyholders to confirm they meet personal needs and expectations for coverage.

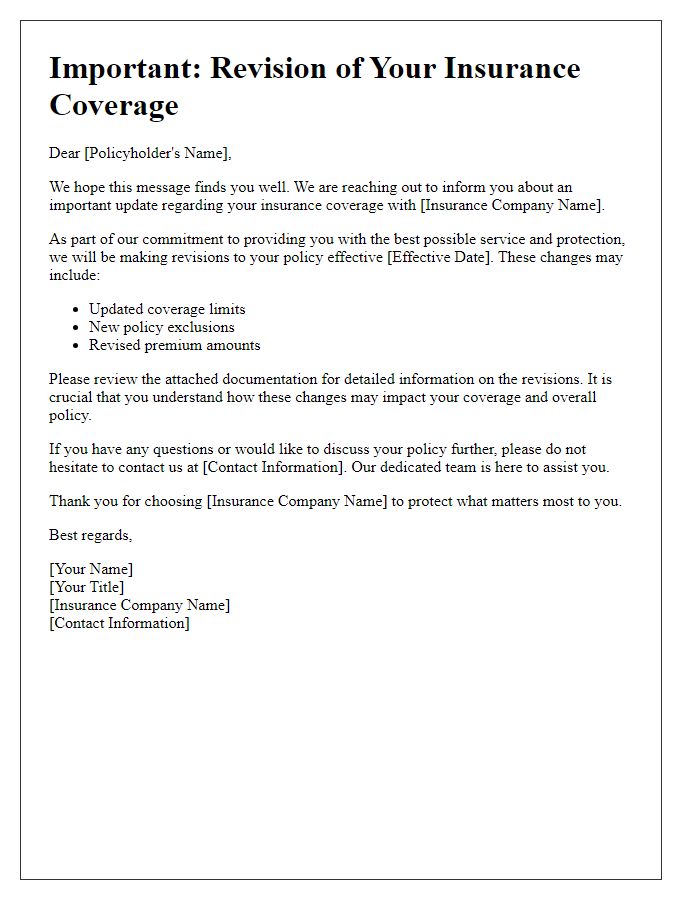

Details of the policy update

Insurance policy updates often include changes to coverage, premium adjustments, or modifications in terms and conditions. For instance, a policyholder may be informed about an increase in liability coverage limits, which now provides up to $500,000 for third-party claims. An update might also specify alterations in deductible amounts, with homeowners now facing a higher deductible of $2,500 for storm-related damage. Furthermore, the notification may outline additional exclusions or included endorsements, like adding coverage for personal property against theft, enhancing protection. These updates typically provide a clear timeline for when the changes take effect, ensuring policyholders have adequate time to review and understand the new terms.

Effective date of changes

Insurance policy updates often include new coverage details or adjustments to premiums. For instance, a homeowner's insurance policy might change coverage limits for personal property, effective March 1, 2024. Adjustments could involve alterations to deductibles or premium rates, reflecting changes in risk assessments. Notifications typically emphasize clarity regarding the effective date, ensuring policyholders understand when these modifications take effect. Glossary terms like "deductible" (the amount paid out of pocket before insurance kicks in) and "coverage limits" (the maximum amount an insurer will pay for a covered loss) may appear in the communication to enhance understanding.

Contact information for inquiries

Insurance policy updates can significantly impact the coverage provided to policyholders. Notification of these changes should clearly include updated contact information, allowing clients to inquire about specifics regarding their policy modifications. For instance, insurance companies such as State Farm or Allstate typically provide a dedicated customer service phone number (often available 24/7 for immediate assistance) and a user-friendly email address. Additionally, including online chat options through the company's official website can enhance accessibility for clients. Ensuring policyholders have multiple avenues to get clarification on their insurance policy changes enhances customer satisfaction and transparency.

Comments