When it comes to ensuring peace of mind, receiving your insurance policy confirmation is a crucial step in the process. This letter serves as an official acknowledgment of the coverage you've chosen, providing clarity on the terms and benefits included in your plan. It's not just a formality; it's a vital piece of communication that solidifies your protection against unexpected events. Ready to learn more about what your policy entails? Keep reading!

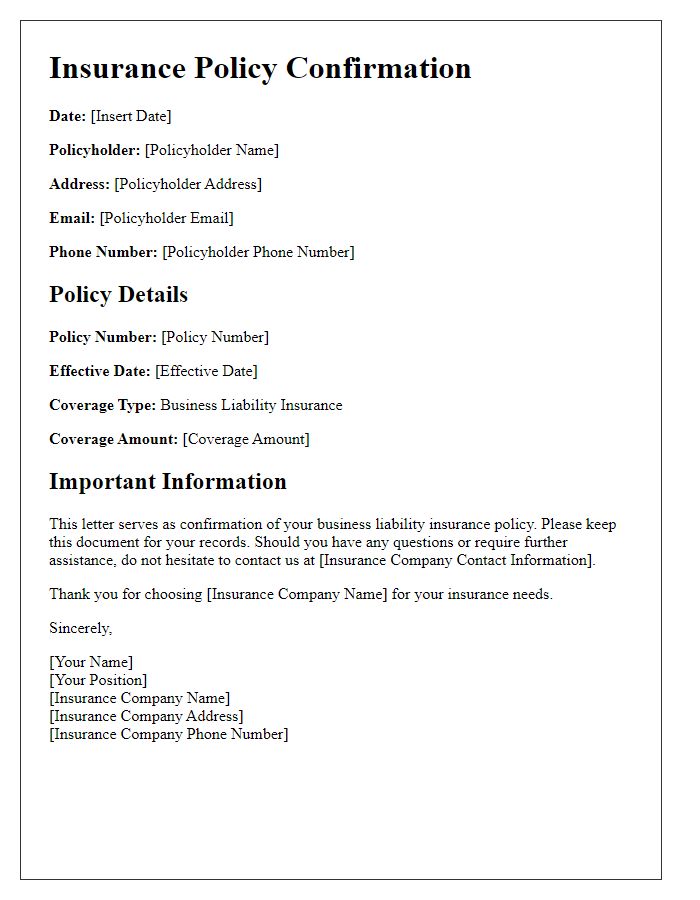

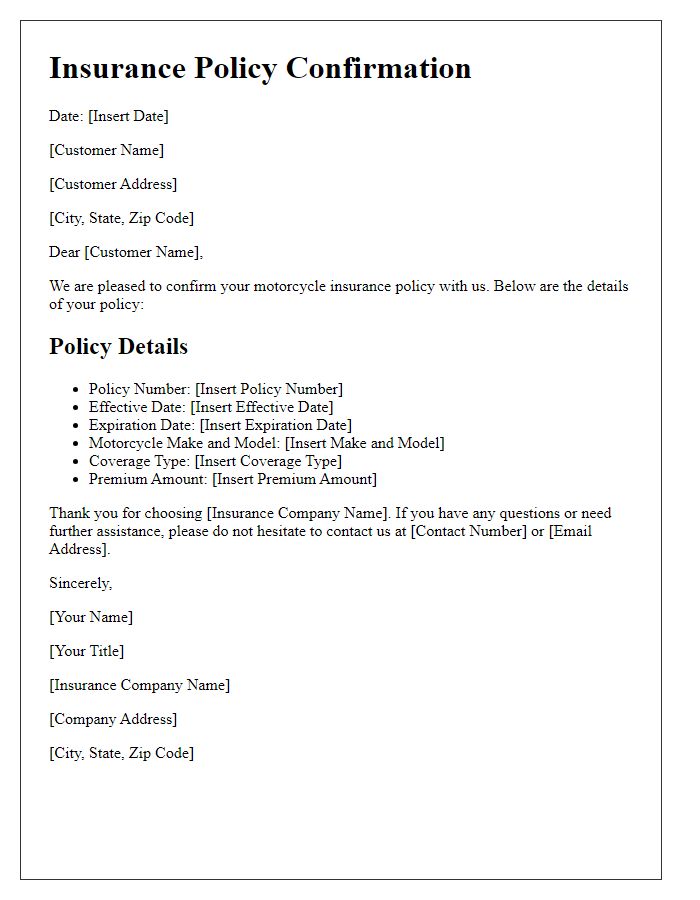

Policyholder information

An insurance policy confirmation serves as a crucial document for policyholders, highlighting vital details about their coverage. The policyholder's name, such as John Smith, must be prominently displayed along with the policy number, which may be unique like ABC123456. Essential coverage dates are also included, specifying the policy's effective date, for example, January 1, 2024, and the expiration date, such as January 1, 2025. The type of insurance coverage, like comprehensive auto insurance, is outlined to clarify what is included. Additionally, the deductible amount, which could be $500, is specified. Information about the insurance provider, such as XYZ Insurance Company located in Springfield, adds further context. A summary of key terms and conditions ensures policyholders understand their rights and responsibilities.

Policy details

Insurance policy confirmation serves as an essential document that outlines critical details of the insurance coverage. For example, an auto insurance policy might include the policy number (123456789), effective dates (January 1, 2023, to December 31, 2023), and premium amounts (monthly installment of $150). Coverage types, such as liability (up to $500,000), collision, and comprehensive, define the extent of protection for the insured vehicle in different scenarios. Additionally, the insured party's information, including their name (John Doe) and address (123 Main Street, Springfield, IL), establishes the connection between the policy and the policyholder. Furthermore, details regarding deductibles (e.g., $500 for collision coverage) help clarify the financial responsibilities in the event of a claim. Understanding these aspects ensures that both parties, the insurer and the insured, have clear expectations and insights into the terms of the agreement.

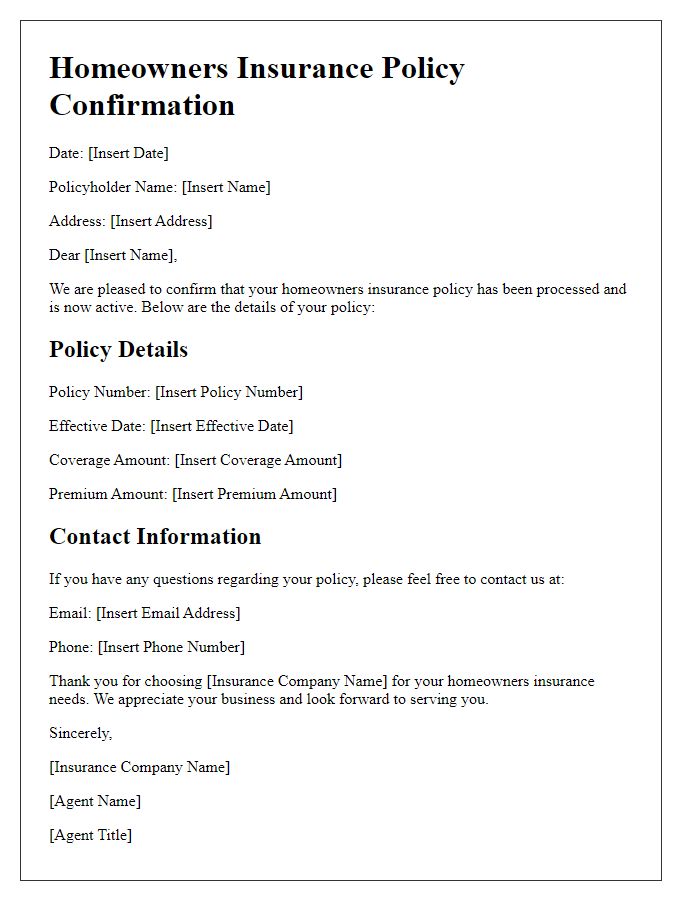

Coverage summary

Insurance policy confirmation provides a detailed overview of the coverage terms and conditions for a specific policy, typically including sections like liability limits, premium rates, and deductibles. For instance, a policy covering home insurance might outline dwelling coverage up to $300,000, personal property coverage valued at $150,000, and additional living expenses coverage of $20,000, detailing circumstances under which claims can be made. Other essential components often include exclusions, endorsements (for additional coverage), and policy number for reference, ensuring policyholders understand their rights and responsibilities. Each aspect of the coverage summary is crucial for clarifying the extent of financial protection against various risks, such as fire, theft, or natural disasters.

Payment terms

Insurance policy confirmations often outline payment terms and conditions that ensure both parties understand their financial obligations. The payment schedule typically includes specific dates (such as quarterly or monthly installments) and total premium amounts, which may vary based on coverage type and insured assets. Policyholders must familiarize themselves with any fees related to late payments or missed deadlines, as these can impact coverage validity. Additionally, understanding grace periods (commonly around 30 days) is essential, as they allow policyholders to rectify payment issues without immediate penalties.

Contact information

Insurance policy confirmation ensures clarity on policyholder details, coverage specifics, and contact information for customer service. Policyholders must provide accurate contact details, including the primary address (like 123 Main St, Springfield, IL), phone numbers (e.g., (555) 123-4567), and email addresses (example@example.com) for efficient communication regarding claims or inquiries. This information is critical for policy renewal notices, updates, and important policy changes that may occur throughout the policy term. Regularly updating contact information ensures uninterrupted communication from the insurance provider to the policyholder.

Letter Template For Insurance Policy Confirmation Samples

Letter template of insurance policy confirmation for business liability insurance.

Letter template of insurance policy confirmation for motorcycle insurance.

Comments