As we approach your business insurance renewal date, it's essential to revisit your coverage to ensure it aligns with your current needs. Staying protected not only safeguards your assets but also gives you peace of mind in an ever-changing market. Many businesses overlook important updates that could enhance their policies, leaving them vulnerable to unexpected risks. Join us as we explore the key aspects of business insurance renewal and how you can maximize your coverageâkeep reading to learn more!

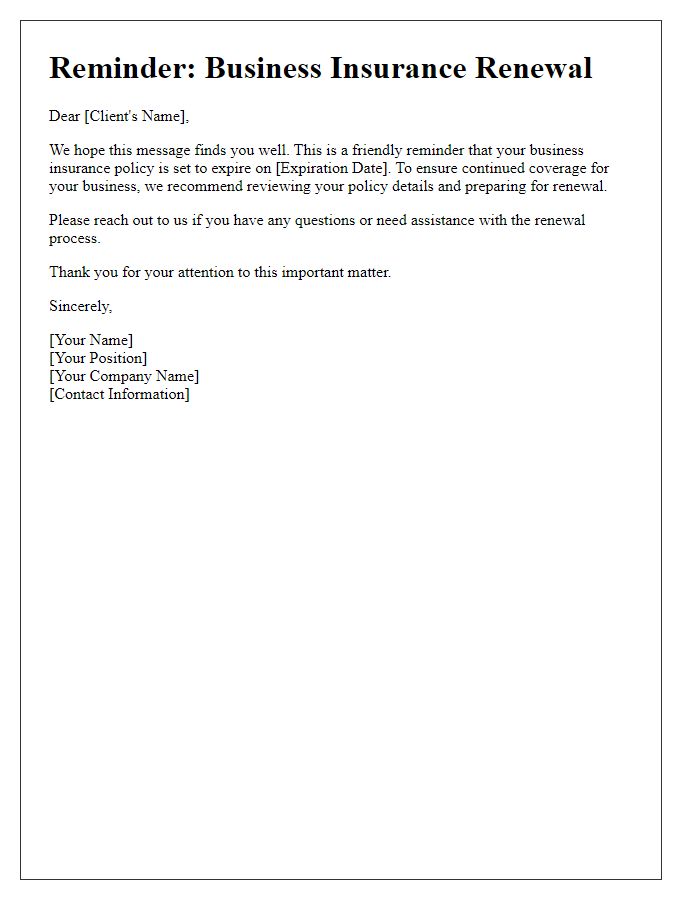

Comprehensive subject line

Business insurance renewal reminders serve as essential notifications for maintaining adequate coverage. Effective communication ensures timely updates about policy expiration dates, premium adjustments, and coverage details. A comprehensive subject line can capture recipient attention while highlighting urgency. For example, "Reminder: Your Business Insurance Policy Renewal is Approaching - Act Now for Continued Coverage!" Indicating specific dates or policy changes enhances clarity, encouraging prompt action from business owners to secure necessary insurance protection and avoid potential lapses in coverage.

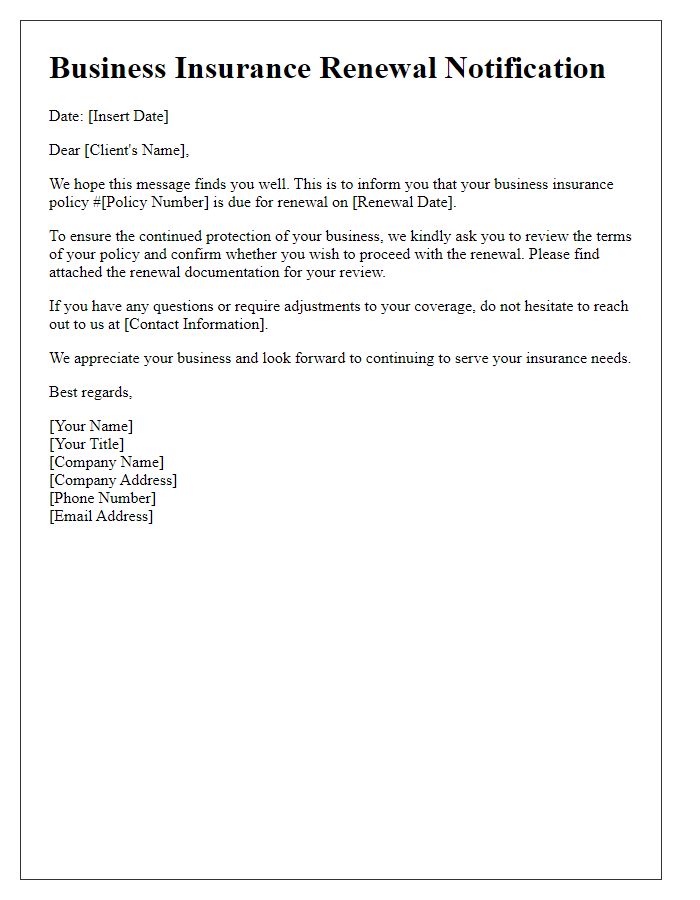

Personalized greeting

Personalized greeting serves as the introductory element in a business insurance renewal reminder letter template. This essential component addresses the recipient by name, fostering a sense of rapport and professionalism. Tailoring the greeting enhances engagement and reflects a commitment to personalized service. Utilizing the client's name and company title emphasizes the importance of the relationship, reinforcing trust and reliability crucial in the insurance sector. Such a thoughtful approach encourages recipients to review their policy updates and promotes timely responses, ultimately benefiting both parties involved in the renewal process.

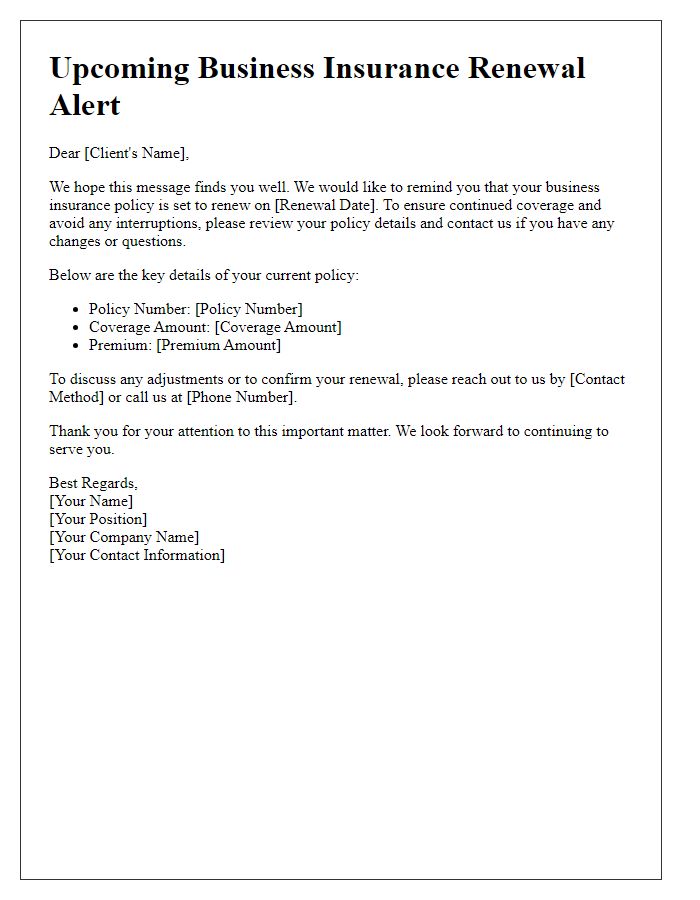

Renewal details and deadlines

Business insurance renewal is crucial for maintaining coverage and protecting assets. Renewal deadlines typically fall within 30 days before the policy expiration date, which varies by insurer. For instance, a policy that expires on March 15 requires a review and renewal process to begin no later than February 14. Businesses should carefully examine renewal quotes, ensuring essential coverage types such as General Liability Insurance, Property Insurance, and Workers' Compensation remain adequate. It is advisable to consult with an insurance agent to discuss potential changes in premium rates and coverage limits, considering factors like business growth or shifts in risk exposure. Timely renewal prevents lapses in coverage, ensuring ongoing protection against unforeseen events like natural disasters or legal claims.

Benefits of continued coverage

Renewing business insurance offers crucial protection against unforeseen risks. Comprehensive coverage safeguards against financial losses resulting from property damage, liability claims, or employee injuries. An estimated 40% of small businesses face significant disruptions due to incidents like theft or natural disasters each year. Continuous coverage ensures compliance with legal requirements, avoiding potential fines. Partnering with established insurance providers can enhance risk management strategies while offering tailored solutions that adapt to evolving business needs. Maintaining uninterrupted coverage solidifies client trust and ensures operational stability, vital for sustained growth in competitive markets.

Clear call-to-action

Business insurance plays a crucial role in protecting companies from potential risks and liabilities, ensuring financial stability during unforeseen events. Annual renewal ensures coverage continues seamlessly, allowing for adjustments in terms of policy limits (like General Liability or Property Insurance) and specific endorsements (such as Business Interruption or Cyber Liability). Policyholders must review their coverage needs based on changing operations and potential risks, alongside regulatory requirements. Renewal deadlines often fall at the end of the fiscal year, emphasizing the importance of early engagement with insurers to avoid lapses in coverage and ensure premium adjustments (based on loss history and market conditions). Taking action now facilitates a smooth renewal process and affirms compliance with industry standards.

Comments