Have you ever found yourself needing to cancel an insurance policy and wondering how to effectively communicate that decision? A well-crafted cancellation letter not only confirms your intent to discontinue coverage but also ensures you have a record for your files. It's important to include crucial details such as your policy number and the date you wish the cancellation to take effect. Curious about the specifics on how to create an effective cancellation confirmation letter? Keep reading to delve deeper into our comprehensive template!

Policyholder Information

For insurance cancellation confirmations, clear and precise communication is crucial. Policyholder information should include the individual's full name, policy number, contact information, and the effective cancellation date. Essential details like the type of insurance, for instance, auto or health insurance, should also be specified to eliminate any ambiguity. The confirmation should state the reasons for cancellation, whether voluntary or due to non-payment, and outline any final steps or consequences, such as potential refunds or coverage lapses. Clear language maintains professionalism and enhances trust during the cancellation process.

Policy Number

A policy cancellation confirmation serves to inform customers about the successful termination of their insurance coverage. An example of an important related detail is the policy number, which uniquely identifies the customer's insurance agreement, ensuring accurate processing of the cancellation request. Insurance providers often include the effective cancellation date, which marks the end of coverage. Customers should also receive information regarding any potential refunds or outstanding premiums due after cancellation. Clear communication through confirmation letters can prevent misunderstandings regarding coverage status and financial obligations.

Effective Cancellation Date

Upon receiving the request for insurance policy cancellation, the effective cancellation date will be set to the last day of the current coverage period, typically corresponding to the next premium due date. This provides the policyholder with a clear understanding that all benefits under the policy cease thereafter. Policy number specifics, along with any relevant terms regarding the cancellation process and potential refunds, will be included in the confirmation documentation. Supporting contact information for inquiries will also be provided to ensure clarity and facilitate any future communication regarding insurance needs.

Confirmation of No Outstanding Payments

Insurance policy cancellation is a vital process for policyholders. Confirmation of no outstanding payments is necessary to prevent future liabilities. Accidental Insurance Companies, such as Allstate and State Farm, typically issue cancellation notices within 30 days. Policyholders should verify payment history through user accounts or customer service, ensuring all obligations are settled. Documentation of cancellation is crucial for future reference, especially if issues arise, affecting claim eligibility. Retaining a copy of the confirmation can aid in addressing possible discrepancies, safeguarding against unintentional premium charges.

Contact Information for Queries

Insurance cancellation confirmation typically requires clear communication and accessibility for further inquiries. Acknowledging the cancellation of an insurance policy, customers can find contact information (such as telephone numbers, email addresses, or office locations) presented in a straightforward manner. For instance, dedicated customer service representatives are often available from 9 AM to 5 PM (local time) on weekdays. This ensures that clients can quickly resolve any questions regarding their account status, final billing statements, or potential refunds. Providing multiple contact methods, including online chat options or direct phone lines, enhances customer experience, ensuring effective and responsive communication.

Letter Template For Insurance Cancellation Confirmation Samples

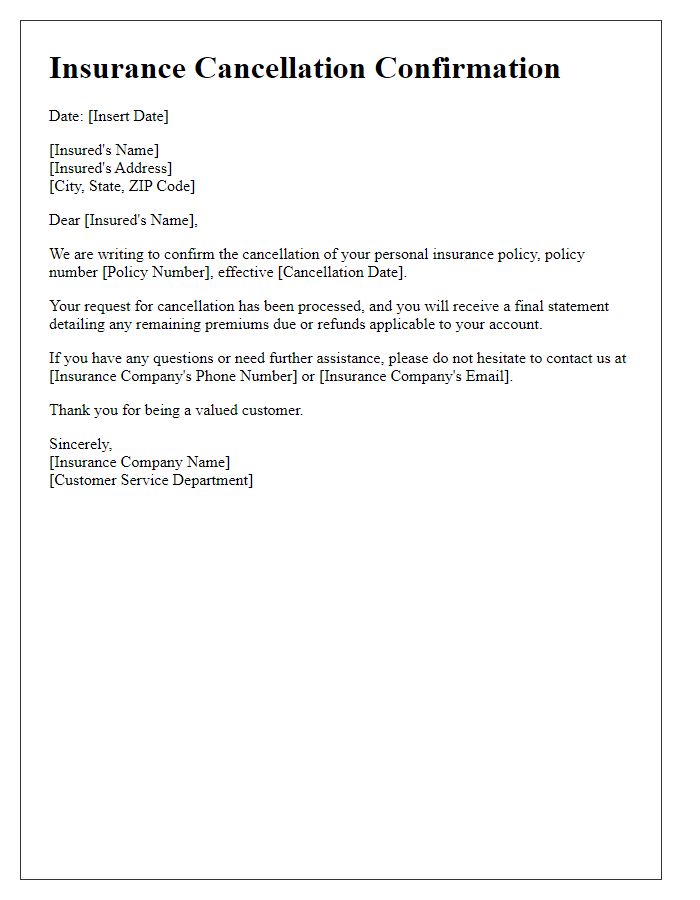

Letter template of insurance cancellation confirmation for personal policy

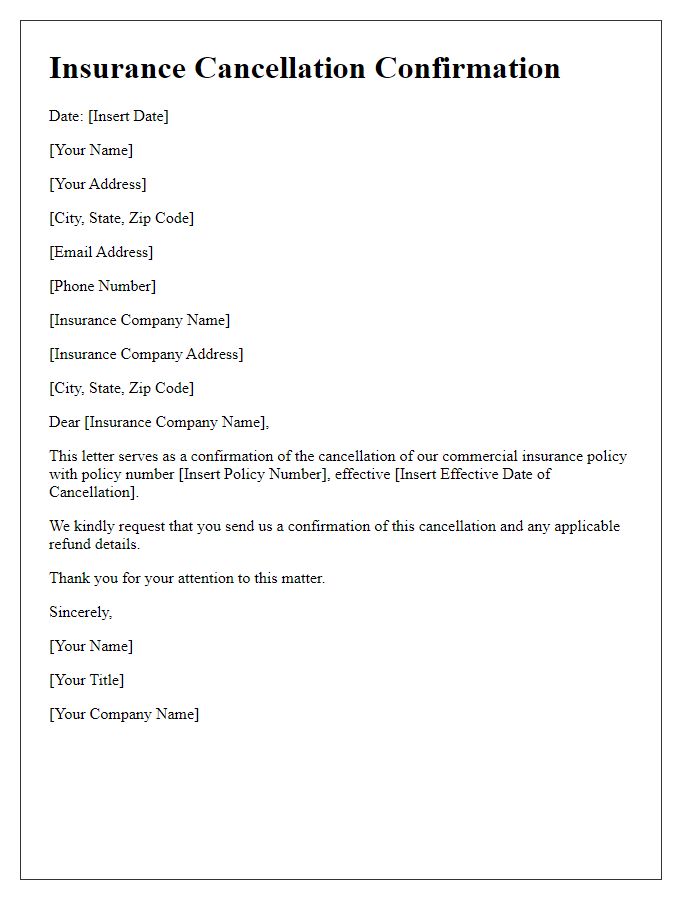

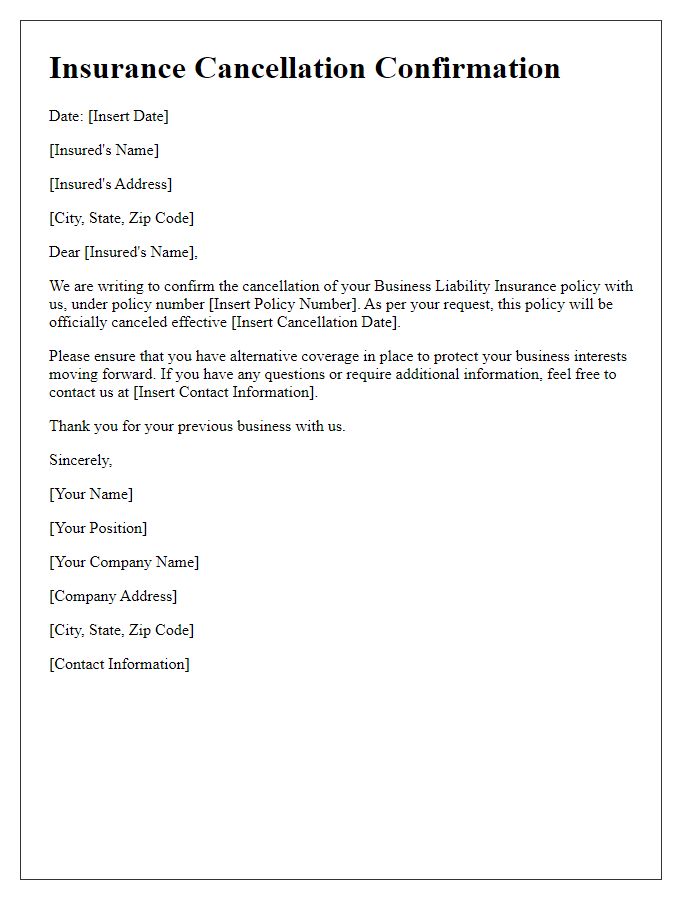

Letter template of insurance cancellation confirmation for commercial policy

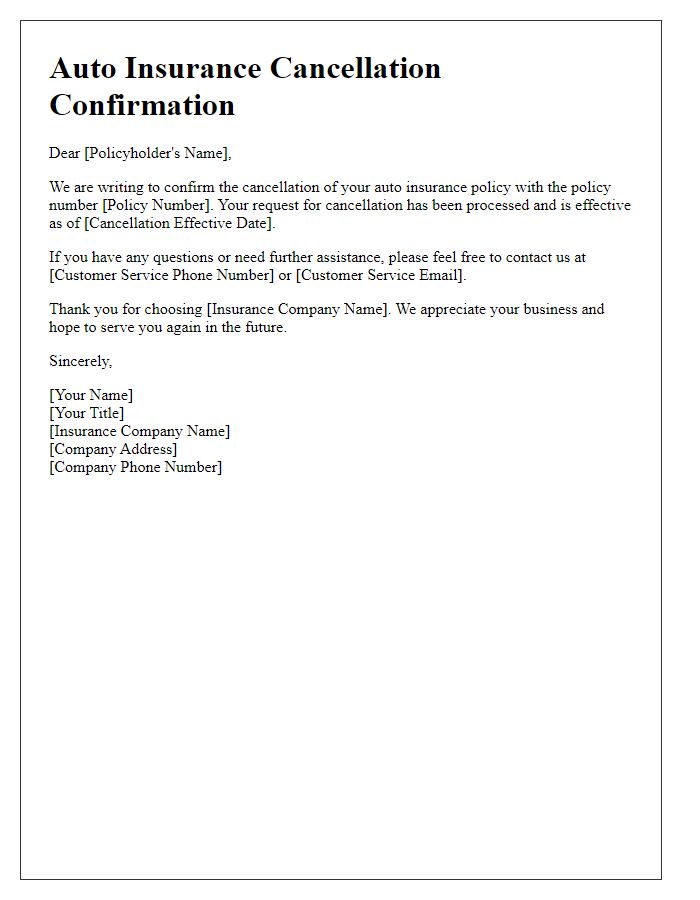

Letter template of insurance cancellation confirmation for auto insurance

Letter template of insurance cancellation confirmation for health insurance

Letter template of insurance cancellation confirmation for home insurance

Letter template of insurance cancellation confirmation for life insurance

Letter template of insurance cancellation confirmation for travel insurance

Letter template of insurance cancellation confirmation for renters insurance

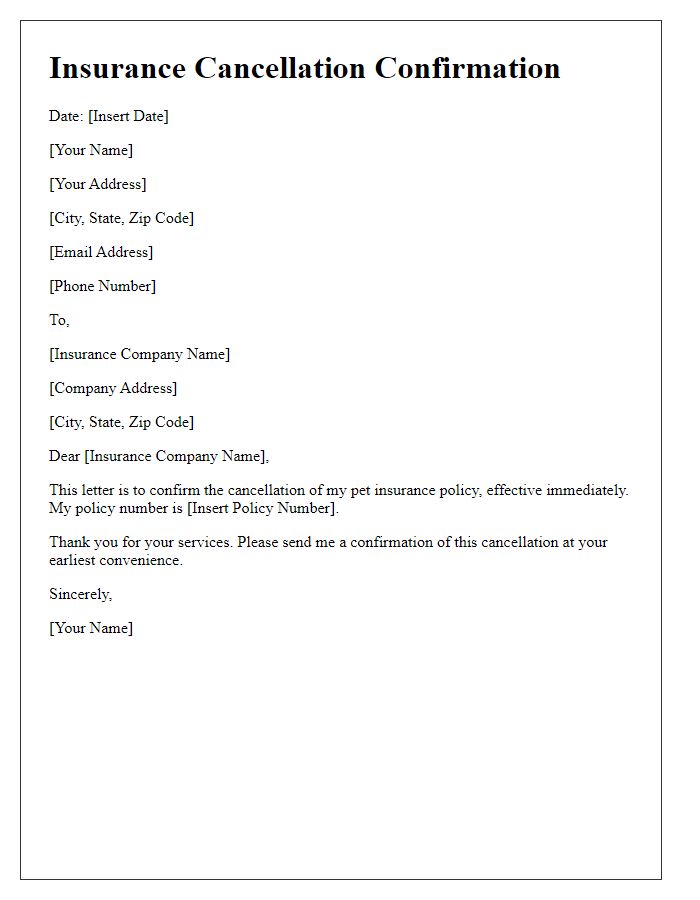

Letter template of insurance cancellation confirmation for pet insurance

Comments