Setting up an inheritance account can feel overwhelming, but it doesn't have to be! This article will guide you through the essential steps to ensure a smooth transition of assets while keeping everything organized. From understanding the necessary documents to selecting the right financial institution, we've got you covered on every front. So, if you're ready to take control of your inheritance process, let's dive in and explore more!

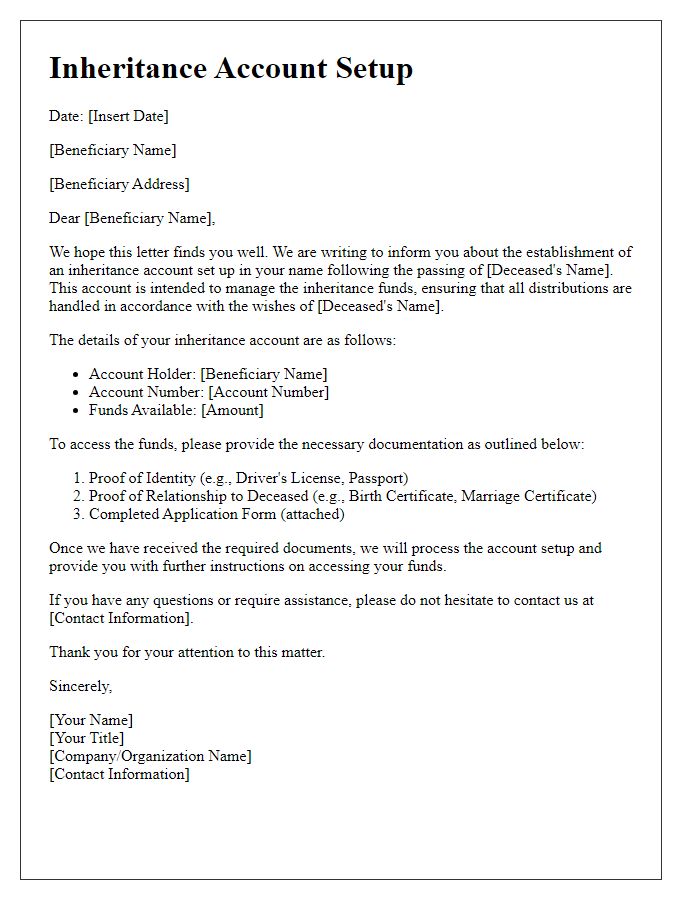

Beneficiary Information

Beneficiary information is crucial for the inheritance account setup process, ensuring that the rightful heirs receive their assets without delay. Typically, individuals provide details such as full name, date of birth, Social Security number, and contact information of each beneficiary, which may include children, spouses, or other relatives. The account information often requires a designation of percentages or specific assets assigned to each beneficiary, possibly involving multiple beneficiaries with unique allocation amounts. It is essential to verify the beneficiaries' identities to prevent fraud and ensure compliance with applicable estate laws. Documentation like a copy of the will or trust can also be necessary to facilitate a smooth transition of property after an individual's passing.

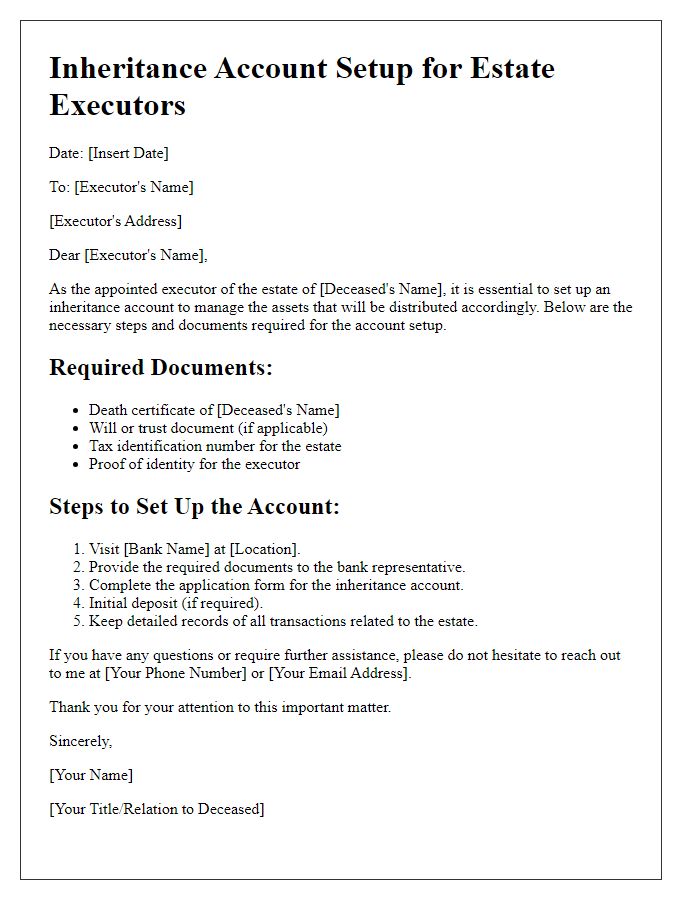

Executor Details

The role of an executor is crucial in managing an estate's financial responsibilities after a loved one's passing, encompassing a wide array of tasks such as settling debts and distributing assets. The executor, often appointed in a will, is responsible for overseeing the probate process, which may take place in various jurisdictions depending on the estate's size and complexity. Executor details typically include the individual's full name, contact information, and their relationship to the deceased, which can provide vital insights into the management of the estate. Additionally, executors may need to handle specific tasks pertinent to the inheritance account setup, such as obtaining a Tax Identification Number (TIN) for the estate, managing bank accounts linked to the estate, and ensuring compliance with state laws regarding inheritance distribution.

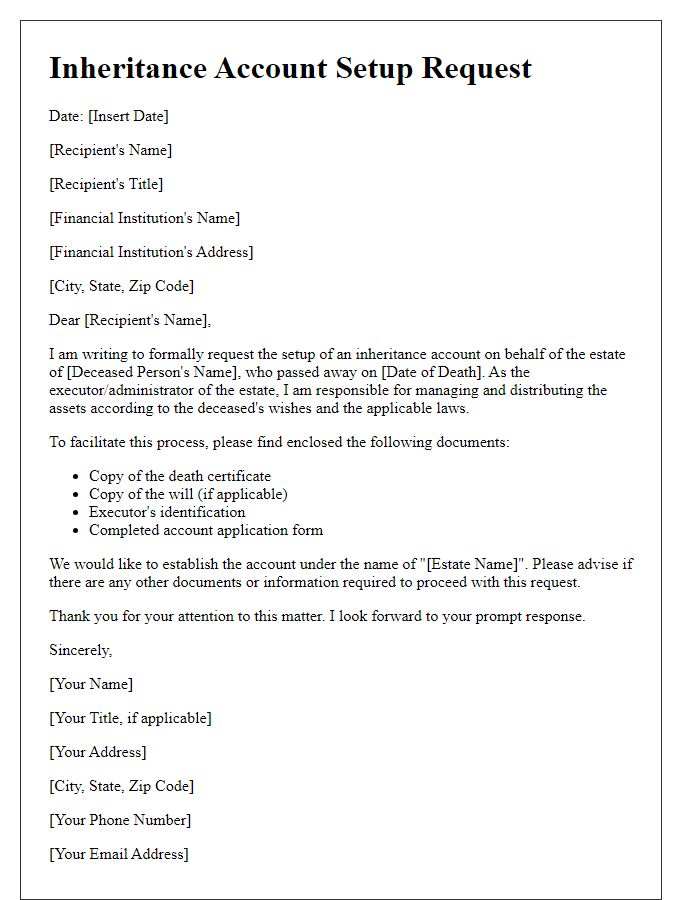

Legal Documentation Required

Establishing an inheritance account involves submitting precise legal documentation to the financial institution, such as a bank or investment firm. Essential documents typically include the death certificate of the deceased individual (the decedent), displaying the date of death which is crucial for establishing the timeline of asset distribution. The last will and testament must accompany this, outlining the specific bequests and the appointed executor (often a family member or attorney), while letters testamentary provide legal authority for the executor to manage the estate. Beneficiary designation forms may also be required, particularly if certain assets bypass probate, enabling direct transfer to named heirs. Identification documents of the heirs, including government-issued ID cards or social security numbers, must be presented alongside any relevant trust documents if the estate is managed under a trust. Furthermore, tax documents, including federal estate tax returns (Form 706) if applicable, may be necessary to clarify tax obligations associated with the inheritance. Each institution may have specific requirements, so confirming these prior to submission is advisable to expedite the account setup process.

Account Access Instructions

Setting up an inheritance account involves several essential steps to ensure proper access and management of inherited assets, particularly following the transition of ownership after a loved one's passing. Beneficiaries must typically gather important documents including the death certificate, will (if applicable), and any pertinent estate documentation required by financial institutions such as banks or investment firms. It's crucial to contact the specific financial institution where the inheritance account is held, providing necessary identification and documentation for verification purposes. Additionally, beneficiaries may need to complete forms for account transfer, specifically designed to facilitate the transition of assets into the new account holder's name. Understanding the institution's policies on account fees, minimum balance requirements, and available account types, such as joint or custodial accounts, aligns with financial regulations and enhances asset management effectively.

Contact Information for Queries

Setting up an inheritance account requires essential contact information for efficient communication regarding queries. Names of legal representatives, such as executors or administrators, must be clearly listed, including their full names, addresses, phone numbers, and email addresses. In addition, include vital data for any financial institutions involved, such as bank names, branch addresses, and customer service phone numbers. Important legal contact details should also be provided, such as the attorney handling the estate, specifying their law firm name and contact information. Furthermore, beneficiaries may require their own contact information to facilitate the distribution process. Providing comprehensive and accurate contact information streamlines the resolution of any inheritance-related queries and ensures timely management of the account setup.

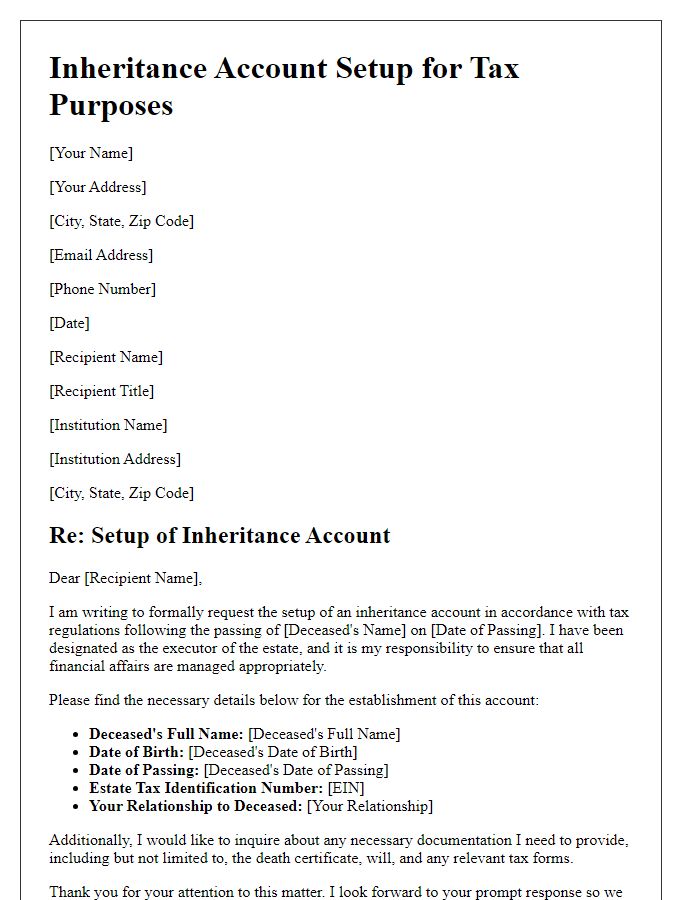

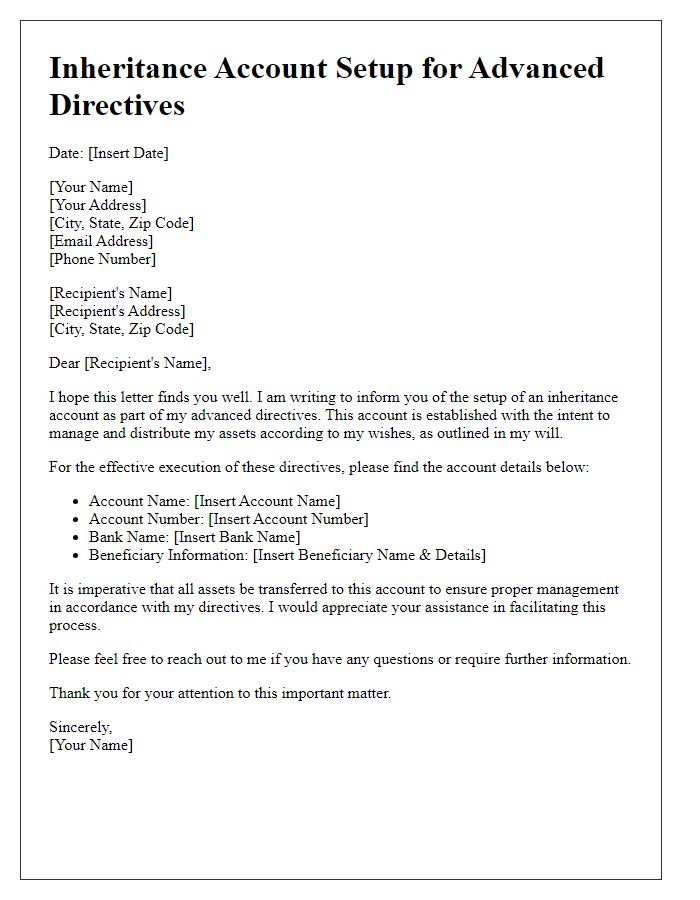

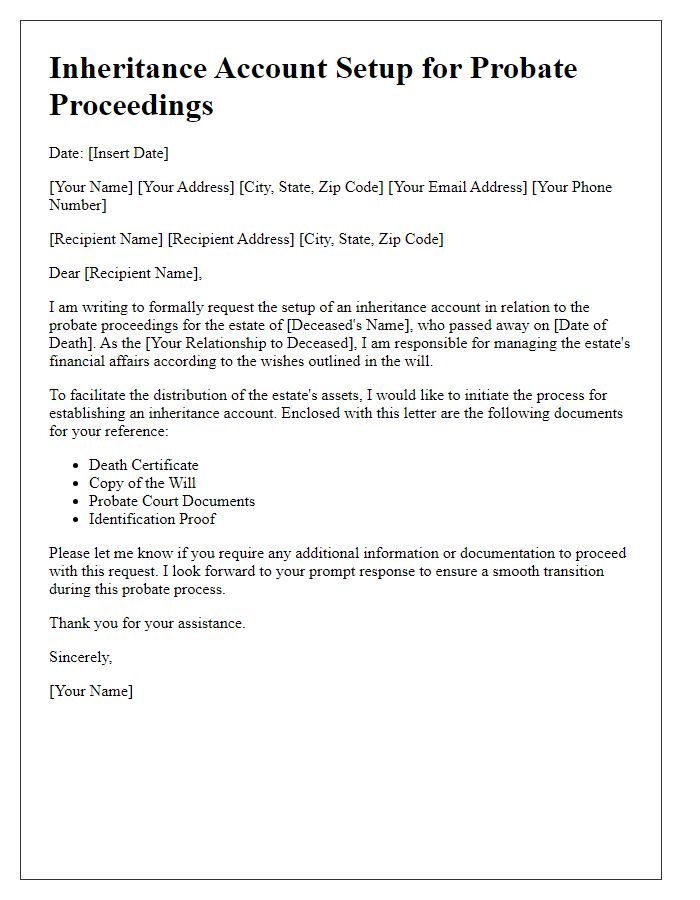

Letter Template For Inheritance Account Setup Samples

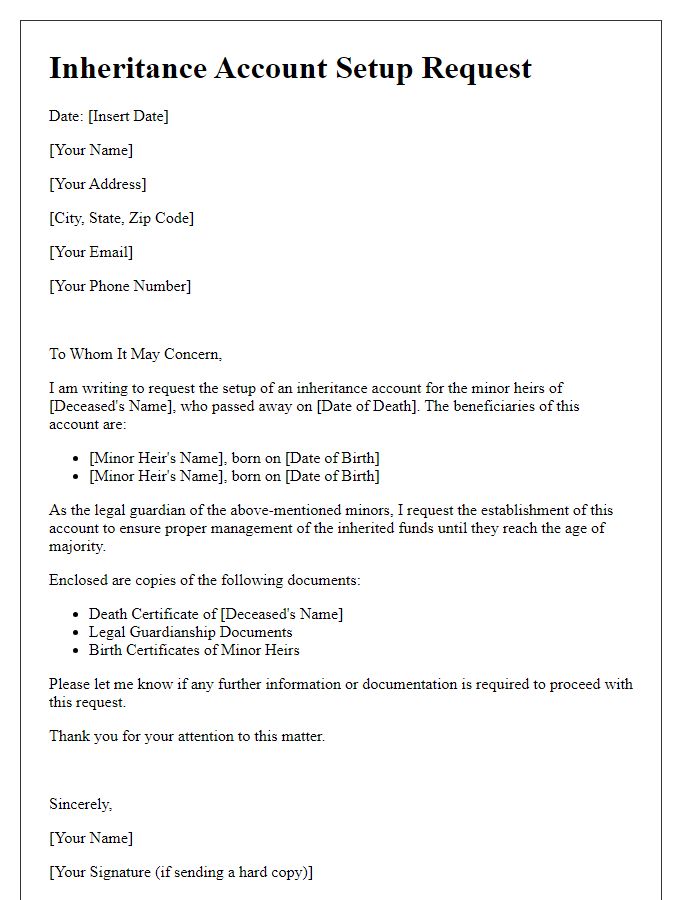

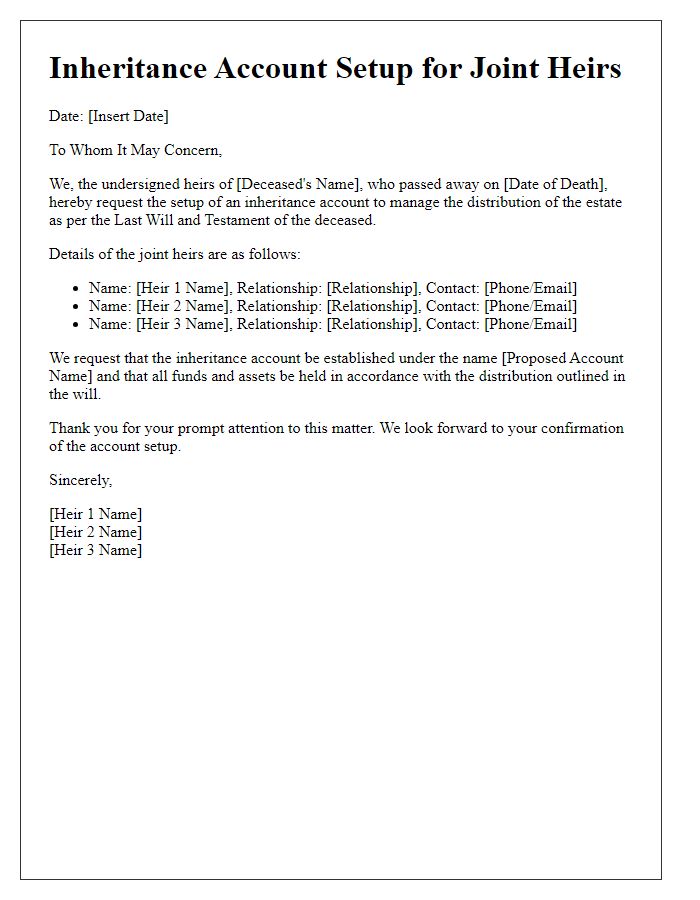

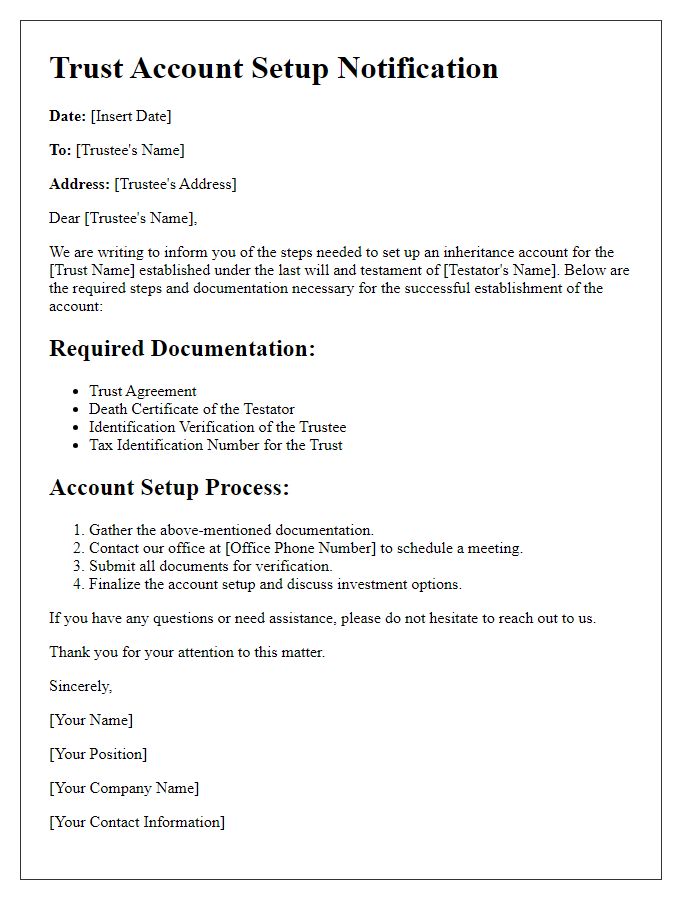

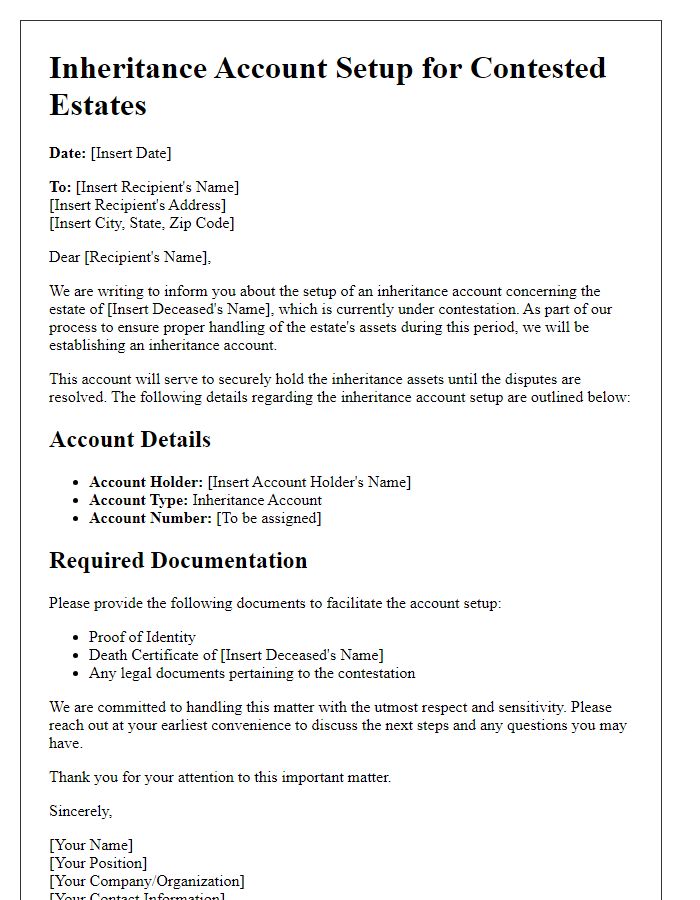

Letter template of inheritance account setup for financial institutions.

Comments