Are you feeling overwhelmed by the process of requesting a refund for an overpayment? You're not alone! In fact, many people find themselves in a similar situation, unsure of how to effectively communicate their request. In this article, we'll guide you through the essential steps and provide a useful letter template to help you secure your hard-earned money backâso keep reading!

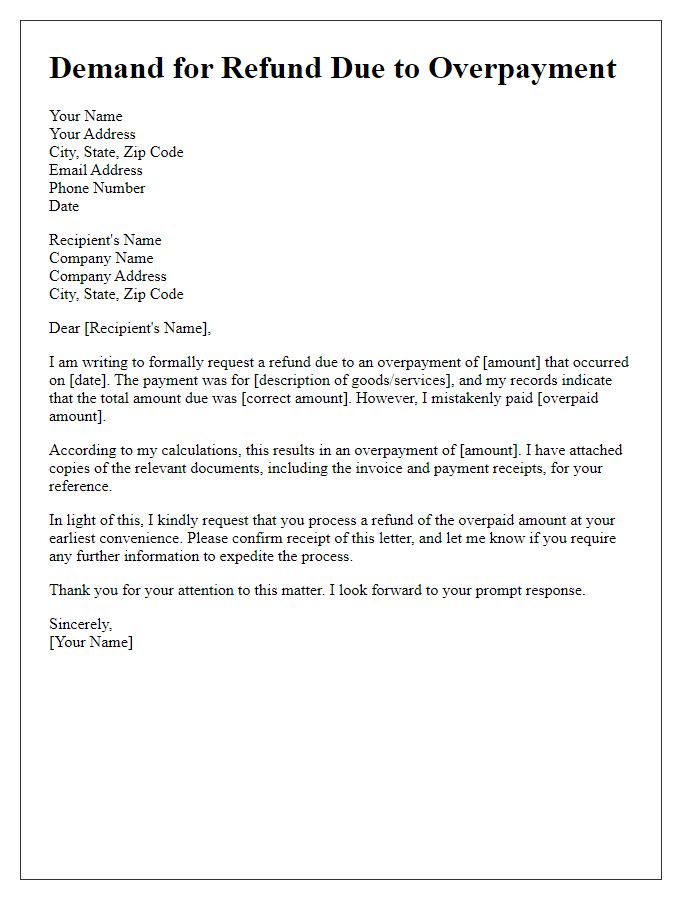

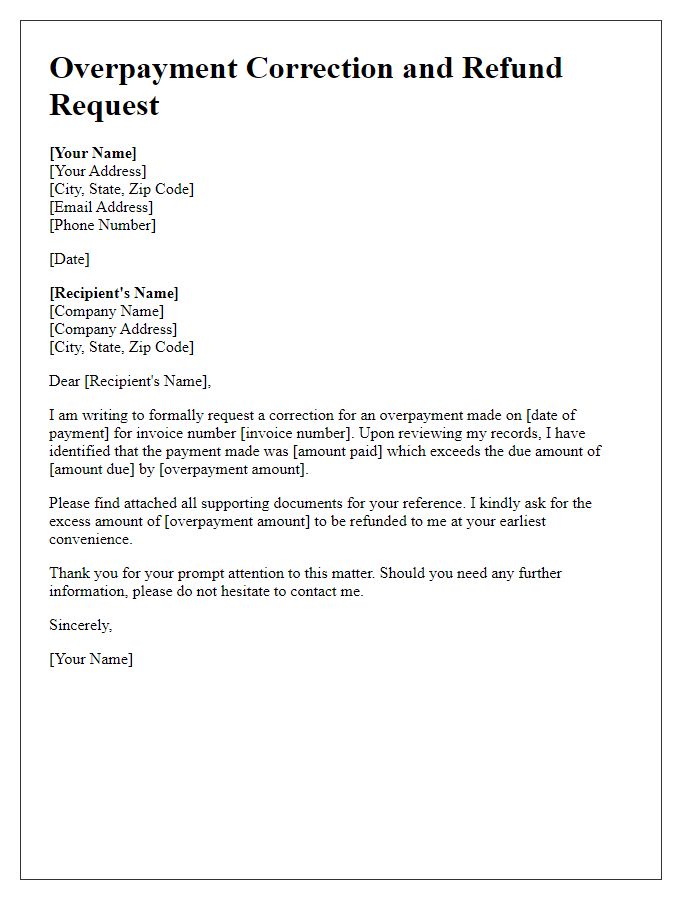

Clear identification of overpayment details

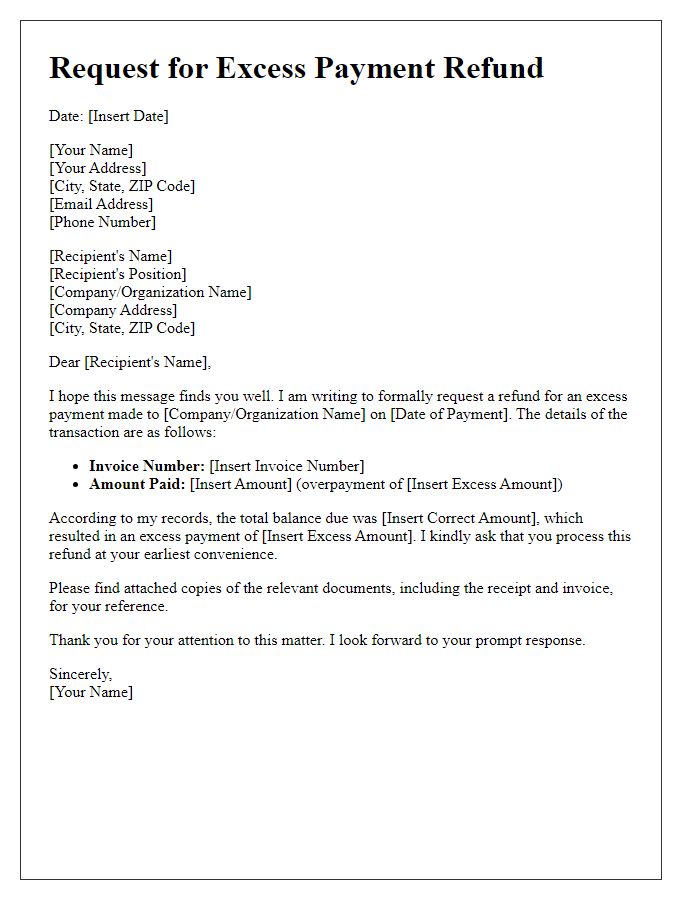

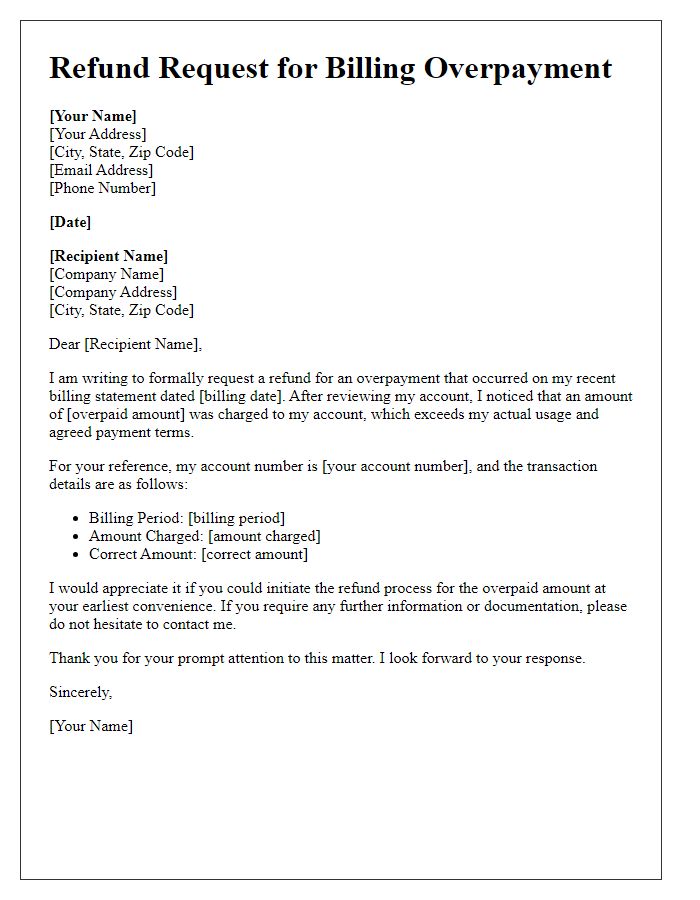

An overpayment refund request involves specifying essential details such as the transaction date, reference number, and amount overpaid. A precise breakdown of the payment items helps clarify discrepancies. For instance, in a recent invoice dated September 15, 2023, referencing Invoice #456789, a payment of $500 was intended for services rendered. However, a charge of $600 was processed, resulting in an overpayment of $100. Including the payment method, like a credit card ending in 1234, can aid verification. Clearly stating the request for a refund and providing contact information enhances communication efficiency regarding the resolution process.

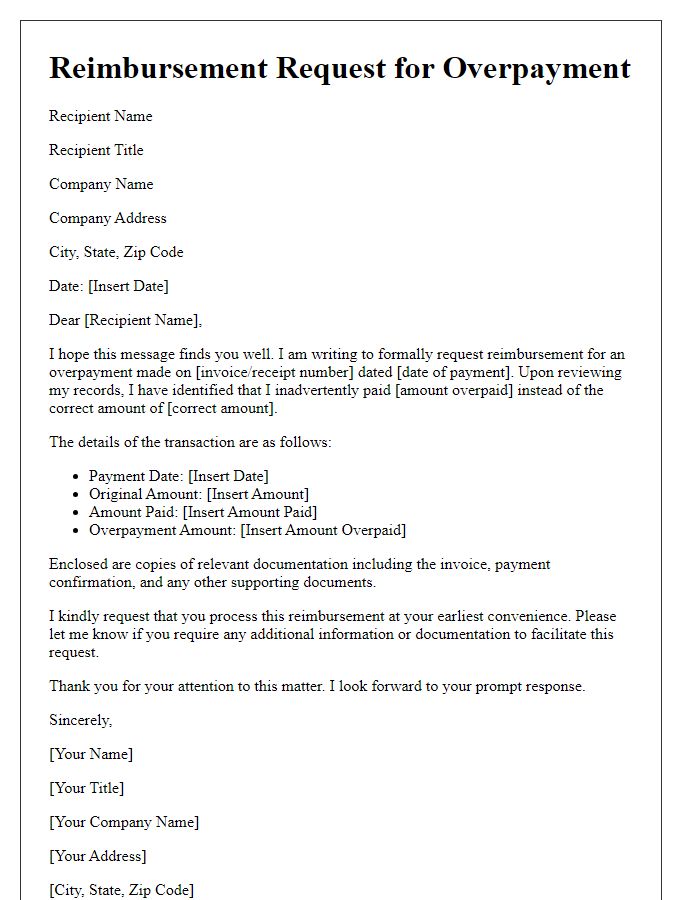

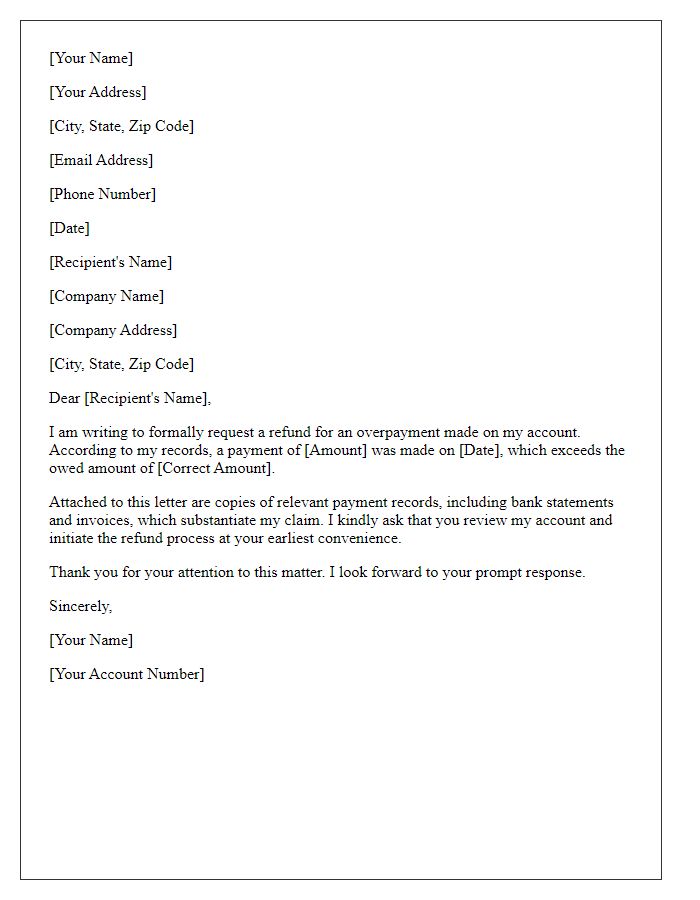

Request for specific refund amount

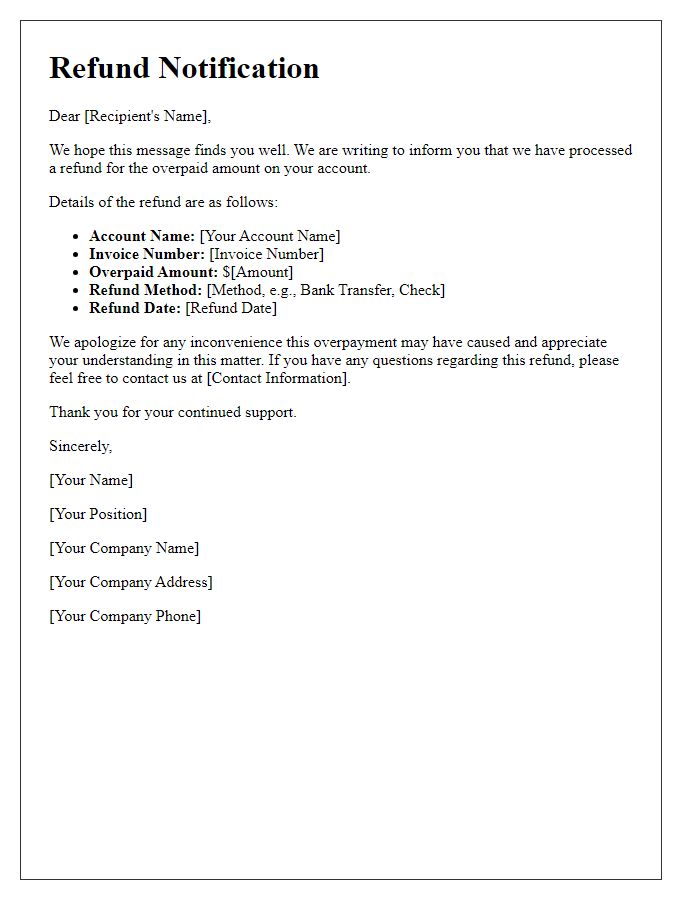

An overpayment on an account can lead to financial discrepancies, necessitating a formal refund request. For example, consider an invoice totaling $500 submitted to ABC Services for services rendered in September 2023. An error occurred in processing, resulting in a payment of $600 from XYZ Corporation. The overpayment amount of $100 requires rectification. To initiate the refund, a detailed request should specify the invoice number, the date of the payment, and identify the exact overpayment amount. Accurate information facilitates prompt processing of the refund, alleviating potential financial strain caused by incorrect billing matters.

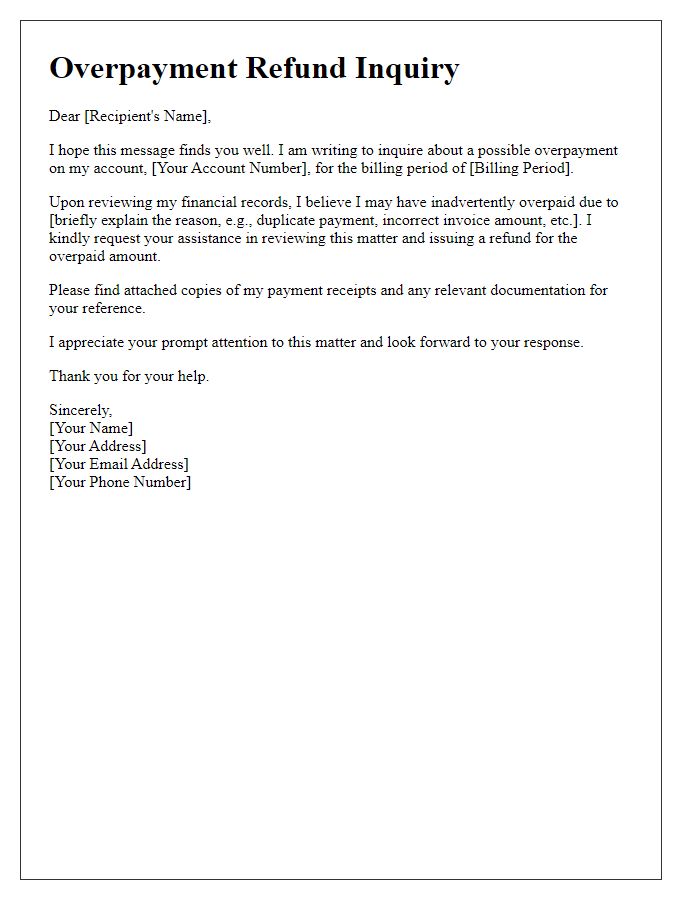

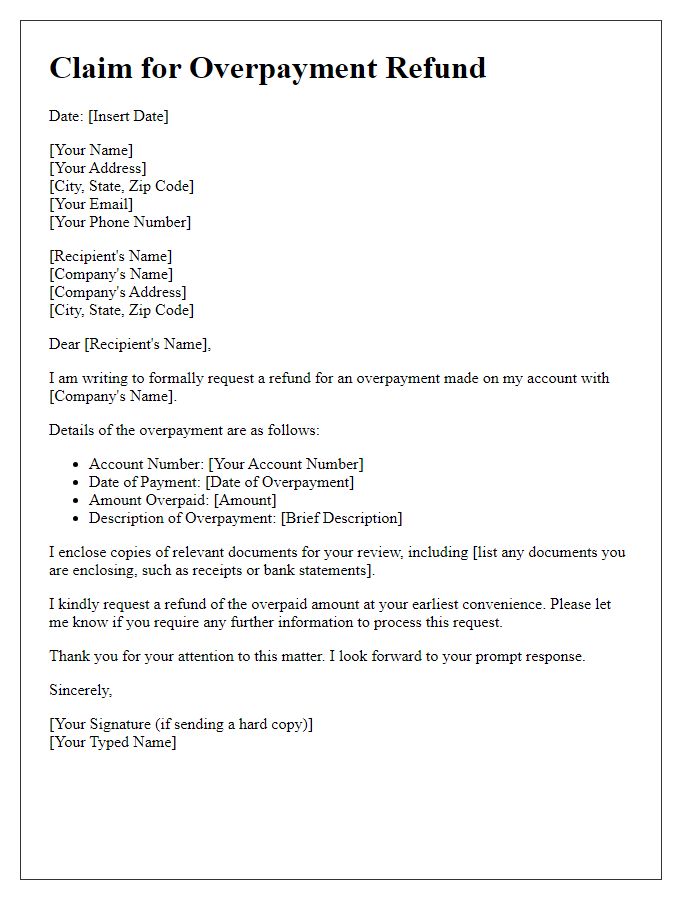

Documentation and proof of overpayment

Individuals often encounter situations involving overpayment, necessitating a formal request for refunds to recover excess amounts paid. Essential documentation for this process may include receipts, invoices, or bank statements highlighting the discrepancies in payment amounts against expected charges. Proof of overpayment should clearly denote the transaction dates, payment methods, and the precise amounts involved, ensuring clarity during the review process. Additionally, including reference numbers associated with the transactions can expedite the verification of the claim, particularly useful in resolution within corporate or institutional contexts such as utility companies or service providers. Effective communication through this formal request can significantly enhance the chances of prompt processing and successful reimbursement of the overpaid funds.

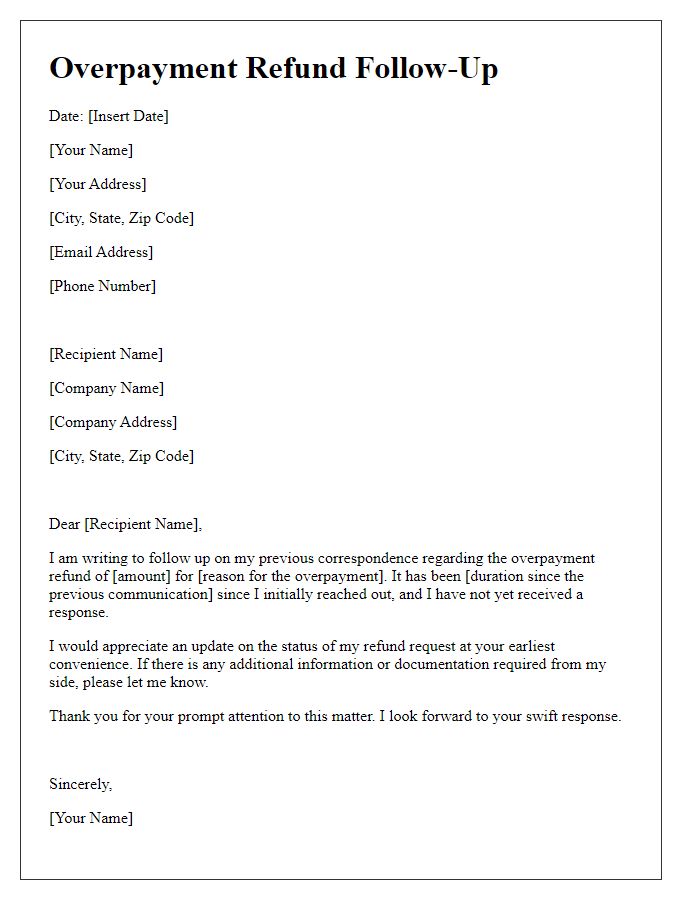

Contact information for follow-up

An overpayment refund request typically involves a detailed explanation of the situation, including transaction dates, specific amounts overpaid, and any relevant order numbers. Clearly articulated contact information for follow-up is crucial, including a primary phone number, secondary phone number, and a professional email address. Providing a physical mailing address may also be beneficial for any necessary documentation. Ensuring that the request includes a clear subject line such as "Overpayment Refund Request" and references any previous correspondence can facilitate a quicker response from the receiving organization or individual. Accurate information helps in tracking the request efficiently and ensures timely communication regarding the refund status.

Polite and professional tone

Overpayment on invoices can create financial discrepancies for businesses. In situations where companies, such as small enterprises or freelancers, accidentally remit excess funds due to errors in billing or miscommunications, timely resolution is essential. Formal requests for refunds should include accurate details, such as invoice numbers (for tracking), dates of transactions (to establish context), and specific amounts overpaid (to clarify the discrepancy). Inclusion of company names or the name of the financial department responsible can enhance the request's professionalism. Following guidelines established by accounting standards can also facilitate a smoother resolution, ensuring that all parties maintain positive relations while addressing financial matters.

Comments