Are you considering renewing your fixed deposit but unsure of the best way to approach your bank? Writing a clear and concise letter can make the process seamless and straightforward. In this article, we'll guide you through a simple template that ensures your request stands out and is processed swiftly. Join us as we explore the key elements to include and tips for a hassle-free renewal experience!

Accurate Account Information

Fixed deposit accounts, a common investment vehicle, require accurate details for effective management. When requesting renewal, essential account information includes the specific Fixed Deposit Account Number, the maturity date (often ranging from a few months to several years), and the interest rate applicable, which typically varies between financial institutions. Clear identification of the renewing tenure--ranging from 1 month to 10 years--ensures proper processing. Effective communication with banks, including localized banks like HDFC or SBI in India, requires adherence to policies, especially when updating nomination details, ensuring seamless continuation of investment benefits while avoiding penalties or disruptions.

Renewal Duration and Terms

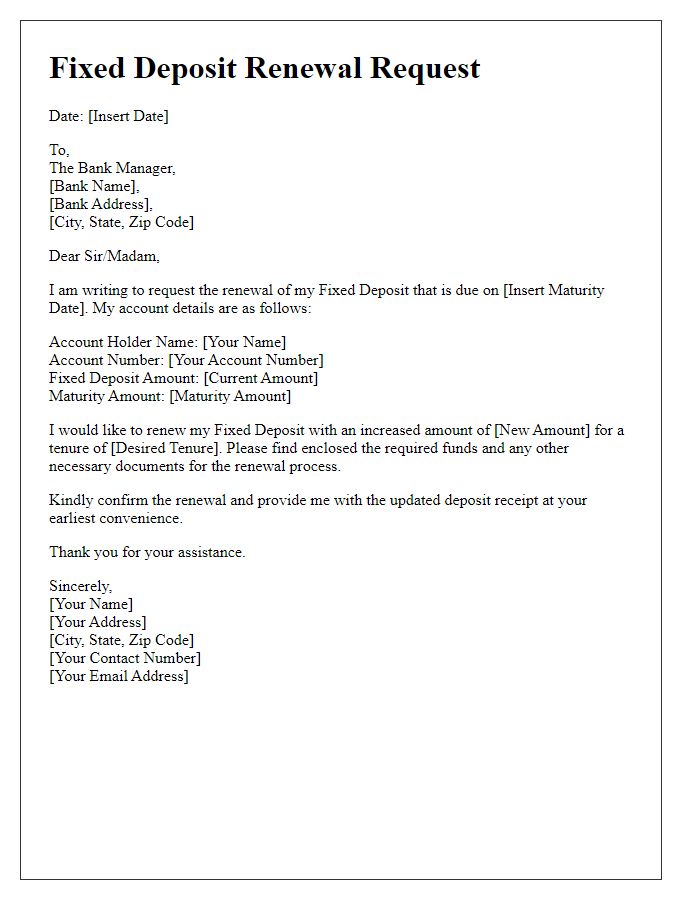

Fixed deposit renewals can be a crucial aspect of personal finance management, especially for individuals seeking to maximize interest earnings while maintaining savings security. Investors often consider various renewal durations, with typical options ranging from three months to five years, depending on financial goals and market interest rates. Financial institutions may also offer varied terms, including rolled-over principal and accrued interest or a new deposit amount based on changing economic conditions. Additionally, understanding the implications of compounding interest versus linear interest calculations can significantly impact the overall returns from fixed deposits.

Interest Rate Agreement

Fixed deposit renewal requests often involve crucial financial decisions and legal agreements. In banking institutions, fixed deposits (FD) are financial instruments with a fixed interest rate, typically higher than savings account rates, intended for a predetermined period. These requests should articulate specific terms, such as prevailing interest rates, renewal duration, and account details. Additionally, addressing any changes in bank policies post the maturity date of the previous FD is essential. This ensures clarity regarding the interest rate agreement, which could be influenced by economic factors like the Reserve Bank of India's monetary policy adjustments or the institution's internal financial strategies. Accurate details in the request minimize misunderstandings and facilitate smooth transitions for continued investment growth.

Contact and Identification Details

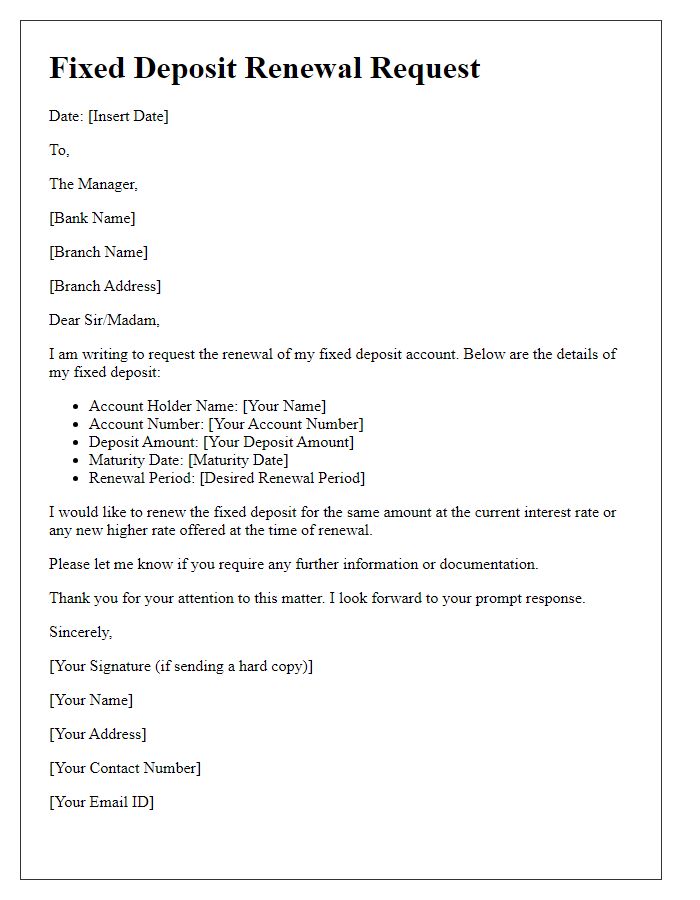

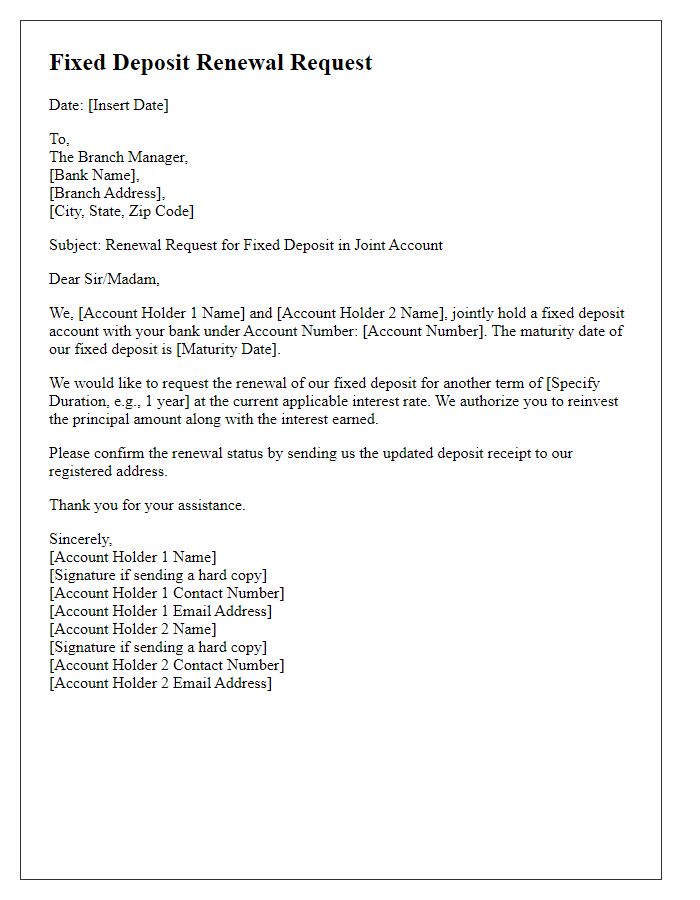

A fixed deposit renewal request involves specific steps and important details. Individuals should include their identification details, such as a government-issued ID number (for example, a driver's license number) alongside their contact details like phone number (with international dialing code) and email address. The deposit account number (a unique identifier provided by the bank upon account creation) is critical for processing the request efficiently. Additionally, the current maturity date of the fixed deposit (often set for a predetermined duration like 6 months, 1 year, or more) should be noted to align with the renewal process. Including specific instructions regarding the renewal period (ranging from terms such as 3 months to 5 years) or interest rate options can further facilitate the bank in meeting the depositor's preferences.

Authorization and Signature

A fixed deposit renewal request form is essential for maintaining an account with financial institutions. Customers wishing to reinvest their funds must specify terms related to tenure, interest rate, and amount. For example, many banks offer fixed deposit terms ranging from one month to five years, with interest rates between 3% and 7% depending on the amount and duration. Renewal authorization usually requires a signature to validate the request, confirming the customer's intention to extend the deposit under the existing or revised terms. This ensures both parties are in agreement regarding the deposit and its associated interest rate upon renewal.

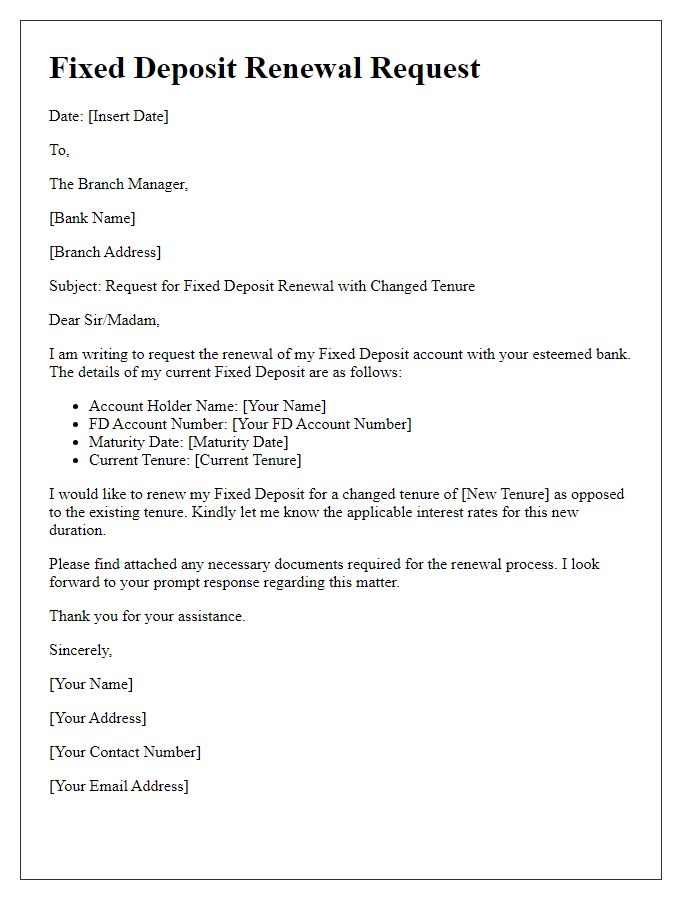

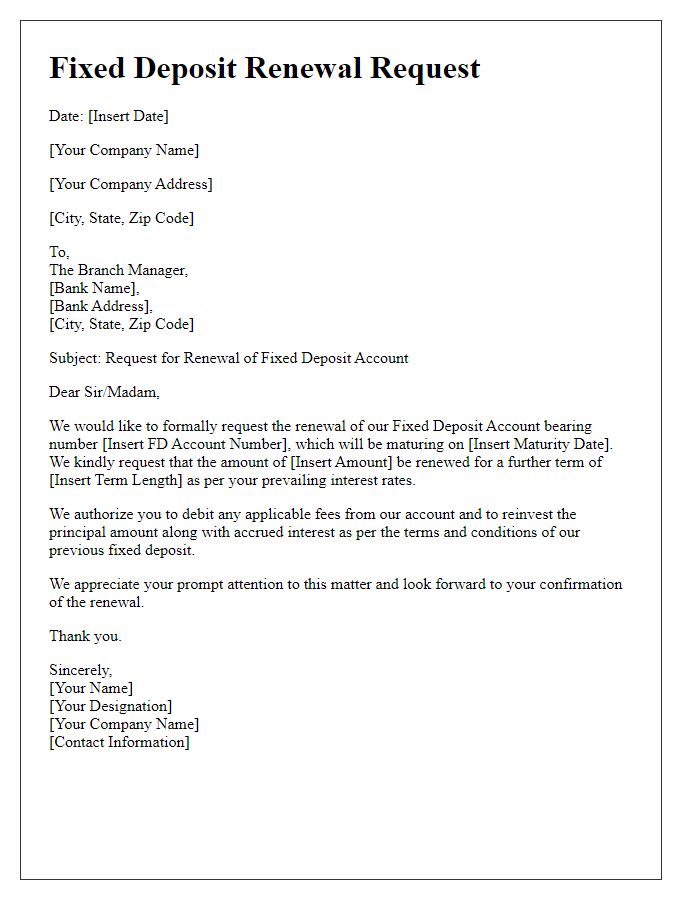

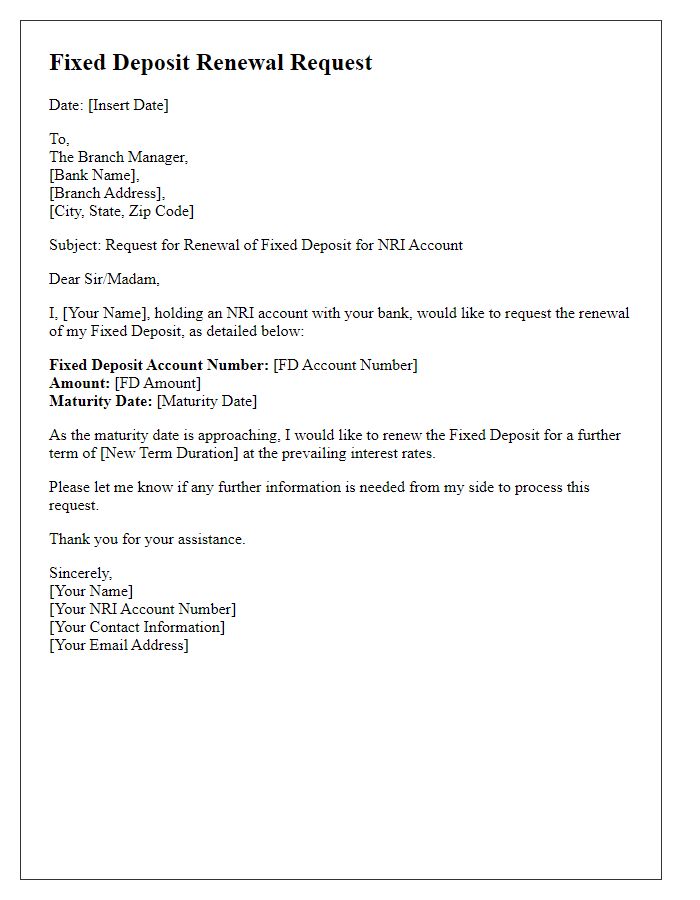

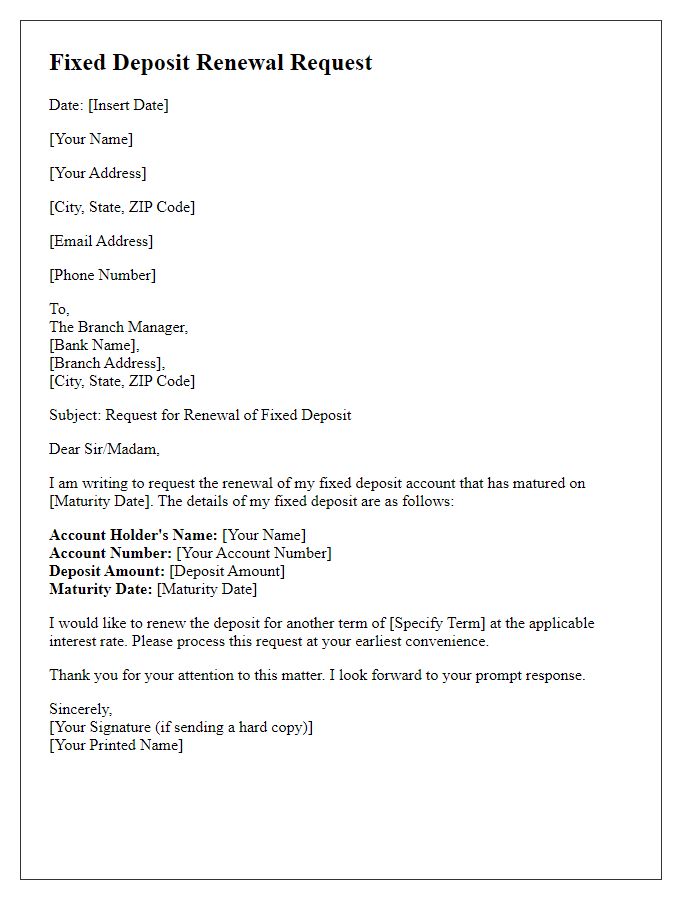

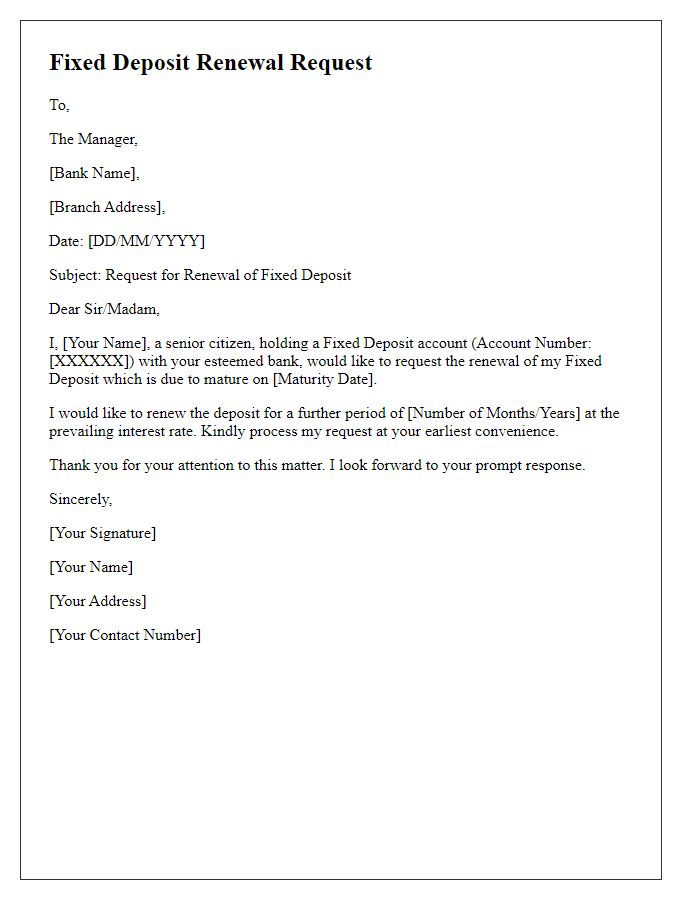

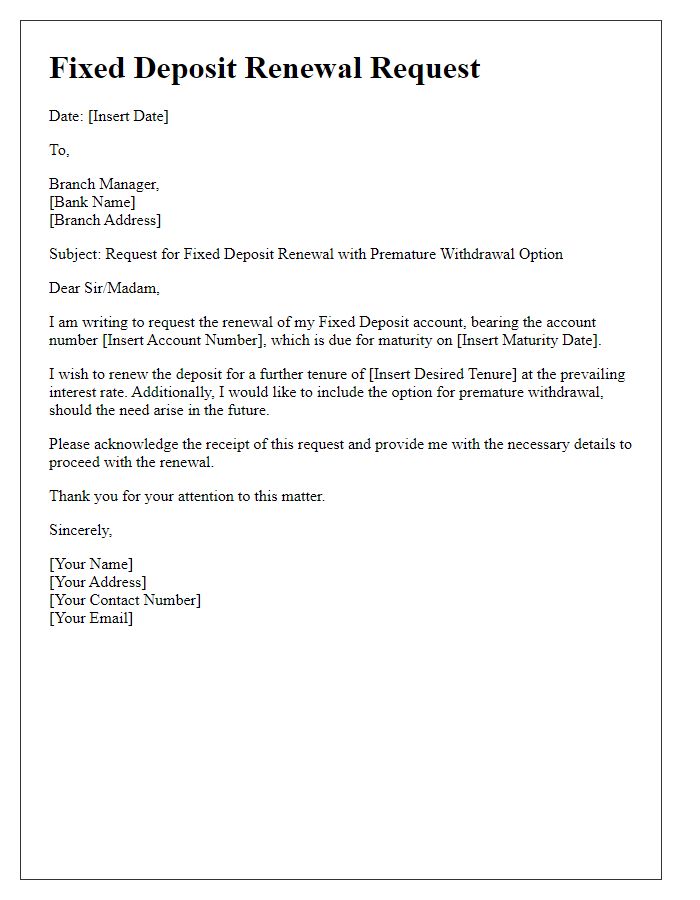

Letter Template For Fixed Deposit Renewal Request Samples

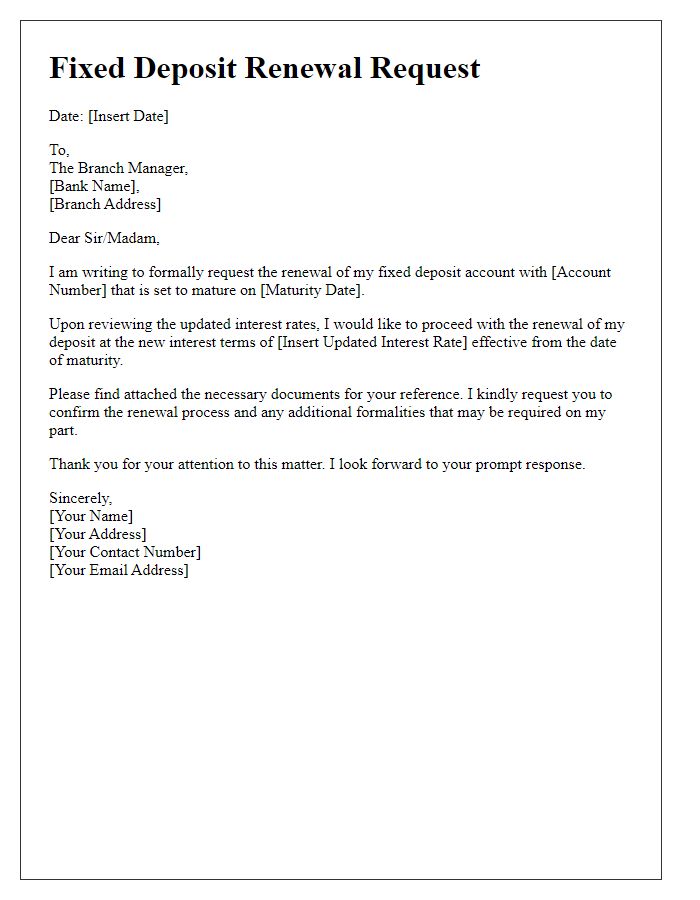

Letter template of Fixed Deposit Renewal Request with Updated Interest Terms

Comments