Are you curious about how to request a margin account interest rate adjustment? Understanding the nuances of margin accounts and interest rates can sometimes feel overwhelming, but it doesn't have to be. A well-crafted letter can make all the difference in getting the terms that work best for you. Let's explore some key elements to include in your request and make the process smootherâread on for valuable tips and a helpful template!

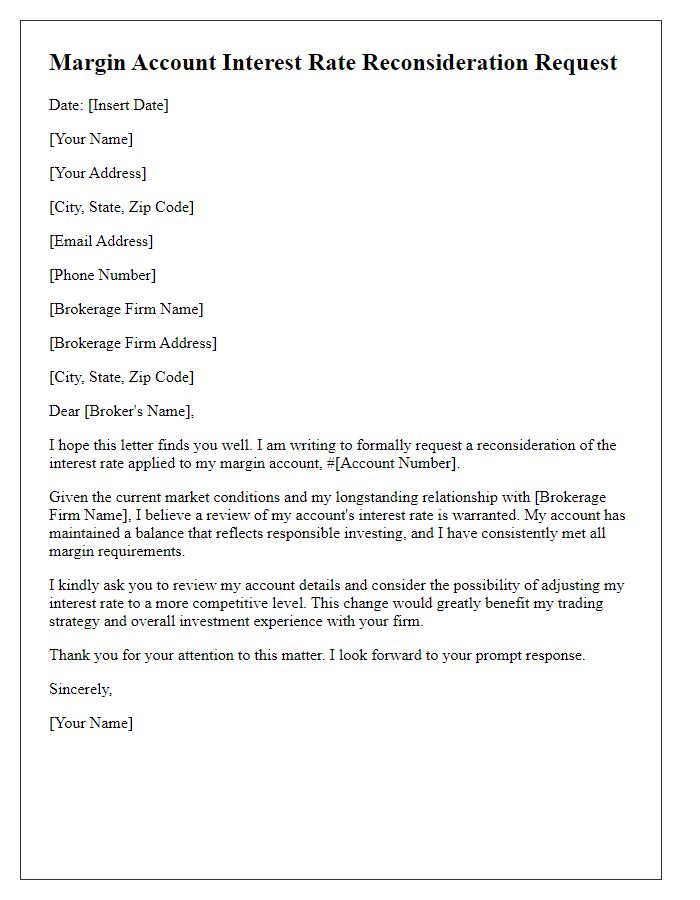

Account details and identification

Requesting a margin account interest rate adjustment can provide significant financial benefits. A margin account, utilized for trading securities, typically charges interest on borrowed funds for purchases. Interest rates can vary widely, often ranging from 4% to 10% annually, based on the brokerage firm and current market conditions. Identifying account details, such as the unique account number (e.g., 123456789) and client identification number, is crucial for processing requests efficiently. Providing a clear justification for the interest rate adjustment, based on competitive rates offered by other firms or the customer's trading volume, strengthens the request. Timely follow-up on the request is recommended to ensure that the adjustments reflect on future account statements for accurate financial management.

Reason for interest rate adjustment

Interest rates on margin accounts significantly impact trading strategies and overall investment costs. Brokers often set these rates based on market conditions, creditworthiness, and central bank policies. For instance, the Federal Reserve's recent interest rate hikes can influence broker fees for borrowing funds, such as when investors use margin to leverage their trades. Lower interest rates (around 2-4%) may encourage increased trading activity, while higher rates (exceeding 6%) could dissuade investors due to elevated costs. Thus, requesting an adjustment should emphasize the current market landscape, overall borrowing trends, and the potential for increased trading volume with a more favorable interest rate structure.

Current financial status and creditworthiness

Investors' margin accounts often carry interest rates determined by their current financial status and creditworthiness. Lenders evaluate factors such as credit score (usually ranging from 300 to 850), debt-to-income ratio (standard benchmarks around 36%), and account history (including duration of the relationship and transaction frequency) to assess risk. Financial institutions may also consider overall investment portfolio performance, asset diversity, and liquidity levels. In certain market conditions, rates may vary significantly, with some brokerages offering competitive rates as low as 3% while others could exceed 8%, depending on these financial indicators. Additionally, regulatory factors may play a role in determining acceptable interest rates for margin loans under the oversight of the Financial Industry Regulatory Authority (FINRA).

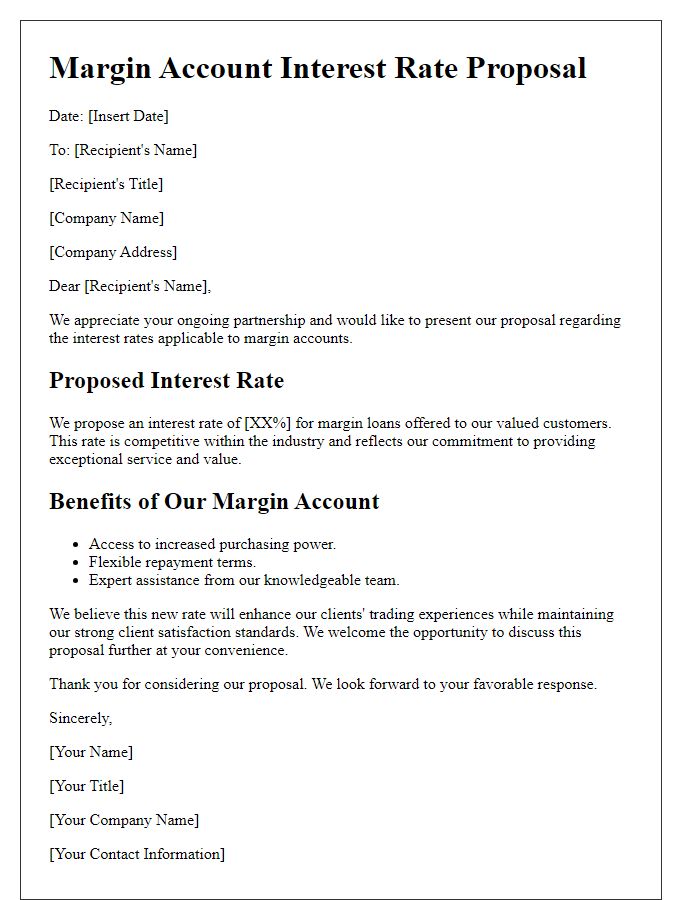

Comparisons to market rates and competitive offers

Margin accounts allow investors to borrow funds to purchase securities, creating opportunities for leveraging investments. Current market rates for margin account interest typically range from 4% to 10%, depending on the brokerage firm and the investor's account balance. Large firms like Charles Schwab or TD Ameritrade offer competitive rates, often providing discounts for higher account balances. Additionally, promotional offers can be found, with some brokers enticing new clients with rates as low as 3.5% for initial months. It is crucial for investors to analyze these rates alongside their investment strategies to ensure cost-effective trading practices and maximize potential returns.

Professional and courteous tone

A margin account, utilized by investors for borrowing funds against their existing securities, presents significant opportunities for leveraged trading. Investors seek clarity regarding the interest rates applied to borrowed funds within this account, as these rates directly impact overall profitability. Understanding the interest structure, including the calculation method and any potential fees, is crucial for informed financial decision-making. Maintaining a professional and courteous tone in communication with financial institutions fosters a productive dialogue, facilitating the exchange of necessary information regarding current rates and any adjustments that may arise based on market conditions or the investor's account status.

Comments