Are you tired of juggling your bank statements and trying to make sense of your finances? A bank account reconciliation statement can be your best friend in this chaotic world of numbers. By clearly comparing your bank records with your personal accounting, you can easily pinpoint discrepancies and ensure everything aligns perfectly. Ready to simplify your financial life? Read on to discover the essential elements of a bank account reconciliation statement!

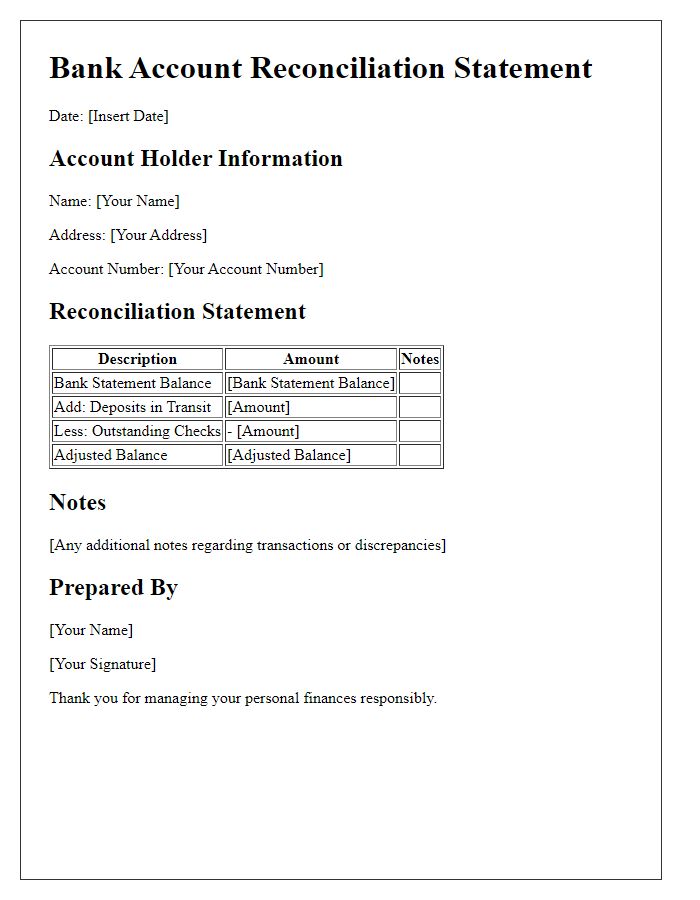

Account Holder Information

An account reconciliation statement serves as a crucial document for maintaining accurate financial records by comparing the entries of an individual's bank statement with their own records of transactions. This statement typically includes key details such as the account holder's full name, the account number (a unique identifier assigned by the bank), and contact information, including the mailing address and phone number. Additional elements may encompass the date of the statement, which indicates the period of the reconciliation, as well as any relevant references for transactions reviewed, like check numbers or deposit references. Essential aspects of this document are the initial balance, total debits, total credits, and the reconciled balance, which confirms the account's accuracy and ensures that discrepancies are investigated promptly.

Bank Account Details

Accurate bank account reconciliation is crucial for maintaining financial health. Monthly statements from financial institutions provide a comprehensive overview of transactions, balances, and fees. These statements typically include account details such as the account number (usually 10 to 12 digits), account type (e.g., checking or savings), and the financial institution's name (e.g., Wells Fargo, Chase). Reconciliation involves cross-referencing these statements with internal records, ensuring that deposits, withdrawals, and bank fees match accounting books. Discrepancies can arise from timing differences, such as outstanding checks or pending deposits, necessitating a detailed review process. Regular reconciliation can help identify unauthorized transactions, ensuring that the account holder's finances remain secure.

Statement Period

A bank account reconciliation statement typically covers the period from the first to the last day of a specific month, detailing all transactions (deposits, withdrawals, checks, and bank fees) that occurred during that timeframe. For example, the statement period may run from June 1, 2023, to June 30, 2023, documenting the account balance at the beginning of the month, all transactions, and the balance at the end of the month. This process ensures that the bank's records align with the account holder's records, identifying any discrepancies that may arise from errors or outstanding transactions. The reconciliation statement provides a comprehensive overview of financial activity, helping individuals and businesses maintain accurate financial records.

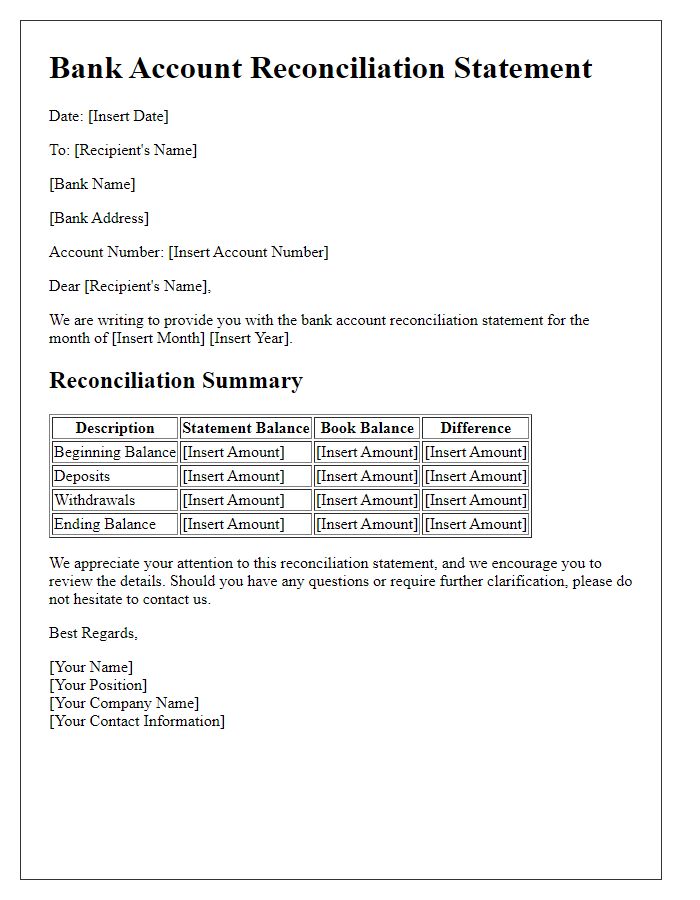

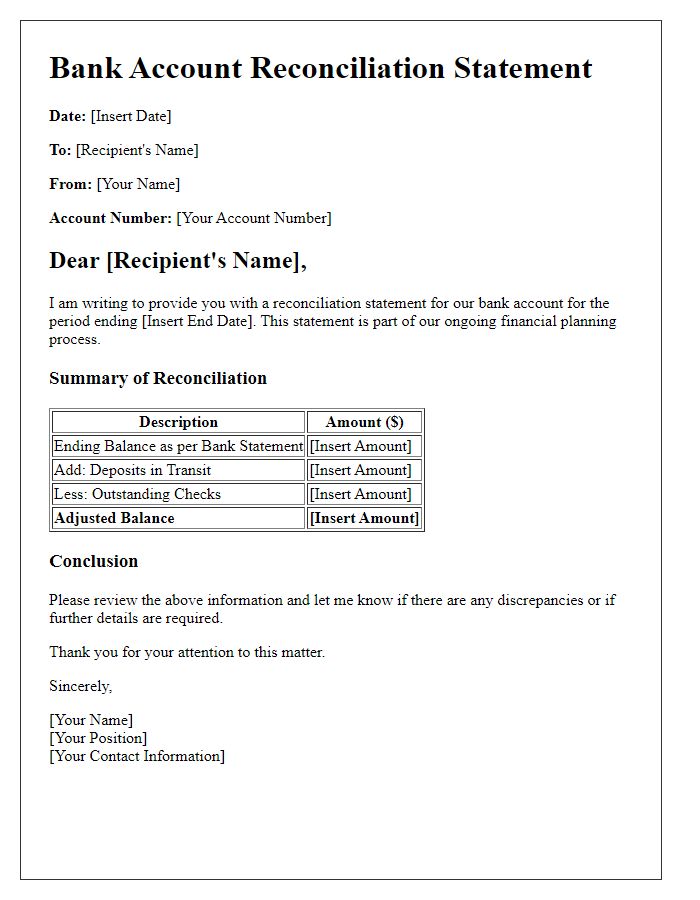

Reconciliation Summary

A bank account reconciliation statement provides a detailed comparison of a financial institution's recorded transactions against those on a bank statement, specifically for accounts such as checking or savings accounts. This reconciliation process, typically done monthly, helps ensure accuracy in financial records and identifies discrepancies, such as outstanding checks or deposits in transit. The summary includes key figures like the opening balance, total deposits, total withdrawals, and the adjusted balance, which should match the bank's ending balance after reconciling any discrepancies. Maintaining accurate reconciliations supports effective cash flow management and aids in detecting potential fraud or errors.

Contact Information for Discrepancies

Discrepancies in bank account reconciliation statements can arise from various sources, such as data entry errors or timing differences between recorded transactions and bank activities. Contact information for resolving these discrepancies typically includes a dedicated customer service phone number, such as 1-800-123-4567, and an email address specific to account inquiries, like account.support@bankexample.com. Additionally, many institutions provide a physical mailing address for formal correspondence, such as 123 Finance Drive, Cityville, ST 12345. The reconciliation statement often lists a specific contact person, such as John Smith, whose role is Senior Account Manager. Providing accurate details can expedite the resolution of issues and maintain account integrity.

Letter Template For Bank Account Reconciliation Statement Samples

Letter template of bank account reconciliation statement for monthly review

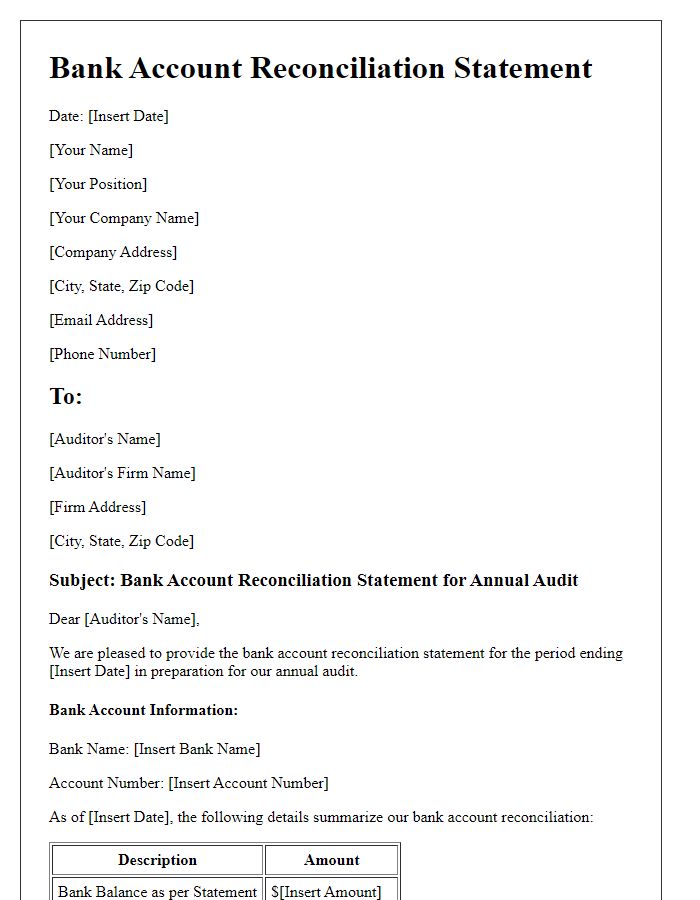

Letter template of bank account reconciliation statement for annual audit

Letter template of bank account reconciliation statement for business expense tracking

Letter template of bank account reconciliation statement for personal finance management

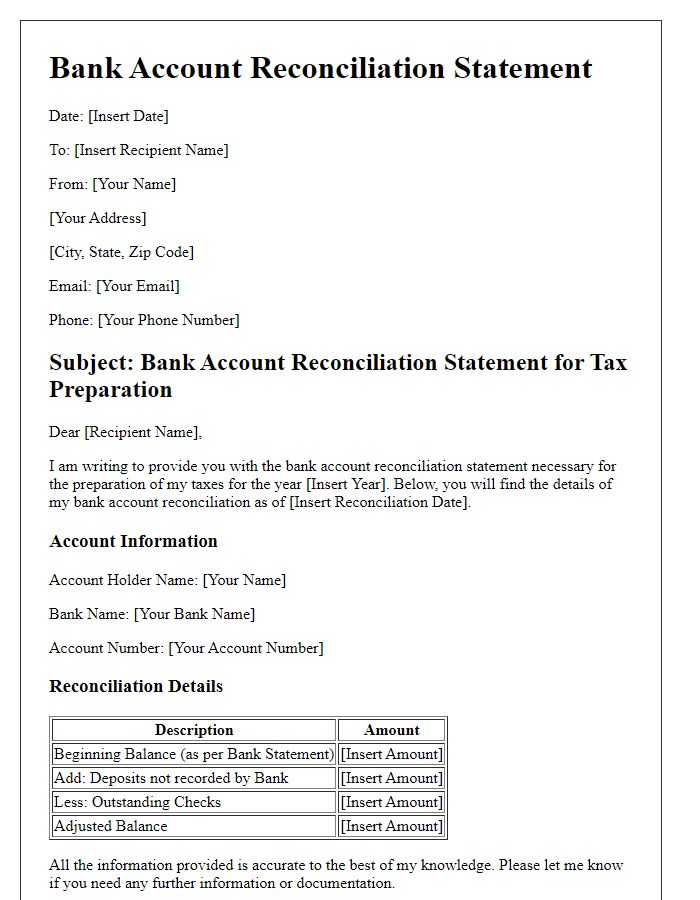

Letter template of bank account reconciliation statement for tax preparation

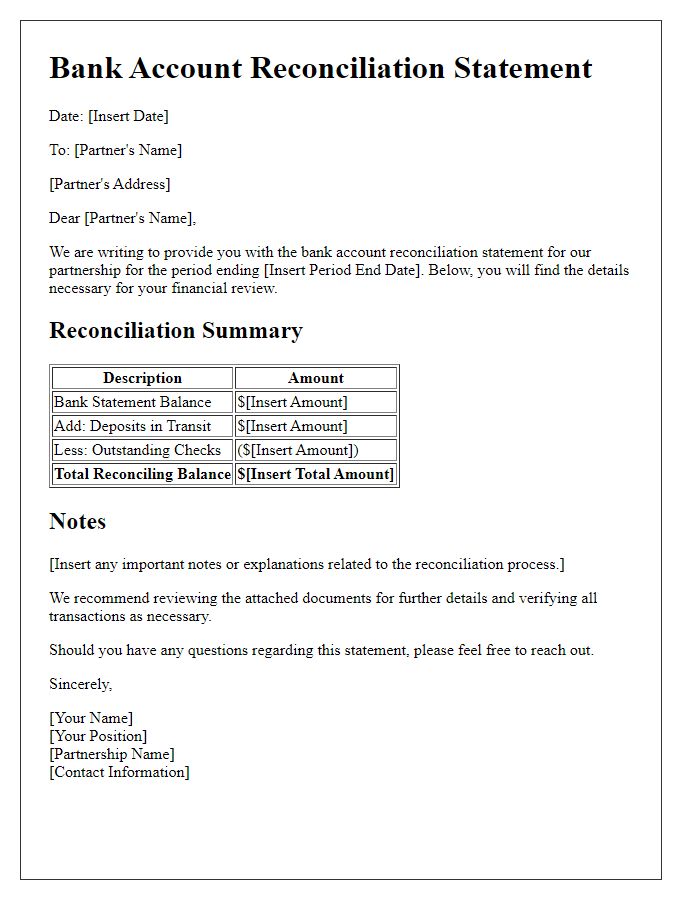

Letter template of bank account reconciliation statement for partnership financial review

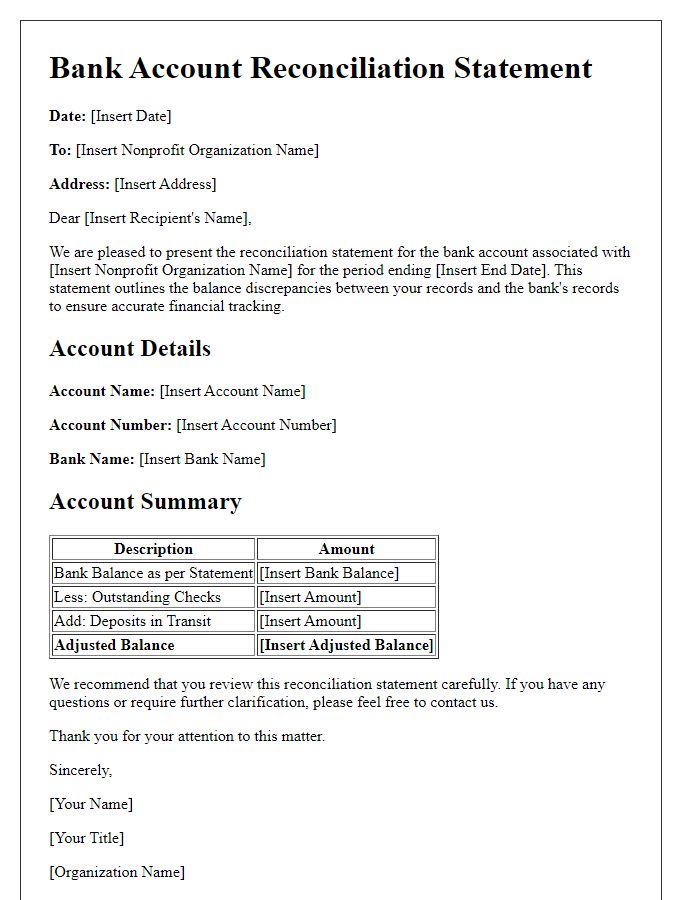

Letter template of bank account reconciliation statement for nonprofit organization

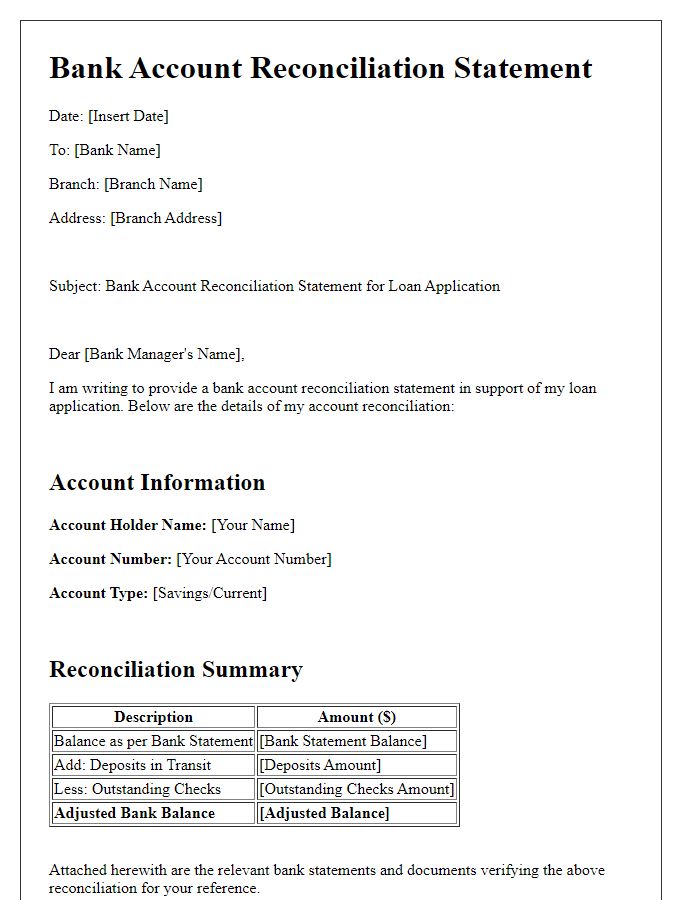

Letter template of bank account reconciliation statement for loan application

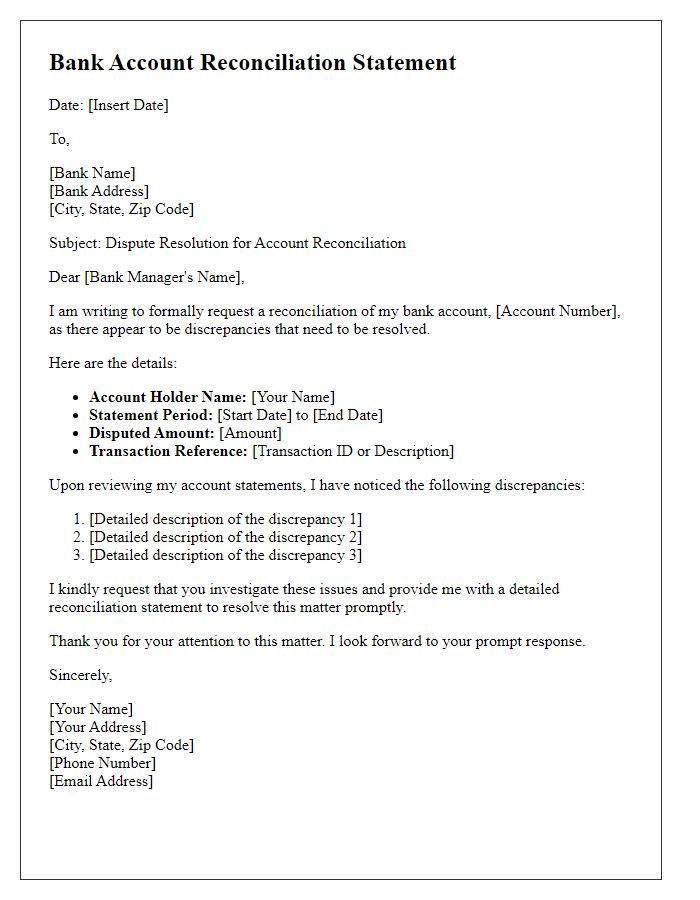

Letter template of bank account reconciliation statement for dispute resolution

Comments