Are you considering tapping into the equity of your home to fund a new project or consolidate debt? A home equity loan can be a smart financial move, but understanding the process and requirements is essential. In this article, we'll break down everything you need to know about home equity loans, from how to apply to the potential benefits and risks involved. So, if you're curious about how this loan option could work for you, keep reading!

Personal information (Name, Address, Contact)

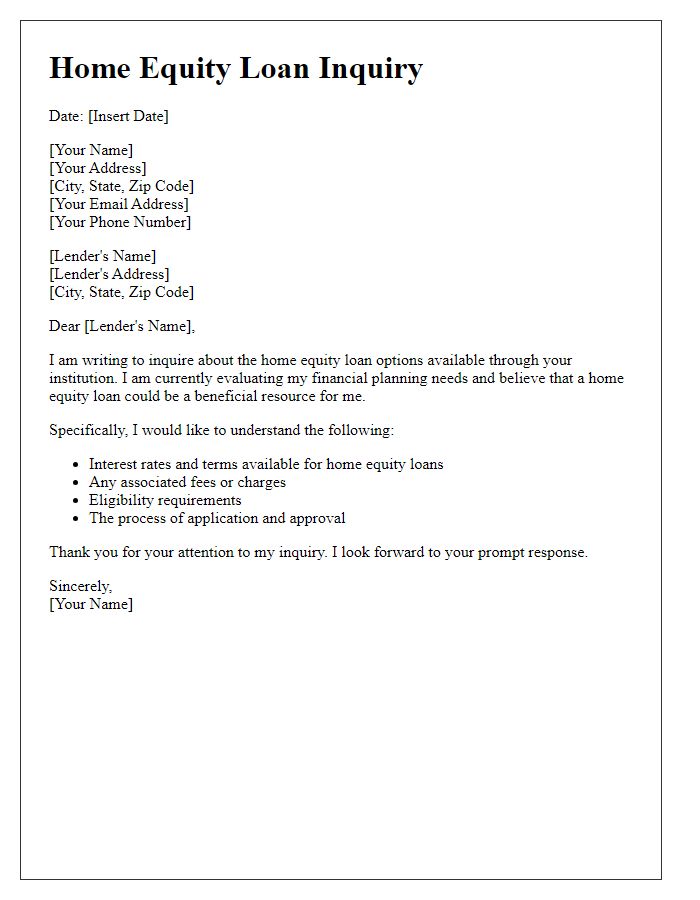

Home equity loans allow homeowners to leverage their property's value for financial needs. Homeowners typically seek such loans for renovations, debt consolidation, or unexpected expenses. Important details include the loan amount (often determined by the home's current market value), interest rates (which can vary widely based on credit score), and repayment terms (usually 5 to 30 years). The loan-to-value ratio (often recommended to remain below 80%) is crucial in determining eligibility. Additionally, personal financial data such as annual income, employment status, and credit history influences loan approval. Lenders require comprehensive documentation to process applications, including proof of ownership, property assessments, and income verification.

Loan amount and purpose

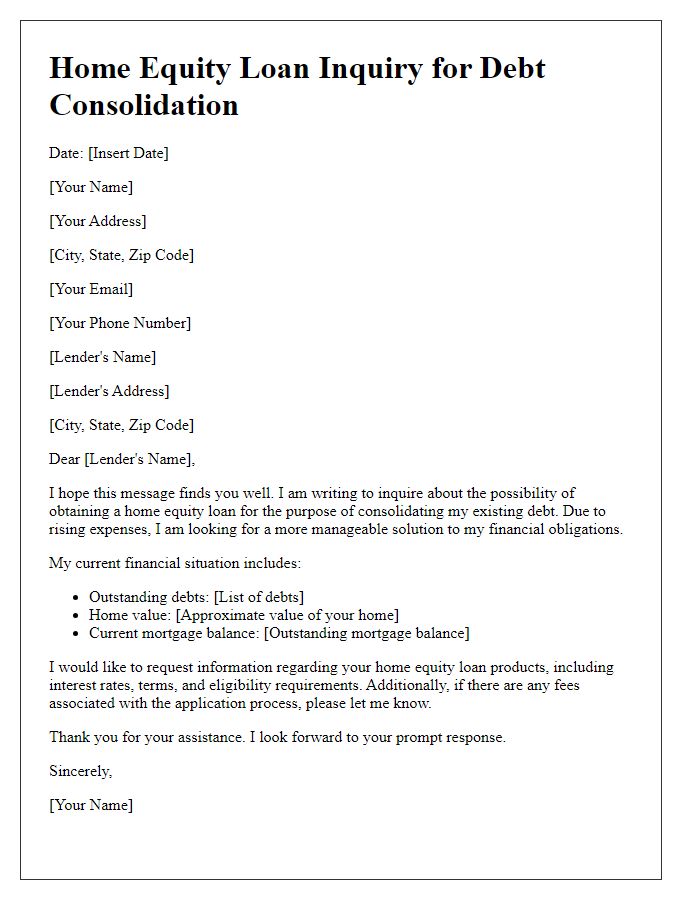

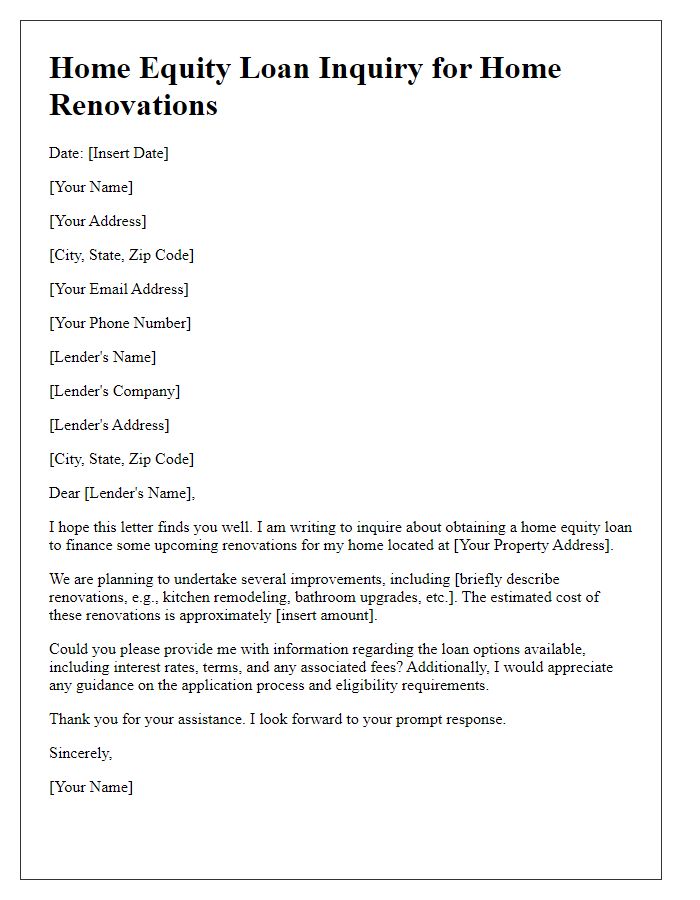

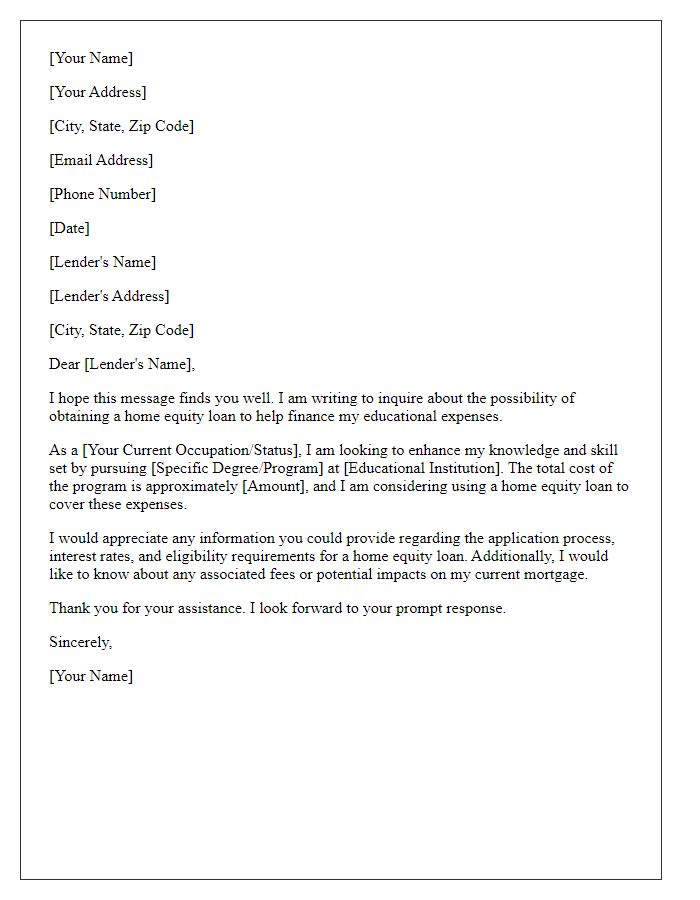

Home equity loans provide homeowners with the ability to borrow against the equity accrued in their properties, typically for amounts ranging from $10,000 to $100,000. Borrowers often seek these loans for various purposes including home renovations, debt consolidation, or financing major expenses such as education. When considering a home equity loan application, lenders evaluate factors like loan-to-value ratios, credit scores, and the borrower's financial history to determine eligibility and interest rates, which can vary widely depending on the borrower's profile. Home equity loans generally feature fixed interest rates, making them an attractive option for those seeking stability in monthly payments during the loan term.

Property details (Address, Value, Mortgage status)

Inquiring about a home equity loan requires comprehensive information regarding the property, including essential details such as the address, current market value, and mortgage status. The property located at 123 Maple Street, Springfield is valued at approximately $350,000, based on recent appraisals and regional real estate trends. Currently, there is an outstanding mortgage balance of $200,000, reflecting a stable loan status with consistent payments. Understanding the equity available, given the current market environment and mortgage conditions, is crucial for evaluating viable loan options.

Employment and income verification

Home equity loans allow homeowners to borrow against the equity they have built in their properties, typically measured as the difference between the property's current market value and the outstanding mortgage balance. Lenders often require employment and income verification to assess the borrower's ability to repay the loan. Standard documentation might include recent pay stubs, W-2 tax forms from previous years, and potentially bank statements showing regular deposits. For those self-employed, lenders often require profit and loss statements as well as personal tax returns. These documents help establish financial stability and reliability, crucial for loan approval. The income verification process often varies by lender and can include checks for consistent employment and salary history over a period of time.

Additional financial details (Credit history, Debts)

Potential home equity loan inquiries necessitate thorough financial evaluations, including a detailed credit history that showcases your borrowing behavior, payment timeliness, and existing credit scores (FICO scores usually ranging between 300 to 850). Lenders assess debt levels, which encompass current obligations such as car loans, student loans, and credit card balances. A debt-to-income ratio (DTI) is crucial for calculating financial health, ideally below 36% for favorable loan terms. Documentation should include recent pay stubs, tax returns, and bank statements, ensuring all financial aspects are transparent for potential lenders in the home equity market. An accurate appraisal of the property's value, which typically requires a professional evaluation, also plays a significant role in the loan approval process.

Letter Template For Home Equity Loan Inquiry Samples

Letter template of home equity loan inquiry for investment opportunities

Letter template of home equity loan inquiry for unexpected medical bills

Comments