Welcome to our guide on financial risk assessmentâan essential tool for anyone looking to navigate the complexities of financial decision-making. In today's unpredictable economic landscape, understanding the potential risks tied to financial ventures is more important than ever. By carefully analyzing factors like market volatility and credit risks, you can make informed choices that safeguard your investments. Ready to dive deeper into effective strategies for risk assessment? Discover more in our detailed article!

Identification of financial risks

Conducting a financial risk assessment involves identifying potential financial risks that could impact an organization. Key financial risks can include market volatility, which refers to fluctuations in market prices that may lead to significant losses, and credit risk, which is the possibility of a borrower defaulting on a loan. Liquidity risk, related to the difficulty of converting assets into cash quickly without significant loss in value, needs attention. Operational risks also play a crucial role and arise from failed internal processes or systems. Regulatory risks, stemming from changes in laws or regulations, can result in increased costs or penalties. Identifying these risks requires thorough analysis of financial statements, economic indicators, and industry benchmarks. Continuous monitoring and reassessment of the financial environment are essential to mitigate these risks effectively.

Risk measurement and analysis

Financial risk assessment involves systematic evaluation of potential losses due to factors such as market volatility, credit exposure, or operational failures. Key metrics such as Value at Risk (VaR) are utilized to quantify potential losses in various scenarios, often modeled using historical data across asset classes like equities or bonds. Risk analysis takes into account economic indicators such as interest rates, inflation rates, and unemployment figures, which can significantly impact investment outcomes. Companies often utilize software tools to aggregate and analyze vast datasets, enabling more accurate forecasting and strategic planning. Successful risk management requires continuous monitoring of these metrics, adherence to regulatory frameworks like Basel III, and a proactive approach to mitigate emerging threats to financial stability.

Impact evaluation

The financial risk assessment process involves a comprehensive impact evaluation of potential risks associated with investment strategies. Market fluctuations, represented by stock indices like the S&P 500, can lead to significant loss percentages (often exceeding 20% during downturns) that affect portfolio valuations. Economic indicators, such as interest rates currently at 5.25% set by the Federal Reserve, directly influence borrowing costs and capital availability. Additionally, geopolitical events, including trade wars or sanctions, contribute to market volatility and investor sentiment. Analyzing these risks requires a detailed understanding of asset classes such as equities, bonds, and alternatives, along with stress testing scenarios to assess worst-case outcomes, ultimately guiding strategic decision-making processes for enhanced financial stability.

Risk mitigation strategies

Financial risk assessment involves identifying and evaluating potential risks such as market volatility, credit risk, and operational inefficiencies. Risk mitigation strategies, critical for safeguarding assets, include diversification, insurance policies, and hedging techniques involving derivatives. Implementing robust internal controls ensures adherence to regulatory compliance (e.g., Sarbanes-Oxley Act), minimizing fraudulent activities. Regular stress testing, simulating adverse scenarios, aids in understanding vulnerability against economic downturns. Additionally, liquidity management strategies, such as maintaining adequate cash reserves or revolving credit facilities, provide liquidity to meet unexpected financial obligations. Key stakeholders must continuously monitor these strategies to adapt to market changes and emerging risks, enhancing overall financial stability and resilience.

Compliance and regulatory considerations

Compliance and regulatory considerations play a crucial role in financial risk assessment for organizations such as banks and investment firms. Adherence to frameworks such as Basel III, which sets global standards on bank capital adequacy, stress testing, and liquidity risk, is essential to ensure stability in the financial system. Financial institutions must also comply with regulations from authorities like the Securities and Exchange Commission (SEC) in the United States, which oversees securities markets, ensuring fair practices and protecting investors. Additionally, Anti-Money Laundering (AML) protocols require diligence in monitoring and reporting suspicious activities to prevent illicit financial flows. Failure to meet these compliance requirements can lead to severe penalties, reputational damage, and increased scrutiny from regulators, fundamentally impacting an organization's operational effectiveness and risk profile.

Letter Template For Financial Risk Assessment Samples

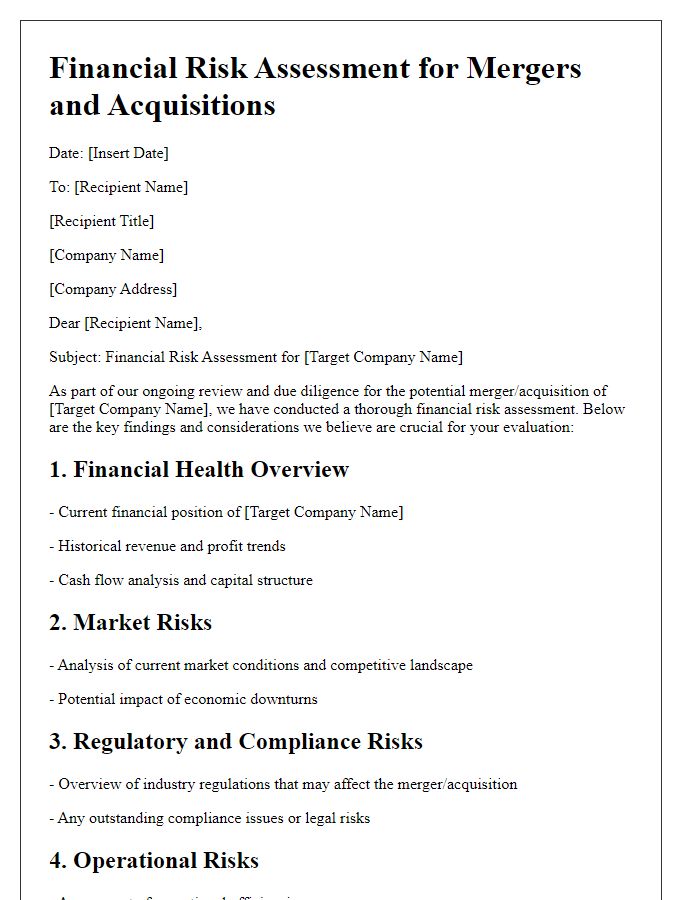

Letter template of financial risk assessment for mergers and acquisitions

Comments