Are you feeling overwhelmed by healthcare costs and unsure how to navigate the complexities of financial planning? You're not aloneâmany people struggle to make sense of rising medical expenses and the impact they have on their budgets. With a bit of guidance and a strategic approach, you can take control of your healthcare finances and ensure that you're making informed decisions for your future. Dive in to discover essential tips and resources that can help you manage these costs effectively!

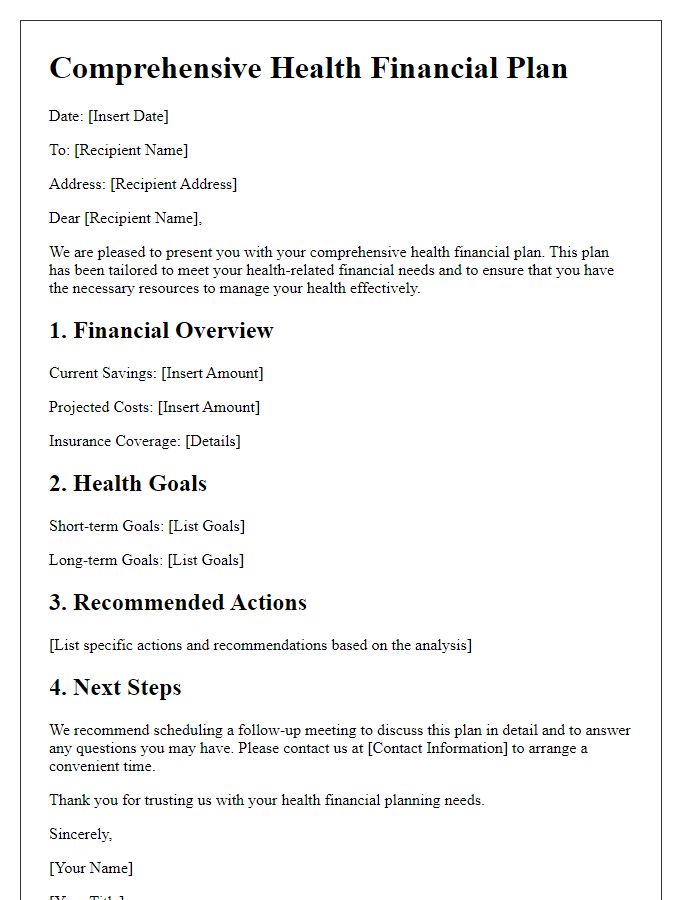

Patient Information

Healthcare cost financial planning is crucial for patients navigating the complexities of medical expenses, especially in today's evolving healthcare landscape. Patients may require detailed information regarding their financial responsibilities, such as copayments, deductibles, and out-of-pocket maximums associated with their health insurance plans. Understanding these costs is essential, particularly for significant medical events like surgeries or ongoing treatments for chronic conditions. Healthcare facilities, such as hospitals or outpatient clinics, often provide financial counselors who can assist patients in estimating their total costs and exploring options for financial assistance. Additionally, resources like Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs) can facilitate saving for medical expenses. Effective planning enables patients to manage unexpected healthcare costs while maintaining necessary treatments, thus ensuring continuity of care.

Description of Services and Treatments

Healthcare cost financial planning encompasses a comprehensive analysis of various medical services and treatments aimed at improving patient outcomes while managing expenses. Services include preventative care, such as routine check-ups and vaccinations, which can significantly reduce long-term costs by preventing illnesses. Specialized treatments, like chemotherapy for cancer patients, often involve high costs averaging $10,000 per cycle, necessitating careful budgeting and insurance navigation. Rehabilitation services post-surgery, such as physical therapy, can range from $150 to $350 per session, emphasizing the importance of planning for these recurring expenses. Additionally, medications play a critical role, with chronic conditions potentially requiring monthly prescriptions that can exceed $500. Understanding the specifics of insurance policies and out-of-pocket maximums becomes crucial in this financial planning process, ensuring that patients can access the necessary care without incurring overwhelming debt. Awareness of average costs in local healthcare facilities, such as hospitals and clinics, enhances the ability to make informed decisions regarding treatment options.

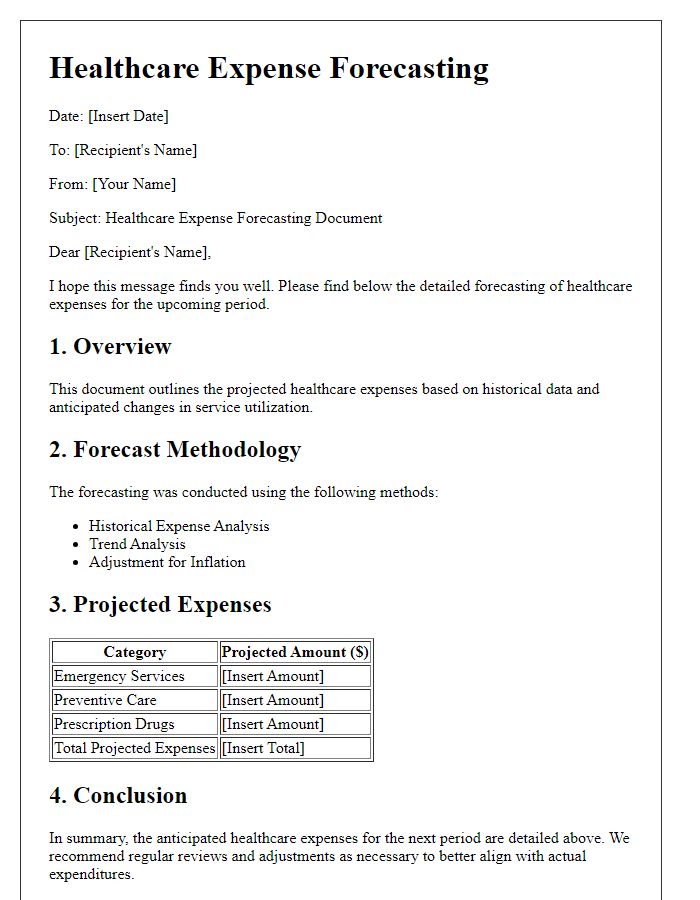

Cost Breakdown and Estimates

Healthcare financial planning requires detailed analysis of anticipated medical expenses, focusing on various elements such as consultations, treatments, and medications. Estimated costs for primary care visits typically range from $100 to $300 per appointment, while specialized consultations can soar between $200 to $600, depending on the physician's expertise. Hospital stays may incur daily charges between $2,000 and $4,000, factoring in room fees, nursing care, and medical supplies. Additionally, routine lab tests and imaging services may cost anywhere from $50 to $3,000 based on complexity and technology used. Prescription medications, especially chronic condition management drugs, can accumulate significant monthly expenses, averaging between $20 to over $1,500 for specialty therapies. Insurance deductibles and co-pays further influence overall healthcare spending, necessitating a thorough budget analysis to prepare for unexpected medical events and expenses, ensuring financial stability when facing healthcare needs.

Payment Options and Assistance Programs

Healthcare costs can pose significant financial challenges for individuals and families, necessitating a thorough understanding of payment options and assistance programs. Many hospitals and clinics offer payment plans, allowing patients to spread out expenses over time for services like surgeries or diagnostics. Financial assistance programs often target low-income individuals, providing funding based on income thresholds defined by the federal poverty level, currently set at $13,590 for individuals and $27,750 for a family of four in 2023. Nonprofit organizations, such as the HealthWell Foundation, provide grants to cover costs related to specific medical conditions, ensuring access to necessary treatments. Medicaid, a joint federal and state program, offers coverage for eligible individuals, with varying income limits by state, while the Affordable Care Act ensures that low to moderate-income earners have access to health insurance through state-based marketplaces. Understanding these options can lead to informed financial decisions and improved healthcare access.

Contact Information for Questions and Support

Healthcare cost financial planning requires clear avenues for assistance. Providing contact information is essential for ensuring support to navigate complex medical expenses. For inquiries related to coverage options, billing questions, or claims assistance, individuals can reach the dedicated support team at the health insurance provider's customer service hotline (1-800-123-4567), available Monday through Friday from 8 AM to 6 PM EST. Email inquiries can be sent to support@healthinsuranceteam.com, typically receiving responses within 24 hours. Additionally, online chat support is available through the provider's website during business hours for real-time assistance. Understanding healthcare costs is vital for effective financial planning, facilitating informed decisions about medical treatment and out-of-pocket expenses.

Comments