Are you considering ways to make a lasting impact through your philanthropy? Navigating the world of charitable giving can feel overwhelming, but it doesn't have to be. With the right guidance and a well-structured plan, you can ensure that your contributions align with your values and create meaningful change. Join us as we delve deeper into effective philanthropic strategies that can elevate your giving journeyâread on to discover how we can help you make a difference!

Personalization

Philanthropic planning consultations focus on creating tailored strategies for charitable giving to maximize impact. Personalized approaches consider individual philanthropic goals, values, and the specific community needs, such as local education initiatives in San Francisco or global health projects in sub-Saharan Africa. Advisors utilize metrics like return on investment (ROI) in social impact and identify high-potential nonprofits that align with donors' missions. Tools such as donor-advised funds (DAFs) and community foundations enhance personalization by providing options for flexible giving and engagement opportunities. Understanding trends, such as the increasing emphasis on sustainability and equity within philanthropy, further enriches the consultation process, allowing for the development of a comprehensive, informed plan that reflects the donor's unique vision.

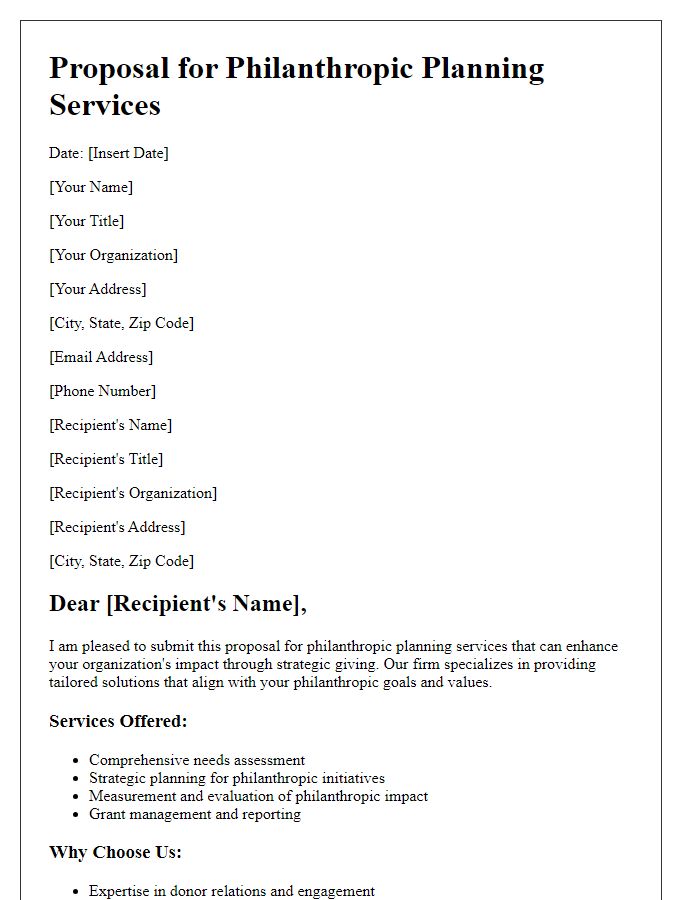

Clear objectives

Philanthropic planning consultation focuses on establishing clear objectives for charitable giving. Identifying measurable goals enables effective allocation of resources towards organizations and initiatives that align with personal values, such as education, health care, and environmental sustainability. Setting specific targets, like funding scholarships for underserved students or supporting local healthcare programs, ensures that contributions add tangible value. Regularly reviewing objectives allows for adjustments based on changing needs and outcomes, optimizing the impact of philanthropic efforts in communities, such as those facing economic challenges in urban areas or rural regions. Engaging with impact assessment tools amplifies the effectiveness of charitable strategies, fostering enhanced collaboration with non-profits and stakeholders.

Call to action

Philanthropic planning consultations serve to guide individuals, families, and organizations in effectively directing their charitable contributions. During these sessions, experts outline strategies to maximize the impact of donations on community development, education, health services, or environmental conservation. Participants can explore various philanthropic vehicles, such as donor-advised funds, charitable trusts, or private foundations, alongside potential tax benefits. Engaging in these consultations not only facilitates informed decision-making but also fosters a deeper understanding of social needs and effective giving. The goal is to inspire impactful action, ensuring that funds contribute positively to the intended causes and make a lasting difference.

Value proposition

Philanthropic planning consultation provides a tailored approach to maximizing charitable impact. Individuals and organizations seek to align their values (in terms of community support and societal change) with strategic giving methods. Utilizing expertise in tax-efficient strategies, philanthropic advisors can recommend avenues like donor-advised funds (DAFs) or charitable trusts to enhance financial benefits while supporting causes such as education, healthcare, or environmental sustainability. This consultation fosters lasting relationships between philanthropists and non-profits, ensuring that contributions lead to meaningful outcomes. Integrating measurable goals allows for continuous assessment of giving strategies, driving innovation and community development in targeted areas.

Contact information

Philanthropic planning consultations often include vital aspects such as donor intent, tax implications, and strategic giving. During these sessions, individuals or organizations can explore opportunities for impactful contributions, aligning their philanthropic goals with social or environmental causes. Key financial instruments, such as donor-advised funds (DAFs) or charitable remainder trusts (CRTs), may be discussed to enhance tax efficiency while maximizing charitable impact. Engaging with a specialized consultant can also facilitate understanding of local community needs and potential partnerships with nonprofit organizations within specific geographic regions, ensuring that donations yield the greatest possible benefit.

Comments