Are you curious about how your credit score is calculated and what it means for your financial future? Understanding your credit score can empower you to make informed decisions and potentially save money on loans and interest rates. In this article, we'll guide you through the process of requesting a comprehensive credit score analysis, so you can have a clearer picture of your financial health. Ready to uncover the details that could shape your financial journey? Let's dive in!

Subject Line

Credit score analysis request: Understanding my financial standing and options for improvement.

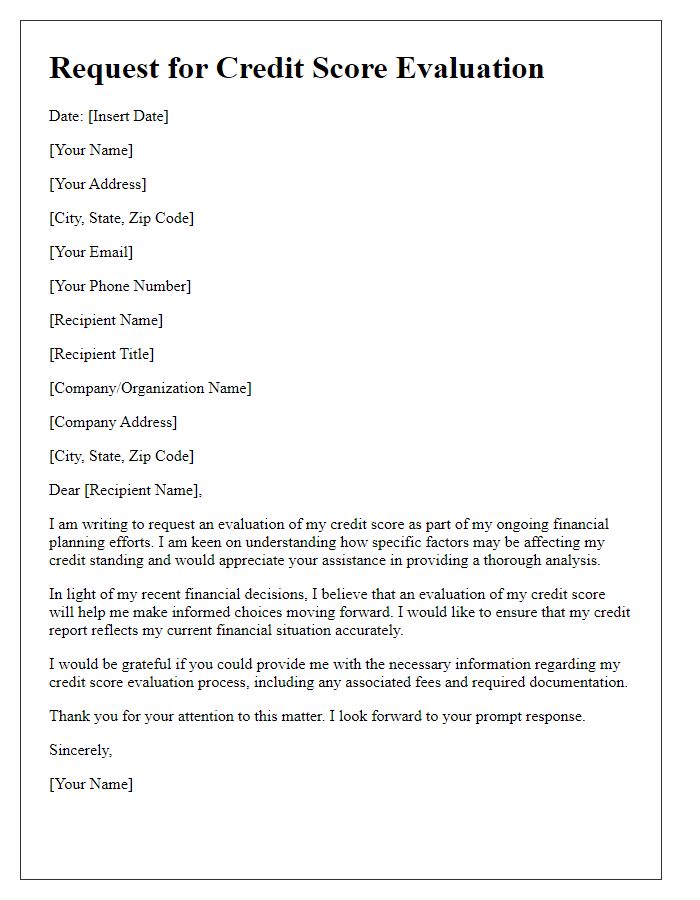

Personal Information

Analyzing a credit score requires comprehensive personal information, which includes details like full name (first, middle, and last), Social Security number (usually nine digits in format XXX-XX-XXXX), date of birth (noted in MM/DD/YYYY format), current address (including street name, city, state, and zip code), previous addresses (if applicable, for the last five years), and employment information (current employer name, job title, and duration of employment). These elements are crucial for financial institutions, like banks and credit unions, to accurately retrieve a credit report from credit bureaus such as Experian, TransUnion, or Equifax. Accessing this data helps in assessing creditworthiness based on payment history, credit utilization ratios, and any public records such as bankruptcies or liens.

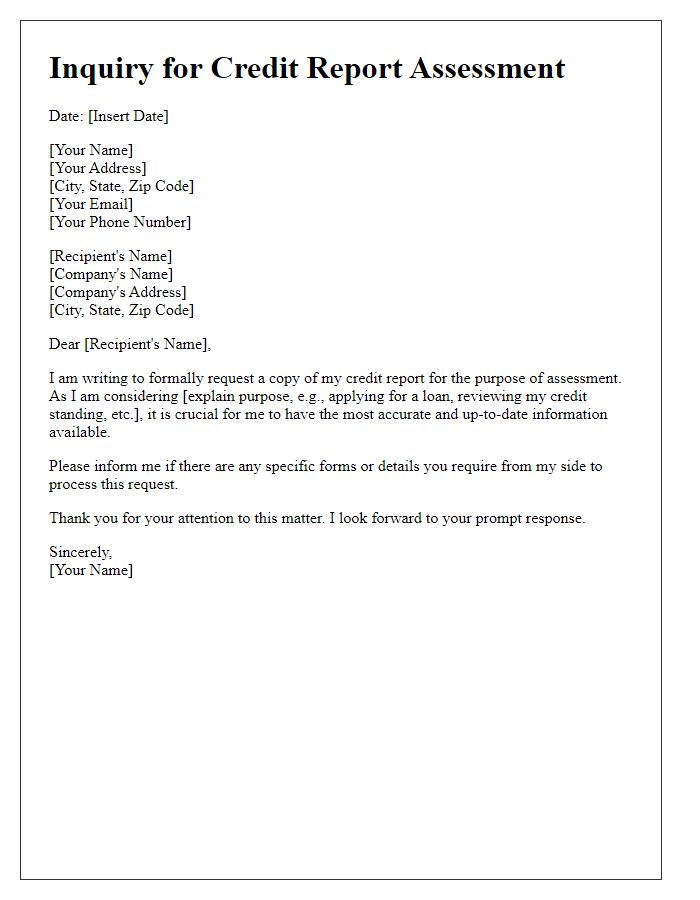

Specific Credit Report Items

Accurate credit reports are essential in determining an individual's credit score, influencing loan approvals and interest rates. A credit report, typically issued by agencies like Experian, Equifax, or TransUnion, details financial behaviors such as payment history (including on-time or late payments), outstanding debts, and credit inquiries. For example, a missed payment (over 30 days late) can significantly lower a score, while maintaining low credit utilization ratios (ideally under 30% of credit limits) positively impacts scores. Additionally, factors like the length of credit history (average account age) and the number of open accounts can further affect overall creditworthiness, making it crucial to regularly analyze specific items within the credit report to ensure accuracy and address discrepancies.

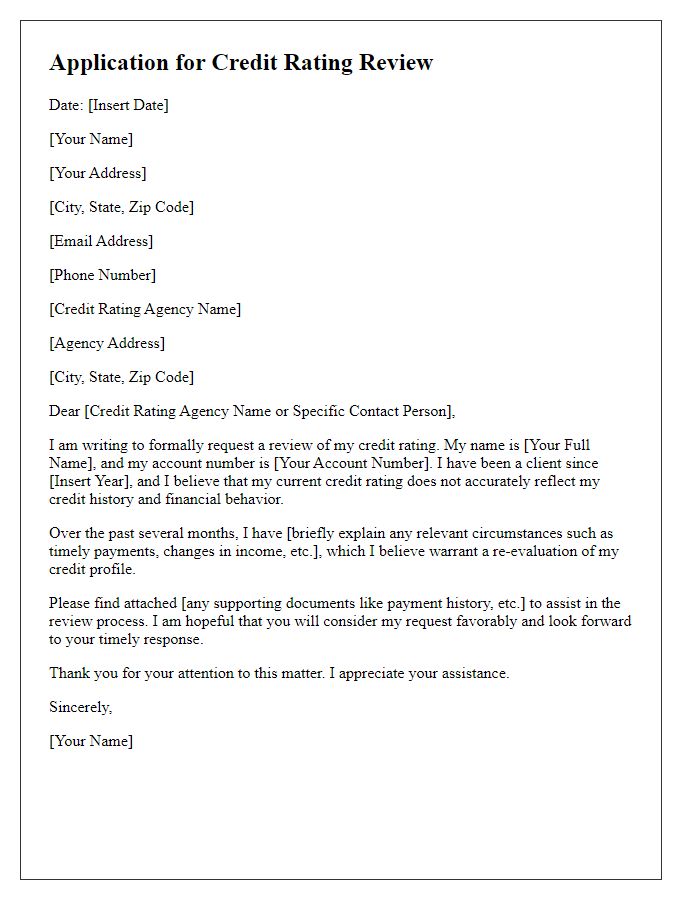

Reason for Analysis Request

A request for credit score analysis often arises from significant financial events impacting personal credit history. For instance, individuals may seek this analysis after experiencing inconsistent credit card payments, mortgage defaults, or identity theft incidents affecting their scores, which usually range from 300 to 850. Understanding credit score components, including payment history (35%), credit utilization (30%), and length of credit history (15%), is crucial for informed financial decisions. Additionally, inquiries into this data can help identify areas needing improvement to enhance financial health and facilitate better loan terms in future endeavors, such as obtaining a mortgage in cities like San Francisco or New York.

Contact Information

Analyzing credit scores is essential for understanding financial health and planning for significant life events, such as purchasing a home or applying for loans. Credit scores, typically ranging from 300 to 850, are influenced by factors like payment history, credit utilization, length of credit history, types of credit in use, and recent credit inquiries. Obtaining a comprehensive credit score analysis involves reaching out to companies like Experian, TransUnion, or Equifax, which are the major credit bureaus in the United States. Including accurate contact information, such as a phone number (often 1-800-XXX-XXXX) and email address, ensures timely communication. Personal details like full name, address, and Social Security number (last four digits recommended for security) help in tracking reports and identifying any discrepancies that may need resolution.

Comments