Are you looking to navigate the complex world of financial instruments? Understanding the nuances can feel overwhelming, but it doesn't have to be! In this article, we'll break down the essential components of financial instrument analysis, offering you clear insights and practical tips. Join us as we explore the intricacies of this topic and invite you to dive deeper into the resources we've prepared!

Executive Summary

The Executive Summary of the financial instrument analysis highlights key insights regarding the investment opportunity in the XYZ equity fund, launched in 2023 and currently valued at $500 million. The fund primarily invests in technology stocks, with a focus on companies like Tech Innovate Inc., which reported a 15% growth in revenue year-over-year. The analysis includes a comparative performance assessment against the S&P 500 index, where the fund has consistently outperformed with a 12% annual return versus the index's 8%. Key risks, including market volatility (historically fluctuating up to 25% in adverse scenarios) and sector-specific downturns (such as the recent slowdown in semiconductor production), are also evaluated. Regulatory considerations, particularly the recent changes in tax law impacting capital gains, further underscore the importance of strategic asset allocation. Overall, the analysis indicates a strong growth potential but emphasizes the necessity of ongoing risk management and market monitoring.

Market Overview

The financial instrument analysis reflects the current market overview of equity markets, such as the S&P 500 index, which recently fluctuated between 4,200 and 4,400 points, reflecting investor uncertainty amid rising inflation rates (currently at 7.9% as of October 2023) and Federal Reserve interest rate hikes (increased by 0.75% during the last meeting). Global markets, particularly in Asia, are experiencing volatility, with major indices like the Nikkei 225 and Hang Seng showing mixed results due to geopolitical tensions in the Taiwan Strait and ongoing supply chain disruptions. Commodities, particularly crude oil prices (hovering around $85 per barrel), have seen an uptick due to production cuts by OPEC+. Currency fluctuations, with the U.S. dollar strengthening against the Euro and Yen, and the impact of new fiscal policies being introduced by various governments, further complicate the economic landscape. These factors collectively shape the investor sentiment and strategy within the financial markets.

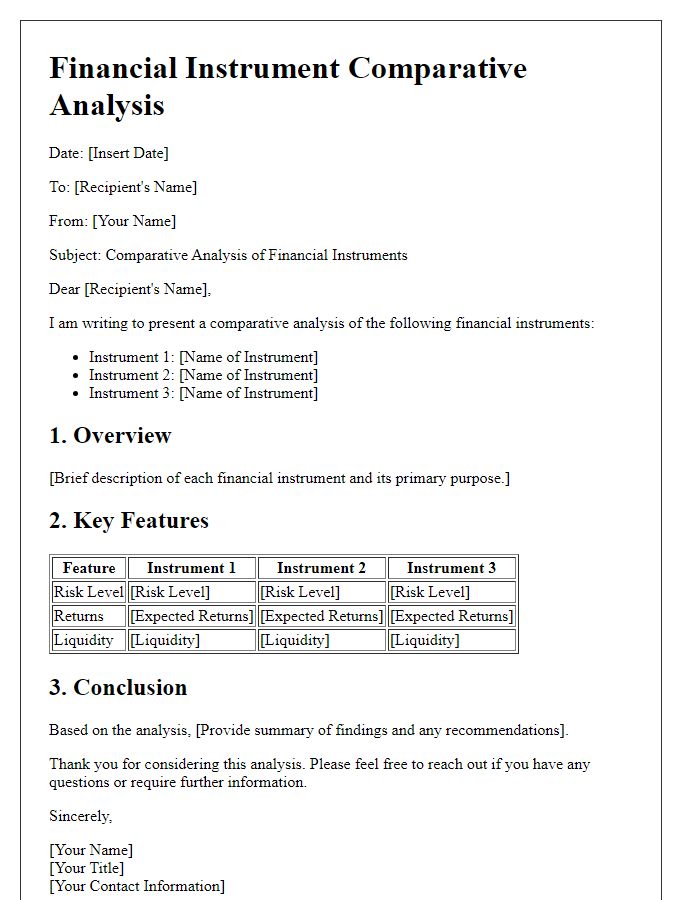

Financial Performance Metrics

Financial performance metrics serve as vital indicators of a company's economic health and operational efficiency. Key metrics such as Earnings Before Interest and Taxes (EBIT), a measure reflecting a company's profitability from core operations, provide insights into operational performance before financial and taxation expenses. Return on Investment (ROI), quantifying the efficiency of an investment, is calculated using net profit and investment cost data. Other critical metrics include the Debt-to-Equity Ratio, assessing financial leverage by comparing total liabilities against shareholder equity, and the Current Ratio, which evaluates short-term liquidity by dividing current assets by current liabilities. Understanding these metrics is essential for stakeholders, including investors and analysts, as they offer a comprehensive view of financial stability and growth potential in various sectors.

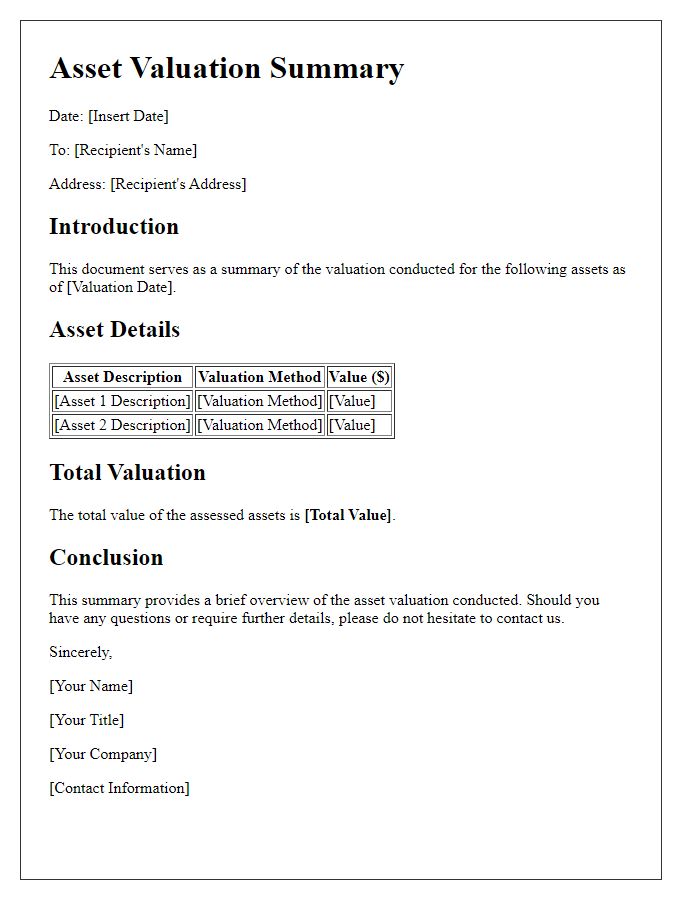

Risk Assessment

Financial instrument risk assessment is crucial for understanding potential exposure in markets such as stocks, bonds, and derivatives. Instruments like high-yield bonds, often rated below investment grade, can present increased credit risk, especially during economic downturns. Market volatility, measured by indices like the VIX (Volatility Index), can indicate the potential for drastic price swings, impacting portfolios. Interest rate fluctuations, according to central bank policies like those from the Federal Reserve or the European Central Bank, can affect the valuation of financial instruments significantly. Additionally, geopolitical events, such as trade wars or elections, could impact market stability and investor sentiment, further complicating risk profiles. It is vital to integrate these factors into comprehensive risk management frameworks to enhance investment decision-making and mitigate potential losses.

Future Outlook

The future outlook for financial instruments, particularly stocks and bonds, indicates a growing trend influenced by global economic factors. Interest rates may rise, impacting bond yields significantly, while inflation rates are fluctuating, causing investor sentiment to shift. The stock market, specifically tech giants like Alphabet and Apple, could see volatility due to regulatory scrutiny and changing consumer behaviors. Additionally, geopolitical events, such as trade agreements between the United States and China, will likely affect emerging market investments. Analysts predict sectors like renewable energy and healthcare to experience robust growth due to increasing demand and governmental support, shaping the investment landscape for the next decade.

Comments