Are you looking to enhance the financial health of your business? A well-structured balance sheet is crucial for understanding your company's assets, liabilities, and equity, and it can significantly impact your financial decisions. In this article, we'll explore effective strategies for optimizing your balance sheet, helping you minimize liabilities and maximize resources. So, let's dive in to discover actionable tips that can strengthen your financial position!

Clear and concise language

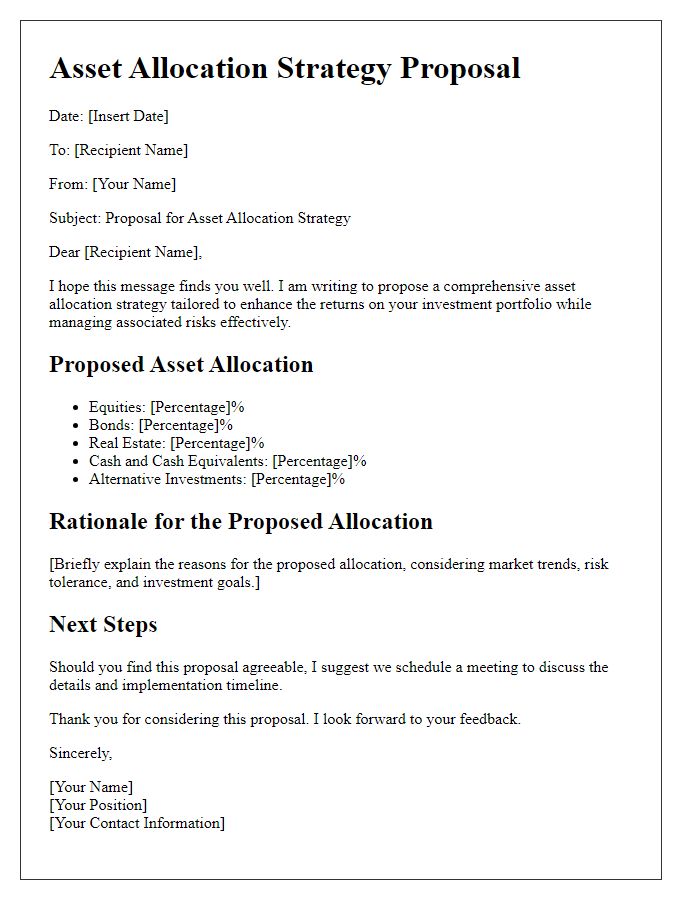

A well-optimized balance sheet is crucial for reflecting the financial health of an organization and ensuring effective resource management. It typically comprises three key components: assets, liabilities, and shareholders' equity. Accurate listing of current assets, such as cash ($20,000), accounts receivable ($15,000), and inventory ($10,000), ensures liquidity assessment. Similarly, detailing current liabilities, including accounts payable ($8,000) and short-term loans ($5,000), provides insight into financial obligations. A precise calculation of long-term assets, like property ($200,000) and equipment ($50,000), alongside long-term liabilities such as mortgages ($100,000), presents a clear picture of overall financial stability. Finally, shareholders' equity, calculated as total assets minus total liabilities, reveals the net worth of the company, critical for investment decisions and growth strategies. This clarity facilitates informed decision-making by stakeholders.

Accurate financial data presentation

Accurate financial data presentation plays a crucial role in business decision-making and stakeholder communication. A balance sheet presents a company's financial position at a specific point in time, typically at the end of an accounting period. This document includes key components such as total assets, which encompass current assets like cash, accounts receivable, and inventory, totaling millions of dollars. In parallel, total liabilities reflect obligations, including short-term debts and long-term loans, revealing the company's financial commitments. Shareholder equity outlines owner investments, indicating company value. Proper organization, clarity, and compliance with standards such as GAAP (Generally Accepted Accounting Principles) enhance the document's reliability, facilitating better analysis by investors, creditors, and management teams for strategic planning.

Consistent formatting and structure

A well-organized balance sheet plays a crucial role in financial reporting, allowing companies to present assets, liabilities, and equity clearly for stakeholders. Consistent formatting, such as using bold headers for major sections (Assets, Liabilities, and Equity), enhances readability and navigating through key financial figures. Aligning figures to the right and using a standard font size (typically 10 to 12 points) contributes to a professional appearance, making it easier to compare years or periods. Including subtotals for both current and non-current assets or liabilities adds clarity and helps in analyzing changes over time. Utilizing color coding for positive and negative values or highlights for significant changes allows quick identification of trends. Additionally, footnotes offering explanations for large variances or accounting methodologies applied reinforce transparency and compliance with accounting standards like GAAP or IFRS.

Compliance with accounting standards

Compliance with accounting standards ensures that financial statements, such as balance sheets, accurately represent a company's financial position. Adherence to the International Financial Reporting Standards (IFRS) or Generally Accepted Accounting Principles (GAAP) is crucial for transparency. Misreporting may lead to regulatory scrutiny or financial penalties. Key components of the balance sheet include assets (current and non-current), liabilities (short-term and long-term), and equity. Timely audits and internal controls promote accuracy and reliability, fostering trust among investors and stakeholders. Using optimization strategies can also enhance data presentation, improving decision-making processes for management and reducing discrepancies in financial reporting.

Professional and polished tone

Creating a balance sheet involves evaluating assets, liabilities, and equity to ensure financial health. Key assets include current assets like cash, accounts receivable, and inventory, which provide liquidity. Long-term assets such as property, plant, and equipment represent significant investments. Liabilities include current liabilities like accounts payable and long-term obligations such as bonds payable, which reveal financial responsibilities. Equity reflects ownership value, including retained earnings and common stock. An optimized balance sheet enables companies to assess financial stability, enhance decision-making, and attract investors by showcasing a solid financial footing and operational efficiency. Regular reviews and strategic adjustments can lead to improved ratios, such as current ratio and debt-to-equity ratio, resulting in stronger financial positioning.

Comments