Are you looking for a simple yet effective way to acknowledge tax-deductible donations? Crafting a professional donation receipt can make all the difference in maintaining relationships with your supporters! Not only does it provide necessary documentation for their tax purposes, but it also demonstrates your appreciation for their generosity. If you're interested in learning how to create the perfect donation receipt, read on!

Donor Information

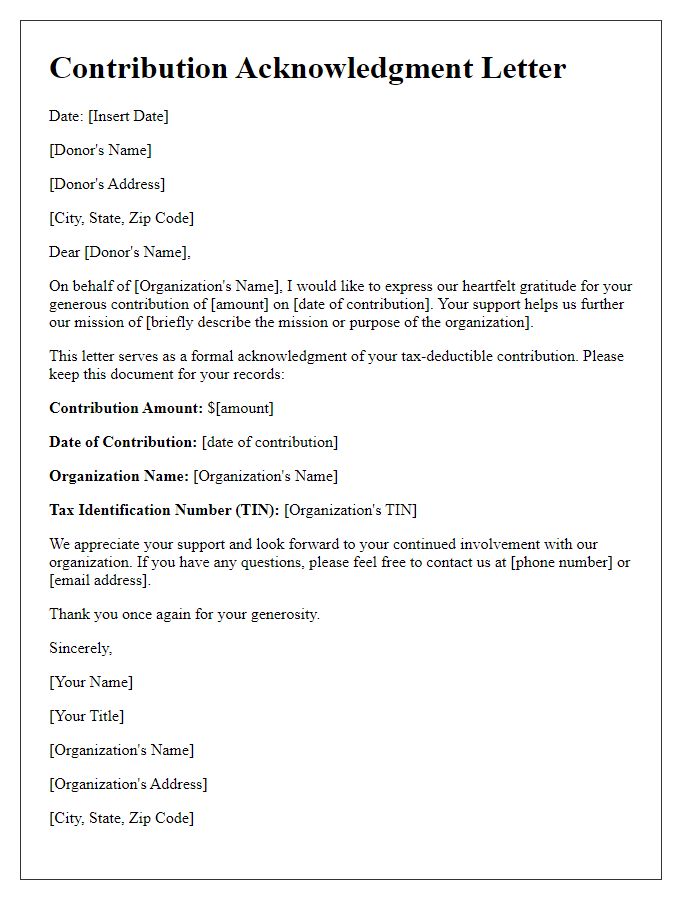

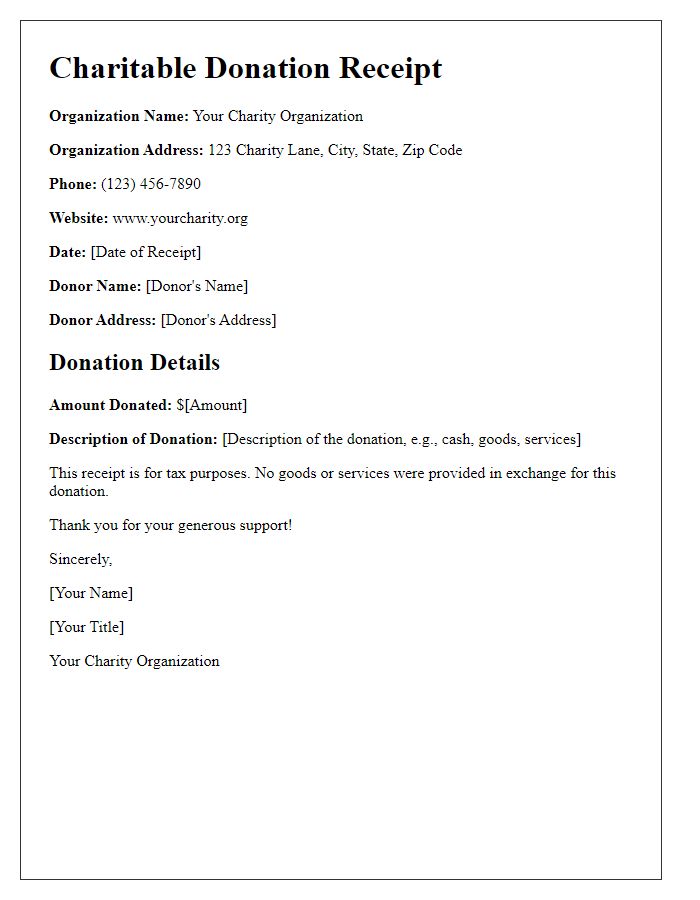

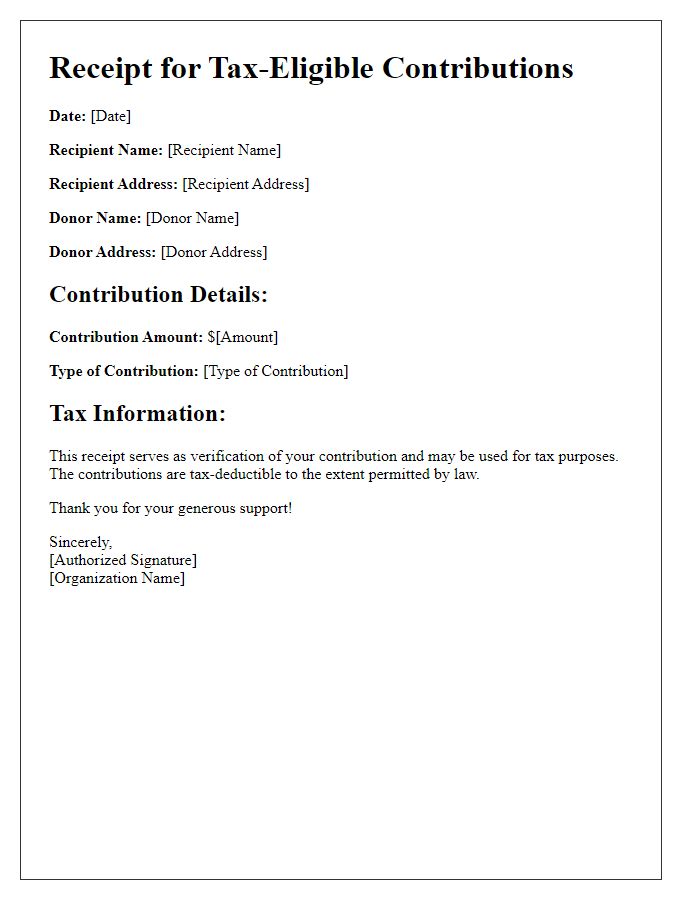

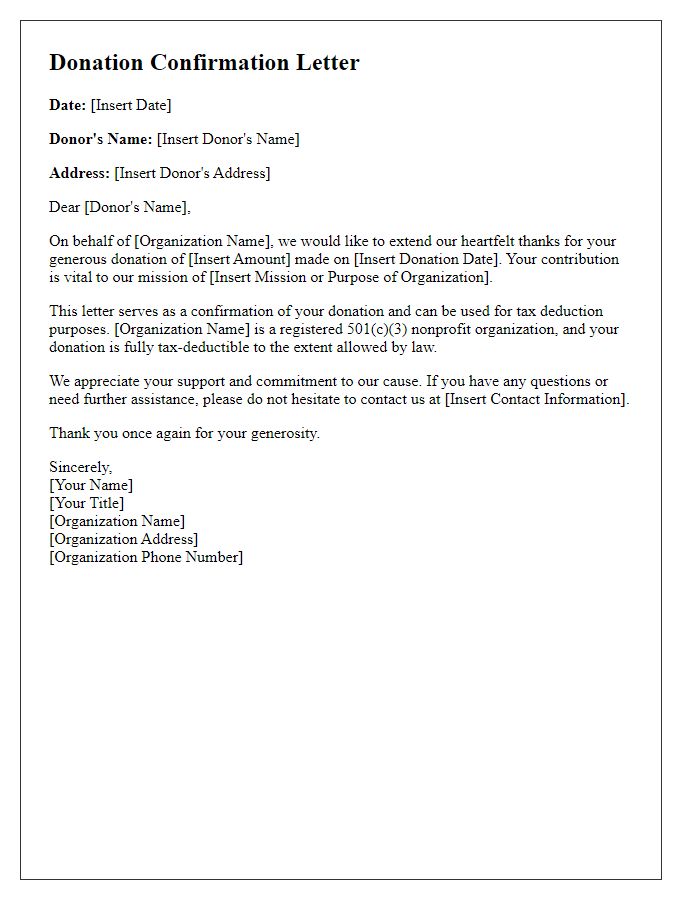

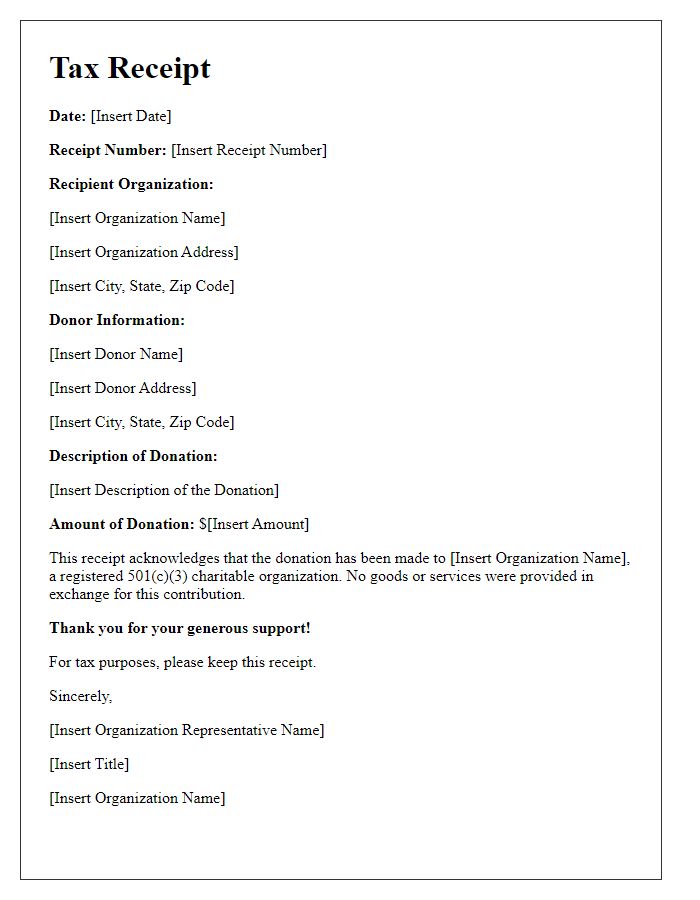

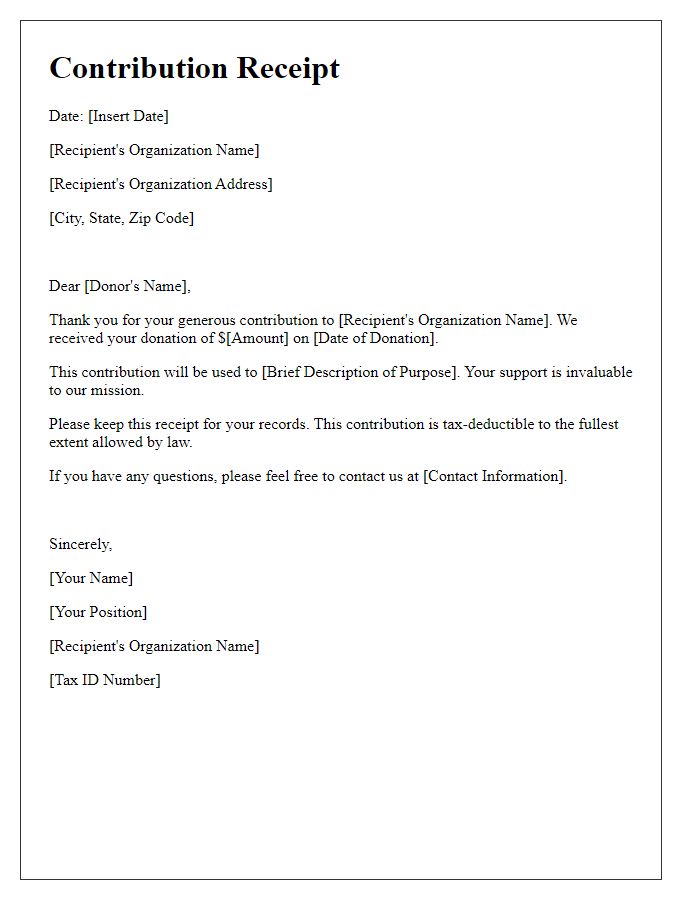

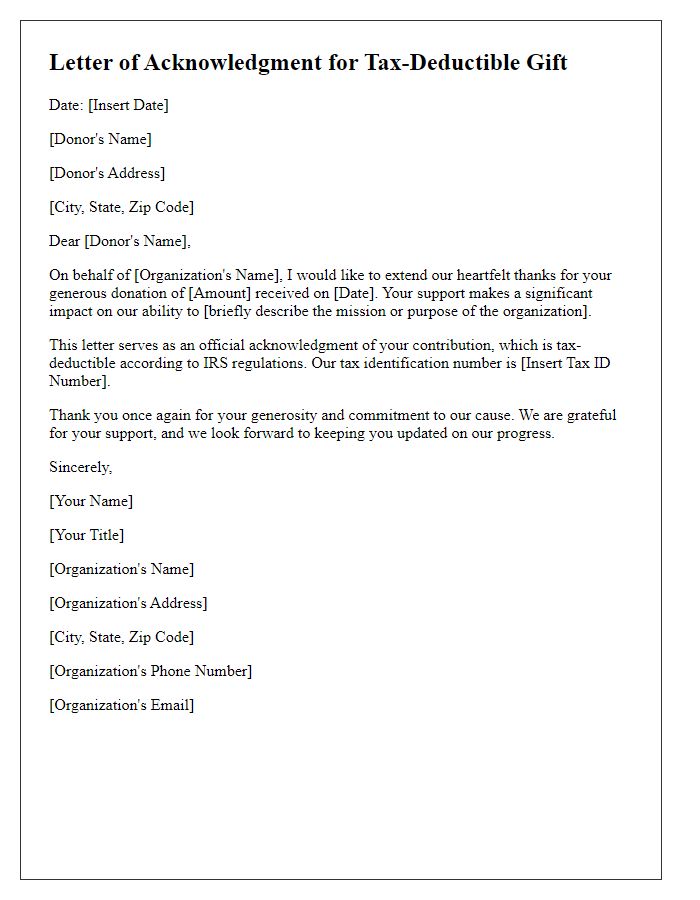

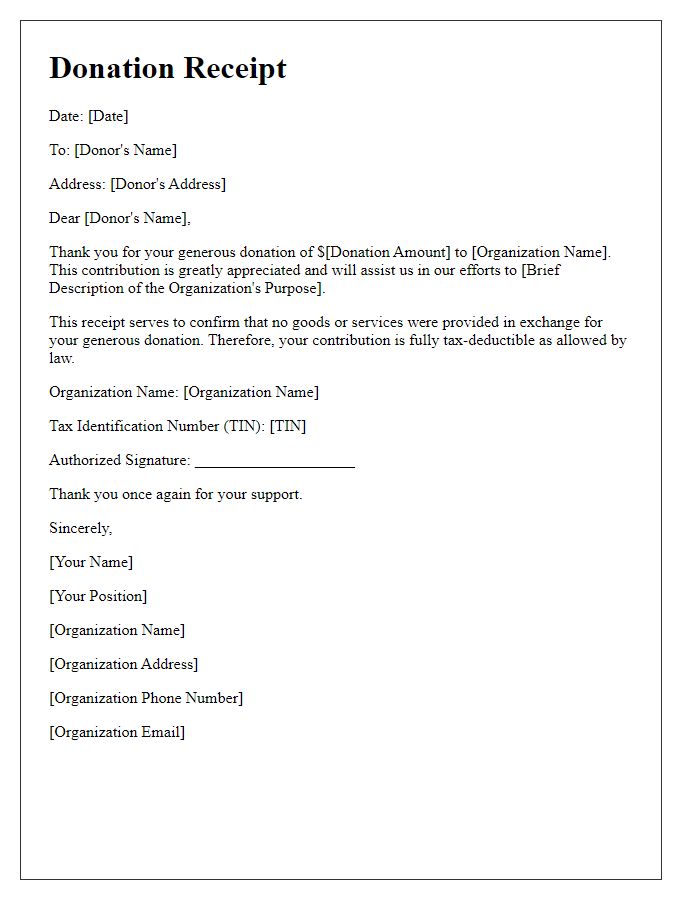

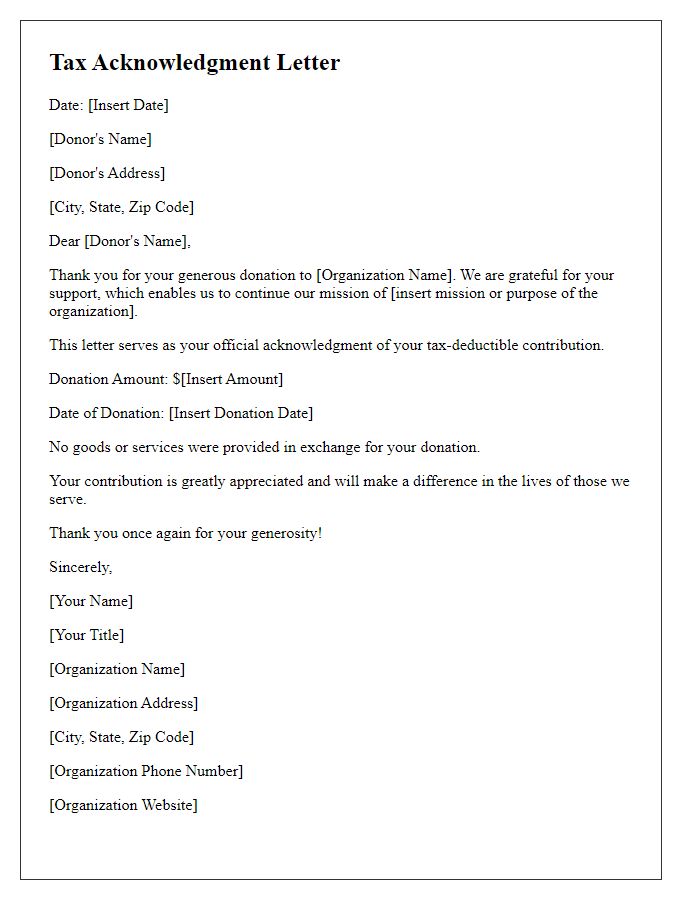

A tax-deductible donation receipt serves as proof for donors, confirming their contribution to charitable organizations, particularly 501(c)(3) entities in the United States. Essential components include donor information such as name (individual or corporate), mailing address (including city, state, and ZIP code), and contact number or email. The donation amount remains crucial, along with a statement of whether goods or services were received in return, which can affect deductibility. The receipt should also note the organization's name, mission, and federal tax identification number, providing transparency and accountability. Proper documentation supports donors during tax filing, potentially resulting in significant tax savings.

Organization Information

Tax-deductible donations can provide vital support for nonprofit organizations, enhancing their capacity to fulfill missions. For instance, a nonprofit like the American Red Cross, established in 1881, plays a crucial role in disaster relief and blood donation services. Detailed information on the organization should include the official name, tax identification number (EIN), and address to validate the receipt's legitimacy for tax purposes. Furthermore, specifying the donation amount--whether it's a one-time contribution of $100 or a recurring $50 monthly donation--communicates transparency. Additionally, acknowledging the date of the donation records the transaction period, essential for donors seeking to claim deductions during tax filing.

Donation Details

Tax-deductible donations play a crucial role in supporting non-profit organizations, such as registered charities and educational institutions. A donation receipt should include essential details like the donor's name, donation amount, date of donation, and the charity's tax identification number (TIN). For example, a donation of $100 made on March 15, 2023, to a 501(c)(3) organization can provide the donor with a record of their contribution for tax filing purposes. This receipt serves as proof of the transaction, allowing donors to claim deductions on their tax returns. Accurate documentation ensures compliance with IRS regulations and provides transparency in charitable giving.

Tax-Exemption Statement

A tax-deductible donation receipt provides important documentation for donors contributing to a charitable organization. This receipt typically includes the organization's name, address, and tax identification number, confirming tax-exempt status under Section 501(c)(3) of the Internal Revenue Code in the United States. It specifies the date of the donation and describes the nature of the contribution, whether cash or in-kind goods. The document also states the amount of the donation, ensuring clarity for IRS reporting purposes. For donations exceeding a certain threshold, such as $250, additional statements may be required, including a contemporary appraisal for non-cash items. These details enable donors to substantiate their claims during tax filing, maximizing potential returns.

Signature and Contact Information

A tax-deductible donation receipt typically includes the donor's name, contact information, and the organization's details. The document usually states the donation amount, date of contribution, and a statement confirming that no goods or services were provided in exchange for the donation. Signatures from authorized representatives of the organization might be included to validate the receipt. The organization's official contact information serves as a resource for any inquiries related to tax deductions or donation inquiries, enhancing transparency and trust for donors in their philanthropic engagement.

Letter Template For Tax-Deductible Donation Receipt Samples

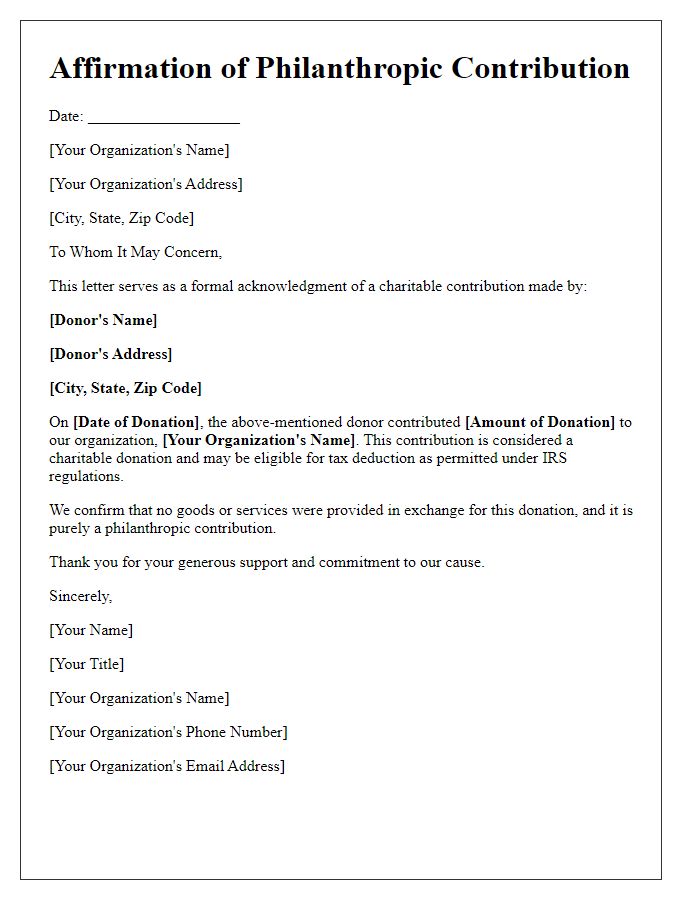

Letter template of affirmation for philanthropic contribution deduction.

Comments