Are you feeling overwhelmed by a debt that seems a bit murky? You're not alone, and understanding your rights is crucial in tackling such situations. One effective way to clarify your account is by requesting a debt validation letter from your creditor. If you're curious about how to craft the perfect request and ensure your financial rights are protected, keep reading for a simple template and helpful tips!

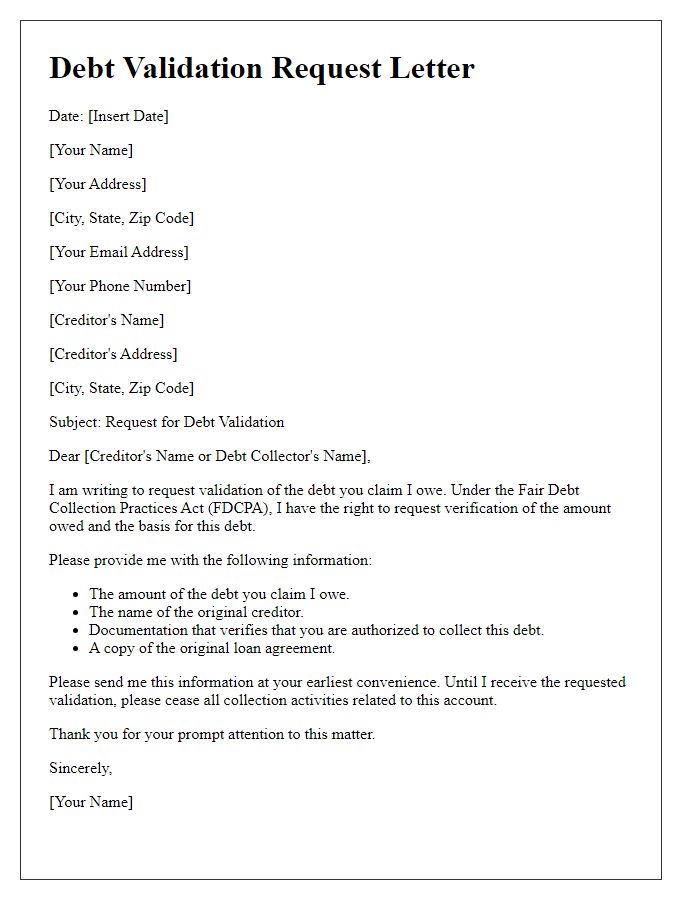

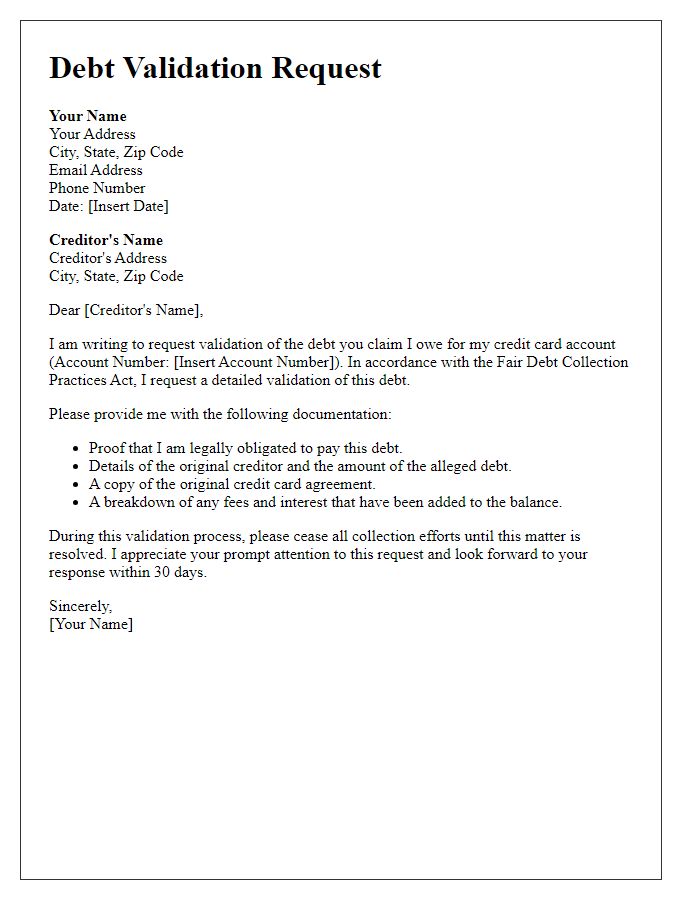

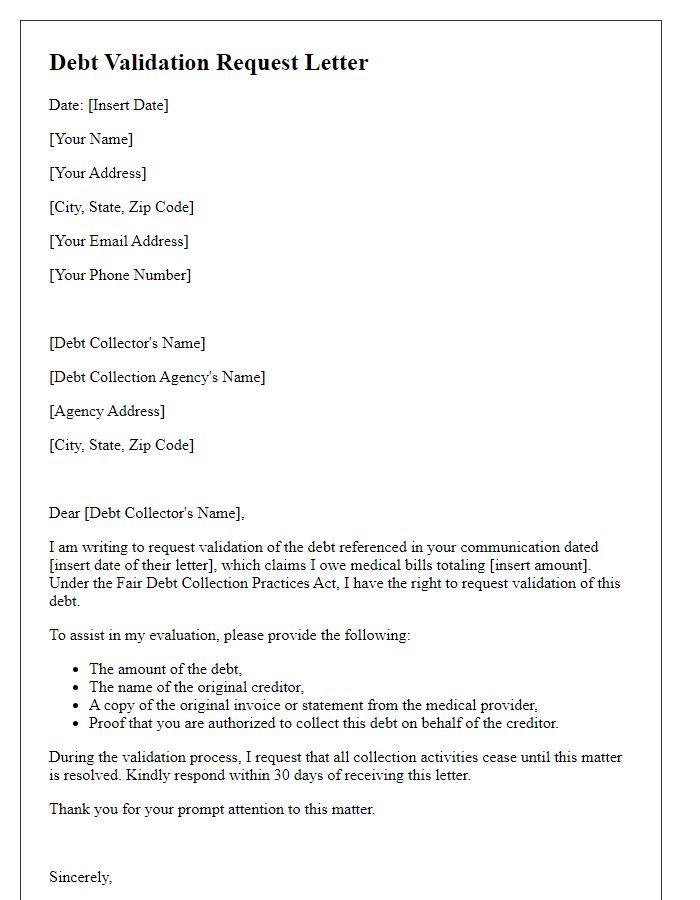

Creditor Information

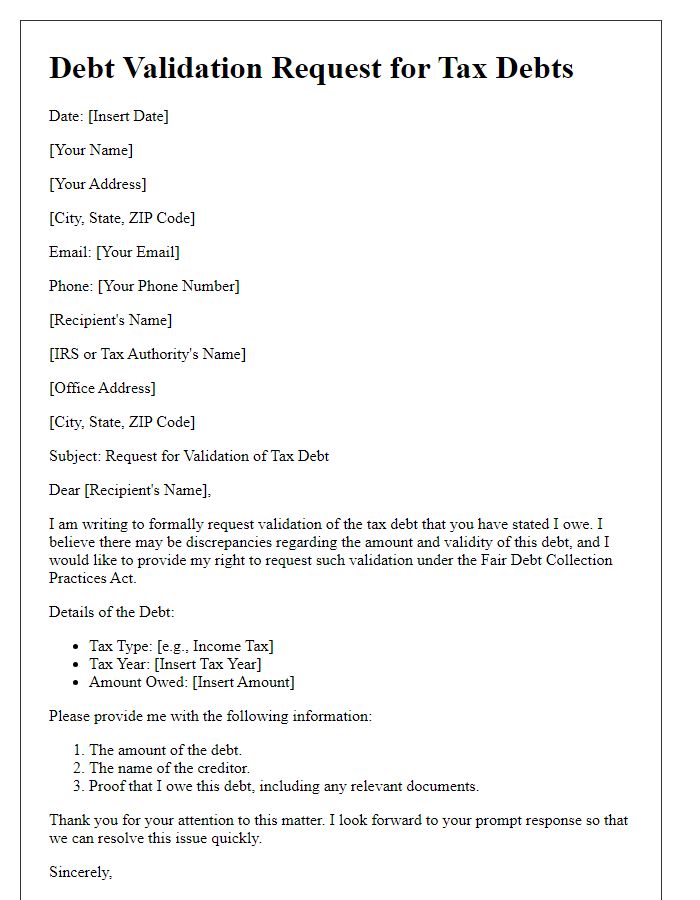

Debt validation requests are vital for consumers seeking clarity on their financial obligations. Creditors, such as banks, collection agencies, or other financial institutions, must provide detailed information regarding the alleged debt. Key details include the debtor's name, account number (specific identifier for tracking), the total amount owed (which may include principal and any accrued interest), and the date of the original charge-off (when the account was deemed uncollectible). Furthermore, valid documentation should include proof of the transfer of debt ownership if applicable. Accurate creditor information ensures transparency and empowers consumers to verify the legitimacy of their debts before making any repayments.

Account Details

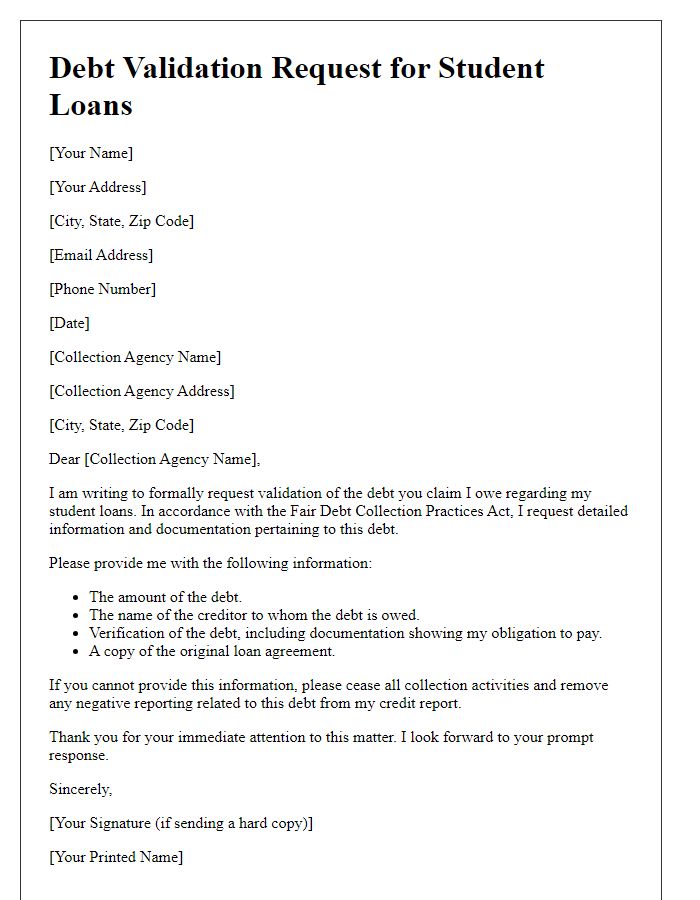

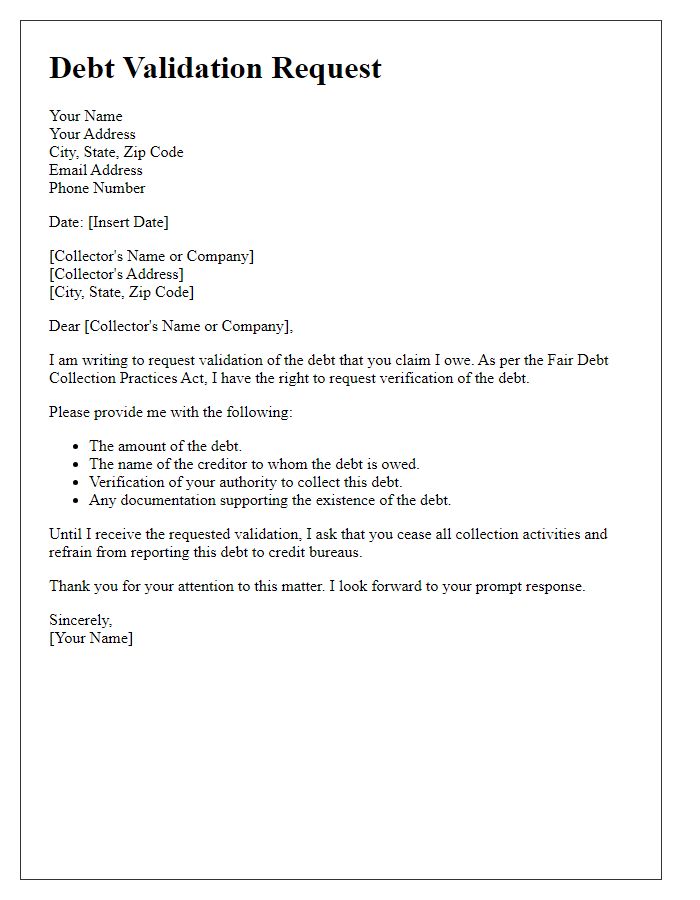

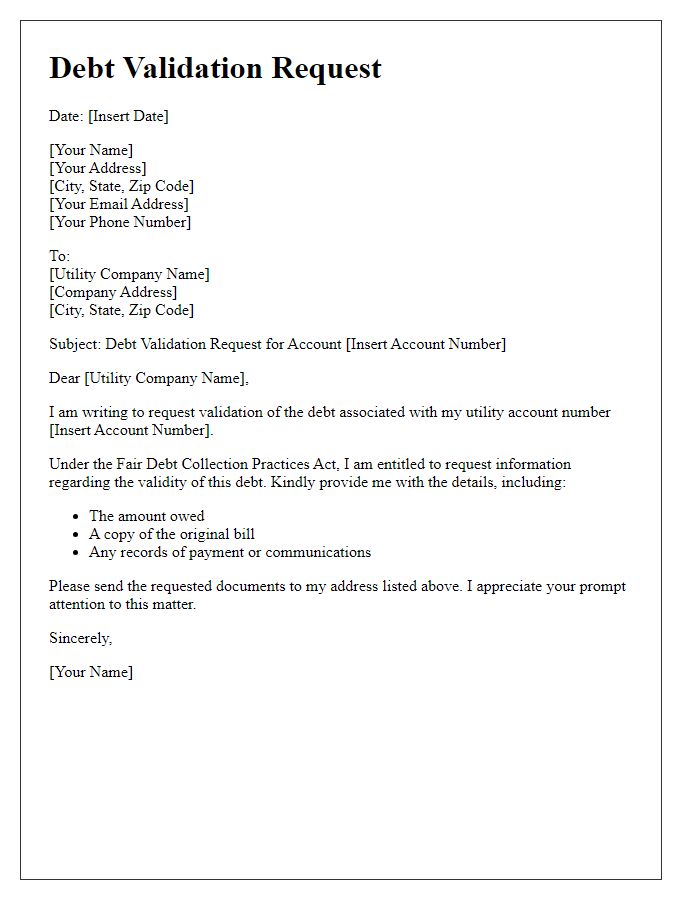

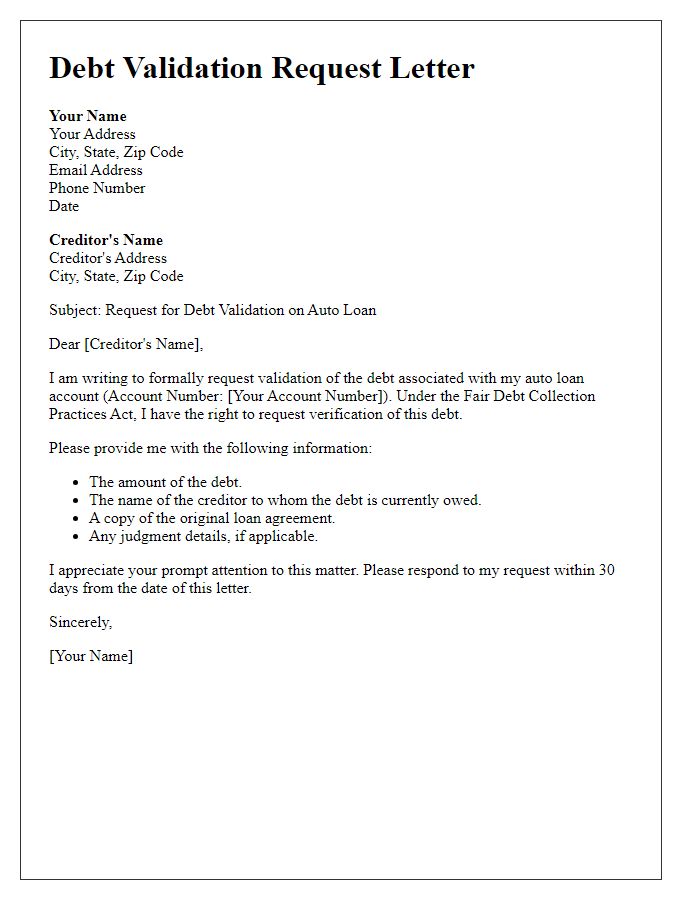

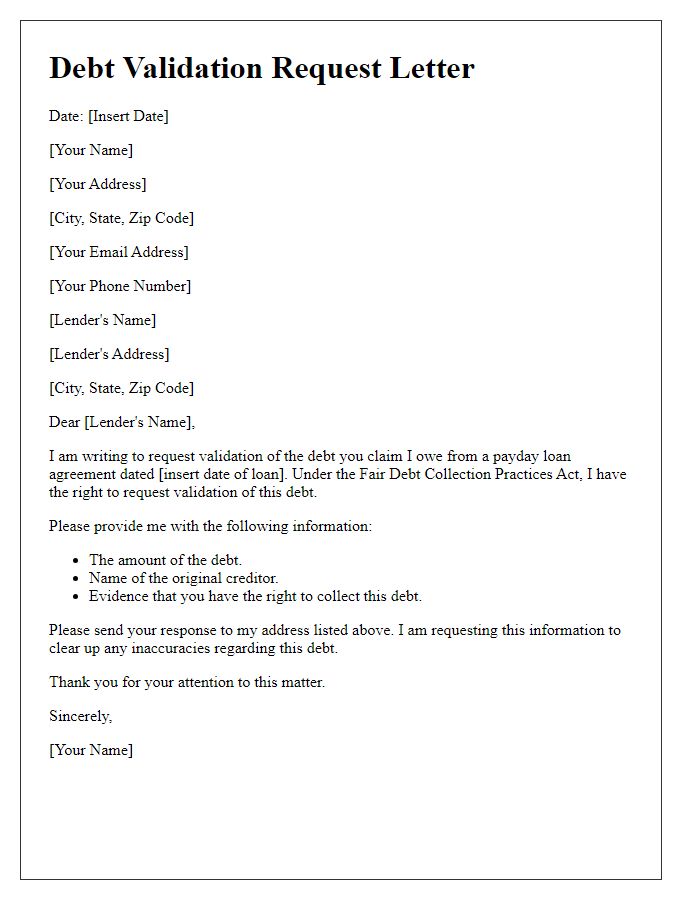

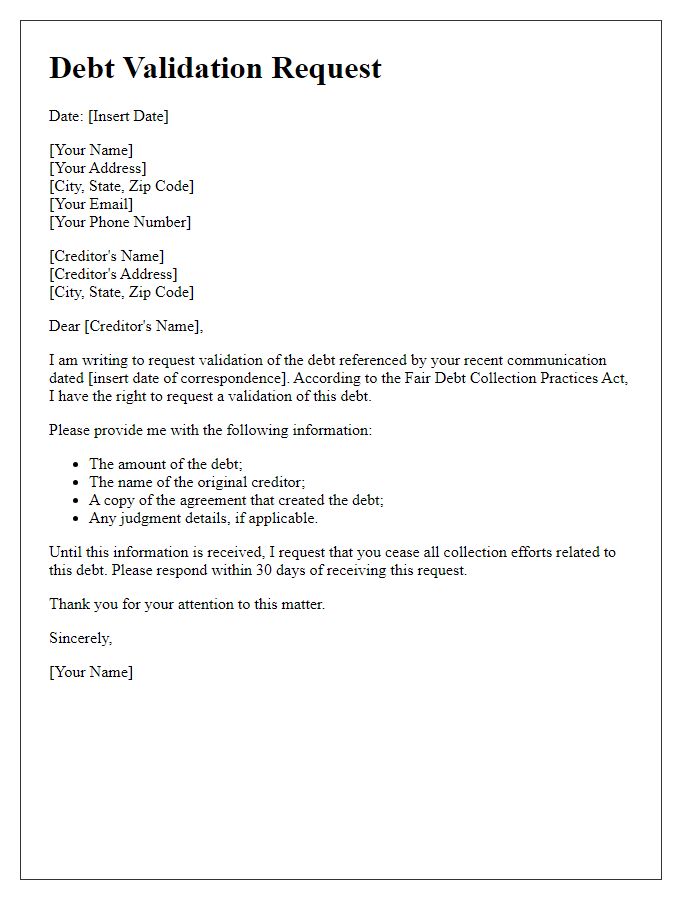

Requesting debt validation requires clarity and precision. A letter typically includes account details such as the creditor's name, account number (which may be a unique identifier issued by the creditor), and any balances owed. Including specific data--such as the date of the original debt, terms of the agreement, and any communication or accounts associated with this debt--will provide context. The Fair Debt Collection Practices Act (FDCPA) grants consumers the right to request validation within 30 days of receiving a debt collection notice, emphasizing the importance of including a clear statement of the request. Ensuring that the letter contains the sender's personal identification details (name, address, and contact number) enables the creditor to easily verify the identity and expedite their response.

Validation Request Statement

Debt validation is a critical process for consumers seeking to confirm the legitimacy of debts being claimed by creditors or collection agencies. A validation request should include essential details such as the name of the creditor or collection agency, account number, and specifics about the debt amount. Under the Fair Debt Collection Practices Act (FDCPA), consumers have the right to request documentation proving the debt's validity within 30 days of initial contact from the collector. Essential documents may include the original credit agreement, billing statements, or any records showing the debt's transfer to the collector. Failing to provide this validation obliges the collector to cease collection efforts. A well-crafted validation request can empower individuals to protect their rights against potential errors or fraudulent claims in debt collection.

Legal Compliance Citation

Debt validation letters serve as formal requests for creditors to provide evidence of a debt owed, ensuring legal compliance under the Fair Debt Collection Practices Act (FDCPA). The request should include specific details such as the original creditor's name, the amount of the debt, and relevant account numbers to facilitate verification. A properly formatted validation letter sent to the debt collector, ideally within 30 days of receiving the initial communication regarding the debt, invokes the collector's obligation to provide validation documentation. Failure to comply with such requests can result in legal repercussions, including potential violations of consumer protection laws. Including citations of relevant legal statutes strengthens the validity of the request, underscoring the borrower's rights under federal law.

Contact Information

An effective debt validation request letter begins with contact information including the debtor's name, address, phone number, and email. For example, John Doe, residing at 123 Main Street, Springfield, IL 62701, reaching out via phone at (555) 123-4567 or email at johndoe@email.com. This essential contact information serves to establish clear identification and facilitates communication with the creditor. The date of the correspondence should follow the contact details, ensuring an accurate timeline. Any reference numbers associated with the debt must be included for precise identification in the correspondence.

Comments